Letztes Update: 7. May 2025

If you travel frequently or shop online in foreign currencies, you know: Using Swiss cards abroad can quickly become expensive. Between hidden fees, unfavorable exchange rates, and high costs for cash withdrawals abroad, it’s easy to lose track – and hard cash. While the two largest neo-banks in Switzerland still offer free accounts, there are cheaper alternatives for use abroad. In this article, I’ll show you which card is particularly attractive in 2025 – focusing on transparent fees, fair exchange rates, and real everyday usability.

Why You Should Choose the Right Card for Abroad

Many Swiss banks charge a foreign currency fee of 1.5% to 2.5% for using their debit and credit cards – in addition to the often unfavorable exchange rate. This fee applies to every payment in a foreign currency, whether you’re shopping in a store or booking online.

Here’s an example: You stay at a hotel in Italy and pay EUR 200 for it. With an average surcharge of 2%, this purchase costs you CHF 4 more – just because of your card choice. And: Some banks cleverly hide these costs in the exchange rate. This means you don’t see the fee directly on the statement, but you still pay it – by applying an unfavorable exchange rate that makes the amount in francs higher than it should be.

Difference: Exchange Rate vs. Foreign Currency Fee

Two things influence how expensive your card payment abroad becomes:

Exchange Rate:

Every payment in foreign currency is automatically converted to Swiss francs. Depending on the card and provider, this rate can vary greatly, especially with credit cards. Banks usually do not use the actual exchange rate, but set a higher rate to generate additional income.

Foreign Currency Fee:

This fee is charged in addition to the rate, usually as a percentage of the amount. Even with so-called “travel credit cards,” it’s not always zero.

Criteria for the Best Card Abroad

For me, transparency is crucial: I want to know in advance what my card payment abroad will cost, and I don’t want to search for this in a thirty-page PDF document between the prices for the fund account and check transactions, only to find out that a bank-specific exchange rate is applied, which can be inquired about from customer service.

Exchange Rate – Who Offers the Best?

The best exchange rate is always the interbank exchange rate. This eliminates neon with the Mastercard reference rate, which is slightly higher than the interbank rate, and especially neon free with its 0.35% surcharge, from the ranking. This leaves radicant and Yuh, both of which apply the interbank rate.

Revolut also has its own exchange rate. While it’s lower than most Swiss banks, it still has a markup on the interbank rate. And for currency exchange on weekends, Revolut charges an additional fee of 1%. If you exceed your monthly free limit of CHF 1,250 in the standard subscription, an additional fee of 1% also applies.

Foreign Currency Fees – Who Waives Them?

While Yuh applies the interbank rate, it charges a fee of 0.95% for currency exchange on card payments abroad. This leaves radicant as the Swiss provider that both applies the interbank rate and waives foreign currency fees.

Let’s look at the three Swiss neo-banks in the Swiss exchange rate comparison:

The Best Cards 2025 in Comparison

| neon free | radicant | Yuh | |

|---|---|---|---|

| Account | Free, no monthly fee | Free, no monthly fee | Free, no monthly fee |

| Card payment abroad | Mastercard reference rate + exchange rate surcharge of 0.35% | Interbank rate | 0.95% on the interbank rate |

| Cash withdrawal in Switzerland | CHF 2.50 per withdrawal | 12 included per year, then CHF 2 per withdrawal | 1 free cash withdrawal per week, then CHF 1.90 per withdrawal |

| Cash withdrawal abroad (local currency) | 1.5% | CHF 2 | CHF 4.90 |

| Additional offers | Paid plans, neon Invest | Free travel insurance, interest on everyday account, Saveback, Investing, Pillar 3a, EUR account | Savings Account, Multi-Currency Account, Investing, Pillar 3a |

Personal Test Winner for 2025

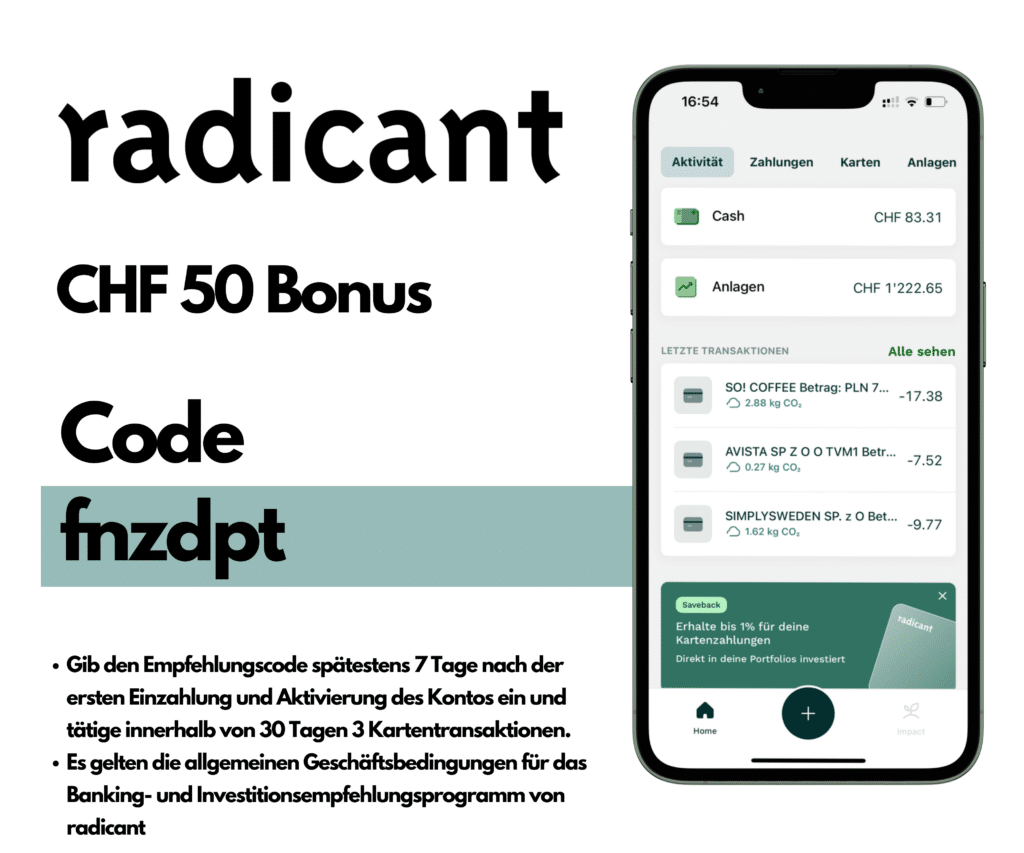

radicant not only offers an attractive interbank rate, allowing you to pay cheaply abroad, but also a everyday account that earns interest. This means you don’t have to move your money back and forth between savings and everyday accounts like with other providers. Additionally, radicant has a Swiss banking license, so CHF 100,000 falls under deposit protection. Of course, you receive your own IBAN number and can easily use your radicant account as a salary account.

You can find more details about radicant in the article Sustainable Banking Investing with radicant.

Tips for Using Cards Abroad

Avoid Fees When Withdrawing Money

Usually, it’s cheaper if you pay directly with your card abroad. When making card payments abroad, always make sure to pay in the local currency. In Germany, for example, in euros. The surcharges from merchants or ATM operators for converting to CHF are usually much higher than your card’s exchange rate.

In some countries, card payments are not yet as common, and you may need to rely on cash. In this case, you should look for low withdrawal costs. Here too, radicant is very attractive with a fixed fee of CHF 2.

Often, ATM operators charge additional fees. It’s best to check travel forums or experience reports before your trip to find out which ATMs don’t charge these fees.

Activate card for ‘international use’

With some banks, you need to activate your card for international use first. This is a security measure to prevent your card from being used abroad unnoticed if it falls into the wrong hands. Therefore, before departing, check with your bank whether you can activate it yourself in e-banking or if it needs to be done by customer service. This way, you can be sure that your card will work abroad without any issues.

With radicant, you can choose in the app whether the card should be usable outside of Switzerland and Liechtenstein. You can also choose whether to activate it for contactless payments, online payments, and cash withdrawals.

Emergency: Lost Card – What to Do?

If you’ve lost your card, you should block it first. In the radicant app, you can do this independently and free of charge. If you use the Client Service for this, it will cost you CHF 20. Replacing the physical card in case of loss or theft also costs CHF 20 with radicant.

Conclusion: Best Card for Abroad from Switzerland

In most cases, debit cards from neo-banks are the most cost-effective option for purchases abroad. In particular, radicant stands out in 2025 with a transparent fee model, real interbank rate, low-cost cash withdrawals, and a full-fledged Swiss account with deposit protection.

If you want to avoid unnecessary fees abroad and value fair conditions, it’s worth switching – or at least having a second account – with a provider like radicant. This way, you maintain full control over your expenses, benefit from a good exchange rate, and don’t pay more than necessary while traveling.

Transparency and disclaimer

This post was made in collaboration with radicant, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.