Letztes Update: 10. July 2024

Challenger bank Yapeal’s digital wallet has been up and running since early July 2020. In this Yapeal review, you will learn about the features and compare Yapeal with neon.

You can find the comparison of the two Swiss account apps from neon and Zak, which have been around for a while, here.

Yapeal – Ya-What?

Yapeal is made up of the words “Appeal” and “Yap”. The meaning of the first word should be known, the last one was – at least to me – unknown. Yap is the main island of the Yap Islands, a small group of islands in the Western Pacific. And what does that have to do with banking? On the island of Yap, the currency “Rai” is used. It is stone money, which is still used as a means of payment. But these are not small pebbles but calcite stones weighing up to four tons. If the owner changes, this is reported to the village elders of the island. The elders then preserve and transmit the knowledge in a distributed manner and without a central authority. The blockchain does the same thing electronically – which brings us back to banking.

Yapeal was founded on 06.06.2018. Soon after, the Yapster community was launched. Users should be brought on board as early as possible. Thus, the needs of the customers play a central role in the development and further development of the app.

It was recently announced that the Swiss asset manager Vontobel has joined Yapeal as an investor. Vontobel already uses Yapeal technology for digital account opening and plans to continue using Yapeal’s new technologies in the future.

Fintech license from FINMA

The first Swiss fintech license from the Swiss Financial Market Supervisory Authority (Finma) went to neobank Yapeal. This allows Yapeal to offer its own accounts with a personal Swiss IBAN without having to rely on another bank. When the already presented account app of neon was launched, this fintech license did not yet exist. Neon therefore works together with Hypothekarbank Lenzburg.

Companies with a fintech license may raise a maximum of CHF 100 million. And they are currently not allowed to invest the funds or earn interest on them. In the case of Yapeal, the funds are deposited with the Swiss National Bank (SNB). And the latter charges negative interest rates for safekeeping. Below a daily balance of CHF 25,000, Yapeal does not continue to charge this negative interest. However, if you have more money on your digital wallet, then 0.75% is due for the SNB plus 0.05% for Yapeal. However, the company has announced its intention to apply for a full banking license. This would then allow savings, retirement and investment accounts to be offered.

Onboarding

Yapeal advertises the fastest onboarding, which works without video and is done in just five minutes. Unfortunately I can’t say anything about the opening process, I’ve been around for a while and back then it worked a bit differently, but also very quickly. If you have any recent experiences with it, share them with us and post them in the comments below.

What’s cool is that you can choose the last 12 characters of your IBAN yourself. Since letters are also possible, you can incorporate your own name within the guidelines. It could then look like this: CH9283019FINANZDEPOT1. Of course, this is more of a one-time gimmick, because you can’t change the IBAN, but I don’t know of any other provider that allows this free of charge for private customers.

Swiss Abroad

Since fall 2021, Swiss citizens living abroad, cross-border commuters and seasonal workers can also open an account with Yapeal. And all this without any surcharges, which are due at many other banks. Currently, this is only possible for residents of bordering countries. In the first half of 2022, 15 more countries are to be added.

Payment and transfer

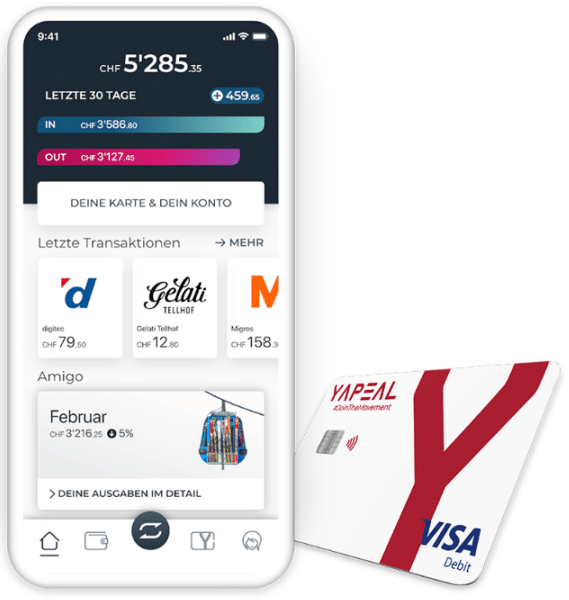

For payments you will receive a Visa Debit card. Yapeal was the first company to offer this card in Switzerland. Yapeal implemented Google Pay, Apple Pay and Samsung Pay within a very short time. Adding your Visa card to Apple Pay is extremely easy and is done directly from the app, no swiping and no confirmation SMS. The whole process takes less than half a minute.

And pay, that can Challenger Bank Yapeal! For each transaction, you will receive an instant push notification and the payment will be displayed extremely quickly and stylishly in the app.

By the way, for payments in a foreign currency, the Visa exchange rate is passed on without any surcharges.

For testing purposes, I made a transfer from my neon account and five minutes later I received a push notification from Yapeal that the money had arrived! Who still needs Twint? And who would have thought a year ago that payments in Switzerland would suddenly work so quickly?

Convenient: You can share your QR invoice code directly with your friends: You send the code, your friend scans it with the QR scanner of his bank (also possible with other Swiss account apps, so he doesn’t have to be a customer of Yapeal), select amount and he transfers money to your Yapeal account. All without tedious typing of the (so beautifully personalized) IBAN number.

You can conveniently make international transfers to over 80 countries directly in the app, with Wise acting as a partner. Before payment, you will be transparently shown the Wise (0.4% to 1.3%) and the Convenience fee (0.35%) as well as the live exchange rate. So you always know how much you pay for a transfer. And you can also see the expected arrival date in the input mask.

Support is integrated directly into the app – just shake your smartphone with the Yapeal app open – and for each of my inquiries, they responded within a few minutes. The tone is hip and modern.

More functions

In the Yapeal app, you can invest directly in your Pillar 3a. For the time being, two funds from Vontobel are available. You can find a comparison of Yapeal’s Pillar 3a with other digital providers here.

eBill is also seamlessly integrated with the Yapeal app. This is in contrast to neon, where a browser window opens on the smartphone.

In the meantime, Yapeal is also available to Swiss abroad and also has its own BIC.

Since the beginning of 2021, there are three different pricing plans, one of which is free. However, in this plan you can almost only use the card, because transfers are not possible with it. If you pay annually rather than monthly, you’ll save two months and over 16%. You can find more details about pricing here.

Yapini is a digital children and youth account with a Visa Debit Card for children aged seven and older. Parents can fund the account in real time or set up a standing order for bag money. In addition, they have insight into the account balance of the children at any time. With Yapini, children learn how to handle money in a digital world.

Recently, Yapeal has been working more on banking solutions for SMEs. For example, Yapeal launched its own bank card in collaboration with Abacus and implemented automated expense management.

neon vs. Yapeal – the comparison

| NEON | YAPEAL | |

| Wo liegt mein Geld? | Hypothekarbank Lenzburg | Yapeal besitzt eine Fintech Lizenz. Damit müssen die Gelder zu 100% hinterlegt werden. Yapeal tut dies bei der Schweizerischen Nationalbank. |

| Kontoführung | kostenlos | Loyalty: gratis Private: CHF 4.08 Private +: CHF 7.42 |

| Karten | Prepaid Mastercard**: gratis mit dem Code finanzdepot, ansonsten einmalig CHF 10 (**direkt mit dem Konto verbunden; keine Aufladung nötig) | Visa Debit Karte: gratis |

| Mobile Payment | Apple Pay, Google Pay, Samsung Pay und Garmin Pay | Apple Pay, Google Pay und Samsung Pay |

| Bargeldbezug in der Schweiz in CHF | 2x pro Monat gratis, danach CHF 2.00mit Sonect gratis | Loyalty: CHF 2.00 Private: CHF 2.00 Private +: gratis |

| Bargeldbezug im Ausland | 1.5% auf den Betrag | Loyalty: 1.5% Private: 1.5% Private +: gratis |

| Einkauf Inland, Bezahlung mit Karte | kostenlos | kostenlos |

| Einkauf Ausland, Bezahlung mit Karte | Keine Auslandsgebühren, ohne Wechselkursaufschlag (Mastercard Kurs) | Keine Auslandsgebühren, ohne Wechselkursaufschlag (Visa Kurs) |

| Überweisung Ausland | Überweisungen mit Wise direkt in der App | Überweisungen mit Wise direkt in der App |

| Convenience Fee bei Überweisung ins Ausland | 0.40% | 0.35% |

| eBill | ja (App öffnet Browser) | ja (direkt in der App) |

| Daueraufträge | ja | ja |

| Lastschriftverfahren | ja | in Arbeit |

| P2P Überweisungen | in Arbeit | teilen des QR-Rechnungscodes |

| TWINT | Prepaid | nicht geplant |

| Push-Nachricht bei Kartentransaktionen | ja | ja |

| Säule 3a | Kooperation mit externen Partnern (Selma, frankly, Inyova) | direkt in der App (Vontobel) |

| Angebot | Erhalte die Kreditkarte von neon gratis plus CHF 10 mit dem Code: finanzdepot Link* (Code bei Kontoeröffnung eingeben) | - |

Yes, they can pay. This is also shown by the incredibly fast ISR scanner in comparison with the competitors.

Conclusion Yapeal experience

Yapeal makes interesting promises but they must now be implemented quickly. Zak and neon have been on the market a lot longer and can further expand their position as top dogs. The Swiss are not exactly known for their willingness to change banks – so step on it, dear Yapeal team.

However, existing providers may take a leaf out of Yapeal’s book when it comes to lightning-fast payments and, in particular, Zak’s design.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.