Letztes Update: 28. September 2023

Now it’s been six months since I opened my securities account with Inyova*. High time to take another look at the impact investing provider. After the news about the fees at Inyova, in the second section you will read about my experience with my real money account at Inyova and my wishes for the future.

Inyova fees

Fee structure

Until now, Inyova calculated the fee based on the amount you deposited in total. From April 2021, the fee will be determined on the basis of total assets. So price increases and dividends now also count.

The following levels are still available:

| Wert aller Vermögenswerte | Inyova Gebühr pro Jahr |

| 0 – 49’000 | 1.2% |

| 50’000 – 149’000 | 1% |

| 150’000 – 499’000 | 0.8% |

| über 500’000 | 0.6% |

So if you have paid in a total of CHF 45,000 and your deposit has risen to 51,000 thanks to rising prices, the Inyova fee is 1%.

However, if the stock market collapses and your custody account falls below CHF 50,000, for example, the higher fee of 1.2% will be charged. Even if you had paid in more than CHF 50,000 before.

FX transaction fees

Recently, fees incurred when exchanging currency are also refunded. If shares in another currency are bought within your deposit, your CHF must be exchanged into another currency. Many brokers and banks make a considerable amount of money for themselves by not charging the real exchange rate, but by adding a certain percentage. I have explained this in more detail in this post. This is also the case with Saxo Bank, Inyova’s transaction bank. But with Inyova’s new fee schedule, this fee is transparently disclosed and reimbursed.

Other providers should be happy to take this as a model and display these fees transparently on their statements. And not just as a percentage in some hard-to-find fee PDF, but on every transaction statement.

Stamp duties

Some countries impose a stamp duty on share purchases. In Switzerland, stamp duty is levied as a turnover tax on the purchase and sale of shares, bonds, ETFs, etc. Domestic securities are taxed at 0.075%. Foreign securities at 0.15%.

Until now, this stamp duty, also called stamp duty, has been refunded by Inyova. From April 2021, this will no longer be the case.

6 months Inyova – Experience

Real money account

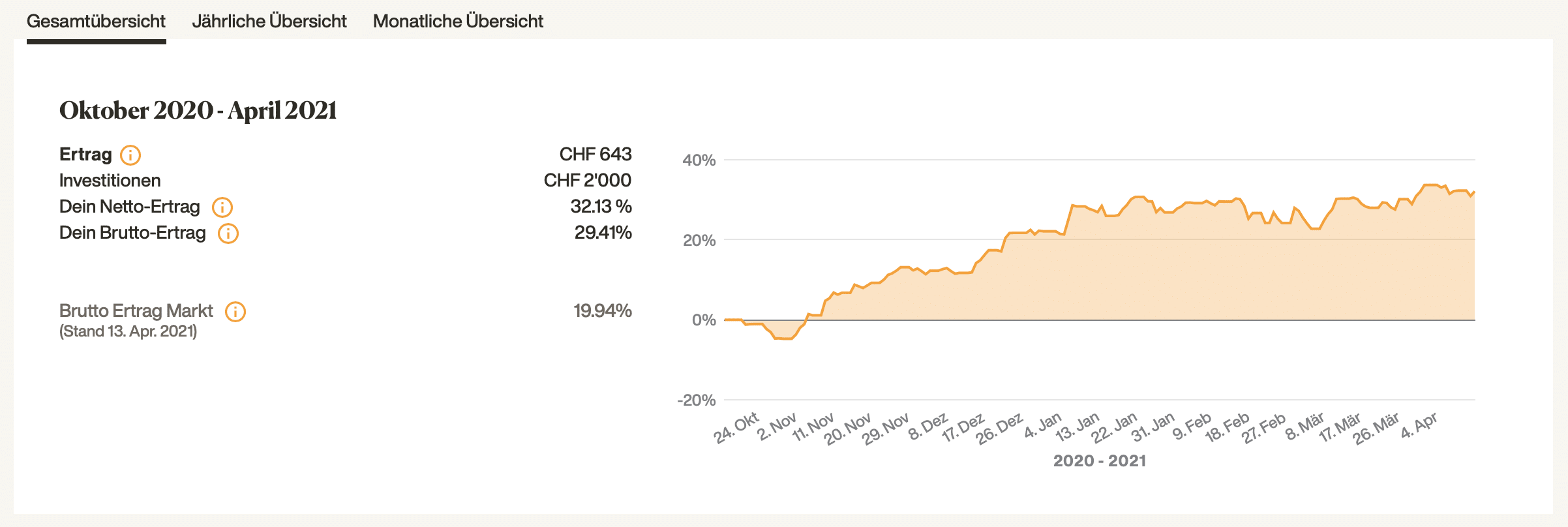

My portfolio at Inyova has developed quite well in the first six months – as has the entire market. Here is the course of the share price:

It should be noted that I opened my account within a special offer open to all, that is why the net income is higher than the gross income.

By the way, Inyova calculates the return as a time-weighted return. I’ve explained the different ways of calculating returns in this post.

Wishes

Benchmark in the graphic

I would appreciate it if the “Gross Yield Market” was not only shown as a number, but also in the history graph. Thus, one could track the benchmark with the Inyova strategy over the entire course of time. Incidentally, the benchmark is calculated using the “Swiss Performance Index” (Switzerland), “STOXX 600” (Europe), “S&P500” (America) and “FTSE World Government Bond Index – Developed Markets” (bonds) indices. The weighting of the individual indices corresponds to the distribution of your portfolio. For example, if your portfolio consists of 20% Swiss equities, the benchmark contains 20% of the “Swiss Performance Index”.

Involvement

And I would like to see more involvement. Let me back up for a second:

I see it a little differently with an ETF. I know right from the start that with the Vanguard FTSE All-World ETF, for example, I’m investing in about 3,500 companies, and I can’t know about every single one. But with Inyova, I do a selection process at the beginning, set hand and footprint, can include or exclude companies. So I have a very different relationship with the companies, and that’s where the communication on Inyova’s part is a little too thin for me. Sporadically, “Impact News” trickles in on the app. So news about companies that are in the portfolio, but that’s it. For example, you are not informed about dividend receipts, you have to actively log in to Saxo Bank.

Or another example, there was an email that came in that said, “I wanted to let you know that we’ve adjusted your strategy so that your portfolio is well diversified.” Uh-huh. Since everything is digitized anyway and there are only 30 to 40 companies in an Inyova portfolio, I could be informed which companies were dropped out or partially sold and which ones were considered instead. Maybe I don’t agree with a company and don’t want it in my portfolio. Then I have to go through the entire list and search for the new companies.

Of course, it’s difficult to find a middle ground there. I don’t want to be bombarded with such info every day, but a little more involvement couldn’t hurt in my opinion – especially with Inyova’s investment approach.

Advertising

Open your Inyova account here* with the code FINANZDEPOT and you will pay no fees for the first 12 months with the impact investing provider Inyova.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.