Letztes Update: 28. September 2023

The recently launched banking app Yuh from Swissquote and PostFinance offers “trend themes” and “investment themes”. Digging a little deeper, the terms “tracker certificate” and “structured product” appear for these products. But what are structured products and how do they differ from ETFs?

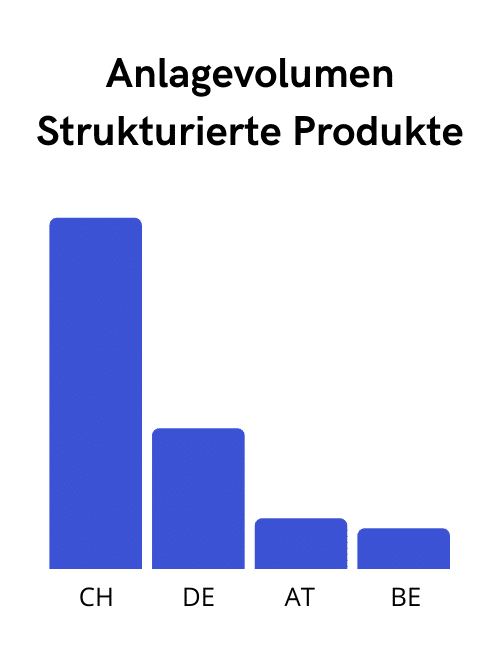

Structured products, also called “strukis”, are something quite Swiss. Switzerland is the world’s largest market for structured products by far, as you can see on the chart below.

Structured products

A structured product is an investment instrument offered by an issuer (issuer) whose performance depends on one or more underlyings. An underlying asset can be, for example, a stock, a commodity such as gold, or a currency.

Structured products are debt securities and involve counterparty risk. This means that if the issuer goes bankrupt, there may be a total loss of the capital invested.

The Swiss Structured Products Association (SSPA) divides structured products into the following categories:

Investment products

- Capital protection

- Yield optimization

- Participation

- with additional credit risk

Leverage products

- Lever

Anyone who reads the advertising material for structured products might think that they are a “wool sow”. It is possible to generate good returns not only in rising markets, but also in falling or sideways moving markets. For example, the Swiss Structured Products Association uses the adjectives “innovative” and “flexible” inflationarily on its website.

Structured products are used in particular when one has a market opinion or a market expectation. That is, if you believe that a sector will rise sharply in the coming weeks or that the overall market will soon fall. First of all: I do not believe in such market timing and betting.

Tracker certificate

Let’s look at it more practically, using the simplest category, participation. Within this category there is the product group “Tracker Certificates”. As a concrete tracker certificate, which is tradable at Yuh, we take the trend topic “Green Hydrogen”.

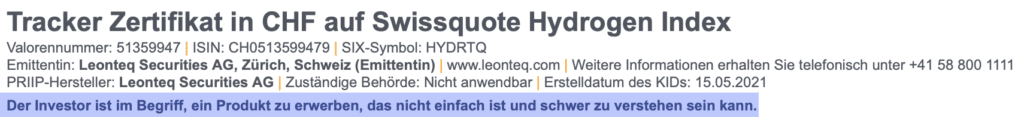

The basic information sheet then sounds a little less flowery:

Like an ETF, the tracker certificate has an ISIN (CH0513599479) and has been traded on the SIX Swiss Exchange since February 28, 2020. The term is “open end”, so there is no set expiration date. On SIX, the certificate is traded on the secondary market and accordingly there is a bid-ask spread (difference between the buying and selling price) there.

Similar to an ETF, this financial product is based on an index, a basket full of shares. For example, if this index increases by 1%, the tracker certificate also increases by 1%.

Issuer

The tracker certificate is issued by Leonteq Securities AG. Leonteq is a Swiss financial company specializing in structured investment products. Leonteq’s largest shareholder is the Raiffeisen cooperative bank.

As a difference to a physical ETF, the issuer does not have to buy the shares contained in the Structured Product. He can do what he wants with the money he receives by issuing the product, to put it bluntly. Legally, strukis are debt securities. This is where the counterparty risk comes into play: if the issuer goes bankrupt, no shares are deposited. Under certain circumstances, all your money will be gone. Thus, the basic information sheet (“KID”) states: “As a debt security, the product is not subject to deposit insurance.”

To make this risk easier to assess, issuers can be given a rating. The rating agency Fitch has given Leonteq Securities AG a BBB- rating. This corresponds to an average quality plant. One level further down, it would already be a speculative investment.

If you want to read more about counterparty risk, Google “Lehman Brothers.”

The shares in a physically replicating ETF, on the other hand, are not considered a debt security, but a special asset. If the ETF provider goes bankrupt, then either these shares can be sold and the customers are paid out or another provider continues the ETF.

Index

The trend topic “Green Hydrogen” is based on the actively managed “Swissquote Hydrogen Index”. Swissquote Bank SA is the index sponsor and compiles the index. For this purpose, there is a “Rule Book” on the Leonteq website. It states, for example, that the shares included in the index must have a minimum market capitalization of USD 100 million or that the index may contain a maximum of 50 components.

The index currently comprises 22 shares. The largest positions are currently “Doosan Fuel Cell” with a share of 9%, followed by “Toyota Motor” (7%) and “Alstom” (5.8%).

For a well-known index, such as the MSCI World, on which there are several ETFs from different providers, you can directly compare the performance of the ETFs. This makes the product very transparent. Unfortunately, this is not the case with self-created indices.

Costs

In addition to the purchase cost, which is 0.5% for Yuh, the cost of currency exchange (0.95%; the certificate is traded in USD) and the bid-ask spread, there are ongoing costs, as with an ETF.

The management fee for this product is 0.8%. The index sponsor (Swissquote) receives 0.5% and the calculation agent (in this case: Leonteq Securities AG) 0.3%. The management fee is deducted quarterly on the observation days.

In addition, a fee is charged for each adjustment made in the index. This transaction fee represents a percentage of the notional volume of the components’ hypothetical transactions and is 0.1%. In other words, the more the index issuer (Swissquote) shifts and includes or excludes new stocks in the index, the better the calculation agent (Leonteq) earns. After all, the Rule Book limits rebalancing to 100 transactions.

Conclusion

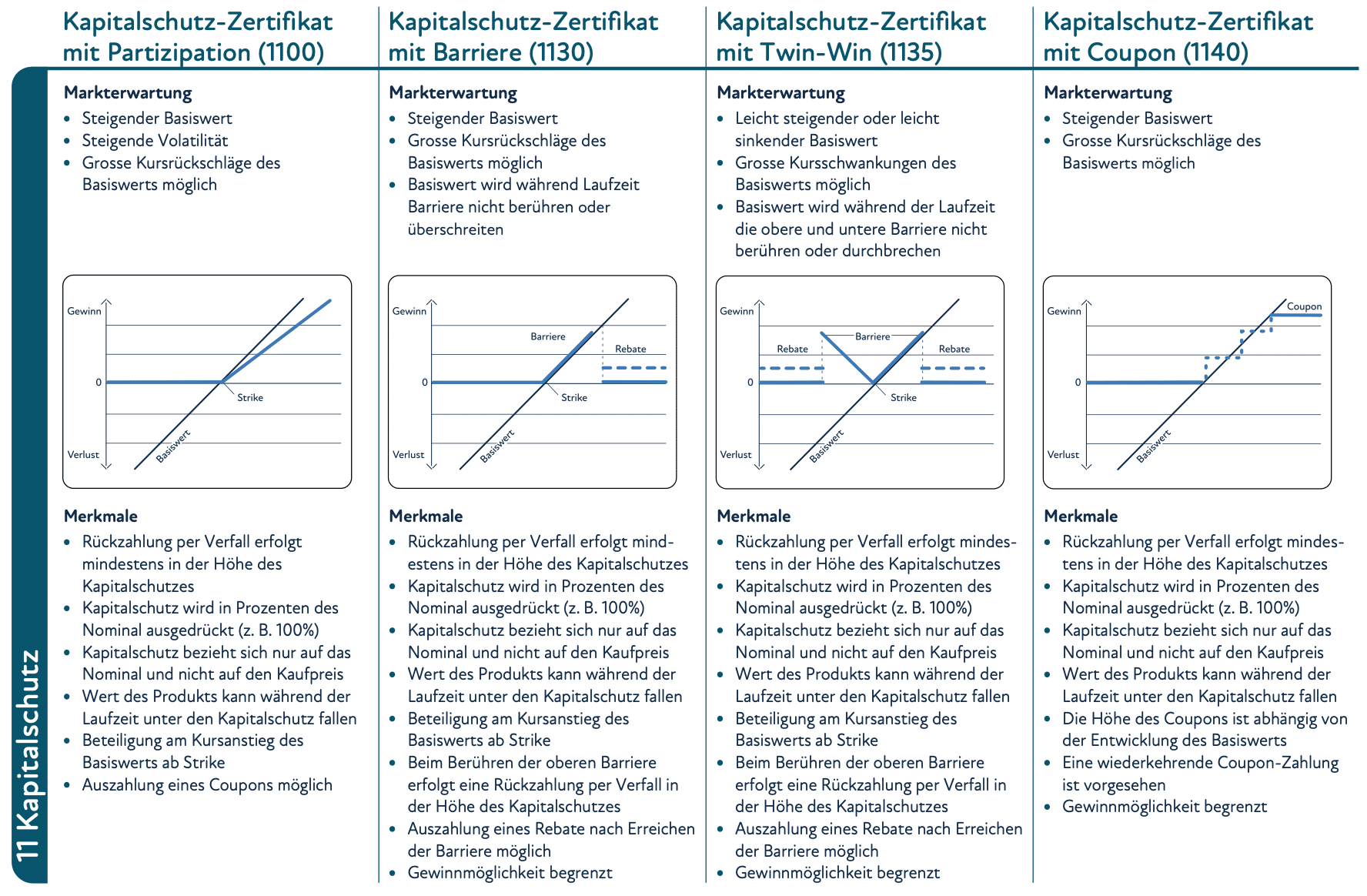

Is all this too complicated for you? Welcome to the club! But it gets much better: because if you dive deeper into Strukis, you’ll find adventurous conceptual constructions that could have been created in Scrabble and pretty graphics that remind you of geometry class:

Knock-out warrants

Softcallable Barrier Reverse Convertible

Capital protection product with participation in the worst of

Autocallable Multi Reverse Convertible with conditional memory coupon

Autocallable Multi Barrier Reverse Convertible with Conditional Memory Coupon

Do private investors need something like this? No.

I don’t want to invest my money in a “hypothetical index” of a “not easy” product. I don’t want to put my money into a financial product where I have to read pages of package inserts with side effects beforehand. And I don’t want to put my money into a financial product where there is counterparty risk.

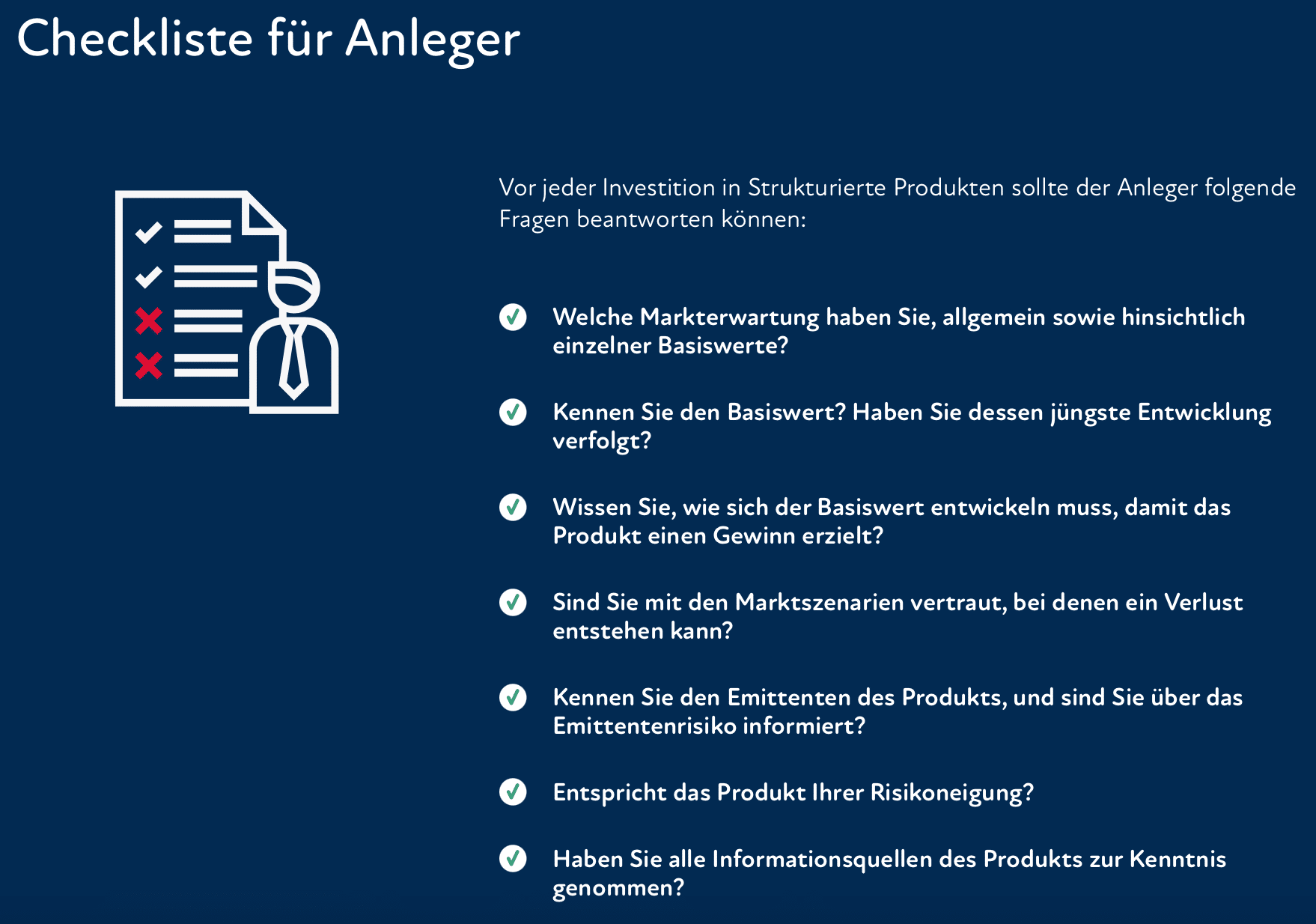

As always with investing, the same applies here: Only invest in things you understand.

And if you do want to invest in structured products, it can’t hurt to go through the checklist of the Swiss Structured Products Association (SSPA) before you buy:

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.