Letztes Update: 16. April 2025

Things are happening in the Swiss investment landscape – and finpension has not been idle either. In addition to the 1e Collective Foundation, the two vested benefits foundations and the finpension pillar 3a, they have now also launched an investment solution for free assets, and this has a lot to offer. In this post about finpension Invest, you will learn everything about the most affordable robo-advisor in Switzerland, its many advantages and disadvantages. Of course you can also read about my finpension Invest experiences.

Inhaltsverzeichnis

- Digital and flexible: the investment solution from finpension

- finpension Invest: Opening an account

- finpension Invest: Strategies

- The advantages of finpension Invest

- Investing in Private Markets Switzerland

- finpension Invest Bitcoin

- finpension Invest in comparison with robo-advisors

- My experience with finpension Invest

- finpension Code Invest

- FAQ finpension Invest

- Conclusion finpension Invest experience

Digital and flexible: the investment solution from finpension

Anyone who is already familiar with the pillar 3a solution or the securities solution as part of finpension’s vested benefits will also be pleased with finpension’s investment solution for free assets. Like the previous investment solutions, finpension Vermögen anlegen is easy to use and geared towards cost efficiency.

In 2024, finpension received authorization from the Swiss Financial Market Supervisory Authority FINMA as an account-holding securities firm and can therefore offer the investment solution directly, i.e. without a bank in the background. On the one hand, this saves costs, and on the other, finpension remains independent of banks and insurance companies.

finpension Invest: Opening an account

You can open all three products both via app and web app and manage them with one and the same login. To increase security, you can add an authenticator app under “Profile” and “Login settings”. Two-factor authentication via SMS code is activated by default.

The opening process is clearly structured in three steps and thanks to the good user guidance you always know where you are. First the risk capacity is determined, then the strategy is queried and finally the personal data is recorded.

No identity check is required for pillar 3a and vested benefits, but it is for finpension Invest. finpension uses the IDnow solution for this – you take a photo of your ID card, move it back and forth and create a short selfie video of yourself. After successful verification, you will receive an e-mail and can view the IBAN of your finpension Invest investment account under “Deposit”. You can also simply scan the QR code with your banking app or have a payment slip sent to you.

The account opening is completed with the conclusion of the basic contract and the asset management contract. Of course, the contract is concluded digitally and without paperwork.

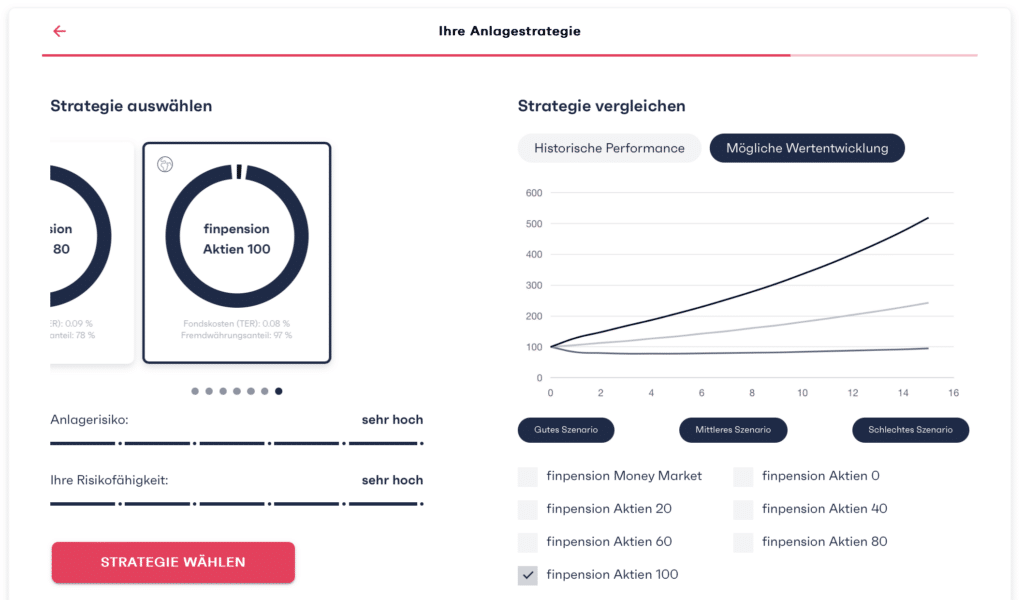

I recommend opening via the web app, as it is clearer and you can compare the strategies better. You can also see the historical performance or the potential performance at a glance.

finpension Invest: Strategies

There are two modes to choose from when selecting a strategy:

- Auto Select: finpension selects the appropriate proportion of shares.

- Self Select: For all those who want their own or a more specialized solution.

In “Auto Select” mode, you can choose between three investment focuses:

- Global: Weighted by market capitalization.

- Switzerland: 50% is invested in the Swiss equity market.

- Sustainable: Mainly ETFs on the MSCI ESG Enhanced indices are used. These exclude controversial business areas and pay particular attention to low consumption of fossil fuels and greenhouse gas emissions.

Six investment focuses can be selected within the “Self Select” mode:

- Global: Weighted by market capitalization.

- Europe: European equities are significantly overweighted and thus have almost the same weighting as American equities.

- Switzerland: 50% is invested in the Swiss equity market.

- Broad Impact: mainly ETFs on the MSCI ESG Enhanced indices are used. These exclude controversial business areas and pay particular attention to low consumption of fossil fuels and greenhouse gas emissions.

- Climate Impact: Mainly ETFs on the MSCI Paris-Aligned Indices, which are aligned with the Paris Agreement’s 1.5°C limit on global temperature rise and give greater weighting to companies that benefit from the transition to a lower-carbon economy.

- Social impact: Companies that attach importance to social gender equality, for example, are given greater weighting.

The following share quota levels are available:

- Money Market

- 0%

- 20%

- 40%

- 60%

- 80%

- 100%

The ETFs used are listed transparently for each investment focus, you can see their weighting, the costs and can call up the factsheets. Another great feature is the performance indicator, which allows you to compare different strategies and share ratios. If you want to put together your own strategy, there are numerous ETFs available to you.

The advantages of finpension Invest

finpension fees

finpension’s fees are very attractive. In addition to the compensation to finpension of 0.39%, there are also the costs of the ETFs used. These amount to between 0.08 and 0.10% for the standard strategies Global, Switzerland and Sustainable.

From 01.01.2025 to 31.12.2025, the compensation to finpension of 0.39% does not apply.

If the ETFs are not traded in Swiss francs, the currency is exchanged without a margin. Other providers earn money from this currency exchange without showing the actual costs separately.

Of course, finpension does not have issue and redemption commissions. Likewise, deposits and withdrawals as well as the closing or balancing of portfolios and products on the part of finpension are not associated with any costs.

Stock exchange duties and the federal sales tax(stamp duty) are passed on to finpension.

The schedule of fees takes up 3/4 of a page and usually also says “free of charge”. Other providers can take a leaf out of the book with their long and confusing PDF deserts.

finpension reporting for withholding taxes on US dividends

The US withholding tax on dividends is generally 30%. Due to a double taxation agreement, the US withholding tax for funds domiciled in Ireland can be reduced to 15%. finpension plans to provide standardized reporting for the flat-rate tax credit for withholding tax on US dividends by 2025. This lists each individual security contained in the ETF with its withholding tax, which could not be reclaimed by the fund. This means that the remaining 15% should also be creditable with the DA-1 form. finpension is still in contact with the cantonal tax authorities in this regard. Please note that the lump-sum tax credit is only possible if it amounts to more than CHF 100 for the tax year in question.

finpension savings plan

Up to ten portfolios can be opened with finpension. For example, you can open an account for your godchild or a portfolio with different investment horizons and therefore different equity ratios for each investment goal.

finpension trades weekly on the second bank working day so that the funds never sit idle for long. Rebalancing takes place as soon as the deviation from the target weighting is greater than one percentage point. If you do not want this, you can deactivate automatic rebalancing.

The easiest way to do this is to set up a standing order for your finpension portfolio in your banking app so that you no longer have to worry about your investments.

finpension savings plan

If, for example, you have invested your pillar 3a with finpension and receive your money when you retire, finpension Invest provides you with a follow-up solution that allows you to continue investing your money profitably and cost-effectively. Please note that capital gains tax is payable on the payout. If you want to know how high these are, you can find corresponding calculators on the Internet or contact a financial advisor. With finpension’s savings plan, you can have an amount paid out to you each month, with the payment being made in the last ten days of the month.

To create a savings plan, click on the three vertical dots, “Enter payment” and “Regular payment (savings plan)”. There you select your reference account, the respective amount, the frequency (monthly, every 3 months, every 12 months), the start and the end date. You can adjust or delete the savings plan under “Standing orders”.

finpension Minimum investment amount

There is no minimum investment amount for finpension. You can join from just one franc. You are also not obliged to invest regularly. To implement this, finpension books fractional shares of ETFs into your custody account. This ensures that even small amounts are invested and do not simply sit in the account.

finpension e-tax statement

You will receive the e-tax statement for convenient uploading to your tax return free of charge at the start of the year. Another advantage is that the custody account fee of 0.30% is shown separately for finpension and can therefore be deducted from taxable income. The asset management fee of 0.09% is not deductible in most cantons.

Investing in Private Markets Switzerland

Until now, private market investments in Switzerland were almost exclusively reserved for clients with large to very large assets. finpension now makes these available from a minimum investment volume of CHF 1.

Private market investments, also known as private equity, are investments in unlisted companies that are often less volatile. However, private market investments are less liquid than ETFs, for example, which can be bought and sold on an exchange at any time, and are only suitable for people with a very high risk tolerance. So find out beforehand whether private equity is really the right asset class for you.

finpenson uses the institutional fund classes. The fund costs for these are lower than for the non-institutional classes. Compared to ETFs, however, the costs of actively managed private markets funds are significantly higher at 3.04% and 2.67% respectively. A performance fee is also charged for the Partners Fund.

Private market funds are held individually at finpension, i.e. only one fund can be held per portfolio and investment strategy.

finpension Invest Bitcoin

With finpension Invest, you now have the option to include Bitcoin in your portfolio – through a Bitcoin ETP from iShares. The ETP is backed by physical Bitcoins, which are stored by Coinbase Custody International Limited in a secure, offline wallet. The TER is 0.15%. To add Bitcoin, you need to create an individual strategy via “Self Select” and “Self-Determined”.

finpension Invest in comparison with robo-advisors

Compared to other providers, the first thing that stands out is the lean cost structure, which makes finpension currently the cheapest provider in Switzerland. Compared to the offers of traditional banks, finpension costs less than half as much. For beginners, finpension makes it very easy to set up an ETF savings plan with the “Auto Select” mode. But advanced investors will also find what they are looking for at finpension and can put together their own investment strategy from scratch.

Withdrawal plans are rare with other providers or can only be activated from an investment amount of around CHF 20,000. With finpension, on the other hand, there is no minimum investment amount.

Another unique selling point is that you can invest in private markets from as little as CHF 1 if you have a very high risk tolerance. With other providers, you have to invest at least CHF 10,000 or a multiple thereof.

If you want to learn more about the differences between the individual Swiss robo-advisors and compare their performance, then read the Robo-Advisor Comparison Switzerland 2025.

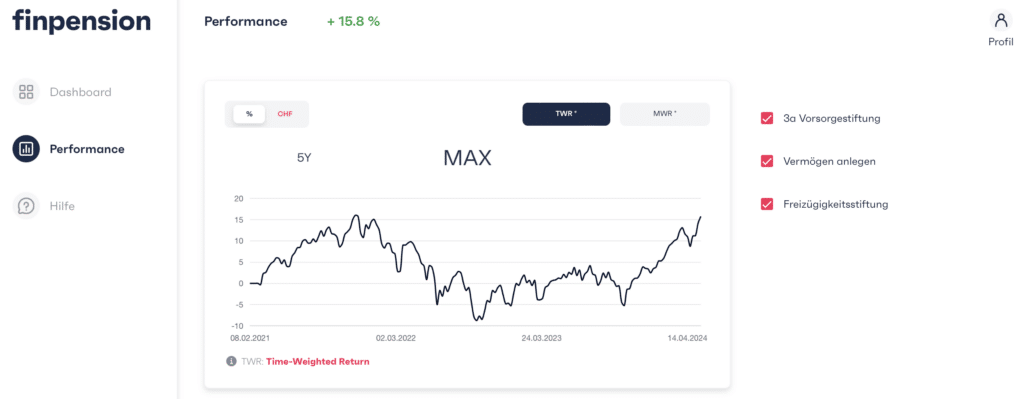

My experience with finpension Invest

I have had a pillar 3a with finpension since the beginning of 2021 and am very satisfied with the simplicity, user-friendliness and performance. After the launch of finpension Invest, I naturally opened an account immediately. The first time the identification did not work, the last step was canceled without comment and I had to start all over again. But it worked the second time. If you have had any experiences with finpension Invest, please write them in the comments below.

finpension Code Invest

Enter the finpension code FIDE83 directly when registering (last step) or at the latest 24 hours later in your finpension profile and you will receive a fee credit of CHF 25.

Note the following condition: You transfer or deposit at least CHF 1’000 within the first 12 months.

FAQ finpension Invest

You invest in securities with finpension and these are not included in finpension’s balance sheet. If finpension were to go bankrupt, your securities would not be affected and could be transferred to another provider. The small amount held as cash at finpension is protected by the Swiss deposit protection scheme up to CHF 100,000, just like at a bank.

The compensation paid to finpension consists of a custody account fee of 0.30% and an asset management fee of 0.09%. Added to this are the costs of the ETFs used, which amount to approx. 0.10%. There is no inactivity or minimum fee.

finpension’s strategies are mainly implemented with low-cost ETFs. Funds are used for the “Private Markets” strategy.

Yes, your shares will then be sold again. A payout takes between two and ten days. You also have the option of setting up a savings plan and having money paid out to you on a regular basis.

Trading takes place weekly on the second banking day of the week. If the actual weighting of the individual ETFs deviates from the target weighting by more than one percentage point, rebalancing takes place. This check is also carried out weekly.

Conclusion finpension Invest experience

finpension stands out in particular due to its cost efficiency. This makes finpension currently the cheapest digital asset manager in Switzerland. I don’t find the app quite so stylish. Other providers have a more appealing design, but that’s a matter of taste and it’s probably better if you don’t look at the depot so often.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.