Letztes Update: 28. September 2023

You found an index that fits your portfolio, there are fortunately ETFs or index funds on it, you screened them for total expense ratio (TER) and tracking difference, and two ETFs are left. One is traded in CHF and the other in USD. What currency do you buy it in? That’s exactly what this post is about.

Fund currency and trading currency

I have chosen the Nasdaq-100 UCITS ETF from Lyxor as an illustrative example. This is because it can be traded on the SIX Swiss Exchange both in CHF (ticker: NADQ SW) and in USD (ticker: NADQUS SW). The total expense ratio of the distributing ETF is 0.22% for both trading currencies. The Nasdaq-100 Index includes the 100 stocks of NASDAQ-listed non-financial companies with the highest market capitalization. The largest position is currently Apple with 12.4%. Of course, this is not a buy recommendation, the ETF only serves as an example.

In the factsheet of the ETF you can read that the fund currency is USD. That makes sense, the shares it contains are traded on NASDAQ in USD. All intra-fund settlements are also made in USD.

You can now choose between two trading currencies with this ETF. Either you buy it in CHF or in USD. What difference does that make in terms of return?

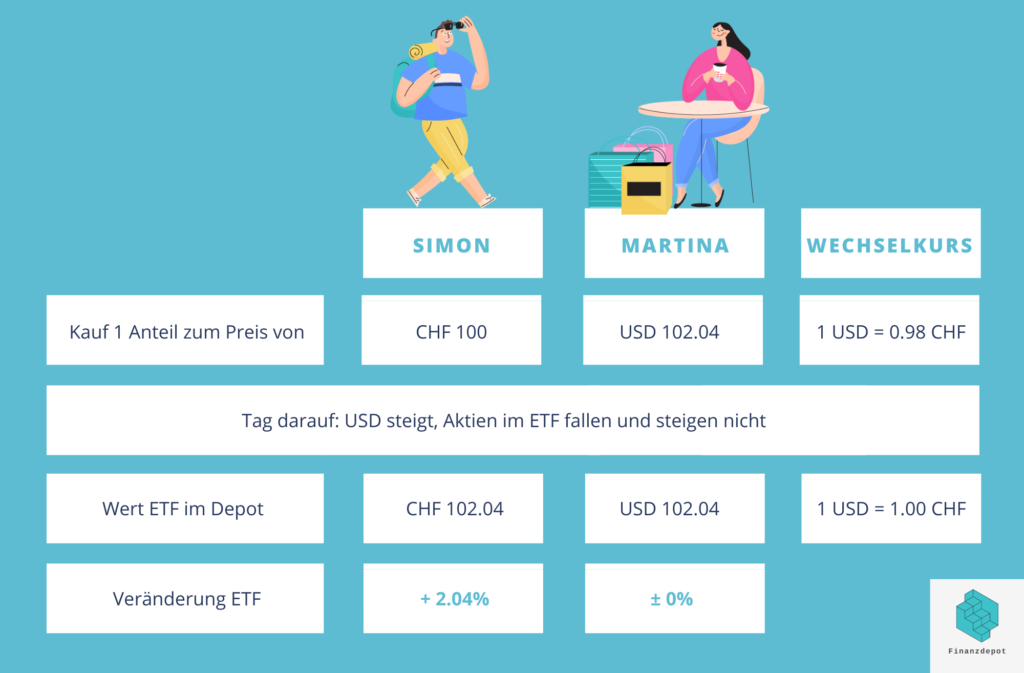

Let’s look at a simplified example with Martina and Simon: Both spend CHF 100 for the purchase: Simon buys the ETF in CHF and Martina buys it in USD at an exchange rate of 1 USD = 0.98 CHF. We ignore purchase fees and exchange rate surcharges (for now).

The following day, the dollar rises 2.04% and stocks in the Nasdaq-100 UCITS ETF fall, not rise. Granted, that’s very unlikely, but we’re all about the currency. It will look like this:

In Simon’s portfolio, the ETF has thus increased by 2.04%. From the rising dollar alone. In Martina’s portfolio, the ETF has not moved, her ETF has a 0% change. Can Simon now rejoice, and Martina must grieve? No, both can be happy, because if Martina converts her share worth USD 102.04 with the current rate of 1 USD = 1 CHF, then she has exactly CHF 102.04. In its home currency, therefore, it has also made gains. Many brokers automatically convert the positions in foreign currencies into the reporting currency, which is usually CHF. So at the total portfolio level, their broker would also show a gain of 2.04%.

So it doesn’t matter at all what currency you buy an ETF in. Well, in the real world, yes. More on this in the next section.

By the way, you actually always get the dividends paid out in the fund currency. So even if you buy our ETF in CHF, the dividend will be paid in USD. Some ETF providers even outline the dividend currency in their fact sheets.

Currency exchange

Martina and Simon earn their money in CHF. When they transfer money to their broker, for example Swissquote, it is then logically also in CHF. If Martina wants to buy her ETF in USD, she has to exchange the CHF, and that costs something, usually a certain percentage. All other fees appear as CHF amounts on the purchase statement. The amount of stamp duties and stock exchange fees is shown transparently. But not in the case of currency exchange. There is usually only the exchange rate. But who knows what the current average exchange rate was at the time of purchase? The possibility to calculate and compare the currency markup is missing. You don’t even know how much you added in exchange fees when you exchanged. Brokers and banks can very conveniently squeeze out additional fees.

Martina had to exchange her CHF for USD before buying the ETF. The average exchange rate was 1 USD = 0.98 CHF. However, your broker has calculated with the rate premium of 1%, i.e. with 1 USD = 0.9898. She thus received only USD 101.03.

Sounds like petty stuff and rag splitting? Well, with CHF 10’000 1% is already CHF 100, which is simply lost to the broker. And when exchanging back, this fee is incurred once again.

Actually, I was going to do a nice breakdown of broker switching fees here, but help, I’ve been searching myself silly. Either you can’t find anything about the fees, or the documents are incomprehensible, or you have to calculate the surcharge yourself from tables. Dear brokers and banks, you earn your money thanks to your clients. Your customers deserve transparency and customer service that lives up to the name.

Exemplary documentation and transparency were: Swissquote and Saxo Bank. For the others, I had to calculate the spread myself. Depending on the amount that is exchanged, the conditions become better. I always took the lowest amount and accordingly the highest spread.

| Wechselkursaufschlag | |

| Swissquote | 0.95% |

| Saxo Bank | 1% |

| Cornèrtrader | 0.5% |

| PostFinance | ca. 1.2% |

| Migros Bank | ca. 1.2% |

| ZKB | ca. 1% |

| BEKB | ca. 1.5% |

| Raiffeisen | ca. 1.75% |

There was nothing at all to be found at the two big banks Credit Suisse and UBS. It must be assumed that their exchange fees are high, otherwise they would not have to hide them.

By the way, switching fees are also incurred by robo-advisors. If a robo-advisor buys ETF shares for you that are traded in another currency, then the broker also charges the fee in the background and this is also not explicitly signposted. However, robo-advisors usually have more advantageous conditions than an individual private investor due to the large trading volume.

Currency risk

The above example with Simon and Martina shows that you are exposed to exactly the same currency risk in both cases. Your ETF can go up continuously, but if the dollar goes down continuously, then some of the return is lost just because of that. If the dollar rises, as in our example, then we can speak of a currency opportunity. Currencies can therefore be viewed as an asset class in their own right. They rise and fall – much like shares – and are almost impossible to predict in the short term.

The currency risk can be minimized by means of hedging, also known as currency hedging. So there are ETFs that do just that. In addition to the name of the index, the title will also include the words “CHF Hedged” or similar. But by no means all of them do. If you only want hedged ETFs in your portfolio, the choice is severely limited. And this currency hedging is not free. Thus, corresponding products cost about 0.1 to 0.3 percentage points more.

Mostly, you can read that retail investors should buy unhedged equity ETFs and hedged bond ETFs. So securities that have low volatility and stable returns should tend to be bought currency hedged.

Ultimately, there is no right or wrong here, and you have to find out for yourself what suits you better.

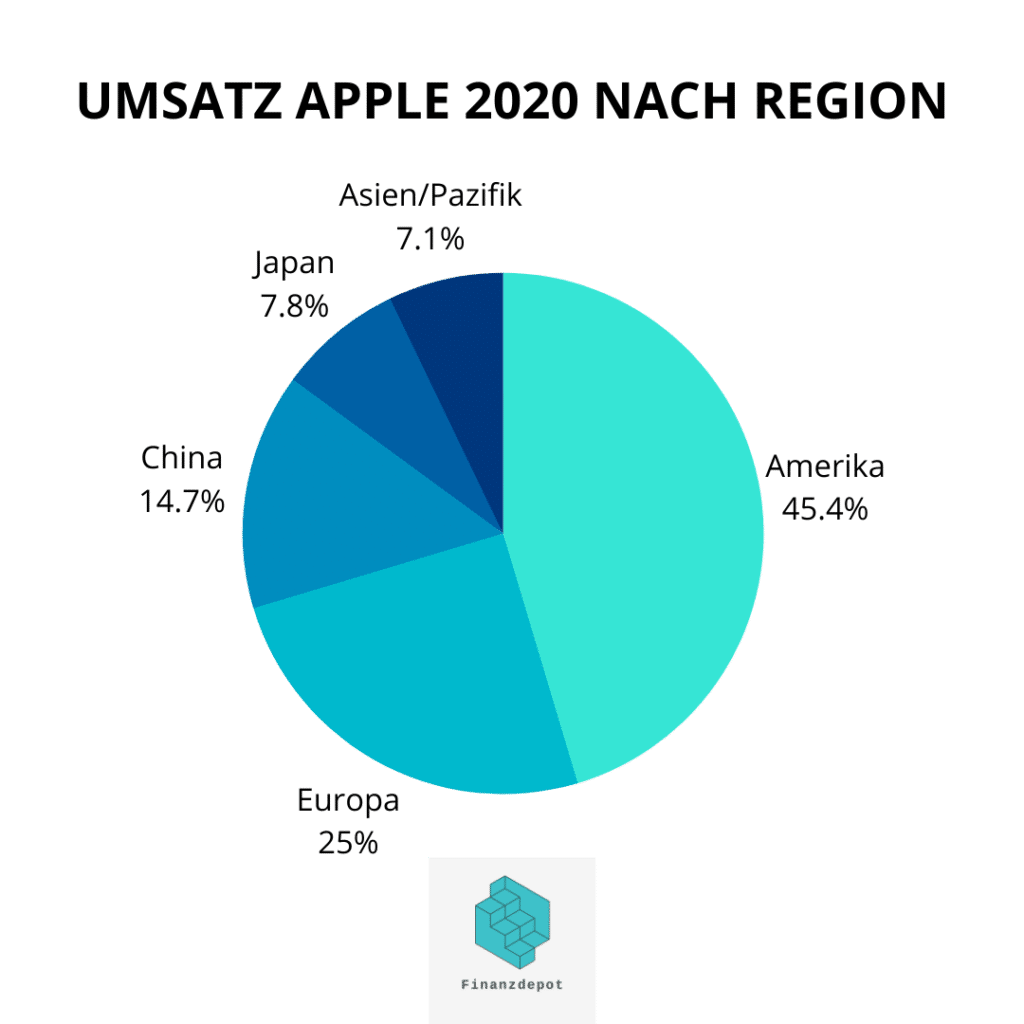

As soon as you invest outside your home currency, you are automatically exposed to currency risk. And even if you hedge it, it gets trickier: Apple, for example, sells its products globally and generated about 55% of its revenue outside the U.S. in 2020. That adds up to around 100 currencies, which affect Apple’s revenue and profit depending on their strength or weakness. You will never be able to eliminate this risk. Not even for Swiss equities such as Roche. Although this is traded in Swiss francs, Roche also has an international presence.

Let us now return to our example with the Lyxor ETF: There is every reason to buy it in CHF. But before buying, you should still take a look at the spreads.

Spread of the ETF

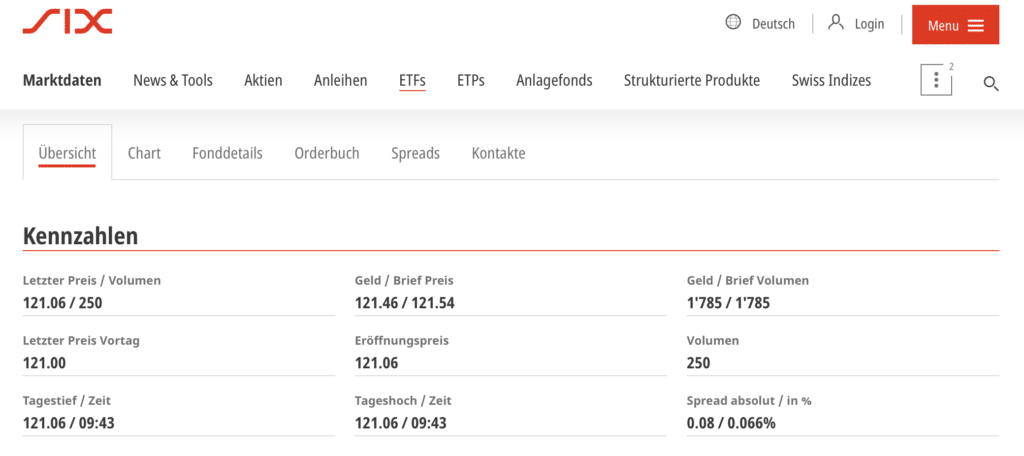

On the SIX website you can view the average spread in the ETF Explorer. The spread is the difference between the buy and sell price. In our example, the spread on Simon’s ETF, which is traded in CHF, is 0.066%. If you buy a share and sell it at the same moment, you would have made a minus of 0.066% due to the spread. We ignore the trading fees of your broker and the exchange in the theoretical example. The ETF traded in USD has a spread of 0.381%.

As you can see, it may be worthwhile to briefly check your desired ETF on the SIX website regarding spread. Exotic ETFs that are still new or not frequently traded, such as the HSBC Hang Seng TECH UCITS ETF, may well have a spread of 0.5% or quite a bit higher. However, a high trading volume is not the only criterion for a low spread.

It should be noted that the spread is also incurred twice – when buying and when selling.

Of course, savings foxes can still check the spread on foreign exchanges (e.g. Xetra, London…). Under certain circumstances, it may be lower there thanks to higher trading volume, so that the bottom line is that buying in USD is still more advantageous.

Conclusion

Let’s conclude that in our example, buying the ETF in CHF is the most cost-effective: there are no exchange fees and the ETF in CHF also has the lower spread on the SIX exchange.

So when looking for an ETF, it can be worthwhile as a Swiss to include the trading currency as a selection criterion and to take a look at the spread.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.