Letztes Update: 23. January 2024

By now, almost everyone knows that you can save taxes with pillar 3a. And you’ve probably also heard that you should have several pillar 3a accounts or pillar 3a custody accounts because of the capital gains tax. But why is that actually the case and how much tax do you actually pay when you draw? With concrete figures from various cantons – which of course tax the withdrawal differently – we take a closer look at this in this amount on the staggered withdrawal of pillar 3a.

Save Pillar 3a Taxes

First, the general conditions. In order to be able to deduct the payments into pillar 3a from your taxes, you must be gainfully employed. If you are insured under Pillar 2, i.e. affiliated with a pension fund, the maximum amount for Pillar 3a in 2023 is CHF 7,056. Employees and self-employed persons who are not insured under Pillar 2 can deduct up to 20% of their earned income, up to a maximum of CHF 35,280 (5 x 7,056 = 35,280).

Fill out pillar 3a tax return

And how does the deduction of Pillar 3a contributions in the tax return work? It’s very simple: You receive a “certificate of pension contributions” from your Pillar 3a provider. This shows how much you paid into pillar 3a with this provider in the year in question. You transfer this figure to your tax return. If you’ve deposited with multiple providers, you add it all up.

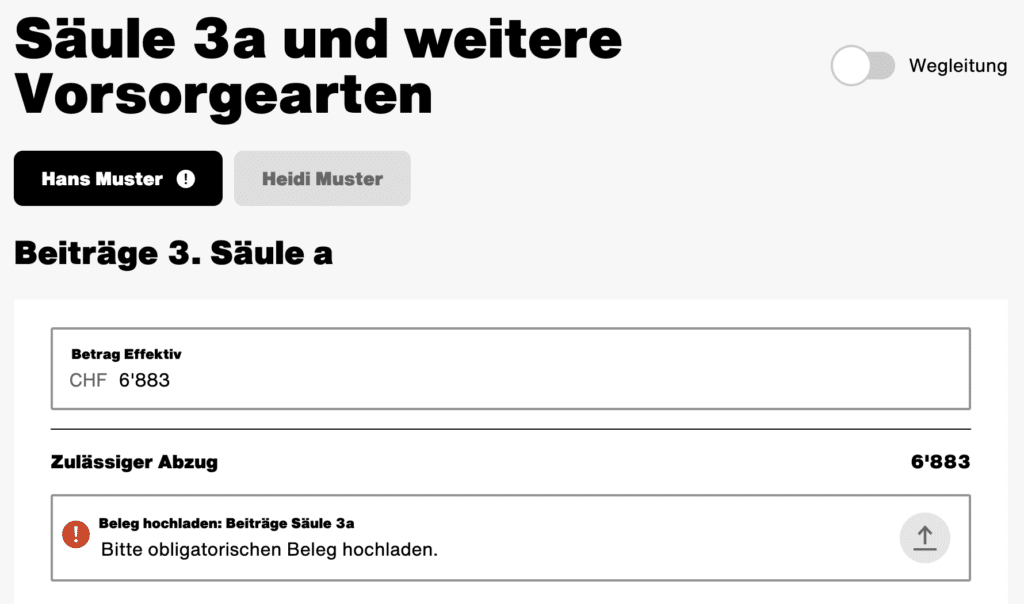

In the tax return of the Canton of Zurich, you will find the heading “Pillar 3a and other types of pension” under deductions. Here you enter the number from the “Certificate of pension contributions” and upload the certificate. For the year 2022, this looks as follows in the canton of Zurich:

This amount is now deducted from the taxable income by the online tax return tool ZHprivateTax. Which leads us to the next question.

How much tax can you save with pillar 3a?

I can’t answer that question in this blog post for your specific case. This is because it depends on various factors. For example, how much you earn, where you live, if you are married and so on.

But I can give you a few very rough examples of how much tax you can save if you pay the maximum amount of CHF 7,056 into pillar 3a (single, non-denominational, no children):

| Kanton | Hauptort | PLZ | Steuerersparnis bei Bruttojahreseinkommen von CHF 80000 | Steuerersparnis bei Bruttojahreseinkommen von 100000 |

|---|---|---|---|---|

| Aargau | Aarau | 5000 | 1535 | 1863 |

| Appenzell Ausserrhoden | Herisau | 9100 | 1577 | 1883 |

| Appenzell Innerrhoden | Appenzell | 9050 | 1171 | 1476 |

| Basel-Land | Liestal | 4410 | 1971 | 2341 |

| Basel-Stadt | Basel | 4000 | 1702 | 1951 |

| Bern | Bern | 3000 | 1791 | 2081 |

| Freiburg | Freiburg | 1700 | 1851 | 2124 |

| Genf | Genf | 1200 | 2077 | 2388 |

| Glarus | Glarus | 8750 | 1385 | 1634 |

| Graubünden | Chur | 7000 | 1578 | 1866 |

| Jura | Delémont | 2800 | 1856 | 2105 |

| Luzern | Luzern | 6000 | 1377 | 1626 |

| Neuenburg | Neuchâtel | 2000 | 1994 | 2347 |

| Nidwalden | Stans | 6370 | 1229 | 1505 |

| Obwalden | Sarnen | 6060 | 1114 | 1363 |

| St.Gallen | St.Gallen | 9000 | 1818 | 2067 |

| Schaffhausen | Schaffhausen | 8200 | 1495 | 1873 |

| Schwyz | Schwyz | 6430 | 1081 | 1360 |

| Solothurn | Solothurn | 4500 | 1778 | 2026 |

| Thurgau | Frauenfeld | 8500 | 1468 | 1740 |

| Tessin | Bellinzona | 6500 | 1830 | 2051 |

| Uri | Altdorf | 6460 | 1194 | 1443 |

| Waadt | Lausanne | 1000 | 1859 | 2272 |

| Wallis | Sitten | 1950 | 1738 | 2238 |

| Zug | Zug | 6300 | 723 | 1205 |

| Zürich | Zürich | 8000 | 1449 | 1853 |

On the Internet you can find various tools that allow you to calculate your personal savings more accurately.

You do not have to declare the total amount you have saved in your Pillar 3a accounts and custody accounts on your tax return. You therefore do not pay property tax on it.

Pillar 3a withdrawal

Retirement benefits from pillar 3a are exclusively for pension purposes and may be drawn no earlier than five years before reaching the AHV retirement age. There are exceptions to this, which we will not discuss further here.

The latest withdrawal date is the year of ordinary retirement (65/64). If you are still in paid employment after that, you can withdraw your Pillar 3a funds up to five years later – currently at age 69 for women and 70 for men. The AHV reference age will be standardized at 65 in the next few years, and then the latest payment date will be 70 for both genders.

Pillar 3a: Taxes on staggered withdrawals

So, now we finally come to the actual topic; the taxation of Pillar 3a withdrawals. Of course, every canton does it differently, so let’s first look at the capital gains tax under the direct federal tax. This is because the federal government also has its hand out when it comes to Pillar 3a withdrawals.

This is an excerpt from the “Federal Law on Direct Federal Tax” (DBG) and sounds appropriately dry. The important thing to take along is that lump-sum benefits, i.e. our 3a withdrawals, are taxed separately from other income and at a reduced rate. For the federal government, this tax rate is one-fifth of the normal rate. And the normal tariff is progressive, so the federal pension tariff is also progressive.

To explain the tax progression: the higher the income, the higher the percentage tax rate. Example: If you withdraw CHF 50,000 from pillar 3a, approx. 4.5% tax is due on it. With a withdrawal from pillar 3a of CHF 250,000, the figure is already around 6%.

The tax laws of the individual cantons are not considered individually here. Comparisons with concrete figures are more interesting.

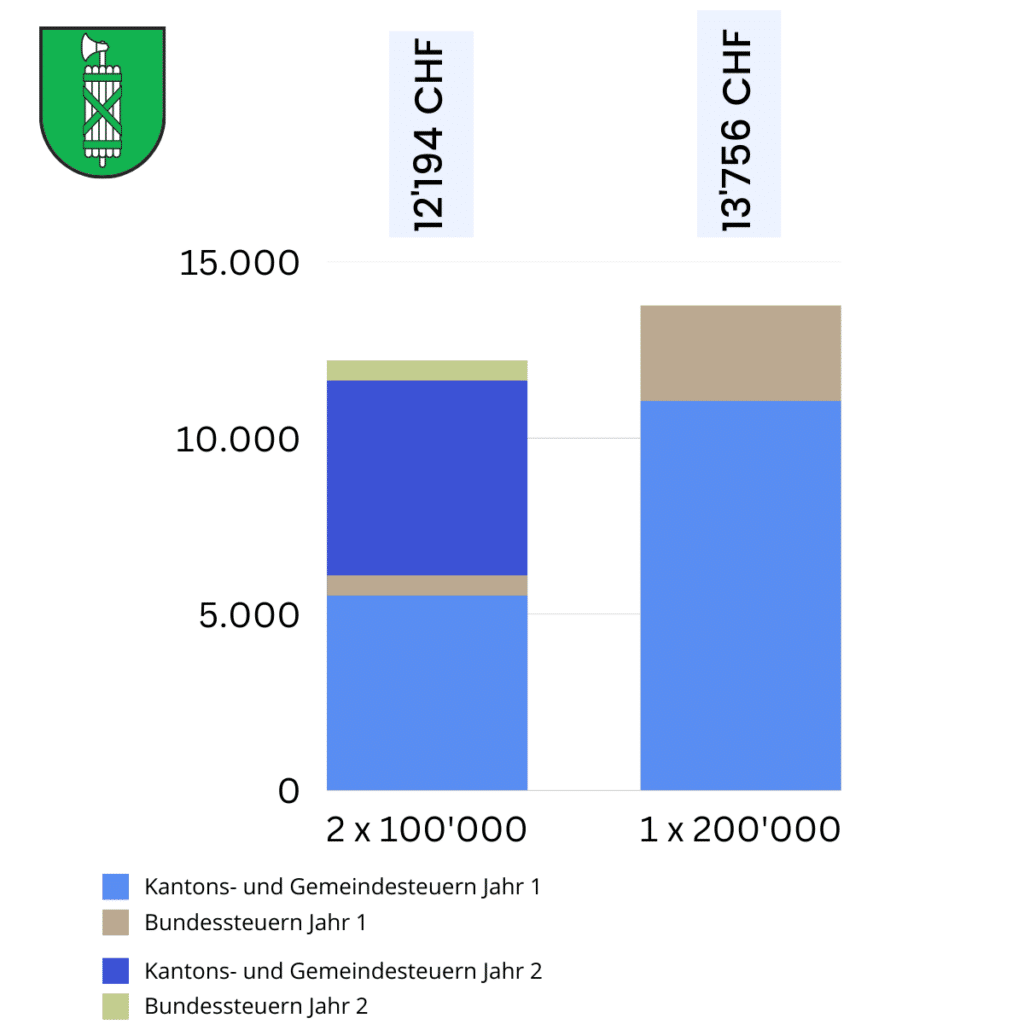

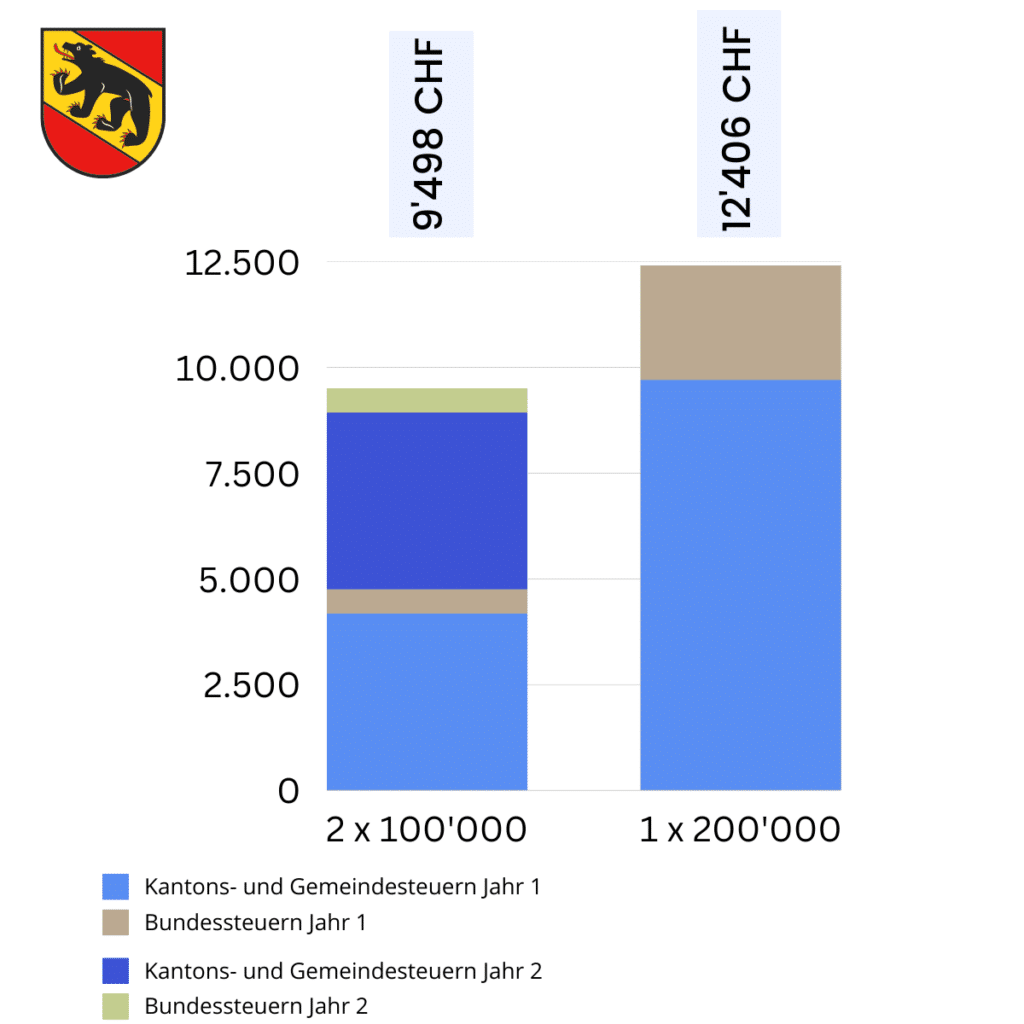

All examples show the cantonal, municipal and direct federal tax for a withdrawal of CHF 2 x 100,000 in two different years and 1 x 200,000 in one year for a single, non-denominational person.

Taxes reference 3a in St. Gallen

In the canton of St. Gallen, capital benefits are taxed on a straight-line basis. This is also called a flat rate. So it doesn’t matter at the cantonal level whether you close all your accounts and securities accounts at once or withdraw them in stages. It will look like this:

Wait, the right bar at the single resolution is higher than the left bar at the staggered resolution. Yes, this is due to the direct federal tax, which is progressive.

If we sort by federal tax and cantonal or municipal tax, this becomes clear:

Taxes reference 3a Bern

The differences are greater here because Bern also has a progression for lump-sum benefits from the pension scheme.

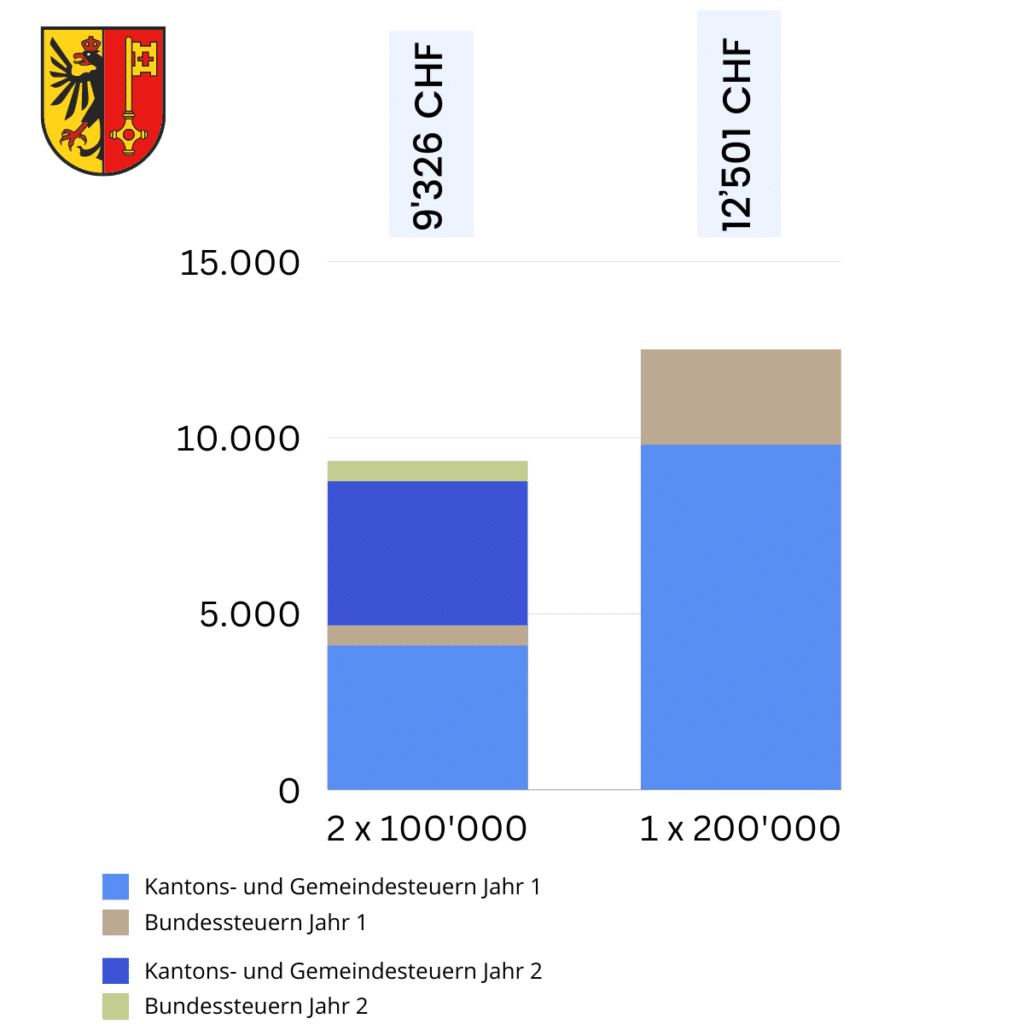

Taxes reference 3a Geneva

The differences are even greater in Geneva. Geneva is anything but a tax haven anyway.

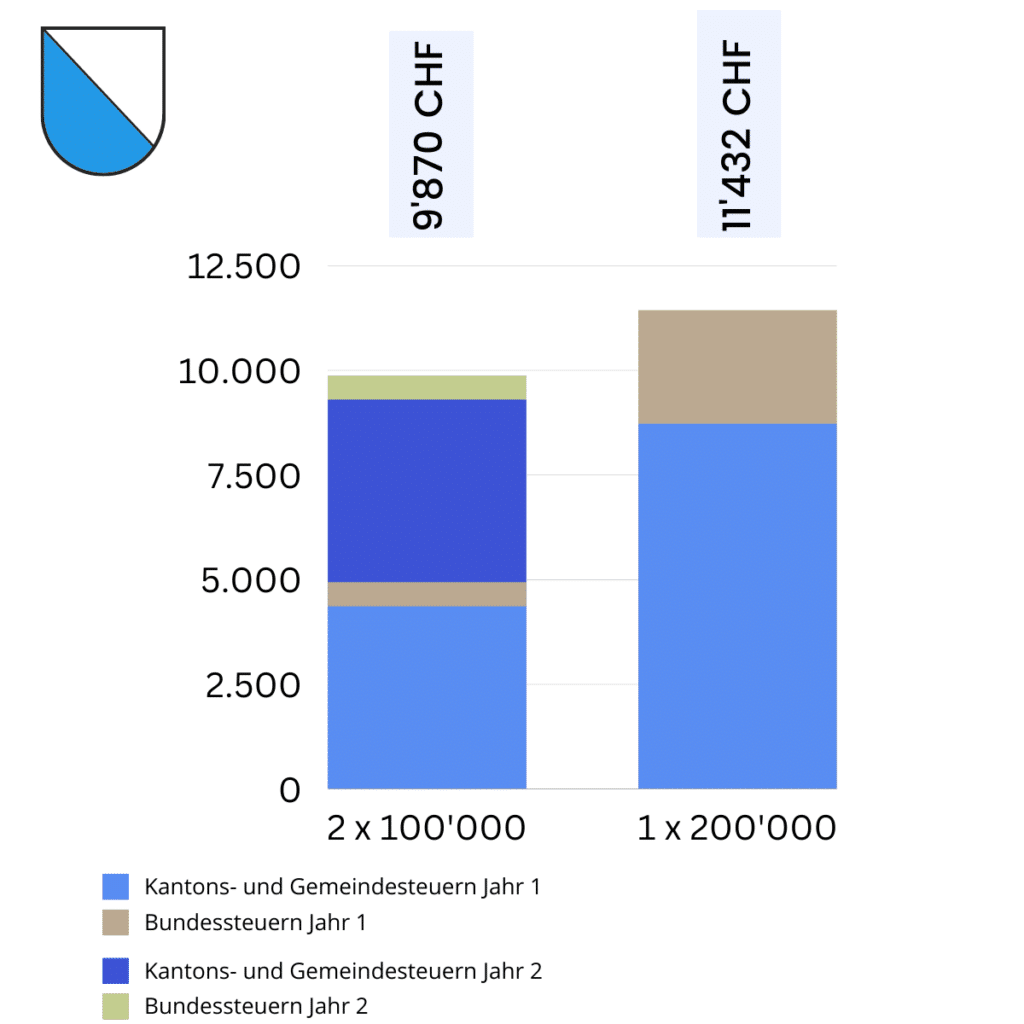

Taxes reference 3a Zurich

Zurich is somewhat special because the tariff is actually progressive as well, but the progression kicks in quite late. To be precise, only from CHF 409,000, before that the simple state tax is 2%. But beware, the direct federal tax is progressive much earlier. And so multiple accounts and staggered withdrawals are again worthwhile in Zurich.

Comparison cantons reference pillar 3a

| Kanton | Hauptort | PLZ | Steuern bei Bezug von 1 x 100’000 in CHF | Steuern bei Bezug von 1 x 100’000 in % | Steuern bei Bezug von 2 x 100’000 in CHF | Steuern bei Bezug von 1 x 200’000 in CHF | Steuern bei Bezug von 1 x 200’000 in % | Einsparung bei 2 x 100’000 statt 1 x 200’000 in CHF |

|---|---|---|---|---|---|---|---|---|

| Aargau | Aarau | 5000 | 5014 | 5.01% | 10028 | 13513 | 6.76% | 3485 |

| Appenzell Ausserrhoden | Herisau | 9100 | 7975 | 7.97% | 15950 | 17512 | 8.76% | 1562 |

| Appenzell Innerrhoden | Appenzell | 9050 | 3386 | 3.39% | 6772 | 8872 | 4.44% | 2100 |

| Basel-Land | Liestal | 4410 | 3875 | 3.88% | 7750 | 9312 | 4.66% | 1562 |

| Basel-Stadt | Basel | 4000 | 5325 | 5.33% | 10650 | 15462 | 7.73% | 4812 |

| Bern | Bern | 3000 | 4749 | 4.75% | 9498 | 12406 | 6.2% | 2908 |

| Freiburg | Freiburg | 1700 | 5612 | 5.62% | 11224 | 16392 | 8.2% | 5168 |

| Genf | Genf | 1200 | 4663 | 4.66% | 9326 | 12501 | 6.25% | 3175 |

| Glarus | Glarus | 8750 | 5183 | 5.18% | 10366 | 11928 | 5.96% | 1562 |

| Graubünden | Chur | 7000 | 3395 | 3.4% | 6790 | 8352 | 4.18% | 1562 |

| Jura | Delémont | 2800 | 6240 | 6.24% | 12480 | 16316 | 8.16% | 3836 |

| Luzern | Luzern | 6000 | 5269 | 5.27% | 10538 | 13449 | 6.72% | 2911 |

| Neuenburg | Neuchâtel | 2000 | 5843 | 5.84% | 11686 | 15413 | 7.71% | 3727 |

| Nidwalden | Stans | 6370 | 3696 | 3.7% | 7392 | 9601 | 4.8% | 2209 |

| Obwalden | Sarnen | 6060 | 5694 | 5.69% | 11388 | 12950 | 6.47% | 1562 |

| St.Gallen | St.Gallen | 9000 | 6097 | 6.1% | 12194 | 13756 | 6.88% | 1562 |

| Schaffhausen | Schaffhausen | 8200 | 3533 | 3.53% | 7066 | 9959 | 4.98% | 2893 |

| Schwyz | Schwyz | 6430 | 2439 | 2.44% | 4878 | 9810 | 4.91% | 4932 |

| Solothurn | Solothurn | 4500 | 5006 | 5.01% | 10012 | 13209 | 6.6% | 3197 |

| Thurgau | Frauenfeld | 8500 | 6647 | 6.65% | 13294 | 14856 | 7.43% | 1562 |

| Tessin | Bellinzona | 6500 | 4375 | 4.38% | 8750 | 10312 | 5.61% | 1562 |

| Uri | Altdorf | 6460 | 4280 | 4.28% | 8560 | 10122 | 5.06% | 1562 |

| Waadt | Lausanne | 1000 | 4714 | 4.71% | 9428 | 13007 | 6.5% | 3579 |

| Wallis | Sitten | 1950 | 4775 | 4.78% | 9550 | 11392 | 5.7% | 1842 |

| Zug | Zug | 6300 | 3352 | 3.35% | 6704 | 9144 | 4.57% | 2440 |

| Zürich | Zürich | 8000 | 4935 | 4.93% | 9870 | 11432 | 5.72% | 1562 |

Tips reference pillar 3a

Very roughly, it can be said that the taxation of lump-sum benefits from the pension scheme by the federal government, the canton and the municipality together amounts to between five and ten percent of the pension benefit.

Remuneration within one year is added together. If, in addition to your third pillar, you also draw on your vested benefits account or your pension fund benefits in lump-sum form in the same year, the amounts are added together for tax purposes. When planning the graduation, you should therefore also take these capital withdrawals into account.

It is advantageous if all 3a accounts or deposits are approximately equal. It should be noted that 3a custody accounts with securities tend to grow faster than pure 3a accounts. You cannot split an existing Pillar 3a account or custody account. But you can put them together.

The payments of spouses are also added together within a tax year – at least in the vast majority of cantons.

After withdra wing pillar 3a, the amount must of course be declared as assets in the tax return.

This blog post does not cover all special cases and restrictions. It is advisable to consult a financial advisor for detailed planning.

Are you looking for the right provider for your Pillar 3a? Then you will find a pillar 3a comparison here.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.