Letztes Update: 30. January 2025

It took a relatively long time for ETF savings plans to become available in Switzerland. Some providers have only tentatively launched ETF savings plans on the market in recent months. However, the range of functions and the number of ETFs on offer have been modest. Saxo, a bank with a Swiss banking license and Danish roots, has now filled this gap. The fully-fledged AutoInvest savings plan, which is very easy to set up on the newly launched SaxoInvestor investment platform, makes it possible to save in an individually compiled ETF portfolio every month. In this article, you can find out all about Saxo’s big hit and my personal experience with the Saxo Bank ETF savings plan.

Saxo Bank

At the beginning of 2024, Saxo Bank Switzerland reduced its prices by up to 95%. Previously, the bank focused primarily on traders, which meant that the powerful SaxoTraderGO and SaxoTraderPRO trading platforms often seemed overwhelming for newcomers. With the change in strategy, however, Saxo is now specifically targeting long-term investors. The introduction of the new SaxoInvestor trading platform, which is available both as an app and as a desktop version, offers an intuitive solution for anyone who does not want to trade a large number of financial instruments on a daily basis. Switching between the trading platforms, which are all free to use, is easy at any time using the same login.

At the beginning of 2025, the custody fees were eliminated, and since Saxo AutoInvest also has no recurring fee, the only ongoing costs are the TER (Total Expense Ratio) of the ETFs being invested in. You can find more details on this under Saxo AutoInvest – Costs. Already in the summer of 2024, the optionally activatable securities lending at Saxo was introduced. This allows for additional income to be generated from lending stocks and ETFs.

Over 1.2 million clients worldwide trade with Saxo and have access to over 71,000 financial instruments. The global rating agency Standard & Poor’s recently upgraded Saxo’s credit rating from BBB to A-, indicating the bank’s improved financial stability. In some countries, SaxoInvestor and Saxo AutoInvest have already been successful on the market for several years.

Saxo Bank ETF savings plan: AutoInvest

With most of the previous Swiss ETF savings plans, you could simply select an ETF and specify the amount. The provider then bought this ETF on a regular basis. If you wanted to save several ETFs, you had to open a separate savings plan for each ETF, and some providers charged a fee for each purchase. The more ETFs you wanted to save in, the more expensive the savings plan became.

With AutoInvest, on the other hand, you can save in a customized ETF portfolio every month instead of investing in just one ETF. You simply set up a standing order from your salary account to your AutoInvest account and on the 5th of each month Saxo automatically invests in your ETF portfolio. Saxo buys the maximum possible number of ETFs according to your allocation.

Example ETF savings plan with AutoInvest

Assuming you want to invest CHF 1,000 per month 50% in an SPI ETF and 50% in an ACWI ETF, Saxo buys 3 shares of the SPI and 6 shares of the ACWI ETF. Saxo always buys whole units, i.e. no fractional shares, so that a certain residual amount always remains. Depending on the ETF, this makes it difficult to put together a portfolio. For example, a unit of the NASDAQ 100 ETF currently costs USD 1,144, so in our example you could not buy a unit in the first month, but only in the second month if you have CHF 2,000 in your AutoInvest account.

And the great thing about it is that you can not only save in one AutoInvest account, but up to ten. For example, you can set up a separate savings plan for your children or another savings goal. Please note that the sub-accounts are still in your name, so they are not tied child assets. If you want to open an additional account, simply select “Start AutoInvest” under “Profile” and you can enter a name for the account and receive an individual IBAN to which you can transfer the money for the new savings plan.

There is a choice of 87 ETFs from iShares, the ETF brand of the US fund company BlackRock, and 16 ETFs from Amundi, one of Europe’s largest asset managers. All ETFs eligible for savings plans are traded on the SIX Swiss Exchange.

Saxo Bank ETF savings plan: ETF list (selection)

| ETF | Symbol | TER | Distribution | Trading currency |

|---|---|---|---|---|

| iShares Core SPI (CH) ETF | CHSPI | 0.10% | Distributing | CHF |

| iShares Core S&P 500 (Acc) UCITS ETF | CSSPX | 0.07% | Accumulating | USD |

| iShares Core S&P 500 (Dist) UCITS ETF | IUSA | 0.07% | Distributing | USD |

| iShares Core MSCI World UCITS ETF | SWDA | 0.20% | Distributing | USD |

| iShares MSCI World ESG Screened UCITS ETF | SAWD | 0.20% | Accumulating | USD |

| iShares MSCI World SRI UCITS ETF | SUSW | 0.20% | Accumulating | EUR |

| iShares MSCI ACWI USD Acc UCITS ETF | SSAC | 0.20% | Accumulating | USD |

| iShares MSCI ACWI USD Acc UCITS ETF | SSAC_CHF | 0.20% | Accumulating | CHF |

The list provides a selection of the ETFs available from Saxo AutoInvest. Neither the ETFs contained therein nor those mentioned in the article are to be understood as recommendations for action. No responsibility is taken for the accuracy and completeness of the list.

The complete list of ETFs available at AutoInvest can be found here.

Saxo Bank ETF Savings Plan – Setup

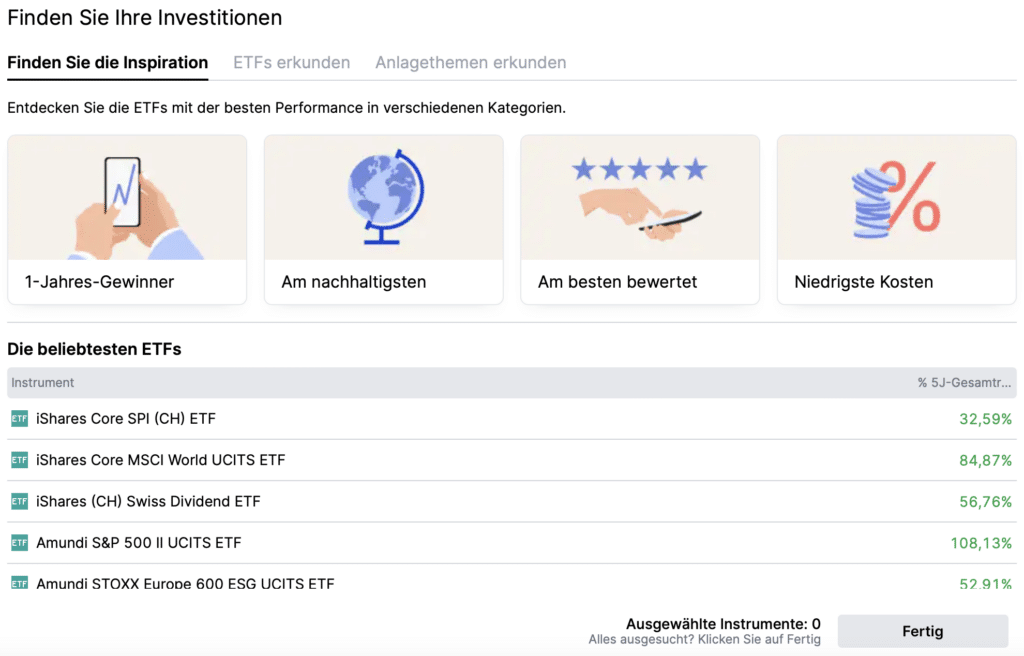

In SaxoInvestor, select the “Start AutoInvest” option under “Profile”. First, enter a name for your new account and select “Open an AutoInvest account”. This account will then appear under “Portfolio”. Now you can start setting it up. The easiest way to do this is with “Explore ETFs”. Here you can search for ETFs by filtering them according to various criteria. If you already know which ETF you want to invest in, you can enter the symbol of the ETF directly. The columns “Last trade” and “OCF %” are interesting. The former shows the last traded price, the latter the annual TER of the ETF.

In our example, we select the ETF with the symbol CHSPI. You will now be shown various details about this ETF in the product overview, and you can also call up the key information document here. Next, select “Add” and “Done”. At the top you can enter the monthly amount to be invested and either complete the savings plan by allocating 100% to an ETF or add another ETF. Below each ETF you will see the minimum amount and the number of units that can currently be purchased. After the summary, you can save the savings plan and the account information to which you can transfer the money will be displayed directly.

Under “Portfolio”, you can adjust the savings plan at any time and, for example, add or remove ETFs. If you remove ETFs, they are not automatically sold, but simply no longer invested in.

Flexibility and control with AutoInvest

There is no minimum amount with AutoInvest. This means that you are under no obligation whatsoever, and even if you have no money left to invest one month, this is not a problem at all: nothing is invested this month, and when there is money in your AutoInvest account again the next month, it is automatically reinvested. If ETFs pay out dividends, these end up in your AutoInvest account and are reinvested the next month, provided the denomination allows this.

Your money is invested on the 5th of each month. Other dates or intervals are not possible. If the 5th falls on a weekend or public holiday, Saxo invests on the next bank working day.

Up to 10 different ETFs can be included in each AutoInvest portfolio.

Saxo Bank ETF Savings Plan – Costs

The only fees incurred during purchase are a currency conversion fee of 0.25% on the respective investment amount when buying ETFs in foreign currencies. Additionally, as with every Swiss broker, the Swiss stamp duty applies.

When selling ETFs, the usual Saxo fees apply, and for ETFs in foreign currencies there is an additional currency conversion fee. These are still unrivaled in Switzerland. Incidentally, it is not possible to set up an automated withdrawal plan.

Saxo receives compensation for distribution activities from the product providers. This is transparently disclosed when setting up the savings plan. The compensations range between 0.03% and 0.08%. By activating AutoInvest, you expressly waive any claim to reimbursement of these compensations.

Saxo Bank ETF Savings Plan Advantages

- AutoInvest is unrivaled in its affordability: no minimum amount, no monthly fees, no purchase fees.

- An entire ETF portfolio can be saved automatically on a monthly basis.

- AutoInvest offers the largest selection of ETFs in Switzerland that can be invested in free of charge.

- Under “Investment settings” you can specify whether additional money should also be invested in your AutoInvest account.

- Flexibility: Recurring orders can be started, paused or stopped at any time without incurring costs.

Saxo Bank ETF savings plan disadvantages

- Only whole units can be traded. Depending on the monthly savings amount, this severely limits the choice of ETFs.

- Positions cannot be transferred to or from an AutoInvest account.

- AutoInvest only works with ETFs, individual stocks cannot be included in the savings plan.

Conclusion Saxo Bank ETF savings plan

Saxo Bank’s AutoInvest offers Swiss investors a simple and cost-effective way to invest in ETFs. The variety of ETFs and the fact that there are no purchase fees are particularly attractive. The intuitive SaxoInvestor platform and low costs make AutoInvest an excellent option for ETF savings plans in Switzerland. I am curious to see how the competition will react to this disruptive offering.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.