Letztes Update: 28. September 2023

ETFs are so popular not least because of their simplicity. You enter the number of units and a limit at your broker and a little later the purchase is settled and you have invested in several hundred or thousand companies. But who are you actually buying the ETF shares from? Another investor? The ETF issuer? In practice, you often buy your ETF shares from a market maker. Market-what? That’s exactly what this article is about for investors who want to dive a little deeper into the topic of ETFs. Don’t worry: As described at the beginning, trading is quite easy for private investors, you don’t need to understand all this to buy an ETF.

I spoke with Pravin Bagree, Head of ETF Capital Markets of UBS ETF, on the topic of market makers. The major bank UBS is the fourth largest ETF issuer in Europe, manages over USD 94 billion in assets in its ETF division and specializes in the ESG sector, among other things. For more information on UBS ETFs, click here.

Pravin Bagree originally comes from investment banking and now works on the UBS ETF Capital Markets team advising institutional clients on how, with whom and when best to buy ETFs. He is also working on optimizing the trading architecture to make the spread of UBS ETFs as tight as possible.

When you sell an ETF, there is often a market maker on the other side as well. But for simplicity’s sake, we’ll always assume in this example that you’re buying an ETF. And for once, I have used only the masculine form in this post. The female form is of course always included.

The ETF

In order to understand trading with ETFs, we first come back to the advantages of ETFs. Pravin Bagree cites four characteristics that make an ETF so attractive:

- Liquidity: You can trade an ETF at any time during stock exchange opening hours.

- Transparency: The securities included must be published daily. A mutual fund is only required to publish quarterly or less frequently.

- Price transparency: You always know how much you are paying for an ETF share. With a mutual fund that is not traded on the stock market, you don’t know until after you buy it.

- No minimum size: you can also buy only one share.

The biggest difference between an ETF and a mutual fund is that it can be traded on the stock exchange all the time, because mutual funds can only be bought once a day at NAV (net asset value) directly from the fund provider.

For a post that highlights the differences between an ETF and an index fund, click here.

But now let’s get a little closer to ETF trading. To do this, let’s look at the differences between the secondary and primary markets.

On the secondary market, existing ETF shares change hands. Whereas on the primary market, also known as the issue market, securities are created or redeemed.

ETFs can be traded on both the primary and secondary markets. As a private investor, however, you will hardly come into contact with the primary market, but more on that below.

The secondary market

In the secondary market, there are several ways in which a trade takes place. For example, on the stock exchange, a private investor is found with a retail investor or an institutional investor. It looks like this:

The seller’s ETF shares go to the buyer. The seller receives money from the buyer in return.

“For an ETF like the UBS ETF SMI® (CH0017142719), which has total fund assets of just under CHF 2 billion and is traded frequently, the likelihood of a buyer and a seller finding each other and trading without a market maker is relatively high,” says Pravin Bagree.

However, if no seller can be found at the moment, then a market maker steps in. It is therefore also called a liquidity provider. It will look like this:

In this case, you buy your ETF shares from a market maker. According to Pravin Bagree, “The stock market is a anonymous trading place. Who the ETF shares are bought from cannot be traced. UBS, as the ETF issuer, is not involved in the secondary market. We don’t know who is buying or selling the ETF shares on the exchange.” So you’ll never buy your ETF shares from UBS itself on the secondary market.

The primary market

Earlier I wrote that when you buy an ETF, you don’t come into contact with the primary market. This is only partially true because if the market maker also runs out of ETF shares in its inventory, then it goes to an “ Authorized Participant “ (AP) who can create ETF shares in the primary market. A Market Maker can be an Authorized Participant at the same time, but does not have to be.

“Authorized Participants are the only entity that can create (create) and redeem (rede em) ETF shares. These are specific entities such as investment banks or market maker firms. These can create or redeem shares at NAV with the ETF issuer. New ETF shares can be created in two ways: Either the AP delivers cash to the ETF issuer, in our case UBS, or it delivers the underlying shares. For example, with an ETF on the Indian stock market, that will mostly be cash; with our SMI ETF, the AP has the choice of providing us with cash or the underlying stocks.”

This looks like this:

Market Maker – Price Determination

“The main job of a market maker is to provide prices on an ongoing basis. So to construct a money and letter prize,” explains Pravin Bagree.

And how does he do this when a stock market is still closed? For example, someone wants to buy an S&P 500 ETF at 10 a.m. on the SIX Swiss Exchange. However, the U.S. stock exchange does not open until 3:30 p.m. Swiss time. How does a price for the ETF still come about?

Pravin Bagree: “A market maker always has to ask himself how much the stocks in the ETF are worth. For example, he can use the S&P 500 future as a benchmark and thus determine an approximate value. The next question a market maker must ask is, at what price am I willing to sell the ETF share. That’s because the market maker incurs hedging costs by selling.”

Market Maker – Hedging Costs and Trading Hours

Let’s take an example: In the morning, you buy an ETF share on the S&P 500 worth CHF 100. The market maker does not hold the share himself, he sells you the ETF short. To close the position, he has several options. For example, he can buy the ETF share on the stock exchange at a later date. However, the stock market fluctuates and he thus bears the risk that he will have to buy the share at a later date at a higher price. That’s why he hedges, he uses hedging strategies. For example, he can use futures or he buys the stocks included in the ETF, provided that the stock market is open.

However, all hedging strategies are not free, so they always involve costs. The more a market fluctuates, the more difficult it becomes to determine the true value of the underlying shares and the more expensive hedging becomes. He passes on this risk or the costs incurred to the investor by increasing the spread.

“If the U.S. equity market is then open and the market maker has more certainty about how much the underlying shares are actually worth, he may be able to tighten the spread,” Pravin Bagree continues.

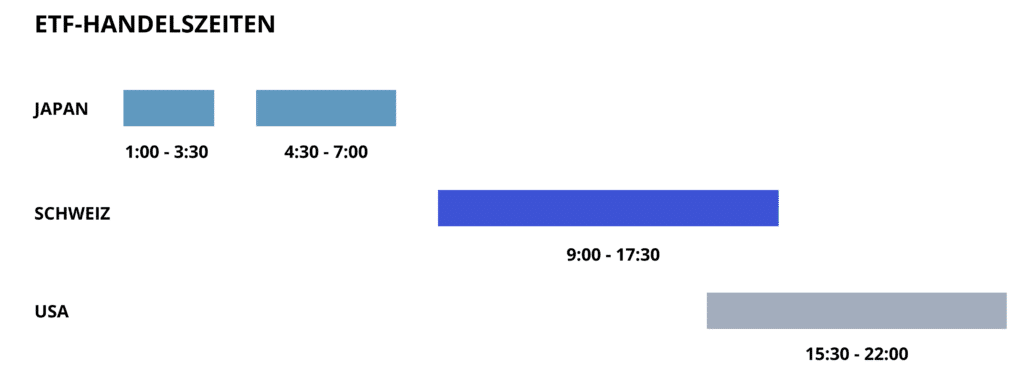

So, for you as an investor, it might be advantageous to buy U.S. ETFs or ETFs that have a high U.S. content (e.g., MSCI World) only after 3:30 pm. Because that’s when the U.S. market opens and the ETF’s underlying stocks are traded. The opposite is true for an ETF on Japanese or Pacific stocks, where the prices of the underlying stocks are most current in the morning.

Market Maker – Competition

Most of the time, there are several market makers that provide prices for the same ETF. How is it decided which market maker will execute the order? Pravin Bagree explains, “It’s simple: competition among market makers plays out on the exchange, and the one with the best price will make the trade.”

And how do market makers make money? Pravin Bagree: “There are ETF issuers who pay market makers to quote prices, we as UBS do not do that. We have an open architecture and let the competition play. Any market maker can set prices if they want to. So with our ETFs, a market maker only earns on the spread, which is the bid-ask spread.”

Simply put, a market maker will try to buy securities at a low bid price and sell ETF shares at the highest possible ask price. However, the competing market makers will try to do the same. However, if the spread is set too high, someone else will make the trade. After all, it’s a high-volume business where even small fry make a mess.

Market Maker – Stock Exchange

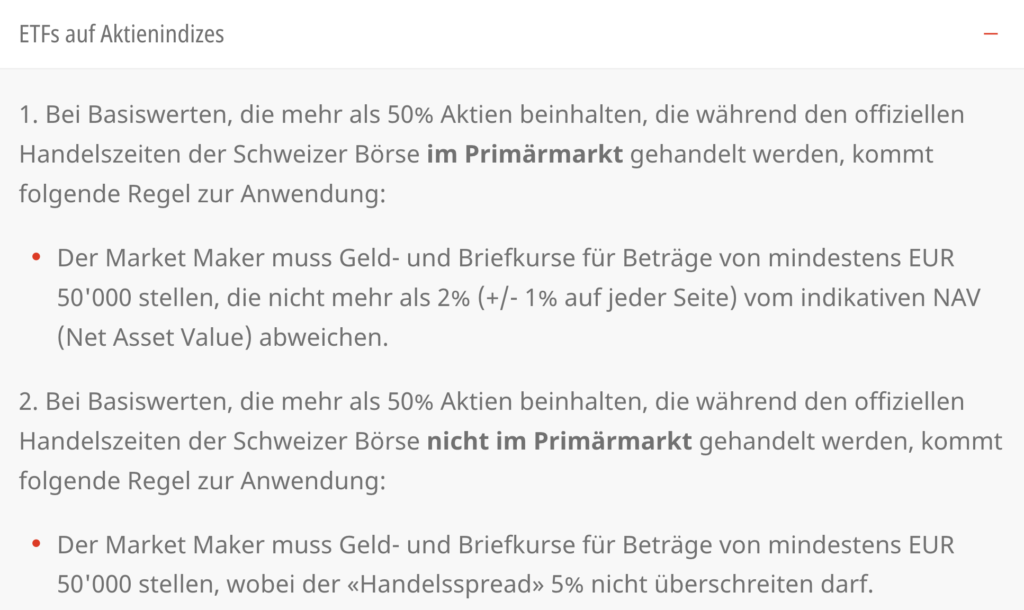

Who may act as a market maker is determined by the respective exchange. A total of 18 market makers for ETFs are admitted to the Swiss exchange operated by SIX. It is also the exchange that imposes certain requirements on market makers. For example, a market maker must be present on the order book during official trading hours, and its quoted prices must not exceed a certain spread.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.