Letztes Update: 27. September 2024

If you’re going into business for yourself with a sole proprietorship, you’ll probably have other concerns than your retirement savings in the beginning. Nevertheless, you should think about your pension plan before you start your self-employment so that you are optimally covered in the event of disability due to accident or illness and later in old age. For example, what happens to the money you’ve already saved in your pension fund? What about freedom of movement? From which pillar do you receive benefits as a self-employed person? All these questions and many more are answered in this article about free movement and self-employed.

Self-employment and pension provision: the three pillars

1st pillar

The compensation offices decide whether you are considered self-employed for the purposes of social security law. To clarify this, you must register with your compensation office. You can find information sheets on their websites and now you can also register online.

If you are self-employed in Switzerland, you are generally liable for AHV/IV/EO contributions. The compensation office sends you a quarterly invoice based on your annual earned income. Remember that you must pay for the contributions in full yourself and set aside appropriate reserves.

AHV and IV benefits are calculated in exactly the same way for self-employed persons as for employees. You will only receive a full AHV pension if you have paid AHV contributions for 44 years without interruption. However, you will only receive the maximum AHV pension if you have earned an average annual income of CHF 88,200 (all figures in this article refer to the year 2023) during the entire contribution period. A little quibble: Full and maximum do not mean the same thing!

Pillar 2

As a self-employed person, you are not subject to the mandatory occupational pension scheme. However, you can voluntarily join a pension plan of a professional or trade association. The Stiftung Auffangeinrichtung BVG serves as a catch basin and safety net. Their website is not very user-friendly, but I have linked it for you anyway.

Accident insurance is also voluntary, but we will not go into this further here.

If you employ compulsorily insured employees – i.e. persons who earn more than the BVG entry threshold of CHF 22,050 – you must find a pension fund solution for them. Many pension funds then offer the option of you insuring yourself there as well.

If you are not affiliated with a pension fund, you will not receive a pension or lump-sum payment from the pension fund upon retirement. This makes private provision in the third pillar all the more important.

Note that the pension fund provides benefits not only in old age, i.e. at retirement, but also in the event of death and disability. If you choose not to join a pension fund, you will most likely be underinsured in the event of disability. The same applies in the event of death, because your descendants or your spouse will not receive any benefits from the pension fund either. A pension analysis by an independent specialist can therefore be worthwhile.

Pillar 3

If you are not affiliated with a Pillar 2 pension fund, you can deduct up to 20% of your earned income each year under Pillar 3a, up to a maximum of CHF 35,280. If you are affiliated with a pension fund, the maximum deductible amount – as for employees – is currently CHF 7,056.

There are no differences when drawing pillar 3a. Pillar 3a can be regularly drawn no earlier than five years before the AHV reference age. For men, the reference age is 65, and for women it will also be gradually raised to 65 over the next few years.

What happens to the assets already saved in the pension fund?

Until 1995, it was sometimes the case that when you changed jobs, you could not take your pension assets in the extra-mandatory area with you to the new pension fund. The saved capital could then be wiped off your leg. Fortunately, this is no longer the case and would not even correspond to today’s working reality.

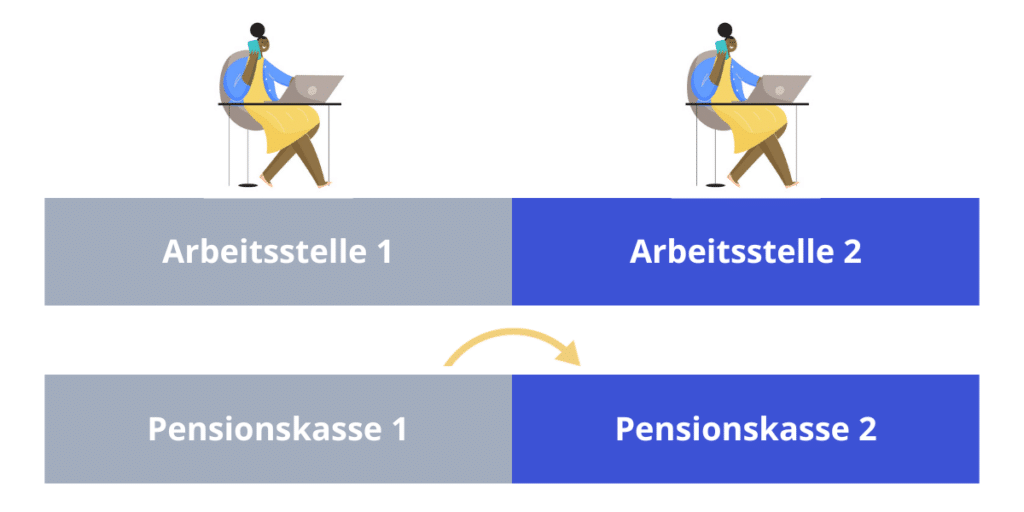

Job change

The classic case is the change of job: You seamlessly start a new job, and your old employer notifies the previous pension fund of your departure. The latter will prepare a termination statement showing your vested benefits, which will now be transferred to the new pension fund. Most pension funds ask you when you join whether you still have vested benefits, as there is generally an obligation to contribute.

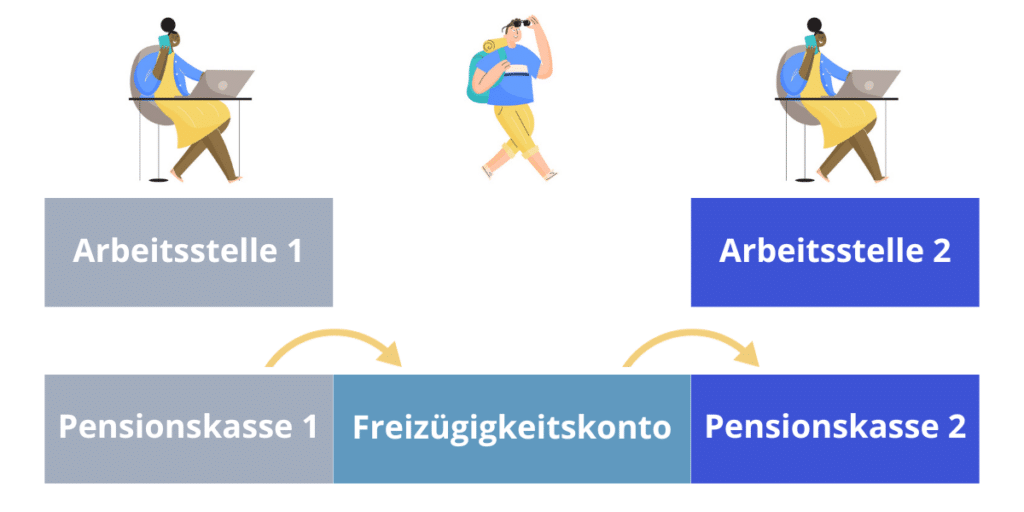

If you don’t start a new job immediately, but take a more or less long break between two jobs, you have to store your vested benefits somewhere in between. For this purpose, there are vested benefits institutions where you can deposit your termination benefit in a vested benefits account. If you finally start a new job, you must transfer the vested benefits to the new pension fund.

Incidentally, it is possible to split the termination assets when they are paid out – but not later – and have the pension fund transfer them to two different vested benefits foundations. This splitting gives you more flexibility and allows you to draw it in two different years if needed, which lowers the tax progression. You can find details about this in the article about the staggered purchase. However, as of January 1, 2030, gainful employment will be required if you wish to draw on the vested benefits account after the statutory reference age. As with pillar 3a, the earliest possible withdrawal is five years before the reference age.

Self-employment without pension fund connection

If you become self-employed with a partnership and decide against joining a pension fund, your saved capital cannot simply remain with your old pension fund, at least not permanently. After six months at the latest, the pension fund will ask you to specify an account at a vested benefits institution to which it can transfer the termination benefit. If you do not do this, the previous pension fund will transfer the pension assets to an account with the BVG supplementary institution.

If you are not sure whether you still have 2nd pillar assets somewhere, you can make a free inquiry at the 2nd Pillar Central Office. This compares your information with the reports from the pension funds and the institutions that maintain vested benefits accounts or policies.

finpension Vested Benefits Foundation

Vested benefits give you the freedom to decide for yourself how your second pillar assets are invested. The securities solution from finpension offers you the following advantages:

- Lower fee without commission on currency exchange

- Better performance thanks to exemption from foreign taxes on dividends

- Higher interest on bond and money market funds than on an account

- More effective thanks to advance payment of VST reclaim to the federal government

Advertising

Enter the code FIDE83 directly in your profile during registration or 24 hours later at the latest and you will receive a fee credit of CHF 25.

Condition: You transfer or deposit at least CHF 1’000 within the first 12 months

Early payment of funds from pension fund

If you become self-employed, you can also have the pension assets saved in the pension fund paid out (early) and thus acquire equity capital. However, a cash withdrawal of the credit is only possible within the first twelve months after confirmation of self-employment by the AHV compensation fund. Please note that this withdrawal is taxed and that you will have to take more care of your pension provision after withdrawing the pension assets so that you have enough money available in old age.

FAQ Free movement

Should I deposit my vested benefits in an interest-bearing account or invest them in securities?

It depends on the investment horizon. If you deposit your vested benefits for only a few months, the fluctuations on the stock market are too great. That’s where an account is a better choice. But if you know your money will be there for a few years, you can look into a securities solution, because pension funds also invest in stocks. When determining the proportion of shares, it is not only the time horizon that is decisive, but also your risk capacity and willingness. If you are unsure, it is best to consult an independent professional.

Can I transfer contributions from my savings or salary account to my vested benefits account?

No, voluntary payments – also known as purchases – as known to pension funds under certain conditions, are not possible to a vested benefits account or custody account.

Do I have to declare my vested benefits account on my tax return?

No, neither interest and dividends on the vested benefits account must be declared as income, nor must the pension assets be taxed as assets. A capital benefit tax is only due upon withdrawal.

Can I cash out my vested benefits?

No, it is basically tied to the second pillar. Payouts are only possible in the following cases:

- Leaving Switzerland for good (restrictions on emigration to EU/EFTA states)

- Start of self-employment (without PF connection)

- Acquisition of permanent owner-occupied residential property or amortization of a mortgage on owner-occupied residential property

- Receipt of a full IV pension

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.