Letztes Update: 1. December 2024

Saving taxes seems to be a Swiss national sport. Those who have paid the maximum amount into Pillar 3a quickly come up with the idea of buying into the pension fund to save taxes. But is it worth it, and if so, what return do I achieve with a purchase? How much should I even buy in with? In this article, you’ll learn whether a pension fund purchase is worth it for you, what benefits it brings, what tips you should consider, and what mistakes you can avoid.

Inhaltsverzeichnis

- What is a pension fund purchase?

- Advantages of a pension fund purchase

- Risks and disadvantages of a pension fund purchase

- When is a purchase particularly worthwhile?

- Step-by-step guide: How the pension fund purchase works

- What’s better, a purchase into the pension fund or a contribution to pillar 3a?

- Conclusion: Is a pension fund purchase worthwhile?

What is a pension fund purchase?

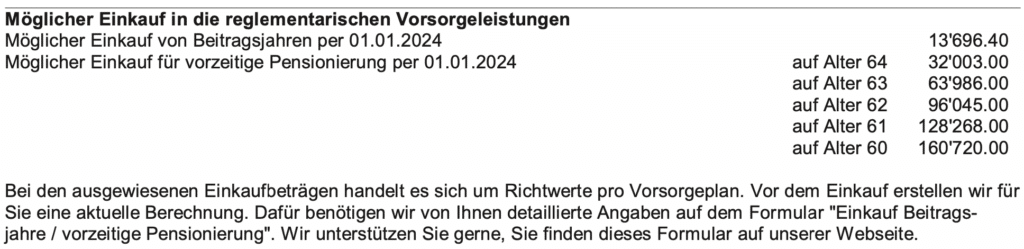

Perhaps you’ve also read on your pension statement that you have a ‘purchase potential’ of X francs, or you’ve stumbled upon the number behind ‘Maximum possible purchase’. To be able to make a purchase at all, you must have a purchase potential.

What exactly is a purchase potential and how is it calculated? Simply put, it’s the difference between the maximum retirement savings and the actual retirement savings. The pension fund calculates the maximum retirement savings as if you had been insured with your current salary since the age of 25. Since income typically increases with age, many people develop a purchase potential as they get older.

In Article 9 of the Federal Law on Vested Benefits in Occupational Old Age, Survivors’ and Disability Pension Plans, it sounds a bit cumbersome: ‘If the pension fund sets out its benefits in a benefit plan, it must allow the insured persons to buy in up to their full regulatory benefits.’

With a purchase into the pension fund, you increase your retirement savings and save taxes because you can deduct the paid-in amount from your income, just like with Pillar 3a. However, for pension fund purchases, the maximum amount is not regulated in an ordinance like with Pillar 3a. So if you have a purchase potential of CHF 200,000, you can buy in with the full CHF 200,000 in one year. Whether that’s sensible is another question.

For some pension funds, the purchase increases the risk benefits in case of disability and death. You need to clarify in advance whether this is the case with your pension fund.

Advantages of a pension fund purchase

- Tax benefits: Reduction of taxable income

- Pension fund assets do not have to be taxed as assets until withdrawal, and the returns are not subject to income tax

- Increase in retirement capital and thus the retirement pension

With most pension funds, you can choose whether you want to receive a monthly pension, a one-time capital payout, or a combination of both. The more you’ve saved during your working life, the higher your retirement savings will be and thus also your pension.

Risks and disadvantages of a pension fund purchase

- Limited flexibility: Capital is tied up, investment strategy predetermined by the pension fund

- ‘Health’ of the pension fund: Coverage ratio and technical interest rate

- Interest rate of the pension fund

- Taxes upon payout:

- Capital withdrawal: One-time taxation separate from other income at a reduced rate

- Pension withdrawal: Taxed as income

If a pension fund is underfunded, i.e., if the coverage ratio is below 100%, the interest earned on the capital is used to improve the coverage ratio, and your purchase is accordingly low-interest-bearing. Purchases are assigned to the super-mandatory portion. There is neither a minimum interest rate nor a minimum conversion rate there.

Pension Fund Buy-In Return

The longer the time until retirement, the lower the return on the purchase. The return from tax savings dilutes, and only the relatively meager return from interest remains. Therefore, purchases usually only pay off from about age 55. The following example of a purchase illustrates the effect:

| Years until retirement | 25 | 20 | 15 | 10 | 5 |

|---|---|---|---|---|---|

| Purchase amount | 50,000 | 50,000 | 50,000 | 50,000 | 50,000 |

| Tax savings | 15,000 | 15,000 | 15,000 | 15,000 | 15,000 |

| Capital upon withdrawal | 68,210 | 64,102 | 60,241 | 56,614 | 53,204 |

| Taxes upon withdrawal | 5,457 | 5,128 | 4,819 | 4,529 | 4,256 |

| Net capital upon withdrawal | 62,753 | 58,974 | 55,422 | 52,084 | 48,948 |

| Net return per year | 2.4% | 2.6% | 3.1% | 4.1% | 6.9% |

Calculated with a marginal tax rate of 30%, an interest rate of 1.25% in the pension fund, and a capital benefit tax of 8%.

If a purchase was made, the resulting benefits may not be withdrawn in the form of capital within the next three years. So if you want to receive capital instead of a pension when you retire, you must absolutely observe this waiting period. The same applies if you plan a WEF withdrawal in the coming years.

If you have made advance withdrawals for home ownership promotion, you may only make voluntary purchases once the advance withdrawals have been repaid. Exceptions are repurchases in case of divorce.

When is a purchase particularly worthwhile?

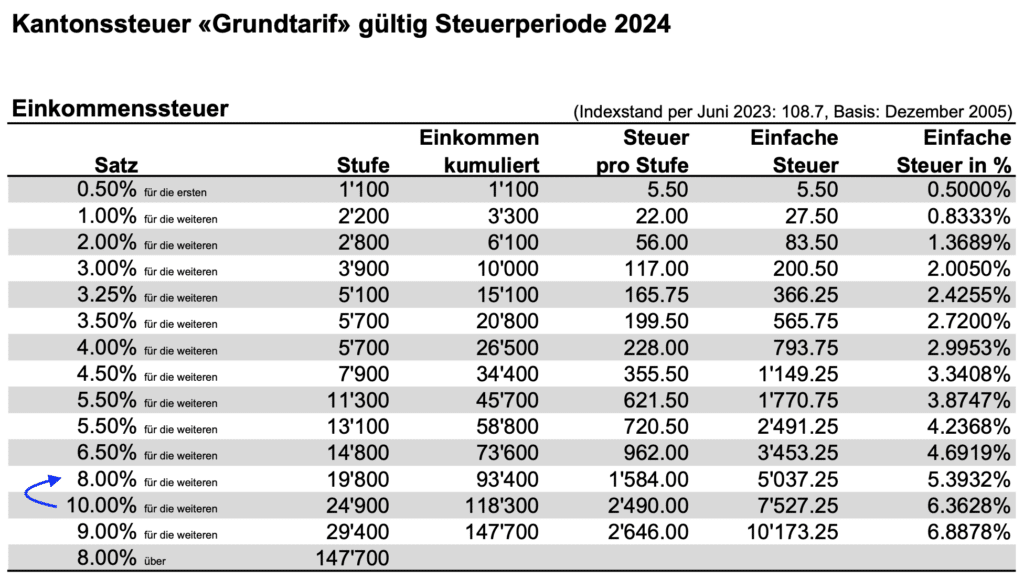

- with a high marginal tax rate

- with high interest rates in the pension fund

- with low capital benefit taxes

- the earlier the money is withdrawn again

Often, staggering is also worthwhile. This can smooth out the tax progression over several years. The optimal purchase amount can be determined using the rate tables of the respective canton and the Federal Tax Administration (FTA).

Step-by-step guide: How the pension fund purchase works

- Step 1: Determine the purchase gap

- vested benefits not contributed and excess pillar 3a assets are taken into account

- Step 2: Check financial possibilities

- Step 3: Submit application to the pension fund

- via form or customer portal of the pension fund

What’s better, a purchase into the pension fund or a contribution to pillar 3a?

Pillar 3a offers you more freedom in investing your money. You can decide for yourself how much risk you want to take. Especially if you still have a very long investment horizon, strategies with a high equity component are worthwhile in pillar 3a. The potential returns are significantly higher than in the pension fund. As retirement approaches, it can be advantageous to utilize the purchase potential in the pension fund.

The three pillars of Swiss retirement provision build on each other and should always be considered together in financial planning. The free provision in pillar 3b also plays an important role. In younger years, it may be more sensible to invest in a broadly diversified stock portfolio instead of a pension fund purchase, as the potential returns are higher. A purchase into the pension fund can then be strategically planned in the years before retirement to specifically take advantage of tax benefits.

Conclusion: Is a pension fund purchase worthwhile?

Simply ‘saving a bit on taxes’ is not enough. Before making a purchase into the pension fund, you should analyze your personal situation and carefully weigh the advantages and disadvantages. Check not only your purchase potential but also the financial stability of your pension fund and possible alternatives. Are you unsure whether a purchase is right for you? Consulting can help you make an informed decision.

Schedule an initial consultation now:

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.