Letztes Update: 16. June 2025

In the past (and it’s not that long ago), there were good reasons to use a foreign broker. Meanwhile, free ETF savings plans have also arrived in Switzerland, and the irregular purchase of stocks and ETFs has become significantly cheaper. Another advantage of Swiss brokers is the eTax statement, as it saves you a lot of time when filling out your tax return. Some neobanks and most robo-advisors offer this for free. And with Saxo, the first Swiss broker will now also send the tax statement to its customers free of charge for the 2025 tax period.

Why a Tax Statement is Helpful

In the tax return, the tax value of all your securities held on the reporting date of December 31 must be stated. This value is then counted towards your assets – so far, so good and simple.

Let’s go a step further: If you have received dividends or interest during the year, these are to be taxed as income. For this, you gather the amounts received from your broker or consult the price list of the Federal Tax Administration – but all of this involves work.

However, if you sold the stock during the year, for example, the tax value on December 31 is CHF 0, but perhaps you received dividends before the sale – and these still need to be taxed as income. So you have to declare them in your tax return.

Even if you buy ETF shares every month with a savings plan, it can become time-consuming. Let’s take an example: You have 250 units of an ETF at the beginning of the year and buy additional shares monthly for CHF 500. Sometimes you get 15 pieces, sometimes 12, and sometimes 16. The dividends are distributed on April 31, for example – how many ETF shares did you have at that time? And what amount from dividends do you now have to tax as income? All of this can be figured out – but it’s also time-consuming.

What is a Tax Statement?

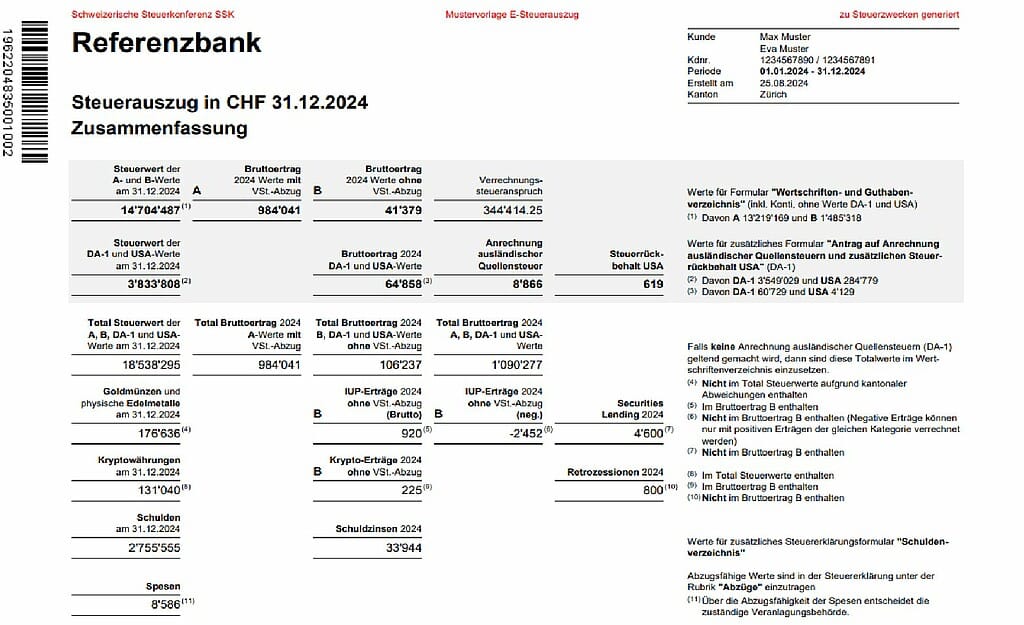

A tax statement summarizes all tax-relevant information for a year in a single document. You will find, among other things:

- the total tax value of your investments (as of year-end)

- the gross yield with withholding tax deduction

- the gross yield without withholding tax deduction

- as well as often an overview of expenses and tax-deductible fees

All securities transactions such as purchases, sales, interest, and dividends are thus listed in cumulative form, which makes filling out the tax return significantly faster and easier.

What is an eTax Statement?

An eTax statement further simplifies filling out the tax return. You no longer have to manually transfer the individual figures – instead, you can upload the PDF directly into the tax return software. The eTax statement is based on a uniform electronic format for the securities inventory. It enables seamless reading of the data into your personal tax return – without typing, copy-pasting, or risk of errors. This saves you time, avoids transfer errors, and automatically ensures all tax-relevant portfolio data is correctly in the form.

An eTax statement looks like a classic tax statement on the first pages: It contains all relevant information on assets, income, and expenses. On the last pages, however, there are special supplements with barcodes that contain all information in a standardized, machine-readable form. These allow the eTax statement to be imported directly into the cantonal tax return – without any manual input. As of January 2024, all Swiss cantons have implemented the corresponding standard and are able to process eTax statements electronically.

What Does a Tax Statement Normally Cost – and where is it Free?

For years, tax statements were available from Swiss online brokers for a flat fee of CHF 100 (excl. VAT). Some traditional banks charged a fee per position and/or per income, while others provided the tax statement free of charge.

However, one does wonder why such a document can cost up to CHF 500 (excl. VAT) at the Obwaldner Kantonalbank, for example – there they charge CHF 3 per tax value and CHF 6 per taxable income. All the data is already available – (hopefully) no one is sitting there manually typing information into a form anymore. The NZZ aptly wrote in an article at the beginning of 2024: “Certain banks have their service gilded, while others show themselves to be customer-friendly.”

eTax Statement Saxo Bank

After introducing free savings plans and abolishing custody fees, Saxo Bank is now also offering the eTax statement for free. For the 2025 tax year, all customers will receive the tax statement electronically for the first time via the Saxo platform inbox. Delivery can be expected by the end of March at the latest.

Conclusion Free Tax Statement Switzerland

A tax statement saves time, reduces errors, and is almost indispensable for tax returns. With the eTax statement, the whole process becomes even easier – thanks to digital import directly into the tax program. While some banks charge high fees, modern providers like Saxo Bank Switzerland show customer-friendliness: From the 2025 tax period, Saxo will provide the eTax statement for free for the first time. Thus, in addition to affordable savings plans and zero custody fees, Saxo now offers real added value with the tax document as well.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.