Letztes Update: 6. November 2024

It’s not as if I didn’t make any mistakes when investing – quite the opposite. For example, I didn’t really take care of my finances until I was in my early 30s. Don’t worry, it’s never too late, but the more time you give compound interest, the more you benefit from its exponential growth. And certain money management habits are easier to internalize when you’re young. To make sure you don’t make the same investment mistakes I did, I’ve put together the best tips for avoiding them. This article appeared in a slightly modified form on missmoneypenny.ch.

1. have no budget

When your salary arrives in your account at the beginning of the month and there is hardly anything left over at the end, it’s time to start looking for money wasters. Drawing up a budget helps to get your finances in order. The website of the umbrella organization Budgetberatung Schweiz provides budget examples and templates for drawing up a budget. As with losing weight, your goals should be realistic. There is no point in creating a budget that has to be abandoned after half a month. You can also use a money-tracking app to keep a record of your daily expenditure and get a better feel for your spending. The aim is to find out how much can be saved or invested each month.

2. do not have a nest egg

What is left over is not invested immediately, but is initially set aside as a nest egg. This can be used to bridge unexpected financial bottlenecks or emergencies. After all, if the stock market is currently in crisis mode and the securities are deeply in the red, you should not sell them just to pay unexpected bills. The nest egg should correspond to around three to six months’ expenditure and be readily available. A salary or savings account with generous withdrawal options is suitable for this purpose.

3. not knowing the investment horizon

If you want to buy a home in the next five years, shares are probably not the right asset class. It may well be that the invested capital has shrunk by 25% at the time of purchase and your dream of owning your own home has been dashed. However, if the money is not needed for retirement provision for another 20 years, you may be annoyed about the 25% loss, but you still have several years to sit out these losses. So only invest money that you can do without for 10 or even better 15 years. If you have an investment horizon of less than ten years, you should choose an investment strategy with a lower risk.

4. misjudge your own willingness to take risks

Many questionnaires to determine the risk profile ask how you would react if, for example, the stock market fell by 25 percent. If you have never experienced a stock market crash, this is very difficult to answer. It can help to calculate with concrete figures. For example, if you have invested CHF 50,000 in shares, you would only have CHF 37,500 left if the stock market fell by 25 percent. If this thought gives you sleepless nights, you should consider how you can minimize the risk. This is possible, for example, by not investing everything in the volatile asset class of equities, but by mixing in more “boring” bonds, for example. This is known as a portfolio with a high-risk share of 60 percent and a low-risk share of 40 percent.

5. making emotional decisions

Let’s take an example: 50,000 francs have become 37,500 francs after a stock market crash. What do you do now? Nothing! If you sell in a panic, you will make your loss permanent. Wait and see, because as soon as the stock market recovers, you will benefit from the upswing again. Remember: when you buy a share, you are acquiring a stake in a real company. These fundamental values remain, even if the market fluctuates strongly in the short term, driven by emotions. The financial market philosopher André Kostolany put it aptly: “Buy shares, take sleeping pills and stop looking at the securities. After many years you will see: You are rich.”

6. do not diversify

Now you could get the idea of picking a share at random and then holding it for as long as possible. That is not what is meant. When investing, you should focus on a broadly diversified portfolio. What does that mean? Instead of investing in just one company, you spread your capital across several companies. It is even better if these companies come from different countries and operate in different sectors. If one company gets into difficulties, the impact on your overall portfolio remains manageable. Funds are suitable for this, as they pool the money of many investors and invest it in a wide range of securities.

7. have unrealistic expectations

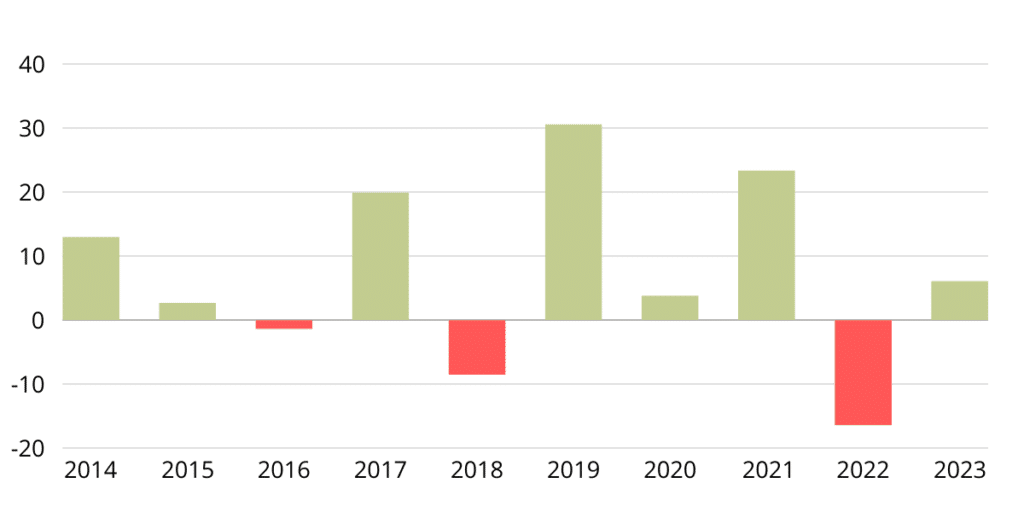

Promising high returns often goes hand in hand with high risk. If a return seems unrealistically high, there is a high probability that only the provider will benefit in the end – at your expense. Over the years, the Swiss stock market has achieved an average return of 7% per year (before costs and inflation). It should be noted that this 7 percent is only the average. The actual annual returns in recent years have been as follows:

Be satisfied with the average and don’t chase after the next hype.

8. ignore fees and costs

If someone invests money for you, this is a service that may cost you something. However, if the fees are more than 1.5 percent per year, you should check whether there are financial products with lower fees and similar returns. Take a closer look at “all-in fees” and “total fees”. Not all providers mean the same thing.

9. short-term thinking

If you have a sound investment strategy, stick to it – as boring as that may sound. Because the perfect portfolio only exists in the past, and if you are constantly tinkering with your portfolio because you have to have an exciting share or a particularly promising fund now, this usually damages your returns and you waste valuable time that you could probably use much more wisely. So be patient!

10. start too late

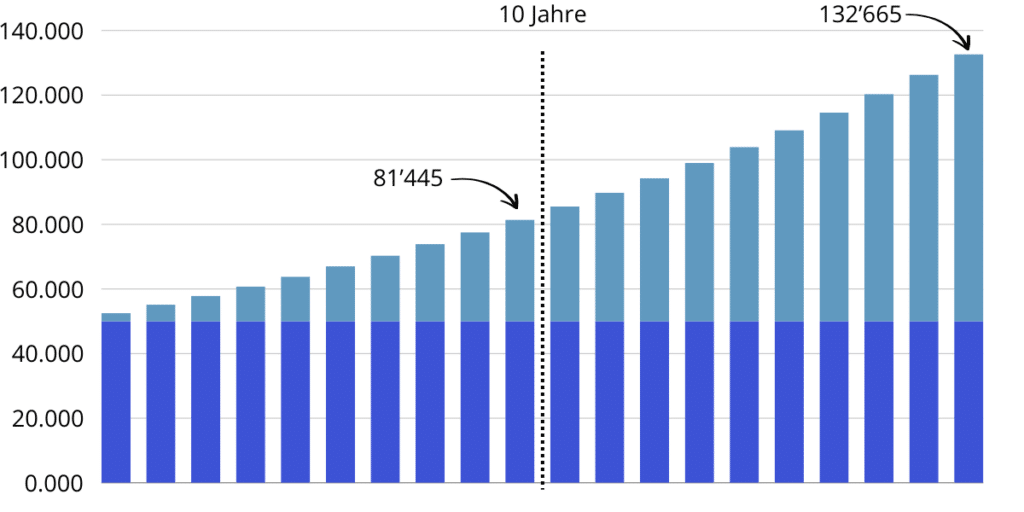

Back to our 50,000 francs: if we invest them in a broadly diversified portfolio, in twenty years they will become 132,664.90 francs at an interest rate of 5 percent. The profit of 82,664.90 francs comes from interest and compound interest alone. In other words, even more than was originally invested. If someone only has ten years, the same initial amount “only” becomes assets of 81,444.75 francs. The interest and compound interest still amount to 31,444.75 francs. This is still respectable, but significantly less. It also helps to familiarize yourself with the ups and downs of the stock market at an early stage. If an inheritance suddenly comes up or you have to decide between a lump sum or a pension when you retire, routine provides security and enables you to make smart decisions even in turbulent times.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.