Letztes Update: 19. December 2023

If you go to your local bank or an old acquaintance suddenly calls and wants to talk to you about finances “without obligation and free of charge,” these are two completely different scenarios, but potential conflicting goals are hard to avoid in both cases. The banker likes to sell you in-house products that are often mediocre and have high (hidden) costs. The old acquaintance likes to sell you life insurance policies with extra-long terms because that’s where the acquisition commissions are the highest. Everything that is “free” has a hidden price tag, and if providers were to show all costs transparently, that would be a pretty fat price tag. Fortunately, these days there are alternatives to staid house banks and unscrupulous financial sharks. In this article you will learn how to find the right Swiss fee-based advisor on FinFinder.ch.

Honorary advisor Switzerland

Independent fee-based advisors, unlike the commission-based advisors mentioned above, work on the basis of an hourly fee that they charge you and that you agree with them in advance. They are paid directly by the client – you – and not in the background by the providers of the financial products. This may seem more expensive at first glance, but the money flows of commission consultants are always more or less well hidden, so you never know exactly how much you are really paying.

Independent fee-based advisorsminimize conflicts of interest because a fee-based advisor acts as your partner and does not line his or her own pockets. Especially investors who have not yet dealt with their finances in depth are easy victims for cunning sales talents. As a financial novice, you can judge whether someone is likeable to you, but not whether the products and suggestions make sense and are in your best interest. You won’t notice that – if at all – for a few years.

FinFinder.ch

And how do you find the right financial advisor? It’s easy, with FinFinder.ch, the first independent matching platform for financial advisors in Switzerland. In other words, a kind of dating platform for financial advisors.

FinFinder.ch was founded by Andreas Schöni and Ati Tosun. Andreas Schöni was a client advisor and later Managing Director at UBS, Zürcher Kantonalbank and SIX and has been a financial planner himself for ten years. Ati Tosun was employed by Zürcher Kantonalbank and has since been active as an independent entrepreneur in the development and marketing of online marketplaces.

On FinFinder.ch qualified financial coaches can register and introduce themselves with a text, a picture and a short video. Before FinFinder.ch accepts a financial advisor, the relevant diplomas and certificates are checked. There are now over 200 registered financial coaches, 21% of whom are women. Even though I only use the masculine form of consultant in this article, the feminine form is of course always included.

FinFinder.ch is not financed by advertising revenue or other sponsoring contributions, but by a fixed monthly contribution from the affiliated financial coaches. Conflicts of interest are therefore ruled out.

Find fee-based advisors with FinFinder.ch

By the way, FinFinder.ch is completely free of charge for you as a searcher. But let’s go through the search process together, step by step. At the beginning, you choose a topic on which you would like to receive advice. For example, you can choose from:

- New life situation

- Retirement

- Precaution

- Attachments

- Real Estate

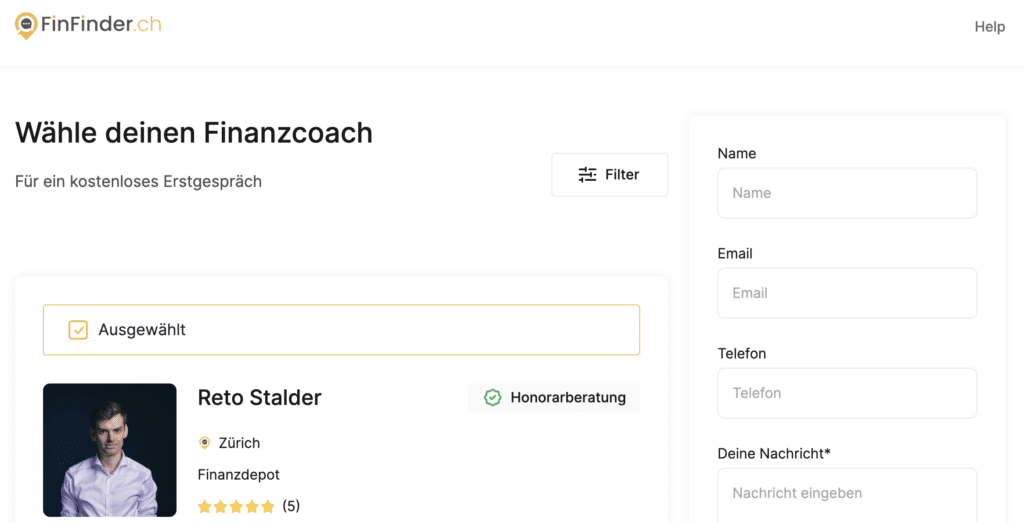

In our example, I have chosen the topic “plants”. You will now be taken by the hand by FinFinder.ch and guided through the search process. First, you select your age group, provide information about your family situation, and indicate whether you own a home. Finally, you’ll be asked what’s on your mind the most. In our example, I have selected “Invest money”. In a text field you can optionally formulate your questions in your own words. FinFinder.ch now asks you for your zip code, your savings balance, your household income and your profession. The financial information is optional. After entering all data, FinFinder.ch suggests a small, sorted pre-selection of nine suitable financial advisors.

Yes, I am also registered with FinFinder.ch and my financial coach profile happened to appear at the top of the criteria entered. You can use the filter to refine the selection and, for example, select only independent financial advisors; i.e. the fee-based advisors described above. You can also filter by gender or age. If you want to decide later, you can have a link sent to you for selection. Your email address will not be shared with financial advisors at this time.

After you have taken a closer look at the profiles of the financial advisors, you can select the ones you are interested in and send them a message directly via FinFinder.ch. Only now will the financial advisors learn of your search and receive your contact information.

Select fee consultant

The consultants contacted will receive your request and can contact you. They usually address your questions and offer you a free initial consultation. You should definitely take advantage of this offer. Because when it comes to finance, it’s not just a matter of expertise and training, but also of interpersonal skills. After all, when you give financial advice, you reveal a lot of personal details that you would otherwise only share with a few people.

During this initial consultation, you will also find out how much the consultant charges for financial coaching and exactly how a consultation works. It is certainly helpful if you think about what exactly you expect from a consultation and what is particularly important to you before the interview. For example, if the independence of the consultant is important to you, you can address that here as well.

After the consultation you have the possibility to rate your financial coach with stars and a short text. Your feedback is valuable to both consultants and future clients.

Conclusion FinFinder.ch

FinFinder.ch enables you to find a fee-based advisor easily and without complications. You don’t have to dig through countless Google search results, you can find qualified financial advisors in one central location. The short introduction texts, videos and reviews from other customers give you a good first impression.

Financial deposit fee advice on onlinefinanzberater.ch

If you would like to book a fee-based consultation with me, you can make an appointment for a free and non-binding initial consultation at onlinefinanzberater.ch. I look forward to hearing from you.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.

2 comments

Hello,

I am interested in getting some fee based financial advice English is preferred. Will this be an issue?

I only give financial advice in German, but on FinFinder the financial coaches can indicate the languages spoken. So you will find an English-speaking advisor there.