Letztes Update: 13. January 2024

Lately, I have been receiving a lot of inquiries about tax issues. Since I am not a tax advisor, I cannot support you in detail. However, there are a few basics about the taxation of ETFs in Switzerland that are worth knowing. For individual tax issues, you would need to consult a professional.

Taxes ETF – Taxes investor

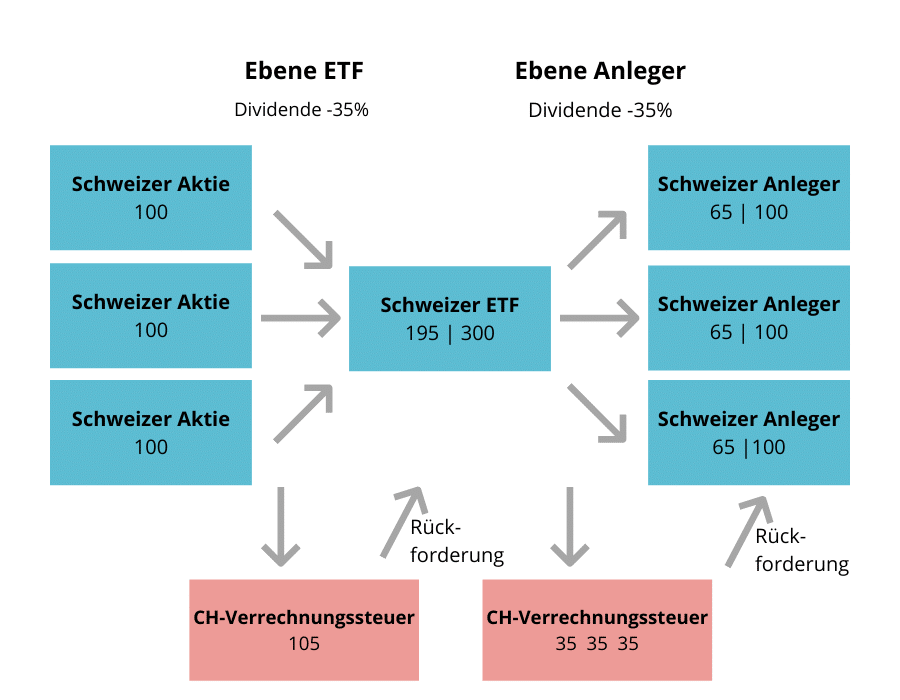

Taxes are not an easy topic and not insanely exciting, but let’s approach it slowly. First, a distinction is made between taxation at the ETF level and at the investor level. This article is mainly about the latter.

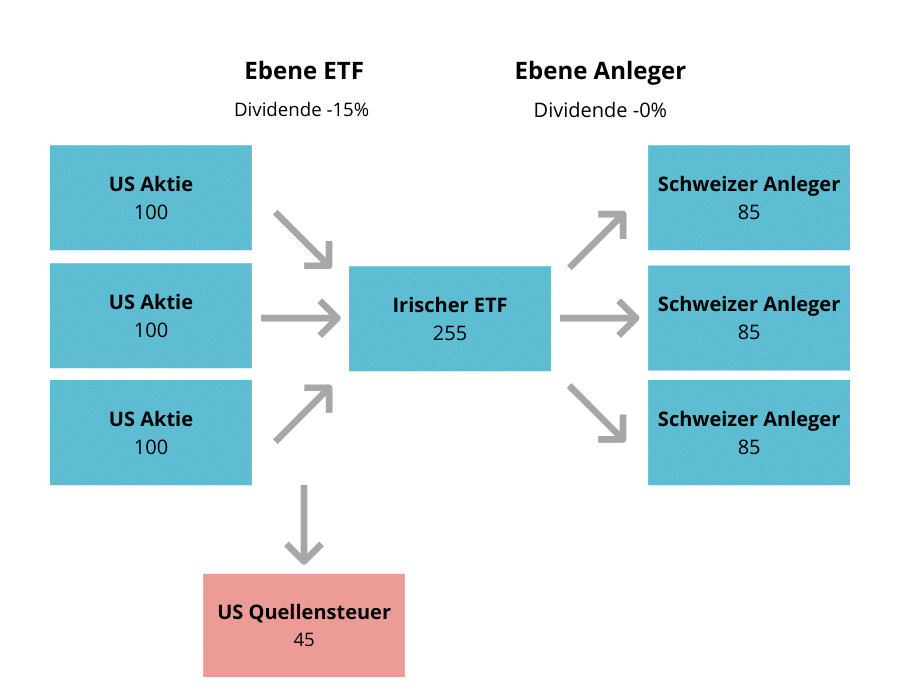

Just briefly to explain the level of the ETF: if you buy an ETF on American stocks, for example, it’s usually domiciled in Ireland. Recognizable by the ISIN, which begins with IE. Ireland has a favorable double taxation agreement (DTA) with the USA. As a result, an ETF domiciled in Ireland only has to pay 15% withholding tax to America (for most other countries it is 30%). This all happens automatically, you don’t even notice it. The ETF then pays you a dividend that has already been reduced by this withholding tax. No further withholding tax is payable on this dividend. The tax at the level of the investor is therefore zero in the example with Ireland. The Federal Tax Administration’s “Overview of the Effects of the Agreement” with Ireland states:

“Dividends are subject to a withholding tax in Ireland of 25 (20% before January 1, 2020) percent. However, provided that the recipient is resident in a state with which Ireland has concluded a double taxation treaty, no withholding tax is levied under domestic law. Therefore, dividend payments from an Irish company to a Swiss resident are generally free of Irish withholding tax.”

Graphically and in a much simplified way, it looks like this: Let’s assume that the ETF consists of three shares, each paying USD 100 in dividends, making a total of USD 300. Then 15% or USD 45 withholding tax is paid to the USA and USD 255 is paid in Ireland. These go directly to Switzerland. Each of the three investors in Switzerland thus receives USD 85.

Synthetic replicating ETFs are a different story again. These are often exempt from U.S. withholding tax.

But let’s now switch to the personal level – the level of the investor.

Tax dividends in Switzerland

Dividends are taxed as income. This is similar to the interest that used to be paid on savings accounts, which also had to be declared and taxed as income.

If you declare your dividend income in your tax return, you will receive a refund of part or all of the withholding tax or withholding tax.

So what is the withholding tax? Let’s look at the example above with a Swiss ETF. When this ETF receives dividends, 35% goes to the state as withholding tax. In simple terms, withholding tax is the domestic withholding tax. This withholding tax at the ETF level can be reclaimed by the ETF provider if it is domiciled in Switzerland. And the ETF provider must also deduct 35% withholding tax, which you can claim back with your tax return.

Of the CHF 100, the full CHF 100 will then arrive at the back – albeit via a few detours. So what’s the point of the whole merry-go-round? Taxpayers should be made to declare their income and assets correctly in their tax returns. This is the only way to get the 35% withholding tax back.

It is important that you buy an ETF that is domiciled in Switzerland as only this ETF can reclaim the withholding tax at the ETF level. Otherwise, the first 35% are lost.

It makes no difference for tax purposes whether you buy a distributing or an accumulating ETF. Many accumulating ETFs report to the tax authorities how much dividends have accrued. And these are then taxable as with distributing ETFs. You can find more about this in the example below.

Tax capital gains in Switzerland

Here, the tax authorities distinguish between private and professional securities traders. If you are classified as a professional securities trader, your profits are taxable as income. And social insurance contributions (AHV, IV, EO…) must be paid on the income. Losses can be offset in return.

As a private securities trader, you cannot claim losses. On the other hand, profits made by private securities traders are tax-free. This is not the case in Germany, for example. In Switzerland, securities simply count as assets for private securities traders, and if these assets increase, the wealth tax naturally increases as well.

To avoid being classified as a professional securities trader, you must meet all five criteria set forth in Circular No. 36 of the Swiss Federal Tax Administration dated July 27, 2012:

- The holding period of the securities sold is at least 6 months.

- The transaction volume (corresponds to the sum of all purchase prices and sales proceeds) per calendar year does not exceed a total of five times the securities and credit balance at the beginning of the tax period.

- Earning capital gains from securities transactions does not constitute a necessity to replace missing or eliminated income for living expenses. This is regularly the case if the realized capital gains amount to less than 50% of the net income in the tax period.

- The investments are not leveraged or the taxable investment income from the securities (such as interest, dividends, etc.) is greater than the proportionate interest on debt.

- The purchase and sale of derivatives (in particular options) is limited to hedging own securities positions.

So if you buy ETFs monthly for long-term wealth accumulation, you’re considered a private securities trader, and you don’t have to pay tax on the price gains as income. But if you trade more frequently (point 1) and use credits to do so (point 4), you need to take a closer look at the situation so that you don’t get a nasty surprise the following year.

Let us now turn to a very specific example of how an ETF is reported on the tax return.

Example: Declaring ETF in the tax return

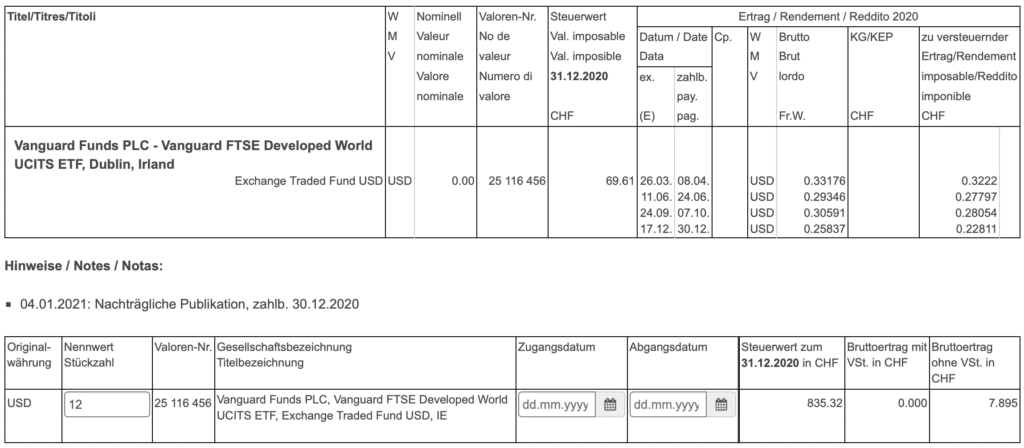

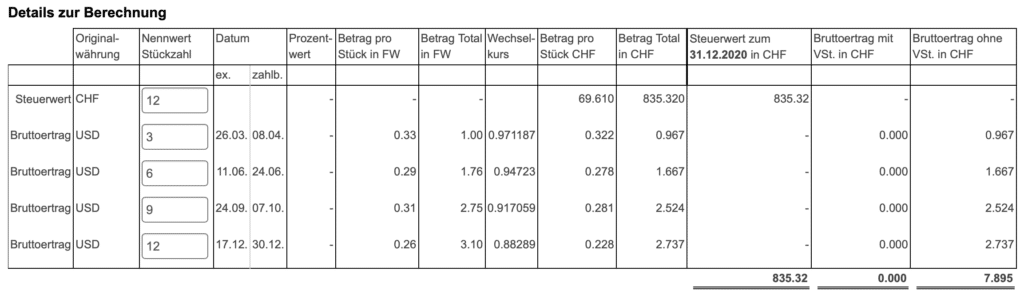

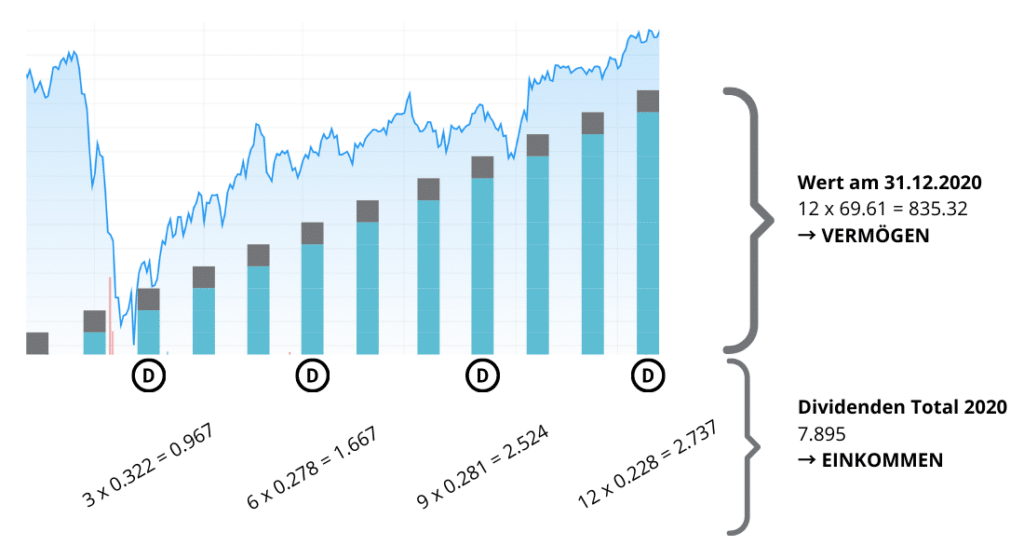

In the securities list of the tax return, you must indicate the number or value of the ETFs held on December 31 (assets) and the dividends received in the respective year (income). Let’s take the distributing Vanguard FTSE Developed World UCITS ETF as an example.

With the electronic tax return, this is relatively easy. Each canton has its own electronic tax software, which looks slightly different everywhere, but the principle is the same. The canton of Zurich for example has a demo version, there you can play around and try out if you are interested. And the great thing is that in the following year you can simply import the previous year’s data and enter your further purchases or sales.

I’ll show you the principle using the Federal Tax Administration’s course list.

Irish ETF distributing

By means of ISIN you can search for the desired ETF. In our example, after the distributing Vanguard FTSE Developed World with ISIN IE00BKX55T58. This distributes dividends four times a year. Let’s assume that you buy one share each month and have 12 shares of the ETF in your custody account at the end of the year. The software now automatically calculates 12 times the tax value that the ETF had at the end of the year. For this purpose, it accesses the price list of the Federal Tax Administration (FTA reporting). The CHF 835.32 are now part of your assets.

However, not all stocks and ETFs are included in the price list. If you can’t find them, you can also enter the tax value and dividends received by hand. However, with FTA Reporting, filling it out is much easier. Because the currency is also automatically converted to CHF. justetf.com provides a good overview of which ETFs have FTA reporting.

You can now specify that you bought a share on January 1, one on February 1, one on March 1, and so on. This way the software knows how many shares you had on each dividend date. On March 26, for example, there were three pieces. Also the multiplication of the number of pieces with the amount per piece is automatically taken over and inserted as income in the right place.

The “ex.” date, by the way, is the date you had to hold/own the ETF share to benefit from the dividend. Payment was then made on the “payable” date.

Graphically it looks like this:

And in Zurich’s online tax return like this:

If you compare all the figures carefully, you may have noticed that Zurich expects an income of CHF 9 and actually only CHF 7.895 was paid out as dividends. The difference comes from rounding.

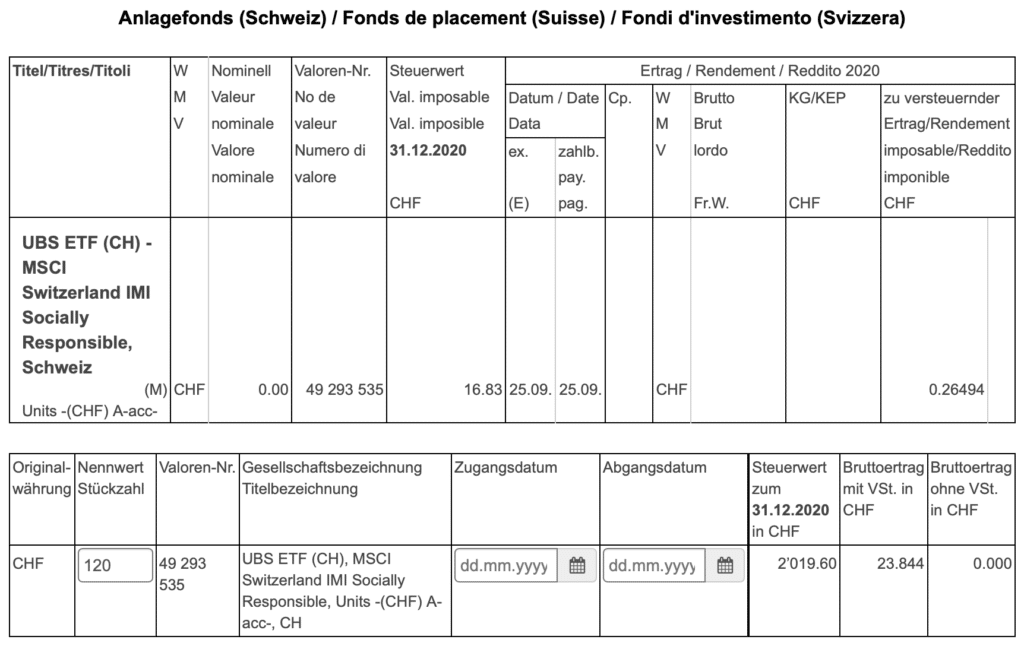

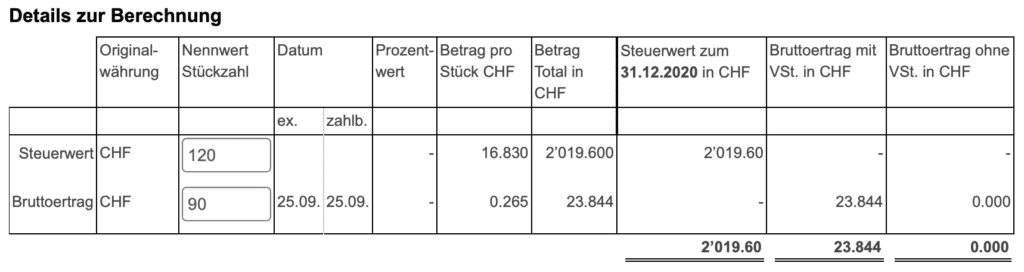

Swiss ETF accumulating

Another example with an accumulating ETF. Again, the FTA reporting will show the dividend even though it never landed directly in your clearing account, and it too is taxable as income.

This time it’s a Swiss ETF. The gross income is therefore stated with withholding tax. Let’s assume that you buy ten shares a month. The software automatically determines the withholding tax claim and inserts it in the correct place. In our example this would be CHF 8.34 (35% of the CHF 23,844). This amount will be offset against your tax liability or paid to you directly.

It is even easier with a tax statement/tax statement. With most brokers you pay extra for this – with Swissquote for example CHF 100. With foreign brokers, this document is often not available at all.

Those who invest with a robo-advisor, for example with Selma or Inyova, usually receive the tax statement for free. This saves you from having to enter the individual purchase dates, and filling out the tax return is much faster.

Deductions

Don’t forget to indicate the Pillar 3a amounts paid in. In Zurich, this can be found under “Deductions” / “Pillar 3a and other pension types”. You will receive a certificate from your pillar 3a provider. You fill in the amount shown on it there and upload the receipt as a PDF or take a photo of it. The amount paid in is then automatically deducted from taxable income.

Yes, in the meantime, tax returns in Zurich can be filed completely online without having to print out a single piece of paper – who would have thought that a year ago?

You can also deduct asset management costs in most cantons. These often include custodial fees and fees for the preparation of tax documents (tax statement). However, trading costs are not deductible. The best thing to do is to consult the guide or contact your canton of residence directly.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.