Letztes Update: 28. September 2023

In the financial blogger scene, big banks are often and gladly scolded objects. Some of the criticism is justified: Horrendous issue surcharges, hidden fees, advisors who tend to have the bank’s best interests at heart rather than those of their clients, bonus excesses, and so on. Credit Suisse has also drawn attention to itself recently with all kinds of bankruptcies, misfortunes and mishaps. However, I don’t want to regurgitate generalities and prejudices on my finance blog, but rather try out and test the products myself. So here you read about my experience with CSX investing. By the way, I was not paid by Credit Suisse for this contribution.

Oh, and to all the Credit Suisse bashers, check out who the index funds in your Pillar 3a from the highly acclaimed fintech VIAC come from. That’s right, from Credit Suisse.

CSX

Credit Suisse launched CSX in the fall of 2020. Just one year later, CSX was considered the best-known Swiss brand for digital banking. According to a CS media release late last year, CSX had already gained 100,000 customers at the time, with about half using CSX as their primary banking connection. And half of CSX users are under 34 years old. As a result of “rebooking actions”, many previous Credit Suisse clients are likely to have switched more or less voluntarily from standard packages to CSX. CS does not disclose figures on this.

The opening of my CSX account was rather bumpy. These teething troubles should have been eliminated by now. In the App Store, the CSX app is rated 4.6 out of 5 stars. The most frequent criticism is that the debit card cannot be deposited with Apple Pay. However, this is now possible. However, the CSX Debit Mastercard cannot yet be deposited with Samsung Pay, Google Pay and SwatchPAY!

CSX Create

Once the CSX account is set up, you can find CSX Anlegen in the Credit Suisse app. I always search for “CSX” on my smartphone, but the app is called “Credit Suisse”. Anyway, you can find CSX Anlegen in the opened app on the bottom right under “More”, “Save/Invest” and then under “Create”.

For setup, you can either get advice from the digital advisor or choose the funds yourself. I opted for the former.

In chat form, you’ll be asked about time horizon, other assets and account balances, liabilities, your gross income, your annual savings balance, and three questions about your risk tolerance.

At the end, the advantages and risks of investment funds are briefly discussed. If you have studied a bit about investing, these explanations are easy to understand. They are likely to be overwhelming for complete novices.

CSX Investing – Strategies and Funds

Finally, an investment strategy is recommended to you based on the information you provide. A total of three strategies are available at CSX Anlegen:

- Relaxed walker (10-30% shares)

- Confident walker (20-60% shares)

- Adventurous climber (50-80%)

Adventurous Climber” was recommended to me.

Within each strategy, there are four funds to choose from:

Sustainability fund (flat fee: 0.95%)(no longer available)- Switzerland Focus Fund (Flat Fee: 0.67-1.24%)

- Distribution Fund (Flat Fee: 1.37-1.63%)

- Flagship Funds (Flat Fee: 1.49-1.84%)

You can find the annual fee of each fund directly at the short description. You can also view the factsheet and compare the funds. This feature is pretty well done. I finally selected the “Sustainability Fund”. This is not investment advice and does not constitute a recommendation to buy or sell this fund. Always do your own thinking about your investments.

In the next step you will be asked for the initial deposit and the monthly investment. CSX will give you recommendations based on the information you provide in the chat, but they can be overridden quite easily. The minimum investment for the one-time investment and the monthly investment is CHF 100.

Finally, you can specify from which CSX account you want to make the initial investment.

A progress bar at the top of the app shows how much longer the consultation will take. Also successful is the confirmation screen, which gives a face to the fund managers.

Credit Suisse ESG Focus Wealth Fund Growth

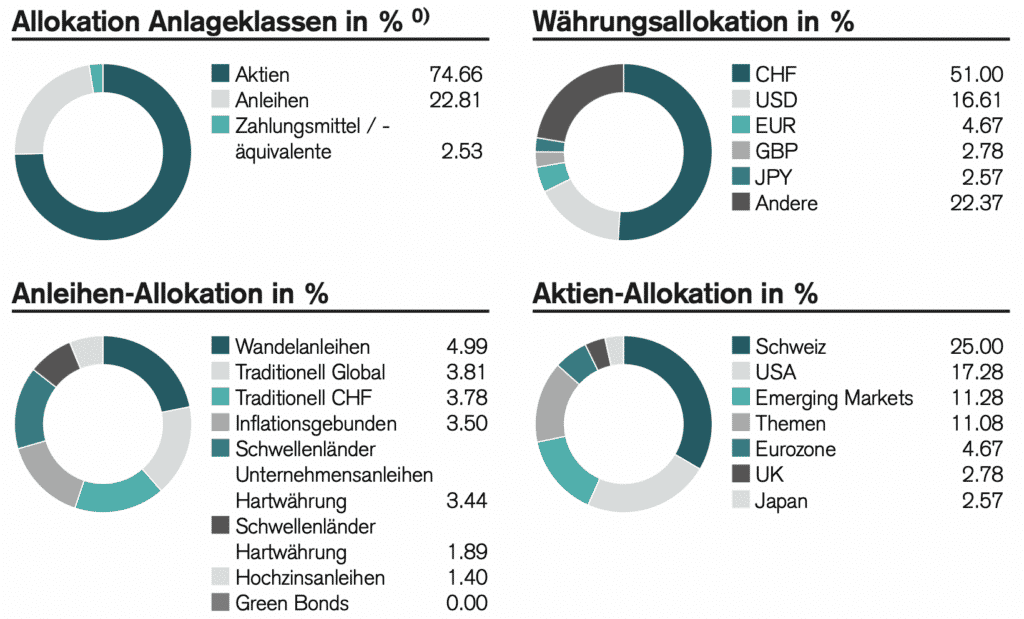

Let’s take another quick look at the factsheet of the fund I selected. This invests in a broadly diversified portfolio of passively and actively managed instruments and takes ESG criteria into account.

A look at the largest ten positions shows that the fund invests in Credit Suisse ETFs, but also takes into account ETFs and index funds from other providers.

CSX Investing Costs

Let’s talk about the costs of investing with CSX. The CSX account in the absolute basic version (CSX White) is free of charge.

There is also no issue or redemption premium for CSX’s funds.

In terms of costs, Credit Suisse can almost keep up with a robo-advisor. Note that product costs must always be factored into any comparison. Robo-advisors often show a large management fee and the product costs would then have to be added. With CSX Anlegen, both are included in the annual fee (also called “flat fee” and “ongoing costs” in the factsheet).

Incidentally, the ongoing costs of the CSX funds also include the costs of the funds they contain, as the Credit Suisse media office was able to confirm to me. This is not always the case with funds that contain funds, also called funds of funds or funds of funds. There, the TER of the funds contained therein is added to the TER shown in each case.

Attention, CSX Anlegen is not to be confused with the Credit Suisse fund savings plan. Different conditions apply there, but even the CS customer service doesn’t know that for sure.

CSX Customer Service

The chat is very well hidden in the app. Most of the time, only one phone number appears. Because I have received false statements from CS employees on the phone several times, I prefer the written form. By chance I discovered the chat after all.

The advisor in the chat mentioned a custody fee of 0.25% (up to 1 million) charged on the custody value at CSX. However, I could not find this fee in any document, so I checked with the media office and they told me that CSX does not have this custody fee.

Credit Suisse has been advertising for some time with “customer service with real people. Real people are of relatively little use to me if their statements are not correct.

CSX Create Conclusion

A big advantage is definitely that with CSX you only need one banking app for daily banking transactions like paying (Debit Mastercard, eBill, transfers, TWINT …), saving, investing, etc. This way you always have an overview of your finances and don’t have to use any Excel lists or other tracking tools.

In terms of price, Credit Suisse can keep up with the younger, digital competition in the cheapest variant. And tools such as the CSX Financial Plan help people to take a playful look at their own pension situation.

So my experience with CSX’s app has been quite positive. It’s a bit of a shame that the app is quite slow, so you’ll see the spinning circle and “Loading …” more often.

Update February 2023 – Fund liquidation

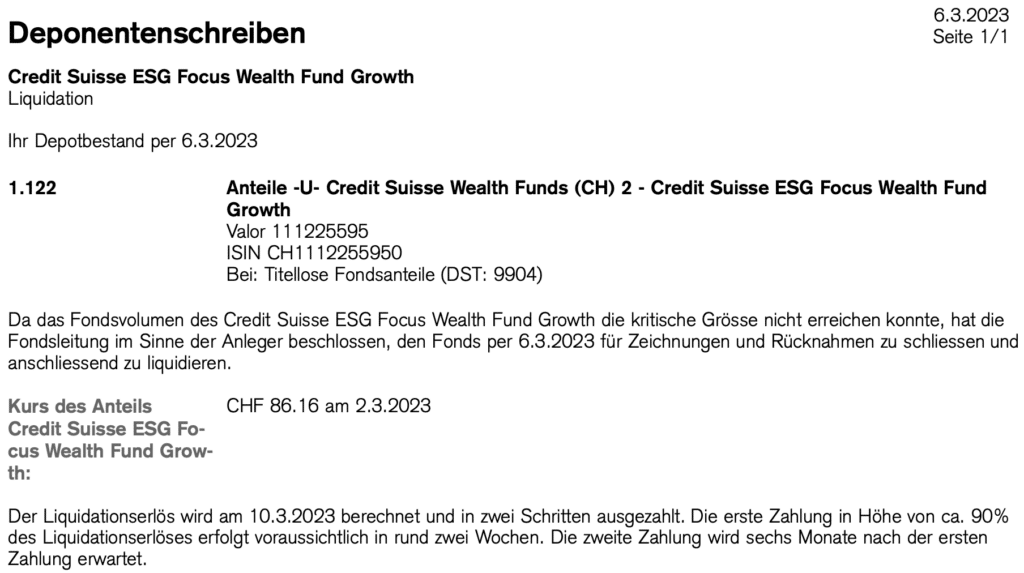

At the beginning of February, I received the following letter from Credit Suisse:

The fund with the flat fee of 0.95% is therefore closed and liquidated. It is not possible to switch directly to another fund. I have no choice but to wait for the payout. This will be done in two installments and the second is not expected for another six months!

For me, the CSX investment experiment is therefore dead. I find the funds that are still available far too expensive. Thus, the experience with CSX Anlegen is unfortunately not so positive.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.