Letztes Update: 15. January 2024

At the end of January, the fee for frankly – the private pension app for your pillar 3a was reduced from 0.47% to 0.46%. This is thanks to the community pension assets, which exceeded the CHF 500 million threshold. The more the community invests in frankly, the lower the all-in fee becomes for everyone. The 2.5 billion mark was reached in January 2024, allowing the fee to be reduced to 0.44%. Incidentally, the next threshold is CHF 5 billion.

In February 2021, the frankly community comprised 22,000 customers, and that in less than a year. If you compare this with the figures for the pioneer VIAC, which was launched in 2018 and listed 32,000 customers with a total of 650 million on its website at the start of 2021, frankly’s growth is impressive. Quite a few may have switched “internally” from the more expensive ZKB products to frankly. And last but not least, the massive amount of advertising was unmissable.

Advertising

Just a quick reminder: frankly was developed by the Zürcher Kantonalbank ZKB and charges a flat fee regardless of the strategy chosen. And what is rather the exception with the young low-cost providers, frankly offers active strategies in addition to indexed ones.

Opening and management is done via the frankly app. I therefore wanted to know whether a web app was also planned for the future. According to frankly, different variants are currently being examined, but no statement can be made about them yet.

By the way, frankly assumes the costs incurred for the transfer of pillar 3a assets at bank foundations. These may include, for example, account balancing and transaction fees. With frankly itself, there are no fees for the transfer to another provider.

You can read more about frankly in this post. An overview of eight digital pillar 3a providers including a comparison table can be found here.

Sustainability

In October 2020, frankly’s active strategies were switched to Swisscanto’s new Responsible Standard. In addition to the exclusion of companies active in business fields involving cluster munitions or nuclear weapons(blacklist) and further exclusions of companies associated with coal mining or arms and munitions manufacturing, the Paris climate target is a binding requirement for their investment funds. This provides for a binding CO2 reduction target of 4% per year. In addition, ESG criteria are systematically integrated. The abbreviation ESG stands for Environment, Social and Governance.

Indexed strategies only exclude blacklisted companies, no systematic ESG integration is applied. However, frankly says it will keep an eye on the development of ESG-optimized indexes. It is important for customers to be able to choose.

Active vs. indexed

According to the Swisscanto website, as of December 31, 2020, the invested assets in the “Ambitious” strategy (75% equities) were about four times higher for the indexed fund than for the active fund. I therefore asked frankly whether there was generally more demand for indexed products. frankly replied to this: “Your observation is basically correct and this despite the fact that both product lines have the same price. However, the funds are not only used at frankly, and the “indexed” has been around for a year longer. Nevertheless, we are convinced that the actively managed Responsible approach generates added value and perhaps need to communicate this better. In addition, frankly is also missing the active Responsible 95% shares strategy, this will follow soon.“

From my point of view it is very welcome that in the future also the strategy with the highest share of equities will be available as an active strategy with a responsible approach. Especially in the strategies with a high share of stocks, frankly is one of the most favorable providers.

What I find missing from frankly’s website is a comparison chart of the five strategies and the eight investment products. The titles and short descriptions of the strategies give a rough indication, but how the different funds have performed in the past, and what fluctuations to expect, you can not find out at frankly. You can compile a comparison on the ZKB website, but this is much more convenient and intuitive with other providers.

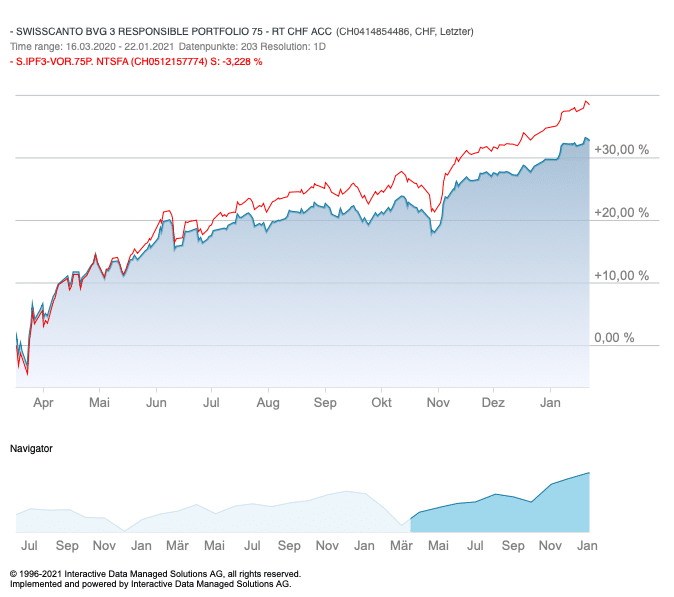

I made the comparison for the indexed and the actively managed fund of the strategy “Ambitious” (75% equities) for you, and it looks like this:

The red is the indexed fund and the blue is the actively managed fund. I chose the observation period from March 16, 2020 to January 22, 2021, before which frankly did not exist. The period is too short to draw any conclusions from this. And as you know, past performance is no guarantee of future profits.

The indexed fund gained a whopping 39% over the ten months and the actively managed fund gained 33%. Anyone new to the stock market should not be blinded by this. Such increases in such a short time are rare. However, this is not due to the special skill of the fund managers at Swisscanto, but to the general catch-up of the stock markets after the Corona price crash.

Have you already taken care of your retirement savings this year? By the way, the maximum amount for employees with a pension fund in 2021 is CHF 6,883, and if you pay in monthly as a savings plan, this makes CHF 573.58.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.