Letztes Update: 23. March 2025

Until now, you could open a Pillar 3a Cash account with radicant. In other words, a classic Pillar 3a account. However, the Pillar 3a account at radicant wasn’t quite so classic: Firstly, you received one of the highest interest rates in Switzerland on your savings, and secondly, radicant invested part of your deposits in financing impactful projects through labeled bonds. Now you can also benefit from higher return opportunities, as radicant has launched the sustainable Pillar 3a investment solution. In this article, you’ll learn everything about the advantages, costs, and comparison with other providers of the new radicant Pillar 3a.

Why Pillar 3a is important for your retirement planning

After retirement, most people in Switzerland receive a pension from AHV and a pension from the pension fund. The two pillars together should enable the continuation of the accustomed standard of living. A replacement rate of 60% is often mentioned. So if you earned 80,000 before retirement, you’ll receive about 48,000 from the first and second pillars. This is a very rough rule of thumb – but it shows that without additional savings, the outlook isn’t very rosy.

With Pillar 3a, you have the opportunity to counteract the income gap in old age. You can deduct the amounts paid into Pillar 3a from your income up to a maximum amount of CHF 7,056 (from 2025, the Pillar 3a maximum amount will be CHF 7,258) and thus save taxes.

A single person with a taxable income of CHF 68,800 (corresponding to the median in Zurich) and residence in the city of Zurich saves a total of CHF 1,444 in tax amounts with a payment of CHF 7,056. The tax burden thus decreases by 17%. By the way, you benefit the most if you then invest the tax savings – in our example CHF 1,444 – in free assets.

Another advantage of Pillar 3a is that you don’t have to declare the saved capital as assets and can thus save taxes again. Also, the returns, i.e., interest and dividends that your Pillar 3a capital yields, don’t have to be taxed during the term. Only upon payout is a so-called capital benefits tax due.

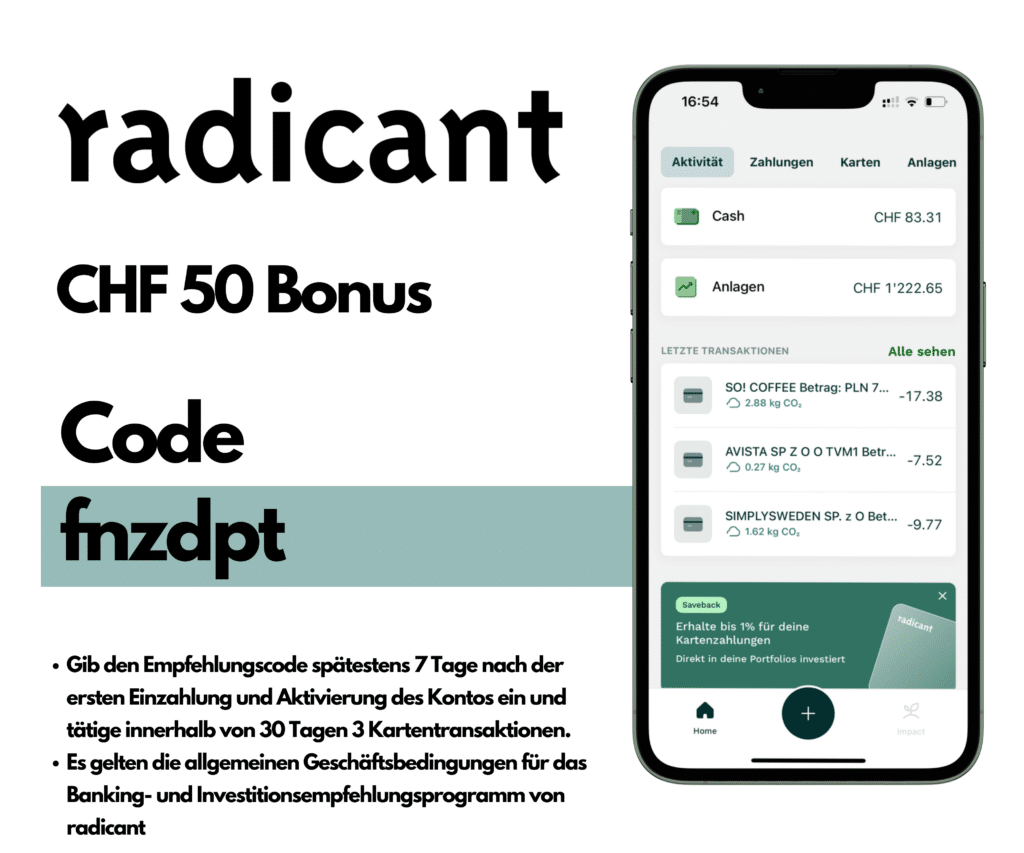

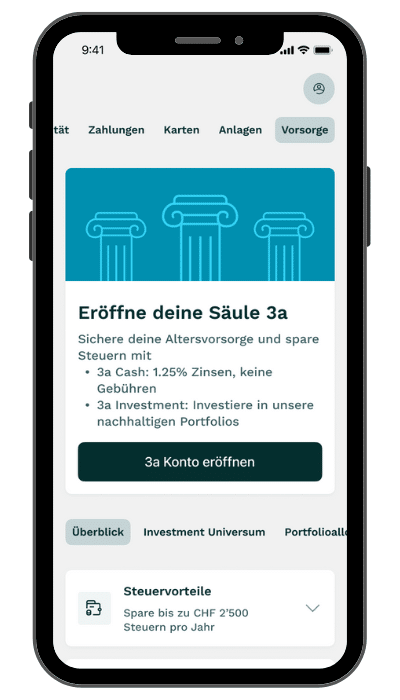

How does Pillar 3a work at radicant? An overview

To benefit from Pillar 3a at radicant, you need a free bank account with radicant. The opening is done easily via the radicant app. By the way, you can read all the basics about radicant in the blog post Sustainable Banking Investing with radicant. You can then also open the 3a Cash or Investment account directly in the radicant app. In total, you can open up to five retirement accounts with radicant. A conversion from a 3a Cash to a 3a Investment account (and vice versa) is possible without any problems.

The minimum deposit for the Pillar 3a Investment account is CHF 1,000. There is no lower limit for the Pillar 3a Cash account. You can make transfers to your Pillar 3a account at radicant either directly in the radicant app from your radicant everyday account or you can make a payment from an account at another bank to your Pillar 3a account at radicant. For this, you need the IBAN of your retirement account. You can find this under “Retirement”, the desired 3a account, and then under “Deposit”. Transfers from other pension foundations are of course also possible. You can also find the transfer form under “Deposit” and then “Transfer 3a account”.

And what about security? radicant has a Swiss banking license and is supervised by the Swiss Financial Market Supervisory Authority (FINMA). Your 3a balances in your radicant Cash account are – as with all other providers – privileged under bankruptcy law up to a maximum of CHF 100,000 per customer and pension foundation.

Your 3a balances are held by the “Vorsorgestiftung 3a Digital” in your name at radicant bank ag. Additionally, radicant bank ag has been appointed as asset manager for your investments.

radicant Pillar 3a interest rates

The interest rate on the Pillar 3a Cash Account is currently 0.75%. This makes radicant one of the Pillar 3a providers with the highest interest rates.

radicant Pillar 3a Costs

For the Pillar 3a Investment Account, the annual fee is 0.45%. In addition, there are annual product costs of 0.40 to 0.47%. These depend on the chosen investment strategy and products.

Comparison: What distinguishes radicant from other providers?

With radicant’s sustainable 3a Investment Account, you only invest in companies that contribute positively to the UN Sustainable Development Goals. For each company radicant invests in, you can find an SDG Impact Rating in the app, as well as a detailed description of the company and its rating. This evaluates the impact of companies and their products on society and nature. You can read more about radicant’s investment process in the article radicant SDG Investing: What Makes the New Bank Different.

In addition to the sustainability aspect and transparency, radicant offers a high degree of customization in choosing your investment strategy. You can compose your portfolio from the following three actively managed investment funds and eight SDG-oriented tracker certificates:

Investment funds

- Sustainable global stocks

- Sustainable Swiss stocks

- Sustainable global bonds

Tracker certificates

- Climate stability

- Healthy ecosystems

- Basic needs

- Gender equality

- Health Wellbeing

- Social progress

- Clean water sanitation

- High quality education

Your investment strategy is compiled based on your individual risk profile.

The following strategies are available:

- Cash

- Cautious (20% stocks)

- Conservative (40% stocks)

- Balanced (60% stocks)

- Dynamic (80% stocks)

- Growth (98% stocks)

Conclusion: Shape your future with radicant’s Pillar 3a

The Pillar 3a at radicant offers a combination of attractive interest rates and sustainable investment opportunities that stand out from conventional providers. With the 3a Cash Account, you benefit from one of the highest interest rates in Switzerland, while at the same time a portion of the deposits flows into effective, sustainable projects. The new 3a Investment solution additionally opens up the possibility of benefiting from higher returns in the long term – and this in alignment with the United Nations Sustainability Goals. Particularly noteworthy is the easy handling via the digital platform, which makes access to pension provision and sustainable investing child’s play.

Transparency and disclaimer

This post was made in collaboration with radicant, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.