Letztes Update: 24. August 2024

The big pension fund FAQ tells you everything you need to know about occupational benefits insurance. Especially in view of the vote on September 22, 2024, in which voters will decide on the reform of occupational benefits insurance (BVG reform), this article is intended to provide you with the necessary basic knowledge. Do you also have a question about occupational pensions? Then write it in the comments so that I can include it in the pension fund FAQ along with the answer.

Unlike the previous posts, this one is not intended to be read from cover to cover (of course you can do that anyway; then I congratulate you on your perseverance). Instead, use the table of contents to find the questions that interest you.

Inhaltsverzeichnis

- How high is the pension from the pension fund?

- What is mandatory and extra-mandatory?

- Can I make additional pension fund payments?

- Can I have my pension fund paid out?

- Can I change pension fund?

- Can I have several pension funds?

- How much do you have to earn to pay into the pension fund?

- Can I make an advance withdrawal from my pension fund for home ownership (WEF)?

- Pension fund: What happens in the event of death?

- Pension fund: What does the employer pay?

- Which pension fund do I have?

- How does a pension fund invest the money?

- Pension fund: How long is the payout period?

- Is the pension fund taxed?

- Does the pension fund earn interest?

- Where should I declare my pension fund in my tax return?

- Pension fund for the self-employed

- Are pension funds and AHV the same thing?

- Pension fund: pension or capital?

- Pension fund Change of job

- Search for pension fund assets and vested benefits

- What measures does the occupational pension reform (BVG reform) contain?

How high is the pension from the pension fund?

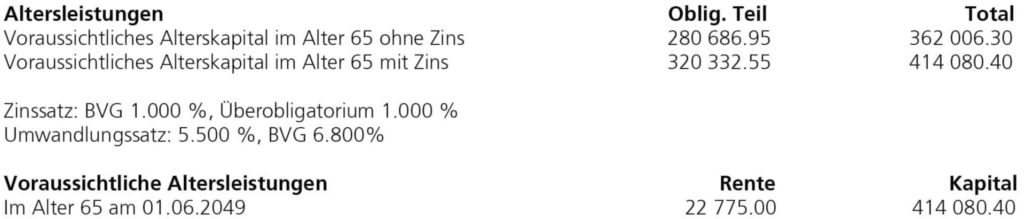

You can see this on your pension fund statement, which you receive once a year by post or can download from your pension fund’s online portal. There you will find the projected retirement assets and the retirement pension. Please note that the projected interest rate and conversion rate used are only assumptions and the figures calculated from them are not guaranteed. The further into the future you retire, the more uncertain the figures are.

The Federal Constitution states: “Occupational benefits insurance, together with old-age, survivors’ and disability insurance, enables people to maintain their accustomed standard of living in an appropriate manner.” Roughly speaking, one can say that the 1st and 2nd pillar together reach around 60% of your last salary. However, this is only a very rough guide, which is in no way guaranteed and in reality depends on many factors.

What is mandatory and extra-mandatory?

If you earn more than CHF 22,050 (entry threshold) per year, you are compulsorily insured under the Federal Law on Occupational Retirement, Survivors’ and Disability Pension Plans (BVG).

The most important legal provisions are

- Start of the savings phase after the age of 24.

- only salary components up to CHF 88,200

- fixed coordination deduction of CHF 25,725

- Savings contributions of 7%, 10%, 15%, 18%

- Minimum interest rate of 1.25%

- Conversion rate of 6.8%

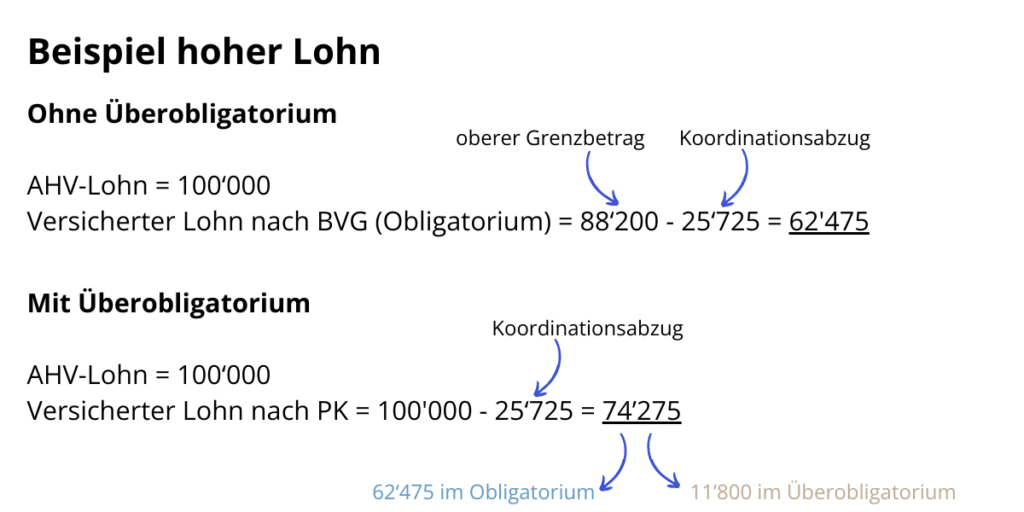

Let’s now take a look at how the extra-mandatory funds can arise. Let’s start with a simple example:

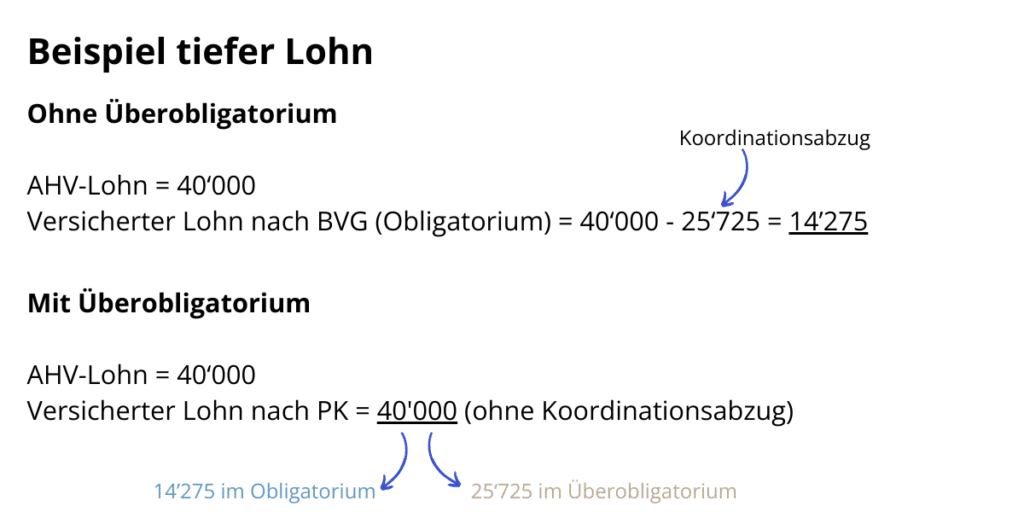

People often only talk about high salaries, but this is only part of the truth. Employees with low salaries can also accumulate money in the extra-mandatory scheme. For example, if the coordination deduction is adjusted to the level of employment or completely abolished. Here is another example:

There is no statutory conversion rate or prescribed minimum interest rate in the extra-mandatory scheme. Put simply, the pension fund can do what it wants here.

In addition, funds can be accumulated in the extra-mandatory area if

- the retirement capital earns higher interest

- retirement savings are started before the age of 25

- the savings contributions are higher

Can I make additional pension fund payments?

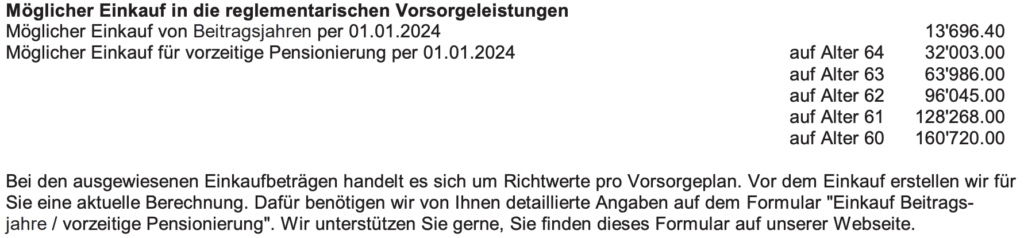

Gaps in the pension fund can be closed by making a so-called purchase. The pension fund calculates how high your retirement assets would be if you had always earned as much as you do today from the age of 25. This value corresponds to the regulatory retirement assets. As you probably earned less in the past than you do today, your actual retirement assets are smaller. The difference is known as purchase potential and can be seen on most pension fund statements. The purchase potential therefore increases with every salary increase.

Purchasing into the pension fund can save taxes, as the amount paid in can be deducted from income in the corresponding year. It often makes sense to stagger purchases and spread the tax savings over several years. The shorter the time until the lump sum is withdrawn, the more profitable a pension fund purchase is. This is why buy-ins are generally only attractive from the age of 55. Please note that there is a three-year blocking period for lump-sum withdrawals after voluntary purchases. You should also find out from your pension fund what happens to the voluntary buy-ins in the event of your death.

If you are planning a purchase, you should register this with your pension fund in good time and not wait until the end of December to start planning.

Can I have my pension fund paid out?

An early withdrawal of money from the pension fund is only possible in exceptional cases, including

- Acquisition of permanently owner-occupied residential property

- Taking up self-employment

- Early retirement

- Emigration: Definitive departure from Switzerland to a non-EU/EFTA country

It should be noted that an early withdrawal is subject to various conditions and time limits. In addition, an early withdrawal leads to a reduction in pension benefits and has tax consequences in the year of the early withdrawal.

Can I change pension fund?

The employer is responsible for affiliation to a pension fund. It transfers the employer and employee contributions directly to the pension fund. This means that you cannot simply switch pension funds on your own initiative. By law, however, every company that employs staff must appoint a pension fund committee with equal representation. This committee is made up of employee and employer representatives and decides on the company’s occupational benefits. If you do not agree with your pension fund solution, the first thing to do is to contact your company’s employee representatives. The names of the employee representatives can often be found on the pension certificate.

If you are looking for a new job, you should definitely compare the pension fund solutions of different companies. The benefits can vary greatly and if you have only been insured with the statutory minimum for your entire working life, you will have to accept considerable financial losses at the latest when you retire.

Can I have several pension funds?

Yes, it is possible. If you work for several employers, you are probably insured with a different pension fund for each employer. If you work for more than one employer, it is important to check whether the coordination deduction is adjusted to the level of employment. If each employer applies the full coordination deduction of currently CHF 25,725, you will not be able to save much for old age and the risk benefits will probably also be meagre. In this case, it is best to talk to your employer, as they are often not sufficiently aware of this.

If you do not reach the entry threshold of CHF 22,050 with one employer, you can ask the pension fund of one employer whether it will also insure the salary of the other employer. This is rarely the case. Alternatively, you can register with the BVG Substitute Occupational Benefit Institution of the Swiss Confederation. With their MA pension plan, you can have the portion of your salary that is less than CHF 22,050 insured by one employer. However, fewer than 300 people in Switzerland do this.

How much do you have to earn to pay into the pension fund?

The BVG mandatory scheme applies to all employees who are insured under Pillar 1 and earn at least CHF 22,050 per year. This is also known as the entry threshold.

Up to the 24 years of age, the contributions only cover the risks of death and disability. From the 25 years of age, savings are also made for the retirement pension.

Among others, self-employed persons and employees with a fixed-term employment contract of no more than three months are not subject to the obligation.

Can I make an advance withdrawal from my pension fund for home ownership (WEF)?

Yes, it is possible. However, the property must be occupied by you . Second homes and vacation homes are excluded. The advance withdrawal can be used not only for the purchase or construction of residential property, but also for the repayment of a mortgage loan or the financing of renovations, for example.

The minimum amount for an early withdrawal is CHF 20,000. It should be noted that future pension benefits will be lower with the early withdrawal. Depending on the pension fund, the benefits in the event of death or disability may also be lower.

An early withdrawal is possible every 5 years. From the age of 50, there are restrictions on the amount of the early withdrawal. A capital gains tax is due on early withdrawals, which is why sufficient liquid assets should be available to pay this tax.

Pension gap

The pension gap resulting from the early withdrawal can be closed by repayments on a voluntary basis. The minimum amount is CHF 10,000. Repayments do not count as purchases and therefore cannot be claimed for tax purposes. However, the capital withdrawal tax paid as part of the early withdrawal can be reclaimed in the event of a repayment. The application for a refund must be actively submitted to the competent authority within three years of the repayment. Voluntary purchases that reduce taxable income can only be made again once all WEF advance withdrawals have been repaid.

If the residential property is sold, the advance withdrawal must always be repaid. To ensure that this cannot be circumvented, an advance withdrawal from the pension fund is entered in the land register.

Pension fund: What happens in the event of death?

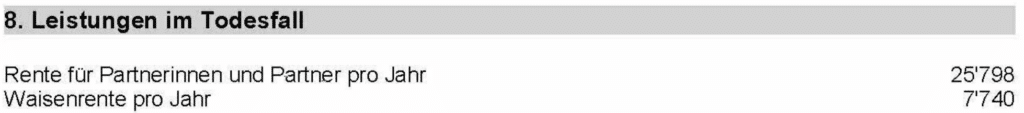

It’s actually quite simple: if an insured person dies, the pension fund pays out a survivor’s pension. However, who exactly is entitled to this and how much this survivor’s pension is depends on the pension fund and the respective pension fund regulations.

According to the law, the surviving spouse is entitled to a widow’s or widower’s pension if he or she is responsible for the maintenance of at least one child at the time of the spouse’s death or is older than 45 and the marriage lasted at least 5 years. The pension amounts to 60% of the retirement or disability pension. If the requirements for a widow’s or widower’s pension are not met, there is an entitlement to a one-off lump-sum settlement amounting to three annual pensions. Children of the deceased person receive an orphan’s pension up to the age of 18. Children who are still in education receive an orphan’s pension until they complete their education, but no later than the age of 25.

Cohabiting partners and restitution

Depending on the pension fund regulations, the benefits may go beyond the statutory minimum and, for example, also benefit cohabiting partners or pay benefits if the spouse or partner is not yet 45 years old. Some pension funds require cohabiting partners to be actively registered. You should therefore read the regulations carefully or enquire directly with the pension fund.

If you pay voluntary savings contributions into your pension fund, known as buy-ins, you should find out from your pension fund what happens to them when you die. Some pension funds pay out voluntary buy-ins as a lump sum on death (reimbursement), while others lose voluntary buy-ins in the event of death before retirement.

Would you like to know how your partner and children are covered in the event of your death? Then have a pension analysis drawn up for you. Contact us for a non-binding initial consultation.

Pension fund: What does the employer pay?

The occupational pension contributions are split between the employer and employee. The employer pays at least 50% of the total contributions. On a voluntary basis, the employer can also pay a higher proportion of the premiums. The employer deducts the employee’s share of occupational pension contributions from the salary and transfers it directly to the pension fund together with the employer’s share.

Which pension fund do I have?

You can find out which pension fund you are insured with from your employer. You can also find the name of the pension fund on the pension fund certificate (also known as the pension certificate). You will receive this at the beginning of the year by post or online, as many pension funds have set up an online portal in recent years where you can download the certificate as a PDF.

You can find out whether you still have pension fund assets from previous employment relationships by contacting the BVG Substitute Occupational Benefit Institution.

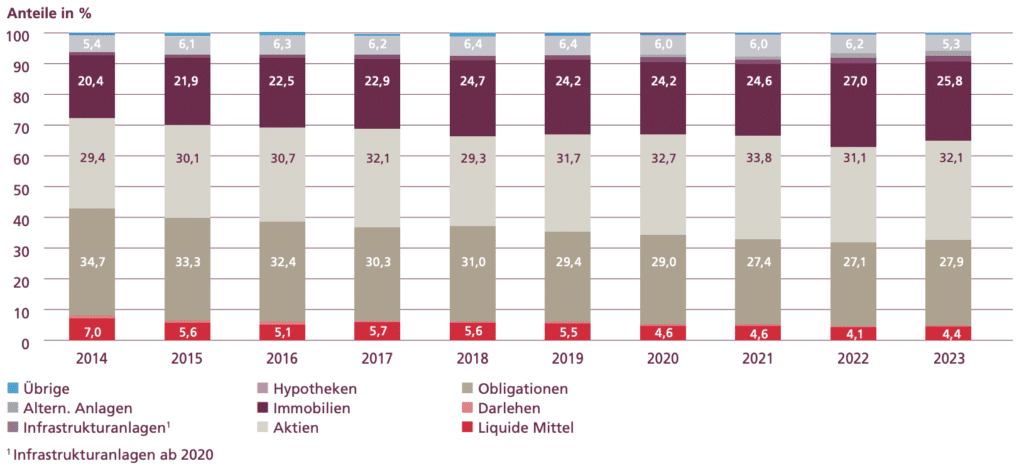

How does a pension fund invest the money?

The Board of Trustees of a pension fund draws up the principles for how the pension fund’s pension assets are invested and sets these out in the investment regulations. The Ordinance on Occupational Retirement, Survivors’ and Disability Pension Plans (BVV 2) contains investment guidelines and provisions on the maximum shares per investment category.

Swisscanto’s “Swiss Pension Fund Study 2024” provides an overview of the asset allocation of Swiss pension funds:

Pension fund: How long is the payout period?

When you retire, you can decide once whether you want to draw an annuity or (part of) the lump sum, although mixed forms are also possible. If you withdraw the lump sum, you bear the capital market and longevity risk.

If you draw the pension, a pension fund pays for as long as you live. In this case, it bears the capital market and longevity risk. Survivors’ benefits may also be paid out after your death. Retirement benefits are adjusted for inflation within the limits of the pension fund’s financial resources. An automatic adjustment is not provided for by law.

Is the pension fund taxed?

Before retirement:

You transfer the net salary from the salary statement to the tax return. The occupational pension contributions are already deducted from this. The higher these contributions are, the lower your taxable income will be.

You do not have to declare the pension fund assets as assets in your tax return. Investment income from pension fund assets is also tax-free.

After retirement:

When a lump sum is withdrawn, a one-off lump sum payment tax is due, which is calculated separately from income and at a lower rate. After the withdrawal, the amount – or what remains of it – must be declared as assets at the end of each year and wealth tax is due.

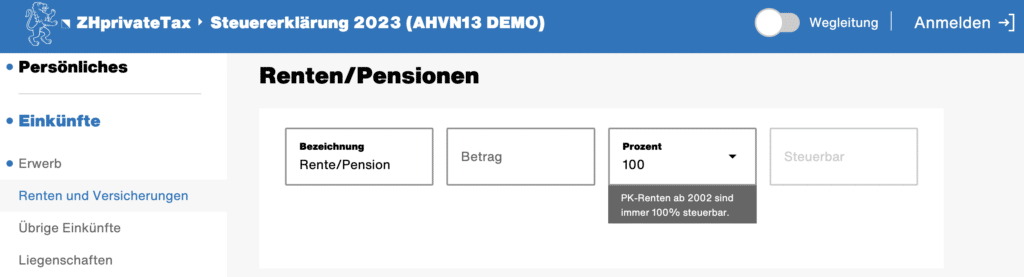

When a pension is drawn, the pension is fully taxed as income.

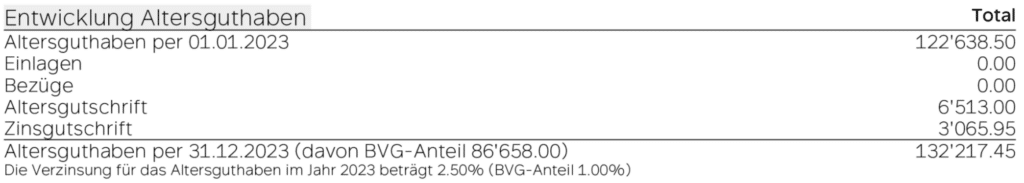

Does the pension fund earn interest?

The minimum interest rate for BVG assets (mandatory) is set by the Federal Council. It is currently 1.25%. A pension fund can also pay out a higher interest rate.

The interest rate for the retirement assets of the extra-mandatory occupational pension scheme is set by the highest governing body of the pension fund. There is no statutory requirement. It can be either below (as long as it is not negative) or above the minimum interest rate.

When the Federal Law on Occupational Retirement, Survivors’ and Disability Pension Plans (BVG) came into force in 1985, the minimum interest rate was still 4%.

Where should I declare my pension fund in my tax return?

The pension fund pension must be declared as income in the tax return, in Zurich this is as follows:

You will receive a pension statement – also known as a pension certificate – from your pension fund at the beginning of the year, from which you can transfer the amounts to your tax return.

The capital saved with your pension fund or vested benefits institution does not have to be declared as assets before retirement.

If you are unsure how to complete your tax return, get in touch for a no-obligation initial consultation.

Pension fund for the self-employed

For self-employed persons without employees, affiliation to the occupational pension scheme is voluntary. However, voluntary affiliation is also possible for self-employed persons without employees via professional or industry associations and the BVG Substitute Occupational Benefit Institution. Depending on the level of earnings and the family situation, voluntary affiliation may well make sense.

Persons without a pension fund can pay a maximum of 20% of their net earned income into pillar 3a, up to a maximum of CHF 35,280.

Are pension funds and AHV the same thing?

No, the first pillar (AHV) is the state AHV, which covers the basic needs of the entire population. The state pension scheme is based on the pay-as-you-go system. This means that the money that the AHV collects from active insured persons goes directly to pensioners.

The occupational pension scheme (pension fund), together with the state pension scheme, is intended to enable the continuation of the accustomed standard of living in an appropriate manner. It is financed using the capital cover method. The savings contributions are credited to a type of savings account, as with a bank, and invested on the capital market. In this way, everyone saves for themselves.

Pension fund: pension or capital?

This question depends on many factors, such as the family and financial situation, and must be answered individually. The decision should be made early on and planned accordingly. Here is a small selection of possible advantages and disadvantages:

| Advantages | Disadvantages | |

|---|---|---|

| Pension | – Guaranteed regular payment – Longevity risk covered – Widow’s and widower’s pension | – Income taxation at 100% – no (guaranteed) inflation protection – no influence on returns |

| Capital | – Financial flexibility – income taxed at a reduced rate, separate from other income – inheritable | – Property taxes – longevity risk not covered – no widow’s and widower’s pension |

A lump-sum withdrawal must be registered with the pension fund in good time. Consult the regulations of your pension fund. They will also tell you whether you can withdraw the entire retirement assets as a lump sum or only part of them. According to the law, the pension fund only has to pay out 25% of the mandatory portion as a lump sum.

Pension fund Change of job

If you continue to work for another employer seamlessly when you change jobs, the pension fund of the old employer will transfer the vested benefits to the pension fund of the new employer.

If you do not join a new pension fund directly, you must deposit your vested benefits with a vested benefits foundation. You can choose between an account and a securities solution.

A payout to your private account is excluded in most cases.

Search for pension fund assets and vested benefits

Pension fund assets can be “lost” in the event of career breaks, frequent job changes or unemployment, among other things. These are not simply lost, but the pension fund of the former employer must transfer the money to a vested benefits account with the BVG Substitute Occupational Benefit Institution after two years at the latest. This manages the money as contactless vested benefits assets until the entitled persons come forward. If you are looking for vested benefits, you can fill out a form online and submit it to the 2nd Pillar Central Office.

Are you looking for support in your search for vested benefits? Then get in touch with me for a non-binding initial consultation.

What measures does the occupational pension reform (BVG reform) contain?

Reduction of the conversion rate

The conversion rate in the mandatory occupational benefit scheme is to be reduced from the current 6.8% to 6.0%. The conversion rate indicates how high the monthly pension will be later on. With retirement assets of CHF 100,000, the annual pension is currently CHF 6,800. With the reform, the pension would still be CHF 6,000.

Compensatory measures

Increase in the insured salary

Regardless of the salary, the coordination deduction of CHF 25,725 is currently deducted from the mandatory occupational benefit scheme. With the reform, the coordination deduction will no longer be a fixed amount, but 20% will be deducted from the salary. This means that lower incomes in particular can insure a higher proportion of their salary, i.e. more retirement assets can be accumulated, so that the later pension will be higher in many cases.

Currently, only around 12% of pension funds apply the statutory coordination deduction, which corresponds to around 20% of insured persons. The majority of funds already adjust the coordination deduction to the degree of employment or waive it altogether.

Pension supplement for the transitional generation

Some employees who will retire in the next few years are threatened with pension losses as a result of the reform, which is why Parliament has provided for pension supplements for the transitional generation. These compensation measures will last for 15 years.

The amount of the supplement depends on the year of birth and the retirement assets saved.

The compensation measures cost an estimated CHF 800 million per year and are financed by the pension funds and by salary contributions from all employees and employers. Calculations have shown that the pension supplement for the majority of the transitional generation is not compensation for a lower pension, but a pension increase that is largely financed by the younger generation.

Improving pension provision for low incomes and part-time work

The entry threshold of currently CHF 22,050 will be lowered to CHF 19,845. This means that around 70,000 additional people will be insured in the 2nd pillar. This means that people in multiple employment will also reach the entry threshold sooner.

Lower savings contributions for older employees

As employee and employer contributions increase with age, this can put older people at a disadvantage on the labor market. The reform reduces the difference between the contributions for older and younger employees. This should make it more attractive for employers to continue employing people over the age of 55.

Retirement credits to date:

| Age | Approach |

|---|---|

| 25 – 34 | 7% |

| 35 – 44 | 10% |

| 45 – 54 | 15% |

| 55 – 65 | 18% |

New retirement credits:

| Age | Approach |

|---|---|

| 25 – 44 | 9% |

| 45 – 65 | 14% |

If you have any further questions about the pension fund, please feel free to ask them in the comments field below. This way we can create a growing body of knowledge together

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.