Letztes Update: 19. December 2023

News from Swissquote: The in-house robo-advisor has not really taken off so far. The concept seems too complicated and the minimum amount of CHF 50,000 is probably too high for many. But now a much simpler investment and savings solution is coming to the market with Invest Easy. In this post you’ll learn all about it and I’ll share my experience with Invest Easy from Swissquote.

The name Invest Easy may sound familiar. This is because AXA Versicherungen AG calls its asset management EasyInvest. The minimum deposit value there is CHF 7,500. A payout plan is possible from CHF 30,000. The investment fee is 1.25%, administrative costs start at 0.80% and product costs are around 0.37%.

Swissquote

The online bank Swissquote grew out of a financial platform that gave its users access to real-time quotes. The Swissquote share (SQN) has been traded on the SIX Swiss Exchange since May 2000. The Chief Executive Officer (CEO) is Marc Bürki. In 2001, Swissquote obtained a banking license and became the first purely online bank in Switzerland.

Invest Easy – Save

Actually, there are two products running under Invest Easy. The simpler product is comparable to a savings account. You deposit money and receive interest on it. You can receive interest in CHF, EUR, USD and GBP currencies. We are looking here only at the interest on Swiss francs paid out at the end of the year:

| Amount in CHF | Interest rate |

|---|---|

| 0 – 50’000 | 1.00% |

| 50’001 – 100’000 | 0.50% |

| > 100’001 | 0.10% |

The withdrawal limit is CHF 25,000 per month. If you wish to withdraw larger amounts at once, you must give three months’ notice, otherwise you will pay a 1% withdrawal fee. As with a normal savings account, the deposit guarantee applies up to CHF 100,000. Note that the CHF 100,000 is limited per client and bank and not per account.

Invest Easy – Invest

You can invest in a total of three strategies:

| Strategy | Equity share | Total cost |

|---|---|---|

| Careful | 25% | 0.81% |

| Balanced | 45% | 0.79% |

| Ambitious | 75% | 0.74% |

The annual management fee is 0.60%, plus product fees, which vary among the three strategies and may also change over time depending on composition and weighting. In the table above, I have added the two fees together and shown them as a total cost. This includes the following fees:

- Transaction fees

- Deposit fees

- Incoming money transfers (from bank or postal accounts)

- Outgoing payments in Switzerland and Liechtenstein in CHF/EUR and SEPA transfers

- Annual report/ Tax return/ Income declaration

There are no stamp duties, but exchange fees will be passed on. There is no custody fee, as is the case with the normal Swissquote trading account.

The minimum deposit is CHF 500 and should be made in Swiss francs. When transferring money in another currency, it will first be changed into CHF and the conversion fee of 0.95% will be charged. The minimum deposit for further deposits is then CHF 100.

The components of the Ambitious strategy are:

- iShares Core SPI ETF (29.0%)

- iShares Core MSCI International Developed Markets ETF (22.5%)

- SPDR Portfolio S&P 500 ETF (16.0%)

- Vanguard FTSE Emerging Markets ETF (7.5%)

- UBS ETF (CH) – SXI Real Estate Funds (5.0%)

- L&G ESG Emerging Markets Corporate Bond USD UCITS ETF (4.4%)

- Invesco Bloomberg Commodity UCITS ETF (3.9%)

- UBS ETF (CH) – SBI AAA-BBB ESG (3.3%)

- iShares Core Global Aggregate Bond UCITS ETF (3.2%)

- Schwab U.S. TIPS ETF (2.7%)

- WisdomTree Bitcoin ETF (1.4%)

- iShares Gold Trust Micro ETF (1.1%)

Invest Easy – Opening

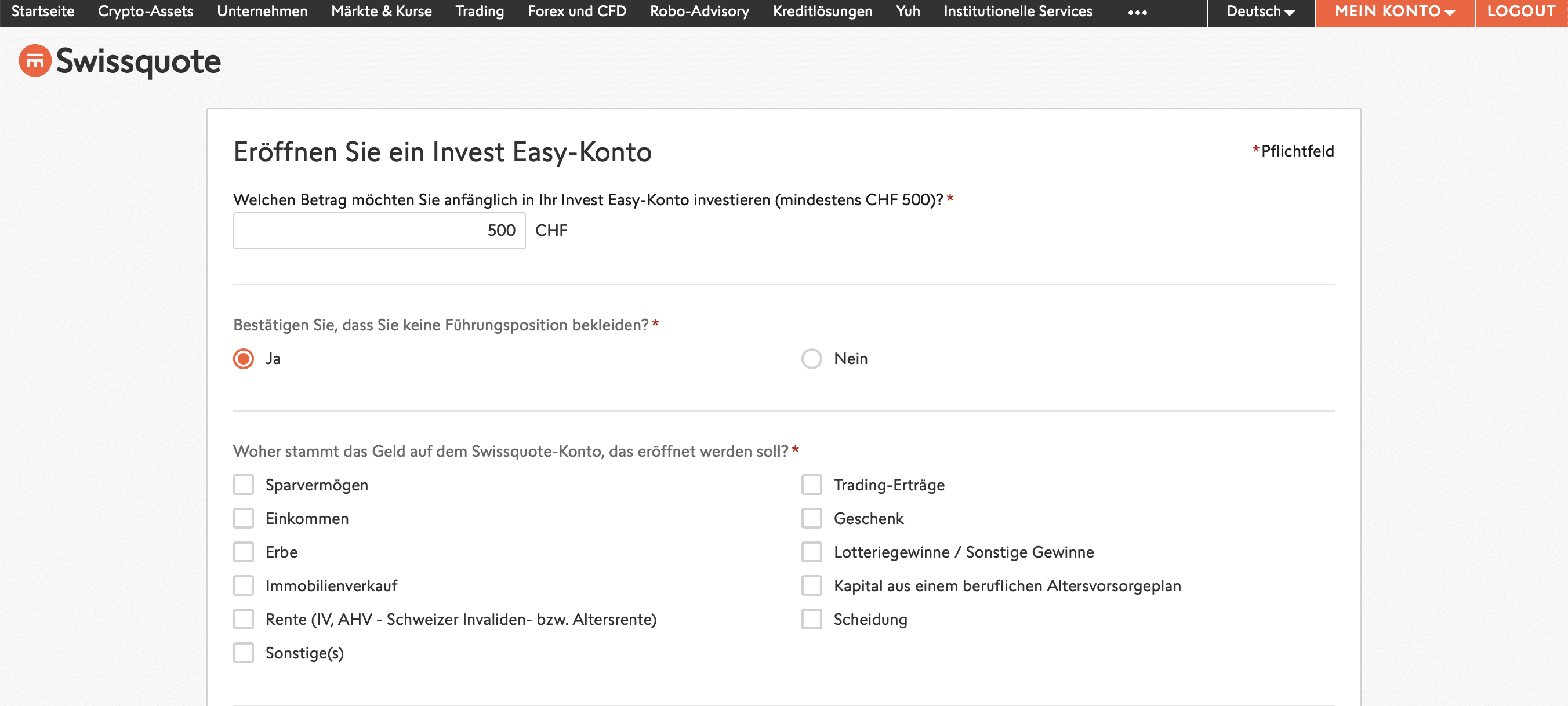

To activate an Invest Easy, you need to open an account with Swissquote. You can find out how to do this in the article about opening an account with Swissquote. Once your Swissquote account is opened, you can easily activate Invest Easy in the Swissquote eBanking environment. At the beginning you have to answer a few questions about the amount and origin of the money.

Afterwards you can sign the application digitally. This will be checked by Swissquote and as soon as the new account is opened, you will receive an email. For me, it only took a couple of hours.

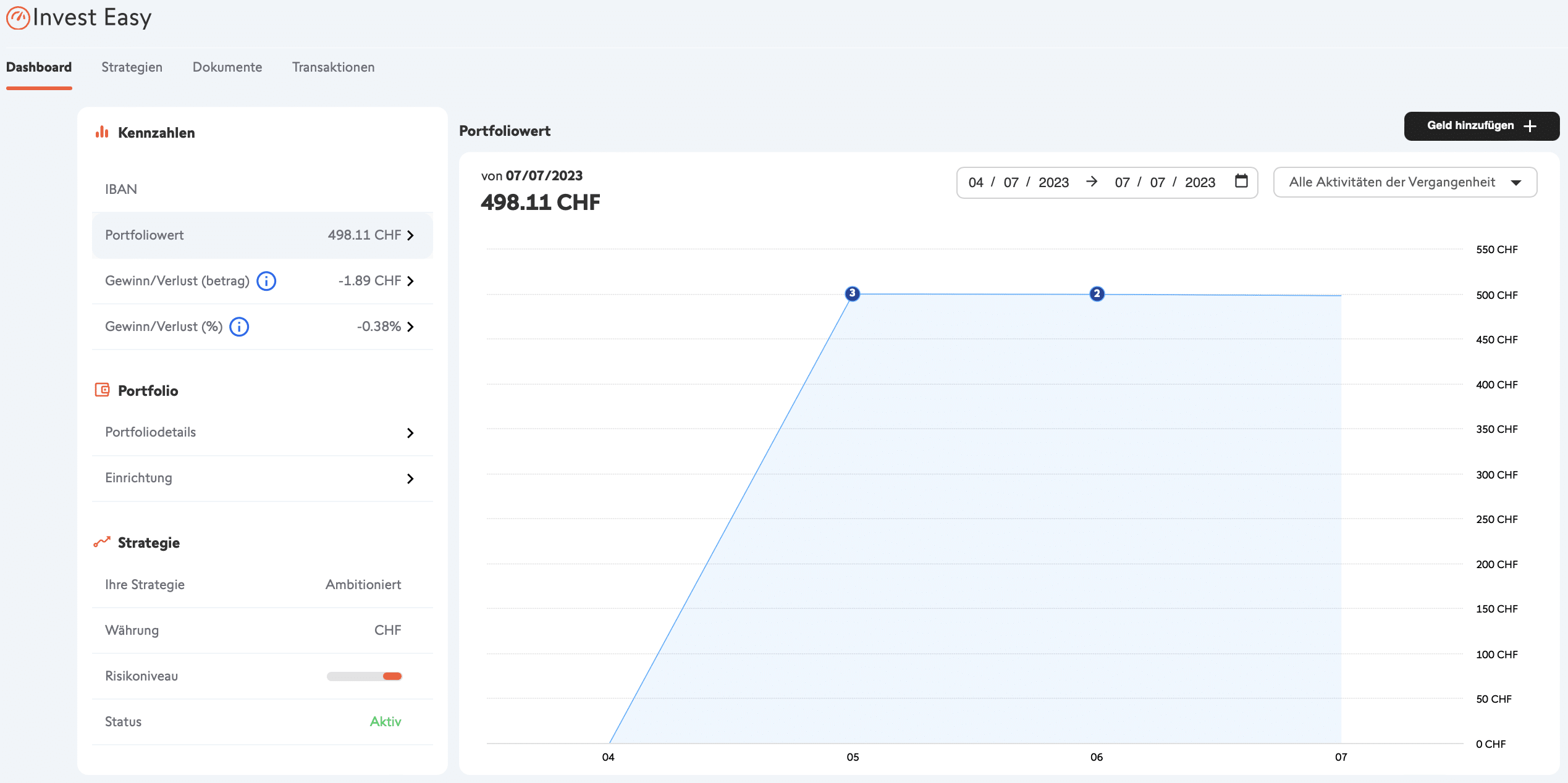

When you log into your eBanking, you can now select one of the four strategies. The four strategies are listed side by side, making it easy to compare and select. When you enter the starting amount, savings rate and frequency above, Invest Easy simulates the future performance of the four strategies.

A change of strategy is possible at any time. You can open multiple Invest Easy accounts, choosing only one strategy per account. However, you can open an Invest Easy account with savings strategy only once.

In the Swissquote account overview you can make transfers between your accounts and, for example, transfer funds from your trading account to your Invest Easy account. You will receive a unique IBAN for each account you open, so you can also fund your Invest Easy account directly from another bank. Deposits are also possible with a Master or Visa card.

Invest Easy – Criticism

So far, so good. The components of the strategies also sound reasonable, but now comes my biggest criticism: the whole thing is mapped with tracker certificates. Swissquote therefore does not buy ETFs on the SIX Swiss Exchange, but a single tracker certificate that reflects the entire strategy. Whereby the average spread of the certificate in a sample was high 0.99%.

Those who do not or no longer know what a tracker certificate is, will find the necessary information in the term sheet:

“This product is a derivative financial instrument under Swiss law. It is not a unit of a collective investment scheme within the meaning of Art. 7 et seq. of the Swiss Federal Act on Collective Investment Schemes (CISA) and it is therefore neither registered nor supervised by the Swiss Financial Market Supervisory Authority FINMA. Investors do not enjoy the specific investor protection conveyed by the CISA.”

and on:

“The Index represents a hypothetical portfolio. The Index Calculation Agent, the Issuer or any other party is under no obligation to purchase and/ or hold any component of the Index and there is no actual portfolio of assets to which any person is entitled or in which any person has any interest. […] The Issuer shall have discretion as to how it wishes to invest or deal with the capital raised by the issuance of any of the Certificates.”

Regarding issuer risk, it states:

“Investors are exposed to the credit risk of the Issuer. If the issuer is unable to make a payment or becomes insolvent, investors could lose part or all of their investment.”

Incidentally, the issuer is Swissquote Bank SA, Gland, Switzerland.

This is a big difference to ETFs or index funds, which are precisely subject to the Swiss Federal Act on Collective Investment Schemes (CISA) and whose assets are protected in the event of the issuer’s insolvency. FINMA writes about this on its website:

“In the event of the bankruptcy of a fund management company, the assets held in the investment fund are segregated from the bankruptcy proceedings and paid out to the investors. Here, the investors receive a preferential position compared to the other creditors.”

When asked about this, Jan De Schepper, Chief Sales & Marketing Officer at Swissquote, responds:

“We chose tracker certificates to implement the strategies flexibly and cost-effectively. Issuer risk is low with Swissquote Bank, which is a very stable bank and very prudent in terms of risk management.”

Conclusion Swissquote Invest Easy

On the one hand, Invest Easy appears ambitious, for example with the specially developed account environment in Swissquote eBanking, but on the other hand it also appears very superficial. For example, I would be interested to know which components contributed how much to the profit or loss, but by packaging it into a structured product, that is not possible. Now, you can say that Invest Easy is made for people who just deposit money and then want nothing to do with it. But the opening effort is far too great for that. First opening a Swissquote account (which I then don’t even need in its complexity and for which I wait a few days), then opening an Invest Easy account – and all this via a web app – is simply no longer up to date. According to Jan De Schepper, the integration into Swissquote’s regular app will not take place until next year.

Since I am not usually compensated extra for issuer risk, I am not a fan of structured products.

In short: The savings solution is not uninteresting. But there are definitely more interesting investment solutions in Switzerland.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.