Letztes Update: 10. July 2024

In November 2020, the Zurich-based fintech neon launched the pilot project neon green on the crowdfunding platform wemakeit. You can read about who neon green’s tree partner is and more details in my post from last year. 1,500 wemakeit supporters have since been able to test neon green. I was there from the beginning and now use neon green as my main account. As of today, neon green is now officially launched and regularly available.

We take a look at the benefits of neon and the additional features of neon green in this post.

What is neon?

neon into a Swiss smartphone account with unbeatable prices. neon free was officially launched in March 2019. Around 70,000 customers have now completed the simple and digital registration process. And the number of employees has increased to around 30. The neon app is available on Google Play, the Apple App Store, and Huawei’s AppGallery. By the way, your neon account is managed by Hypothekarbank Lenzburg and is therefore subject to the Swiss deposit guarantee of CHF 100’000.

Main advantages of neon:

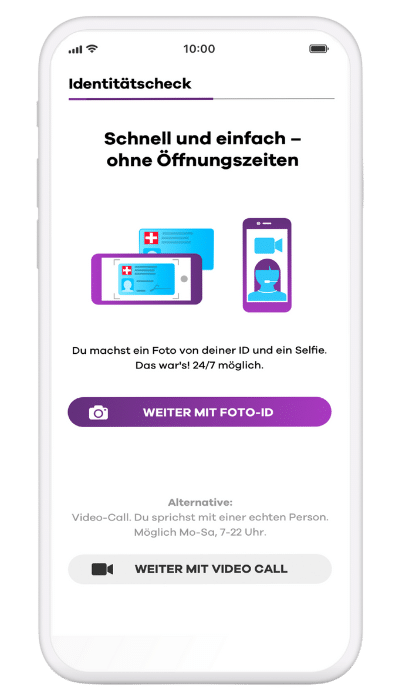

- Account registration under 10 minutes, with photo ident available 24/7

- no basic fee

- Swiss deposit insurance

- two domestic withdrawals in CHF per month free of charge

- Payments in foreign currencies without exchange rate surcharges

- Apple Pay, Google Pay, Samsung Pay

- Standing orders, ebill

- cheap and fast transfers to 40 currency areas with Wise

- neon Spaces (subaccounts)

- Data is stored in Switzerland

That’s what neon is working on:

- Transfers neon2neon

- Joint account

No other Swiss neo-bank currently offers so many currencies to transfer, combined with an attractive foreign currency rate for card transactions.

What does neon green offer in addition?

neon green is, according to neon, “Switzerland’s first digital, climate-positive account.” In contrast to neon free, neon green costs CHF 5 per month and can be cancelled monthly. The following additional features are offered by neon green:

- Basic offset through myclimate

- 5 trees are planted per month

- for every CHF 100 spent with your neon green Mastercard, a tree is planted

- Warranty extension for electronic products for three additional years (details here)

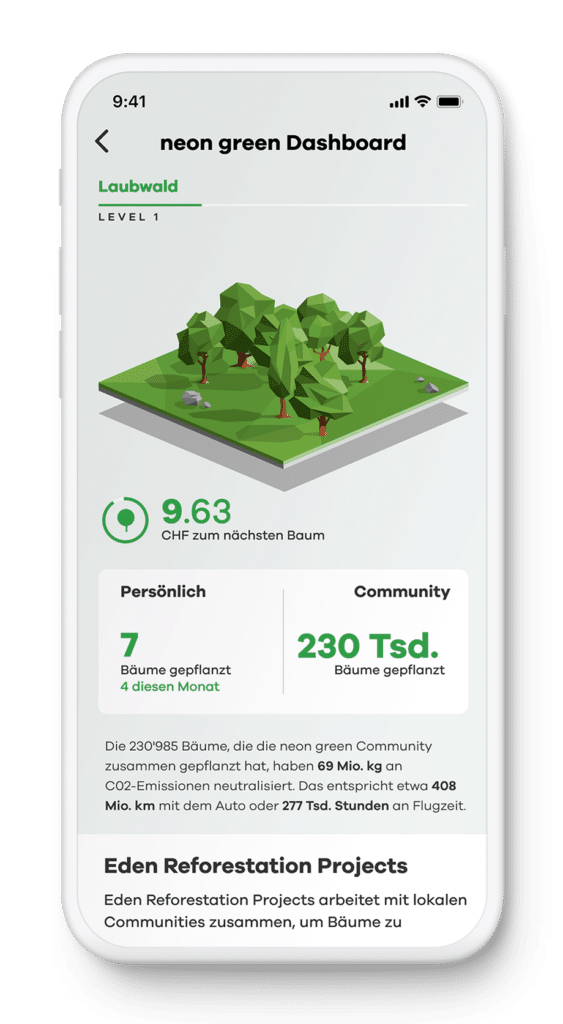

Gamification elements show you the progress of your tree collection: In the account app you can see the number of trees planted thanks to you as well as the total number of trees planted by the neon green community. After 25 trees you will reach a new level. For example, in level 1 you collect deciduous trees, followed by conifers in level 2.

You can “green” your money with impact investing provider Inyova, which partners with neon green. I have already introduced Inyova to you. You can find the article here.

The card is either made of chic cherry wood – by the way, the cherry trees are sustainably grown and 100,000 cards can be produced per tree – or recycled PVC. The wooden card costs CHF 20 when issued, while the recycled PVC card is free.

In a further step, it should then be possible to analyze the company’s own transactions and their CO₂ impact in more detail.

You can find more details directly on the website of neon green.

How can neon green be climate positive?

neon calculates that Swiss people have an average credit card spend of CHF 410 per month and are responsible for CO₂ emissions of around 14 tons per year. Using the neon green credit card would therefore plant 49 trees per year for an average user and thus offset around 15 tons of CO₂.

On the neon green website, you can enter your monthly credit card spending, and a calculator will show you the number of trees planted each year thanks to you.

Conclusion

If sustainability is important to you, neon green is an easy way to minimize your own footprint. Thus, neon green was also created as a result of customer requests, and surveys had shown that the need for a “green” account was widespread.

Also of interest is the warranty extension of three additional years for electronic devices purchased with the neon green credit card.

And all others are still in good hands with neon free.

Want to try neon free or neon green? If you enter the code finanzdepot when opening an account, you will receive the neon credit card for free – normally it costs CHF 10 once – and an additional CHF 10 as a starting credit. By the way, with neon green you pay nothing for receiving the credit card even without a code. With the code you will then simply receive CHF 10 as a starting credit.

Have you already had experience with neon free or neon green? Then share them in the comments.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.