Letztes Update: 1. December 2024

What many have missed in the account app neon is finally available: Subaccounts. In the banking app neon, these are called Spaces. Since neon is now my everyday bank – I haven’t had a banking relationship with a traditional bank in years – I’m naturally happy about the new feature. It makes my liquidity management easier. In this post, you’ll learn how neon’s Spaces work and what my experiences have been with them.

Set up neon Spaces

If you already have an account with neon, it’s time to update your neon app to the latest version.

If you don’t have an account with neon yet, then use the neon voucher code during registration financial deposit . With this you get the credit card for free and in addition you get a starting credit worth CHF 10 from neon.

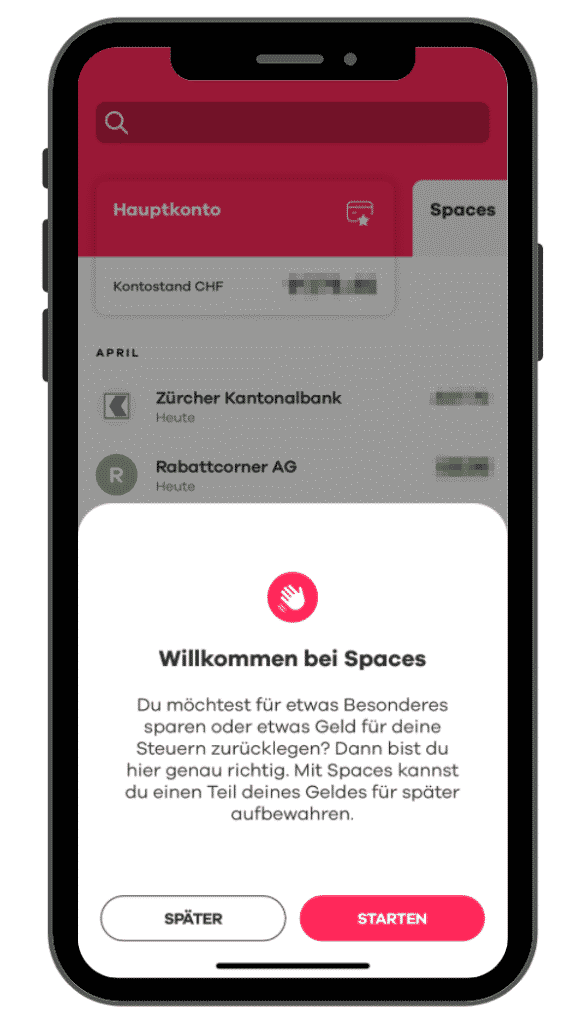

If you select “Sales”, you will see “Spaces” in the upper right corner. Select it and you will be asked if you want to set up Spaces.

With “Start” you confirm the setup of the Spaces. Once set up, which took me a while, you will see your main account under Spaces and the amount available in the main account. Here you can now add a Space.

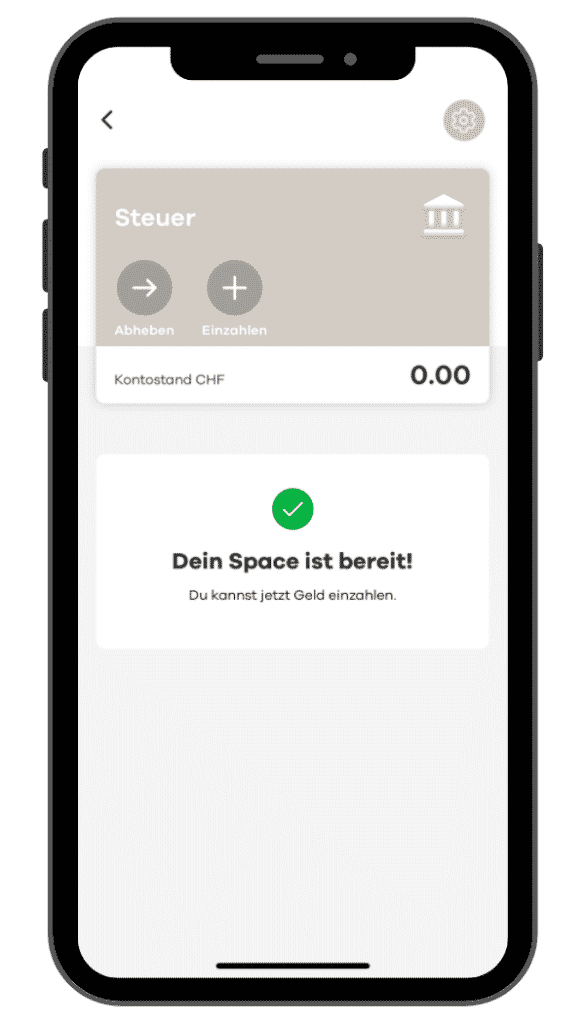

The first thing you can do is select an icon. A total of ten different ones are available. Finally, enter a name for your Space. And your Space is ready to go.

neon Spaces: Deposit and withdrawal

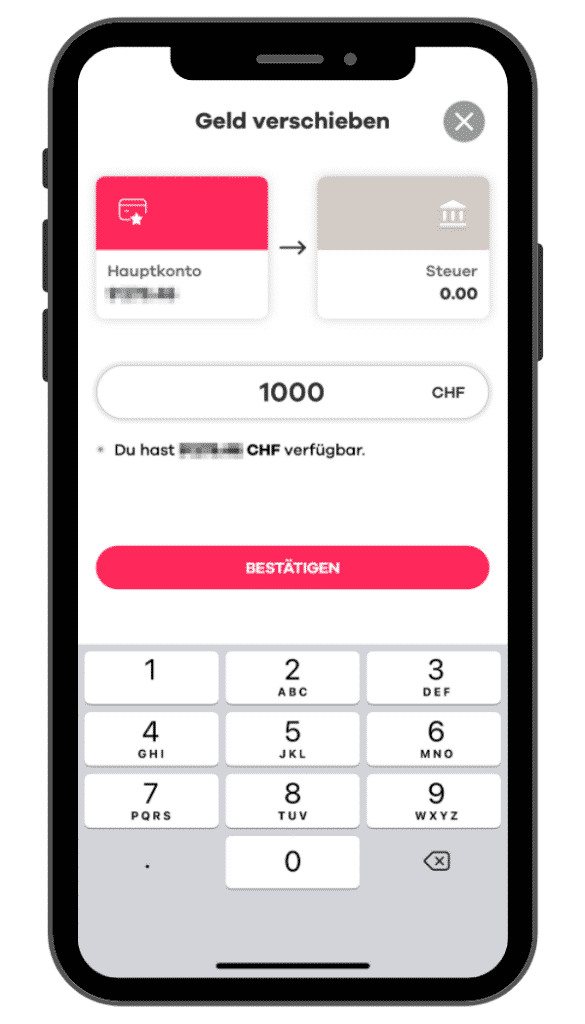

If you select “Deposit” you can move money from your main account to your Space. Conveniently, you will also immediately see how much money you have in the main account, which is the maximum amount to be moved. So enter amount and confirm.

Under “Transactions” your transfer to your Space will appear like a normal transfer to another bank account. The balance of your main account is then also decreased by the transferred amount – in our example by CHF 1,000. If you want to see the total amount of your money held at neon, you can select “Spaces”. There, all Spaces and the main account are added together.

Unfortunately, you cannot make an outgoing payment directly from Spaces. If you want to pay the taxes, as in our example, you must first select the “Taxes” space, use “Withdraw” to transfer the money to your main account, and then order the payment of the tax bill from there.

Deposits and withdrawals are listed chronologically as under “Turnovers”. This way you always have an overview of when you made a transaction to or from Space.

neon Spaces: savings targets and standing orders

In each Space, you can set a savings goal under Settings (top right). This way, when you select a Space, you can always see what percentage of your savings goal you have already achieved.

Payments into Space are now also possible as standing orders. You can set up standing orders monthly, quarterly or annually. With it, you can conveniently automate your finances.

neon Spaces interest

From December 2024, there will be no more interest on neon Spaces. Balances in the main account will also not earn interest.

neon Spaces: Future

You can’t change the name or icon of a Space at the moment – but neon is working on that, too. However, you can close the Space, for this the balance must first be zero, and then recreate it.

Advantages neon Spaces

- Simplifies budgeting and saving.

- Your finances are clearly organized.

- Everything with one provider: You always have an overview of all your liquid assets.

Disadvantages neon Spaces

- Money cannot be moved between Spaces.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.