Letztes Update: 1. November 2024

Increased competition has also left its mark on Swissquote. Swissquote has halved the prices for orders up to CHF 2,000. This makes Swissquote more attractive for smaller amounts as well. Swissquote has also expanded its savings plan function. Numerous shares and around 100 ETFs are now available as fractional shares. This means that fractions of shares or ETFs can be purchased.

You can find a comparison with Saxo in the article Swissquote vs Saxo: Find the best Swiss online broker.

Swissquote fees

Swissquote savings plan fees

The fees in brackets are the previous fees. From CHF 2,000.01 the fees remain unchanged.

| Transaction amount | SIX (CHF) | Germany (EUR) | NYSE, NASDAQ (USD) |

|---|---|---|---|

| 0 – 500.00 | 3 (5) | 5 (5) | 5 (5) |

| 500.01 – 1’000.00 | 5 (10) | 5 (10) | 5 (10) |

| 1’000.01 – 2’000.00 | 10 (20) | 10 (20) | 10 (20) |

| 2’000.01 – 10’000.00 | 30 | 30 | 30 |

| 10’000.01 – 15’000.00 | 55 | 55 | 55 |

| 15’000.01 – 25’000.00 | 80 | 80 | 80 |

| 25’000.01 – 50’000.00 | 135 | 135 | 135 |

| > 50’000.00 | 190 | 190 | 190 |

The fees quoted do not include exchange fees or local taxes and duties. With other brokers, the exchange fees are already included, which I find more transparent as I know exactly what a trade will cost me in advance.

Swissquote ETFs Leaders fees

Fees have also been reduced here, with transactions under CHF 500 now only costing CHF 3.

| Transaction amount | CHF/EUR/USD |

|---|---|

| 0 – 500.00 | 3 |

| 500.01 – 1’000.00 | 5 |

| > 1’000.01 | 9 |

Swissquote custody fees

The custody account fees have not been changed. They amount to:

| Assets in CHF (except cash) | Quarterly custody account fee in CHF |

|---|---|

| 0 – 50’000 | 20 |

| 50’000.01 – 100’000 | 25 |

| 100’000.01 – 150’000 | 37.50 |

| > 150’000 | max. 50 |

At Swissquote, crypto-assets fall under assets in the same way as shares, ETFs and other securities and are also subject to a custody account fee.

Swissquote exchange fees

Swissquote has not changed the amount of the exchange fees. For the main currencies, the fee is still a fairly high 0.95%.

Swissquote real-time surcharge

The fee for the real-time surcharge of CHF 0.85 per transaction – which I don’t know of any other broker – has unfortunately not been abolished.

Swissquote Savings Plan

It has been possible to set up recurring investments at Swissquote for some time. Now the function has been expanded and is finally called a savings plan. Fractional shares of shares, ETFs and themed trading products can now also be traded. For example, if you want to invest CHF 700 per month, but a share costs CHF 1,000, it was previously not possible to save for it. With the new Swissquote savings plan, you simply buy 0.7 shares of the stock. These shares are held in trust by Swissquote in your name. Next month you would then have 1.4 shares in your custody account. Swissquote will now automatically convert all the shares into a “real” share. You would then have one share and a holding of 0.4 in your custody account. You will receive dividends on a pro rata basis.

You cannot exercise any voting rights with the shares and you cannot transfer the shares to another account or outside Swissquote. Participation in corporate actions is also restricted. Even though fractional trading is standard with many brokers abroad, you should read the “Agreement on Trading in Fractional Instruments for Trading Accounts” carefully when activating fractional trading.

The following intervals are available for the Swissquote savings plan:

- daily (only for digital assets);

- weekly

- bi-weekly

- monthly

- every two months

- quarterly

Savings plans cannot be created, changed or deleted on the day of execution. Securities savings plans are executed approximately 30 minutes after the market opens.

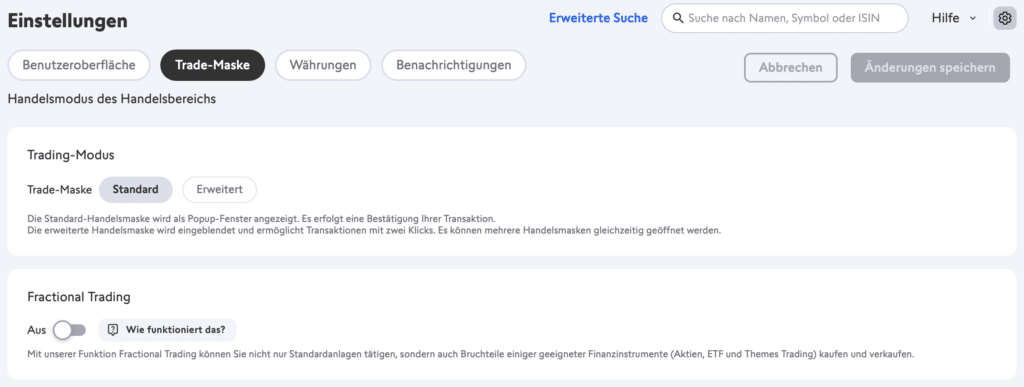

Activate fractional trading

On your trading platform, click on the cogwheel symbol and “Trade mask” at the top right. There you will find the “Fractional Trading” slider, which you can set to “On”. Next, you must accept the “Fractional Instrument Trading Agreement for Trading Accounts”.

In the Swissquote app, you can select the person symbol at the top right and activate fractional trading under “Trading screen settings”.

Swissquote savings plan ETF list (selection)

| ETF | ISIN | TER | Distribution | Handels- währung |

|---|---|---|---|---|

| UBS ETF (LU) MSCI World UCITS ETF (USD) | LU0340285161 | 0.30% | distributing | CHF |

| iShares Core SPI (CH) | CH0237935652 | 0.10% | distributing | CHF |

| SPDR MSCI World Small Cap UCITS ETF | IE00BCBJG560 | 0.45% | accumulating | CHF |

| Vanguard FTSE Developed World UCITS ETF | IE00BKX55T58 | 0.12% | distributing | CHF |

| Invesco FTSE All-World UCITS ETF | IE000716YHJ7 | 0.15% | accumulating | CHF |

| Vanguard FTSE All-World UCITS ETF (USD) | IE00B3RBWM25 | 0.22% | distributing | CHF |

| iShares MSCI ACWI UCITS ETF USD | IE00B6R52259 | 0.20% | accumulating | CHF |

| UBS ETF (CH) SXI Real Estate Funds (CHF) | CH0105994401 | 0.97% | distributing | CHF |

| UBS ETF (CH) SPI (CHF) | CH0131872431 | 0.10% | distributing | CHF |

| ZKB Gold ETF A (CHF) | CH0139101593 | 0.40% | – | CHF |

The list offers a selection of the ETFs available with Swissquote as part of the savings plan. Neither the ETFs contained therein nor those mentioned in the article are to be understood as recommendations for action. No guarantee is given for the accuracy and completeness of the list.

Conclusion Swissquote savings plan

Swissquote has responded to the growing competition and adjusted its savings plan and fee structure. The reduction in transaction fees for smaller amounts makes Swissquote more attractive for small investors. The introduction of fractional trading also makes it easier to get started with shares and ETFs, which is particularly beneficial for investors with smaller monthly amounts.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.