Letztes Update: 20. May 2024

It’s finally here, the first free ETF savings plan in Switzerland! After recently launching Switzerland’s first digital partner account, neon is now following up with the neon savings plan. In this article I share my experiences with you and you find out how you can set up the free ETF savings plan and what advantages and disadvantages the neon savings plan has for you.

Inhaltsverzeichnis

What is an ETF savings plan and how does it work?

With an ETF savings plan, you specify a fixed amount that you would like to invest in one or more ETFs each month. The selected amount is then automatically debited from your bank account and invested in the ETFs you have selected.

In contrast to a robo-advisor, which is more like digital asset management, with a savings plan you put together your portfolio yourself. In most cases, a savings plan is also somewhat cheaper than a robo-advisor, but the boundaries are fluid; for example, some robo-advisors offer the option of putting together your own portfolio from pre-selected ETFs.

Advantages of an ETF savings plan:

- Regular and unemotional investing: No market timing, which rarely works anyway. There is no perfect time to enter the market.

- Flexible: You can make deposits as required and pause the savings plan if, for example, you are doing further training and money is tight.

- Simple and low-maintenance: once set up, you can spend your free time doing better things.

- Average price effect: If the price of an ETF falls, you automatically buy more shares.

Why neon invest is the right choice for free ETF savings plans

Unlike many other banks and brokers, neon invest does not charge custody account fees. On average, custody account fees in Switzerland are around 0.3%. If these are not incurred, you will have more left over.

If you trade with neon, you benefit from favorable trading fees. It doesn’t matter whether the securities are bought as part of the savings plan or not – the neon invest fees are equally low: for Swiss equities and ETFs you only pay 0.5% of the purchase or sale price, for international equities 1.0%. There are no additional foreign currency fees.

For the two 0% fee ETFs from Invesco, you don’t even pay any purchase fees, or neon will refund the fees to your neon account on the next working day. This means that only the stamp duty (0.15%, only when buying and selling), the product costs and, when selling, the fees for the sale are incurred. The following ETFs are available without purchase fees:

| ETF | ISIN | TER (annual) |

|---|---|---|

| Invesco FTSE All-World UCITS ETF Acc | IE000716YHJ7 | 0.15% |

| Invesco MSCI World ESG Climate Paris Aligned UCITS ETF Acc | IE000V93BNU0 | 0.19% |

With a total of over 70 ETFs, neon invest offers a wide range of ETFs. The selection of ETFs is debatable with other providers, but with neon it has a solid foundation so that you can easily put together a broadly diversified portfolio. You can find the ETFs tradable at neon invest in the article neon Invest: The ETF list.

At the beginning of the year, you will receive a free tax statement in the practical eTax format. You upload this PDF to your tax return and all items and transactions are automatically transferred.

Another advantage is that you can flexibly adapt the savings plan to your needs – unlike the unspeakable life insurance policies with a savings component.

It’s a bit of a shame that you can only invest in three ETFs or shares in a savings plan and the execution date is fixed at once a month. You can transfer ETFs purchased from neon to another broker for a fee of CHF 100 per position. However, it is not possible to transfer from another broker to neon. In addition, dividends in foreign currencies end up in your account and the exchange fees are not as favorable.

How to create a free ETF savings plan with neon invest

With this step-by-step guide, you can easily create a free ETF savings plan with neon:

- Open a neon account:

- Use the code finanzdepot when opening and receive the neon Mastercard for free (instead of CHF 20) plus CHF 10 starting credit

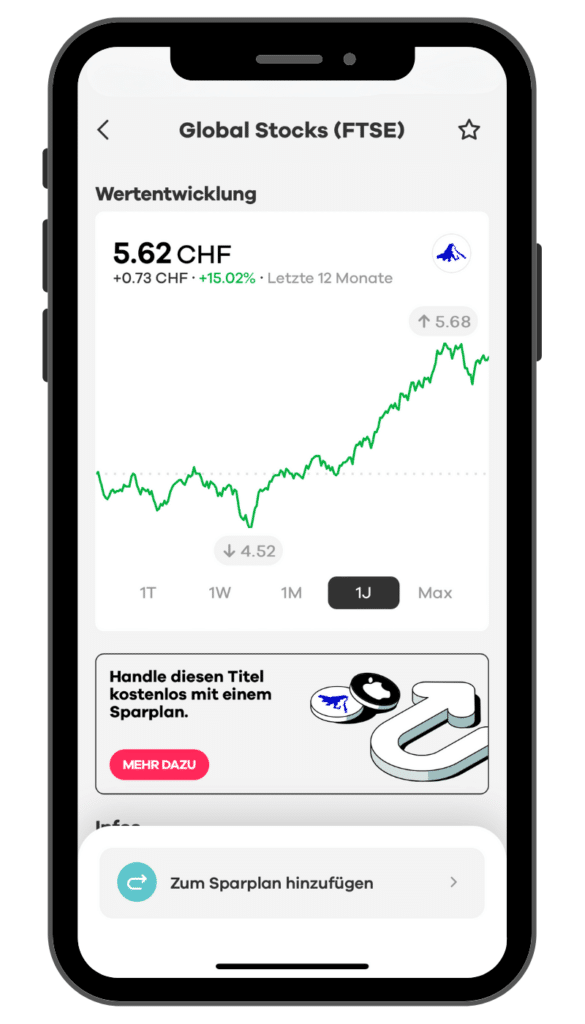

- Tap on “Invest” in the neon app.

- Search for the desired ETF:

- If you know the ISIN, you can enter it in the search field above.

- If not, you will find a list of all available ETFs under “Discover”.

- Select “Add to savings plan” below.

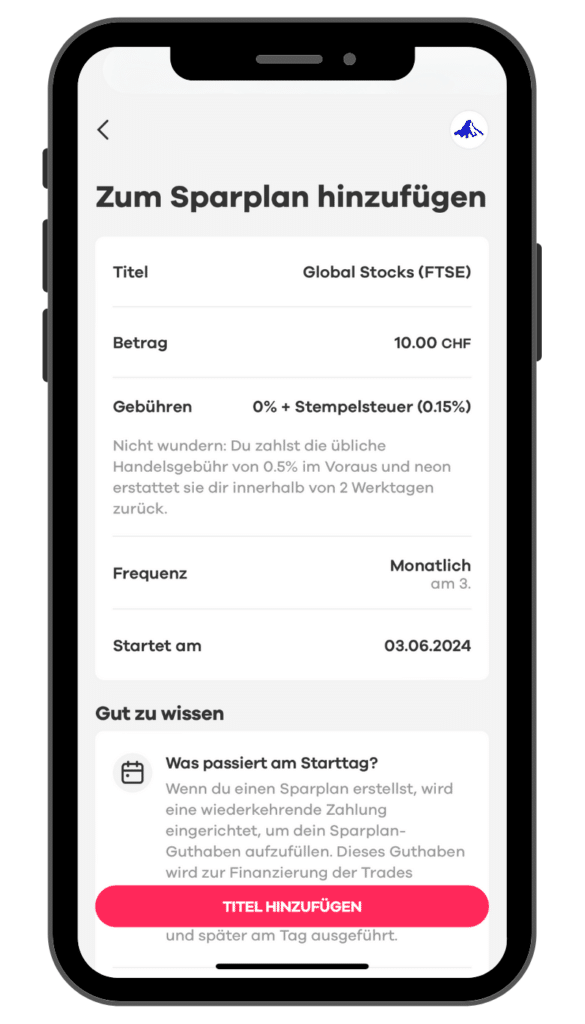

- Set the monthly amount. Depending on the current price, you will see the minimum investment.

- The fees are shown in the summary and under “Good to know” you will find all the details about the neon savings plan.

- The setup is already complete with “Add title”.

Tips and tricks for using ETF savings plans

If you want to invest CHF 50 per month and one unit of the ETF costs CHF 18, neon will buy you two units, leaving the remaining CHF 14 in your plan balance. So next month you have CHF 64 (50 + 14) at your disposal and neon buys 3 shares this time. You can view the “surplus” plan balance at any time in the savings plan overview and have it paid out if required.

If you want to change your ETF savings plan, tap on “Create”, scroll down a little and go to “Savings plan”. If you now select “Manage”, you can make the desired changes. You can add securities, change the amount or delete securities completely. No more changes are possible on the day the savings plan is executed.

You must have a sufficient balance in your main account on the day before execution so that the savings plan can be executed. If this is not the case, this month is simply suspended and invested in the following month.

FAQ free ETF savings plan Switzerland

ETF savings plans are offered by Swissquote and Yuh, among others. You can find digital asset managers who also use ETFs in their portfolios in the Swiss robo-advisor comparison.

As far as I know, there is no other provider in Switzerland that offers free ETF savings plans apart from neon invest. Stamp duty and product costs still apply to neon’s 0% fee ETFs. Other providers charge additional purchase and custody fees.

You can find savings plan calculators on the Internet that make it easy to work this out. Here is an example: If you invest CHF 150 every month for 10 years in a broadly diversified ETF that has returned around 7% per year in the past, you will end up with a final capital of CHF 25,803. You have then paid in a total of CHF 18,000 and the CHF 7,803 comes from compound interest. Please note, however, that ETF investments are also associated with risks and major losses can occur in the meantime. The 7% is an average value and by no means guaranteed.

If you want to invest money for the long term, don’t have a large amount for a one-off investment and know your risk profile, an ETF savings plan can make a lot of sense.

Yes, stock markets and therefore also ETFs are volatile and can be subject to strong fluctuations. However, the risk of a total loss is low if you buy a physical ETF that invests in many countries and sectors.

As you invest gradually and for the long term, you don’t need to worry about the right time, as this is always in the past. So why not start today?

Conclusion free ETF savings plan Switzerland

The free ETF savings plan from neon invest offers you an easy way to gradually build up assets and benefit from the long-term growth potential of the stock markets. The main advantages of the neon ETF savings plan are the low to no fees and the opportunity to invest flexibly in a wide range of ETFs.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.