Letztes Update: 28. September 2023

The Vanguard ESG Global All Cap UCITS ETF has been tradable on the SIX Swiss Exchange since April 13, 2021. Here you can find out everything you need to know about the new ETF, which – let’s get this straight – can be traded both distributing and accumulating in Swiss francs. I showed you why the purchase currency of an ETF matters in this post.

What is Vanguard?

Vanguard is the second largest asset manager in the world after BlackRock. At the end of 2020, Vanguard managed $7.2 trillion. A quarter of this is actively managed, the large remainder is invested in indexed strategies. For number nerds and comparison fanatics: In 2020, Switzerland’s gross domestic product was around 702.2 billion Swiss francs.

The cooperative structure is unique in the USA. Vanguard was founded in 1975 with the idea that investment companies should manage their funds solely for the benefit of fund investors. Vanguard launched the first index fund for private investors in the USA back in 1976. In 2008, Vanguard opened offices in Zurich. Unfortunately, the Swiss website for private investors is treated very stepmotherly by Vanguard. It is neither visually appealing nor particularly informative. If you like it a bit more modern, the German side is a good choice.

What’s inside?

As already written several times, an ETF usually tracks an index. He therefore buys the shares included in the index. Sometimes the ETF buys only a portion of the stocks because this is less expensive and stocks represented by mini percentages have little impact on the ETF’s performance. This is called sampling. The “ESG Global All Cap UCITS ETF” also does not contain all shares of the index.

The index compiled by FTSE Russell contains 7,634 shares. The ETF launched by Vanguard, on the other hand, contains only 4,118 shares. The smallest position in Vanguard’s ETF is currently “True Corp. PCL” (Thai telecom provider) with a share of 0.0006%.

The index is weighted by market capitalization and includes large-, mid- and small-cap stocks of companies based in markets worldwide. It therefore contains equities from both developed and emerging markets.

One difference with the “Vanguard FTSE All-World UCITS ETF” is not only the ESG filter, which we will get to in a moment, but also the inclusion of small cap stocks. Hence the name All Cap. The “normal” All-World contains only large- and mid-cap stocks.

The three largest positions in the ETF are currently: Apple (3.3%), Microsoft (3%), Amazon (2.2%).

The ETF holds the shares physically.

What is outside?

Particularly in the case of an ESG index, we are not only interested in which stocks are included, but also which are excluded.

The parent index is the “FTSE Global All Cap Index”. This contains 9,231 shares. Now, companies that generate a certain percentage of sales in the following areas are excluded:

Vice products (vicious products)

- Adult entertainment

- Alcohol

- Gambling

- Tobacco

Non-renewable energies

- Nuclear power

- Fossil fuels

Weapons

- chemical and biological weapons

- Cluster munitions

- Anti-personnel mines

- Nuclear weapons

- civilian firearms and conventional military weapons

Likewise, companies that do not comply with labor, human rights, environmental and anti-corruption standards in accordance with the principles of the United Nations Global Compact are excluded. And in addition, a (weak) diversity criterion is applied.

More detailed information on the exclusion criteria can be found here directly from the index provider FTSE Russell in English.

Finally, 7,634 shares remain in the index.

One can have many objections to ESG filters and investing according to ESG criteria, but the methodology behind them is very transparent and index providers MSCI and FTSE Russel provide deep insight.

I feel better here than if in the investment committee Ms. environmental engineer does not like share XY or Mr. sustainability expert thinks share AB is not investable.

How does it differ from the parent index and the All-World Index?

Note that this comparison compares one index with two ETFs. An index is only a “list”, only an ETF or an index fund makes an index investable.

| INDEX | ETF | ETF | |

| FTSE Global All Cap Choice Index | Vanguard ESG Global All Cap UCITS ETF | Vanguard FTSE All-World UCITS ETF | |

| Anzahl Aktien | 7’634 | 4’118 | 3’559 |

| Dividendenrendite | 1.6% | 1.5% | 1.7% |

| Mittlere Marktkapitalisierung | USD 57.3 Mrd. | USD 63.1 Mrd. | USD 79.4 Mrd. |

| Gewicht der grössten Position | 3.4% | 3.3% | 3.0% |

| Gewicht Top 10 Positionen | 15.4% | 15.9% | 14.7% |

| Grösster Sektor | Technologie (24.6%) | Technologie (24.2%) | Technologie (22.0%) |

| Kleinster Sektor | Energie (0.3%) | Energie (0.3%) | Immobilien (2.8%) |

| TER | - | 0.24% | 0.22% |

The exclusion of tobacco and oil companies, which traditionally have high dividend yields, lowers the dividend yield from 1.76% to 1.58%.

The energy sector hardly carries any weight due to the exclusions. In the All-World it is a full 3.6%, while in the ESG variant this sector shrinks to 0.3%.

The fact that the All Cap Index also includes small caps can also be seen from the median market capitalization, which is lower than for the All World.

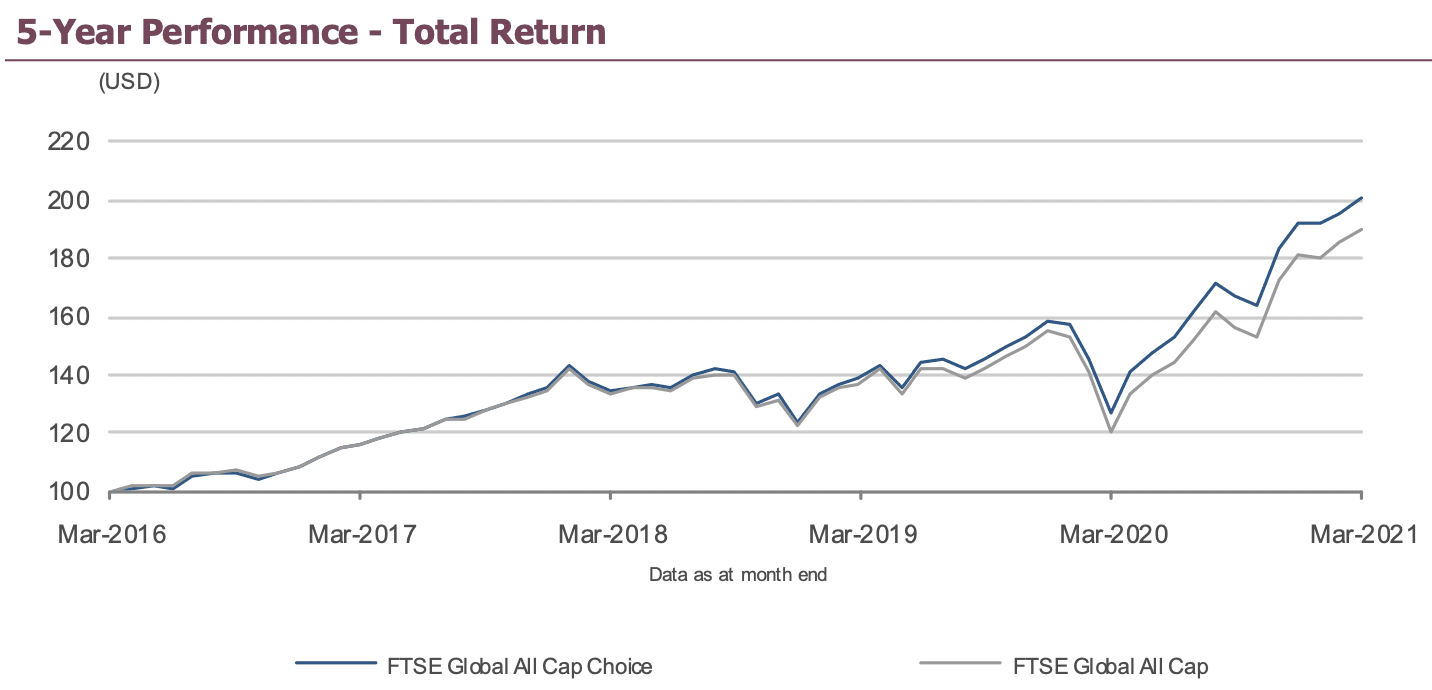

The chart below compares the FTSE Global All Cap Choice Index (ESG) with the FTSE Global All Cap Index over a five-year period.

Where is it traded?

You can buy the new ETF on the SIX Swiss Exchange in Swiss francs. The great thing about it is that it is available in the trading currency CHF in both distributing and accumulating form. Especially when you are at the beginning of your wealth accumulation, the accumulating makes sense. This is because with this type of distribution, dividends are reinvested immediately and you can fully benefit from the compound interest effect. With the distributing one you would have to buy new shares yourself, which causes unnecessary purchase costs.

Incidentally, it does not play a role in Switzerland from a tax perspective. Both are treated equally.

The Swiss broker Swissquote has already launched it.

With these details you will find it at your broker:

Accumulating

Vanguard ESG Global All Cap UCITS ETF (USD) Accumulating

ISIN: IE00BNG8L278

Symbol: V3AA

Distributing (quarterly)

Vanguard ESG Global All Cap UCITS ETF (USD) Distributing

ISIN: IE00BNG8L385

Symbol: V3AL

How expensive is it?

The total expense ratio (TER) is 0.24%. It is therefore slightly more expensive than the All-World ETF (0.22%). However, it must be taken into account that it contains approx. 550 more shares and that the data preparation for the exclusions also means additional work for the index creator.

Costs are still very low for a diversified global developed and emerging markets ETF.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.