Letztes Update: 30. January 2025

Generate additional income with Saxo securities lending for your held stocks or ETFs. In this post, you’ll learn what securities lending is and what you should consider.

Securities lending: What is it?

Securities lending is a financial transaction in which the owner of securities temporarily transfers them to a borrower. The borrower pays a fee to the lender and commits to returning the securities after an agreed period. In this way, the lender can generate additional income from their securities holdings without having to sell them. The borrower can use the borrowed securities to execute trading strategies such as short selling. Saxo Bank lends both stocks and ETFs.

Many ETFs and funds also lend out parts of their portfolios and thus generate income. For the iShares Core MSCI World UCITS ETF, for example, the securities lending yield last year was 0.03%. On average, securities with a volume of around 10% of the fund were lent out.

Securities lending: what you need to consider

You lose ownership of the loaned securities during the loan period. This means that the loaned securities are no longer part of the special assets and in the event of Saxo Bank’s insolvency you can only assert a monetary claim against Saxo Bank’s assets. This monetary claim is not privileged and is not subject to deposit protection.

Clients benefit from collateralization of their return claim. This collateral is provided directly by Saxo Bank and you are not exposed to the insolvency risk of a third party end-borrower.

Securities lending Saxo Bank Switzerland

Securities lending Activation

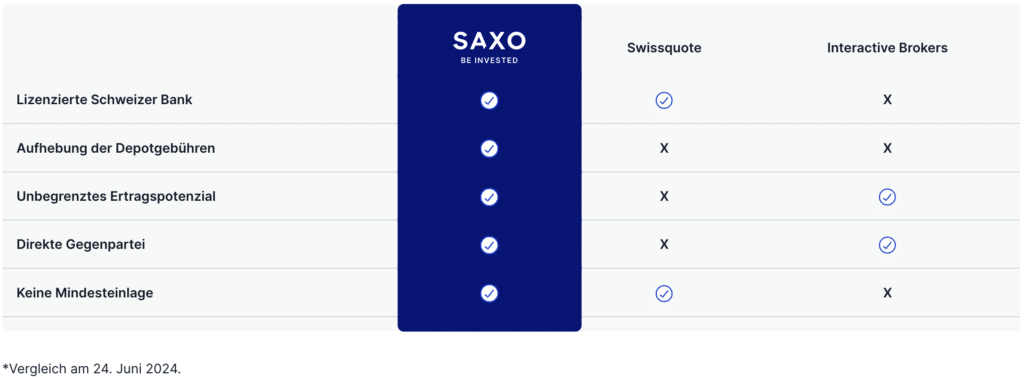

With Saxo, you can activate securities lending with just one click. With other providers, you either have to print out a document, sign it and send it in physically, or securities lending is always active and cannot be deactivated.

Saxo handles the entire lending process and pays you half of the earnings. This way, you can increase the return of your portfolio.

You can activate or terminate the securities lending service at any time. You will receive dividends or dividend-like payments as usual, and you can sell the shares at any time, even if they are on loan. The only downside is that you cannot exercise your voting rights at the AGM if your share is on loan at that time, but you cannot (yet) do that with shares you buy through Saxo anyway.

If you want to exclude certain securities from securities lending, you must transfer them to a separate sub-account. Of course, you must then exclude this sub-account completely from securities lending.

In the portfolio overview, you can see which securities have been lent, if any have been lent at all.

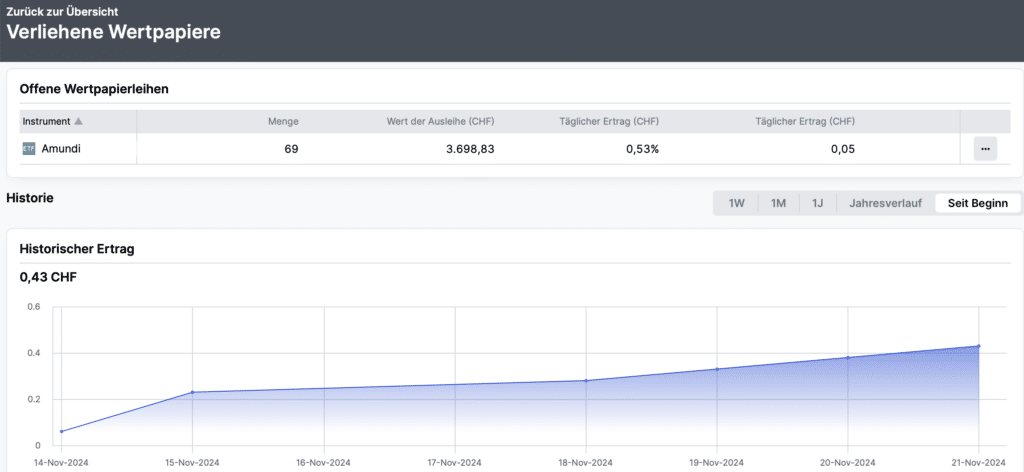

In the SaxoTraderGo app, you can see under “Portfolio” and “Securities Lending” whether securities lending is activated. There you can also see if and which securities are currently being lent out. I currently have two ETFs with Saxo Bank and have activated securities lending to try it out. In half a year, only one ETF has been lent out for just under a month so far.

Securities lending Collateral

Saxo acts as the counterparty for securities lending. In the event that the borrower defaults, at least 102% of the securities lent are deposited as collateral in a separate Swiss custody account. The collateral is valued daily at market value and adjusted in line with fluctuations in the value of the securities. If the value of the securities lent increases during the course of the day, the collateral is also increased at the end of the day. The borrower must provide more collateral.

Securities lending income

The additional income is transferred to your Saxo Bank clearing account at the end of each month.

However, it is also possible that no securities are lent at all because there is no demand for your shares or ETFs.

If several Saxo clients own securities that are in demand, an automated, random process is used to decide who will lend the shares or ETFs. Saxo has no influence on this.

How high are the yields?

Let’s take an example: Beyond Meat Inc. is currently in high demand among borrowers. These are ready to pay 12.68% per year for the loan. You have USD 1,000 worth of shares in Beyond Meat Inc. in your portfolio and your stocks are lent out, you will receive USD 63.40 per year (half of USD 126.80 goes to Saxo Bank – other providers give nothing or a smaller share to their customers). In most cases, however, securities are not lent for an entire year. Accordingly, the annual interest rate would be calculated down to the effective period.

Conclusion securities lending Saxo Bank

With the introduction of securities lending, Saxo Bank offers its customers the opportunity to generate additional income by lending securities and thus increase the return of their portfolio. However, you should be aware of the risks. Saxo makes the activation and management of securities lending simple and transparent, so you always have an overview.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.