Letztes Update: 28. September 2023

You can now put together your own ETF investment solution at findependent with an investment volume of CHF 5,000 or more. You can choose from around 30 pre-selected ETFs. You can find more info about findependent here. In this findependent vs. Swissquote savings plan comparison, we’ll take a look at how the findependent investment app, which lets you invest automatically, compares to Swissquote, where you have to implement the savings plan manually.

One ETF

Let’s start very basic. You want to invest in the global stock market on a monthly basis in a diversified and cost-effective way. I chose the Vanguard FTSE All-World UCITS ETF (VWRL) for our example because it is available from both providers.

I have calculated with these prerequisites:

- Initial investment in the first month of CHF 5,000, then monthly contribution of x

- Annual increase in value of 7%

- Management & custody fees at findependent of 0.44% per annum. These are deducted on a quarterly basis, based on the investment amount on the respective reporting date. There are no management & custody fees on the first CHF 2,000.

- ETF purchase at Swissquote: commission: CHF 9.00 (ETF Leader rate), real-time fee: CHF 0.85, stock exchange fee: CHF 2.00, custody fees: 0.025% per quarter (min. CHF 15, max. CHF 50; plus VAT) on average custody assets.

- Investment period of 10 years. Small parenthesis: You should be able to do without your money invested in the stock market for longer than 10 years. Otherwise, the fluctuations could catch you on the wrong foot and you may have to sell at a loss.

Not included are the ETF’s TER and stamp duties, which are the same for both providers. I also did not pay any further attention to the spread.

Let’s assume that all ETFs are traded in Swiss francs, which is the case with the VWRL ETF. If the ETFs were purchased in another currency, the following currency exchange fees would be added:

- 0.50% at findependent

- 0.95% at Swissquote

I didn’t look at anything below CHF 100, because one share of the VWRL ETF currently already costs CHF 106.04. A smaller denomination is not possible, because both providers do not offer fractional shares.

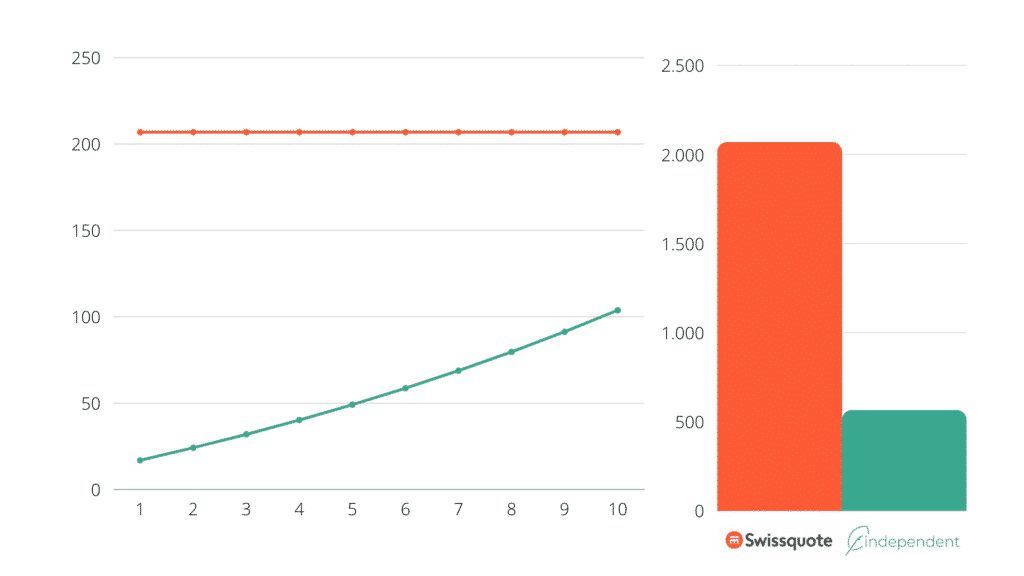

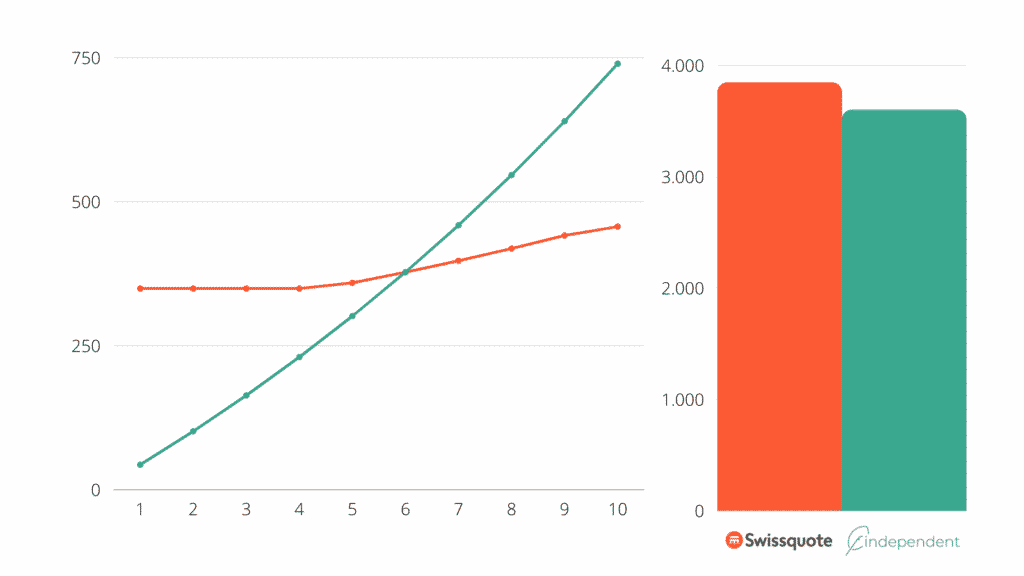

CHF 100 per month

If you want to invest CHF 100 per month, the case is pretty clear: with Swissquote you pay a total of CHF 2,000 in fees over the ten years, while with findependent you pay only a little over CHF 550. The chart clearly shows that the fee level at Swissquote remains constant and that at findependent the absolute fees increase with increasing investment volume.

Graph on the left: Costs in the respective year

Chart on the right: Cumulative costs over the ten years

You would have paid in a total of CHF 16,900 Fr over the ten years and this would have turned into around CHF 26,700.

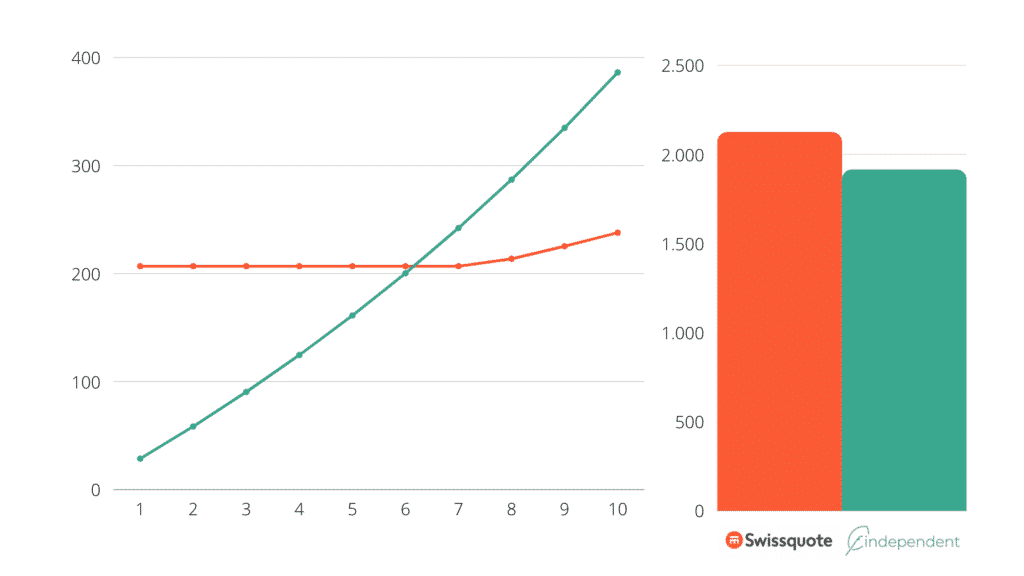

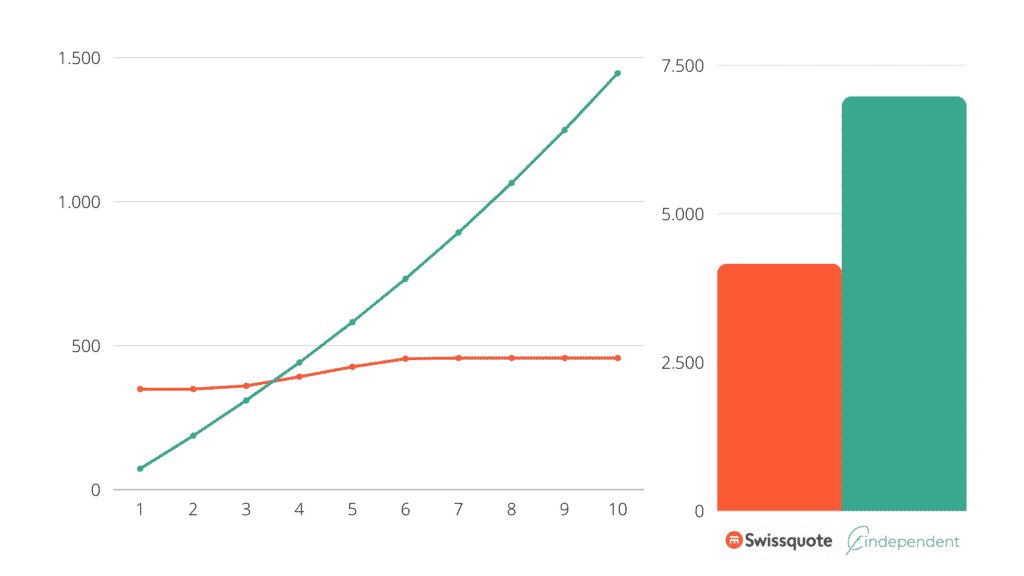

CHF 500 per month

Now you invest CHF 500 per month and in this example the curves intersect. From the sixth year findependent becomes more expensive. However, if we look at the total cost, findependent is still cheaper. This is because Swissquote charges just over CHF 2,100, while findependent charges just over CHF 1,900.

The graph clearly shows that the curve at Swissquote is slowly rising, as custody account fees are no longer subject to the lower limit of at least CHF 15 per quarter, but to the 0.025% per quarter.

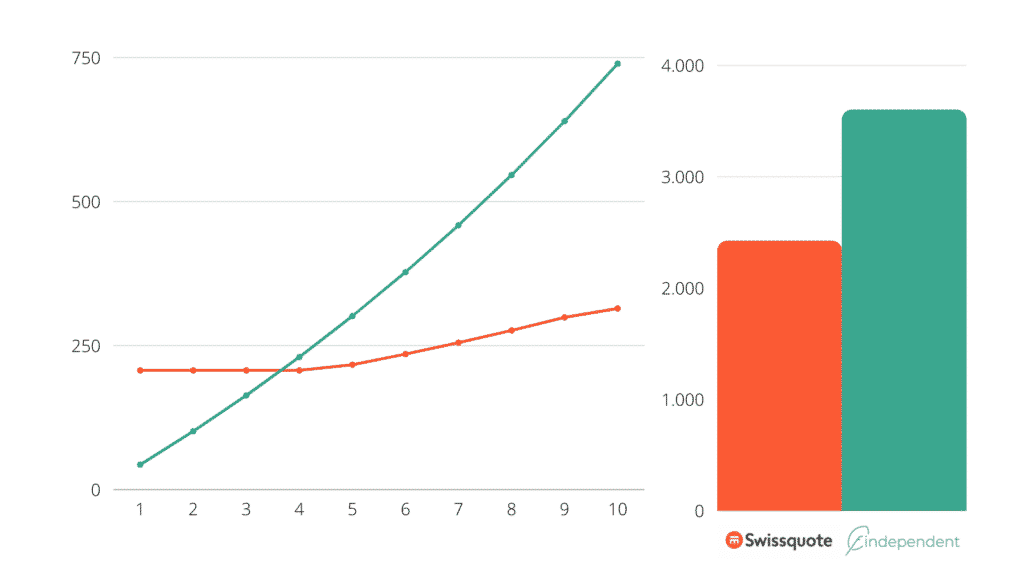

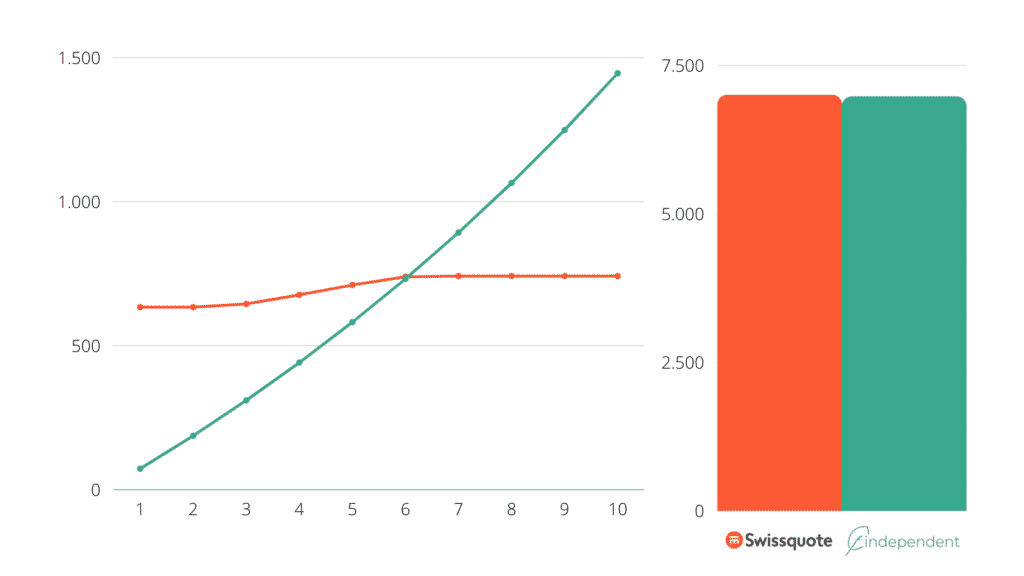

CHF 1’000 per month

After a little more than 3 years, the curves already intersect in this example and Swissquote also becomes more favorable in terms of absolute fees. There, a little more than CHF 2,400 is due. At findependent CHF 3’600.

And it can be seen that the Swissquote curve is already flattening out again, as the CHF 50 cap on custody fees is now having an impact. By the way, in this example you would have paid in a total of CHF 124,000 and this would have grown to just over CHF 178,000.

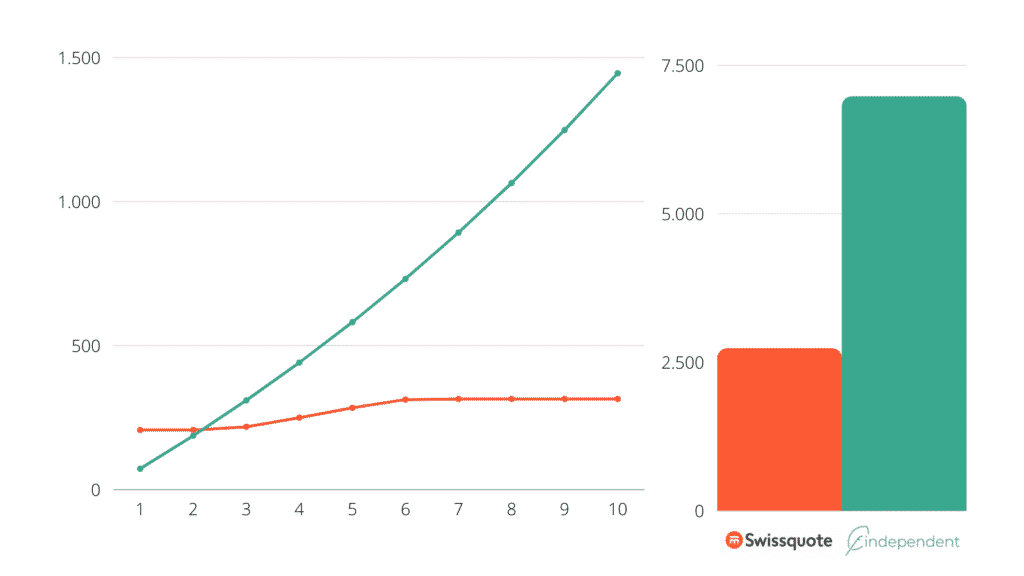

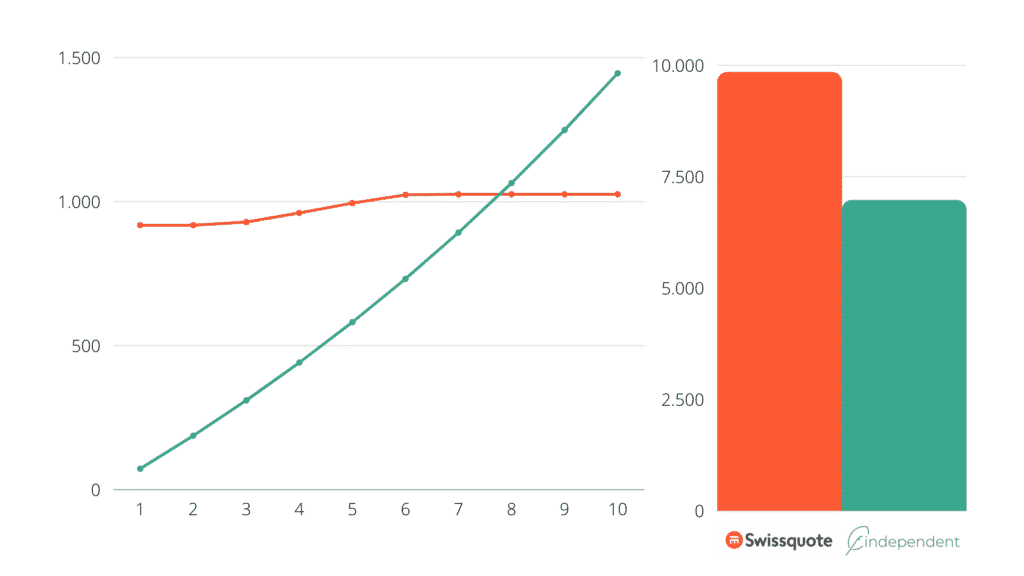

CHF 2’000 per month

The result is clear: Swissquote charges a little more than CHF 2,700, while findependent charges almost 2.5 times as much, i.e. not quite CHF 7,000.

Here you can clearly see the custody fee cap at Swissquote.

Two ETFs

Let’s assume you put together a classic 70/30 portfolio with 70% in a world ETF and 30% in an emerging market ETF. Here we no longer calculate all examples. You can imagine that CHF 100 per month divided between two ETFs – and thus double the purchase costs – is even less worthwhile with Swissquote than before.

CHF 1’000 per month

Now it’s getting exciting, but Swissquote is still more expensive over ten years.

CHF 2’000 per month

Here it is again quite clear.

Four ETFs

Let’s say you want to buy an ETF for each world region, i.e., U.S., Europe, Pacific and Emerging Markets. And thus minimize the preponderance of the USA.

CHF 2’000 per month

In this example, we only need to look at a monthly investment amount, because after ten years you will have paid CHF 7,000 at Swissquote and also almost CHF 7,000 at findependent.

Six ETFs

Now you add thematic ETFs, real estate or bonds to your portfolio, broken down by region.

CHF 2’000 per month

Here findependent is not only cheaper, but definitely much easier to handle. In any case, I don’t want to buy six ETFs per month. That’s 72 transactions in one year and 720 transactions in ten years.

Advantages findependent

- automated: Set up standing order and sit back

- Suitable/cheaper for smaller monthly savings plan contributions

- lower foreign currency fees

- no additional costs for tax display

Advantages Swissquote

- Very large product range, also individual shares

- Suitable/cheaper for larger monthly savings plan contributions and one-time investments

- Immediate transmission of orders to stock exchange

- no asset manager interposed

Concluding remarks

You don ‘t have to buy the ETF monthly either, you can buy it quarterly or semi-annually. If you choose this option, it is advisable to still transfer your savings installment monthly to another account, for example to Swissquote or to a sub-account. That way you won’t be tempted to spend the money elsewhere. So, for example, put CHF 250 into your sub-account every month and then buy an ETF for CHF 1,500 every six months.

Of course, with multiple ETFs, you don ‘t have to buy every single ETF every month. For example, you can buy one at a time and then the next one a month later and so on.

Or this is how I do it: I look at which ETF deviates the most from the target weighting and then buy that one. The following month, the game starts all over again. This is not to be had without effort, but once you’ve built yourself a spreadsheet in Excel or Numbers, it’s a snap.

Conclusion findependent Swissquote savings plan comparison

As is so often the case, you won’t be served a ready-made answer, nor will there be a clear winner. Which provider you choose and whether you choose your own strategy or a predefined one depends on your individual situation.

I would base the decision on which provider is right for you on the following questions:

- How much can I invest?

- How much do I want to do myself or how much will I let the time I gain cost me?

- Do I have the confidence to put together a portfolio myself?

- Do I have the discipline to implement my strategy on a monthly basis, even when the stock market gets uncomfortable?

Your decision is not set in stone either. At a new stage in life, another provider may prove to be a better fit. With three kids, your time might be better invested in time together than in a fancy Excel spreadsheet and 72 buy orders.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.