Letztes Update: 19. March 2025

Here you can find out everything about the precautionary digitizer finpension from Lucerne. We examine the strategies of finpension Pillar 3a, the lean fees, and the differences compared to other Pillar 3a providers. Not to forget: My experiences with the finpension 3a securities app, which I have been using for nearly three years for a portion of my retirement savings.

finpension

finpension was initiated by Beat Bühlmann in 2015. Together with Ivo Blättler, he first founded the 1e collective foundation. Brief explanation: For salary components above CHF 136,080 up to a maximum of CHF 907,200, companies can conclude pension plans with a 1e collective foundation. The pension recipients can decide for themselves how their 1e assets are invested. This is also called cadre provision.

In 2017, the offering was expanded to include a follow-up solution in the form of a vested benefits foundation. Finally, in 2020, the 3a pension foundation was added. To manage and open your third pillar with finpension, you can use both the app and the finpension web app.

Since May 2024, you can also invest your free assets with finpension. finpension Invest is the ideal follow-up solution for your retirement savings after retirement. But of course, you can also benefit from the very low fees of finpension Invest before retirement.

finpension is a privately held stock corporation with no dependencies on banks or insurance companies. finpension currently manages retirement assets of over three billion Swiss francs. The pension assets are held separately by finpension AG in the respective foundation.

finpension Pillar 3a Strategies

But let’s get back to the 3a securities app and the investment strategies available at finpension. These differ according to the amount of the equity component. The strategy “finpension shares 0” contains only bonds. After that, the strategy goes up in steps of 20 percentage points until the “finpension Aktien 100” strategy with 100% shares is reached.

The six investment strategies are available in three different versions:

- Global

- Switzerland

- Sustainable

The proportion of Swiss equities in the “Switzerland” category is roughly twice as high as in the “Global” category. In the strategy “finpension Aktien 100” it looks like this:

| Expression | Equity share Switzerland |

| Switzerland | approx. 80% |

| Global | approx. 40% |

At finpension you can now choose between the fund houses Credit Suisse, Swisscanto and UBS. finpension thus underlines its independence from product suppliers. The custodian banks are either Credit Suisse (Schweiz) AG or Swisscanto by Zürcher Kantonalbank.

In the case of “Sustainable”, finpension uses ESG funds. These take into account various ESG requirements, i.e. criteria from the environmental, social and governance areas.

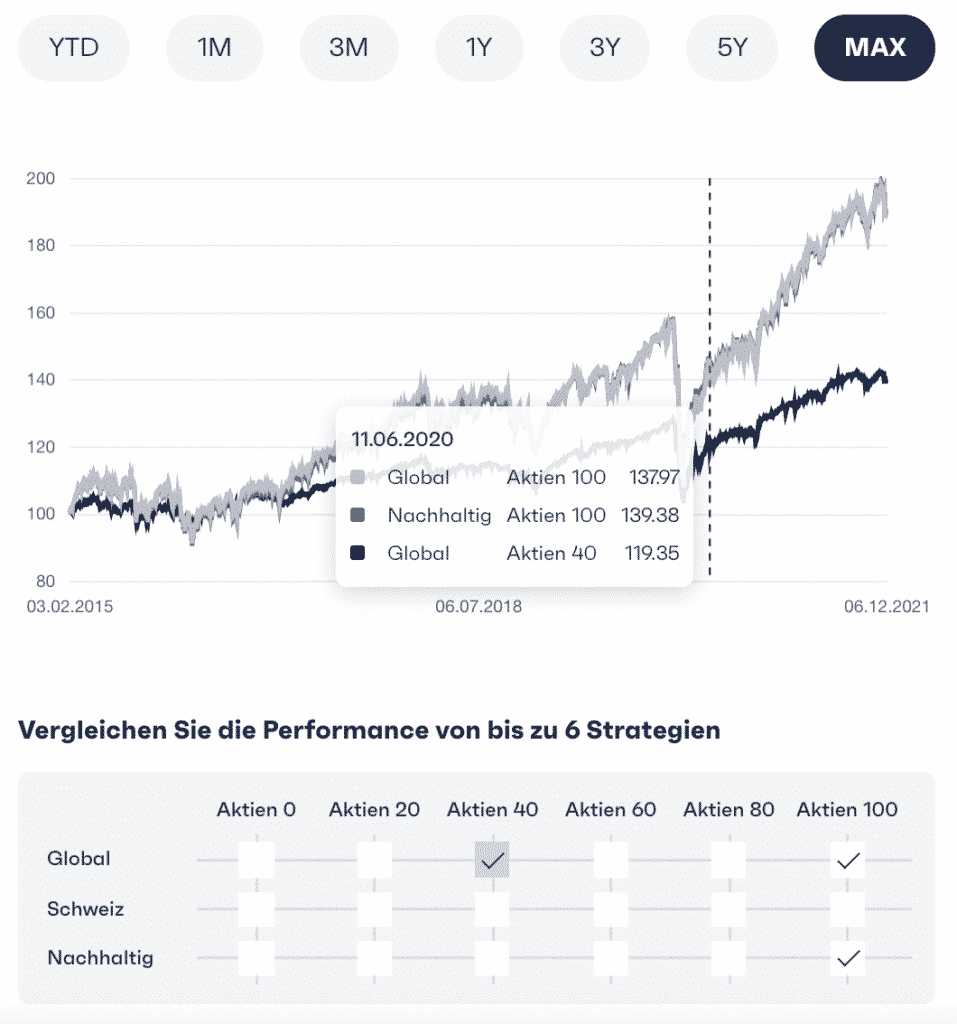

The performance comparison on the finpension website is well done. There you can select the strategies and characteristics in a table and compare them on a chart.

All strategies are customizable and you can even create completely custom strategies. There are around 100 index funds to choose from. Among them is a Swiss crypto fund, but more on that later.

With finpension you can open up to five portfolios and implement different strategies. If you want to change the strategy, this is possible free of charge.

Incidentally, all finpension investment strategies with an equity component of 20 percent or more received a rating of “very good” in the 3a fund comparison conducted by Handelszeitung in November 2021.

For experts: money market funds instead of bonds

All finpension strategies maintain 1% in cash. This proportion cannot be changed. However, if you are not comfortable with bonds in your portfolio and at the same time you do not want to hold 100% equities, you can add the “CSIMF Money Market CHF ZB” fund (ISIN: CH0031419960). This fund invests in money market instruments denominated in Swiss francs and in short-dated fixed- and floating-rate securities issued by first-class borrowers.

The fund is currently yielding a yield to maturity of 1.76%, which is very close to the SNB key interest rate. Due to the short maturity of the securities included, it reacts relatively quickly to changes in interest rates, but much less strongly than longer-dated bonds. It is thus the closest thing to a cash investment.

finpension Pillar 3a Global 100

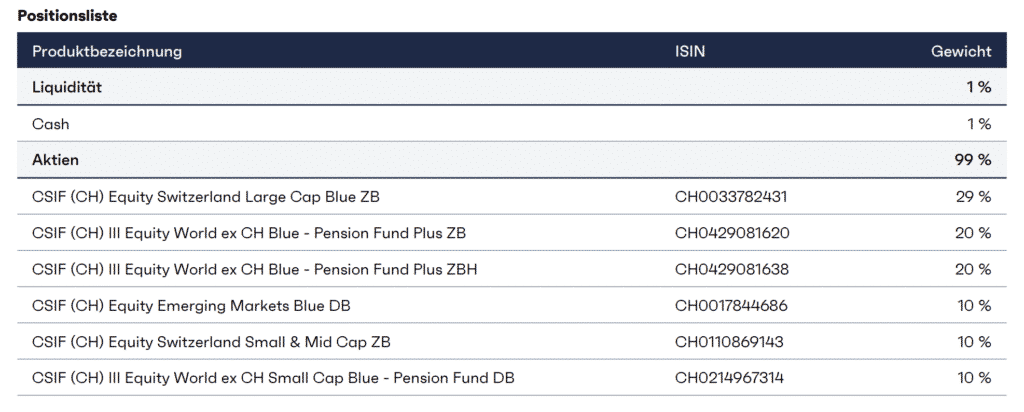

Let’s take a closer look at the standard finpension Global 100 strategy. You can see which funds are used in the factsheet or on the website.

Compared to other providers, finpension also uses a fund on small-cap companies. Included, for example, is the stock of Floor & Decor Holdings, Inc. a U.S. multi-channel specialty flooring distributor, or Quanta Services, a U.S. company that provides infrastructure services to the power, pipeline, industrial and communications industries.

On the factsheet you will also find the breakdown by currencies, regions and sectors as well as the ten largest positions.

The institutional index funds from Credit Suisse, Swisscanto, and UBS can reclaim a large portion of the withholding taxes on foreign dividends and interest.

finpension Cryptocurrencies – Bitcoin in Pillar 3a

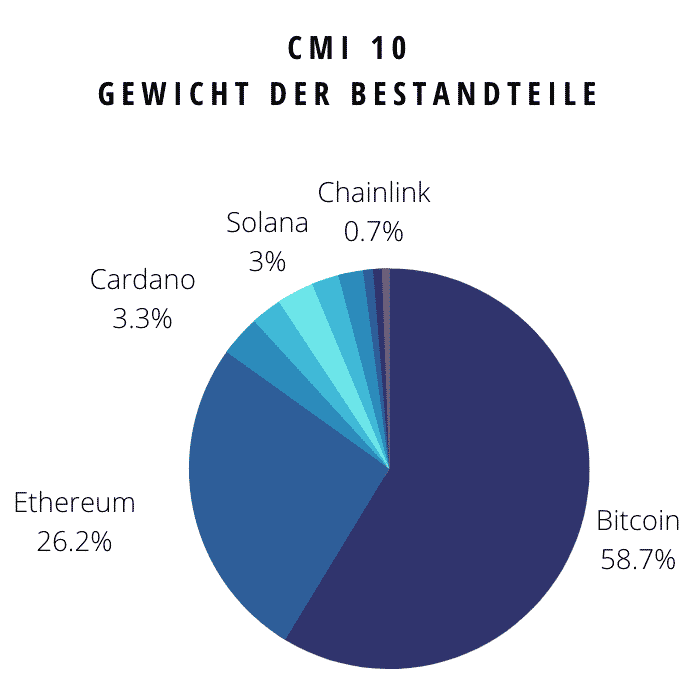

In early December 2021, finpension became the first provider to make it possible to invest in a cryptocurrency fund as part of Pillar 3a. You can add the “Crypto Market Index Fund” to your own strategies up to a maximum of 5%.

The “Crypto Market Index Fund” is the first Swiss crypto fund to be approved by the Swiss Financial Market Supervisory Authority FINMA. It is only available to institutional and professional investors and passively follows the Crypto Market Index 10. This includes the ten largest and most liquid crypto assets and tokens. The index is calculated by SIX Swiss Exchange AG and is rebalanced on a quarterly basis. The composition at the end of October is as follows:

Crypto Finance (Asset Management) AG acts as asset manager and the assets are held at SEBA Bank AG.

Since 2024, you can also add the pure Bitcoin ETF “iShares Bitcoin Trust”. The TER is at an affordable 0.25%. Or the pure Ethereum ETF “iShares Ethereum Trust ETF”.

Just because crypto funds are available doesn’t mean you have to invest in them. Inform yourself about digital assets before adding the funds.

finpension Pillar 3a Fees

finpension applies a simple and transparent flat fee of 0.39% regardless of the equity quota.

In the past, VAT was charged additionally, but this is no longer the case. The very favorable 0.39% now also includes the costs (TER) of the investment funds used (exception: Crypto Market Index Fund with a TER of currently 1.60%).

The flat fee is calculated quarterly based on the average market value of the pension assets and charged directly to your pension assets.

There are no issuing commissions or fees on foreign currencies at finpension.

finpension Pillar 3a Account

From autumn 2024, you can not only invest in securities with finpension but also open a Pillar 3a account. The interest rate at finpension is linked to the Swiss National Bank’s key interest rate. Currently, you receive 0.5% interest. Note that the management fee of 0.39% is also charged on the Pillar 3a account balance. The effective interest rate is therefore currently 0.11%, placing finpension rather in the lower range compared to other Pillar 3a accounts.

The account opening is, of course, digital, and no risk questionnaire needs to be filled out for the account opening. There is also no minimum fee here, so you can start with a deposit of just CHF 1.

finpension Pillar 3a Experiences and Review

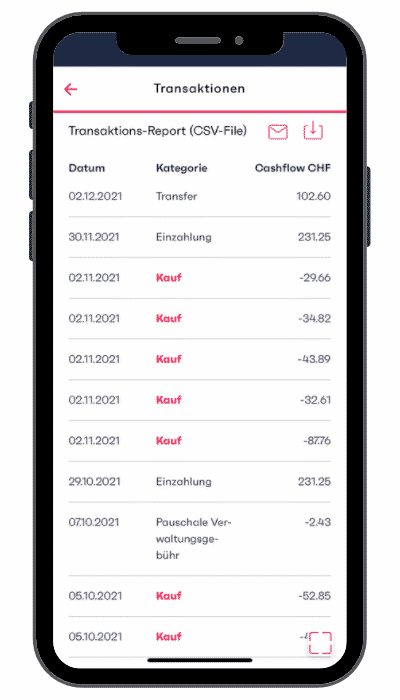

I find the app a bit less fancy than the competition. Functionally, however, it is in no way inferior to it. Recently, you can also switch from the 3a pension foundation to the vested benefits foundation in the app. And you can export the transaction report as a CSV file.

By default, finpension performs rebalancing automatically. Recently you can set this to inactive. To do this, click on the three dots at the top right of your portfolio and select “Rebalacing”.

Trading takes place weekly on the second banking day. Before acting, finpension looks to see if internal clearing is possible. To explain: If customer A wants to sell 15 shares of a fund, for example, and customer B wants to buy 20 shares of the same fund, then finpension offsets the orders and trades only the five missing shares. The whole thing is called netting and thus spread costs can be avoided, which has a positive effect on your performance. You can find more interesting articles on the topic of retirement planning and pillar 3a on the finpensionblog.

Overall, finpension has succeeded in creating a convincing pillar 3a product, which I have been using since January 2021. If you are looking for a pillar 3a solution that is cost-optimized down to the last detail, without any frills, you are in good hands with finpension. True to the motto: “finpension – looking forward to more”.

finpension vs. VIAC

Yes, VIAC used to be on the market. And even though finpension uses some of the same Credit Suisse funds, it is its own product and not a cheap copy. Let’s compare here the standard strategies Global with the highest share of equities of the two providers:

| Standard strategy Global, highest share of equities | finpension | VIAC |

| Equity share | 99% | 99% |

| TER | 0.39% | 0.40% |

| Share Switzerland | 40% | 40% |

| Return 2024 | 14.7% | 16.7% |

| Return 2023 | 9.3% | 8.8% |

| Yield 2022 | -17.7% | -16.5% |

| Yield 2021 | 20.6% | 20.8% |

| Yield 2020 | 7.2% | 5.3% |

| Return 2019 | 26.0% | 25.2% |

| Yield 2018 | -10.0% | -9.4% |

| Yield 2017 | 19.6% | 19.1% |

Fees

finpension applies a flat fee. As a result, strategies with a low equity share are more expensive than with VIAC.

VIAC always trades the funds in the currency of risk and there is a fee for foreign currency exchange. finpension trades, whenever possible, the CHF tranche, where the foreign currency exchange is made at much more advantageous conditions only within the funds. finpension therefore earns nothing from the currency transactions.

Portfolio

Unlike VIAC, finpension bets the aforementioned fund on small-cap companies.

Another difference is the allocation to regions: finpension uses an index fund on the MSCI World ex Switzerland Index. With 20% the currency-hedged and with another 20% the non-currency-hedged (recognizable by the H at the very end of the designation).

VIAC makes the allocation to the regions themselves:

- 10.6% on the MSCI Europe ex CH

- 31.5% on the MSCI USA

- 1.9% on the MSCI Canada

- 2.5% on the MSCI Pacific ex Japan

- 4.5% on the CSIF Japan – Pension Fund

VIAC pays 0.8% interest on cash, finpension does not.

In the strategies with less equity exposure, finpension uses bonds, while with VIAC you can choose between bonds and an interest-bearing pillar 3a account.

Sustainable strategies

For sustainable strategies, finpension uses the ESG index funds of Credit Suisse, Swisscanto and UBS. VIAC accesses the somewhat stricter SRI ETFs of UBS in addition to the ESG index funds of Credit Suisse for the Switzerland and USA part. These are traded in a foreign currency, with VIAC incurring a foreign currency exchange fee.

You can read about the differences between ETFs and index funds here. In brief: Domestic index funds have the advantage that no stamp duty is payable on trading. And pension funds can reclaim withholding taxes on dividend and interest income.

You can find the pillar 3a comparison with other providers here.

finpension code for fee credit

Enter the finpension code FIDE83 directly during registration or within 24 hours afterwards in your finpension profile, and you will receive a fee credit of CHF 25.

Note the following condition: You transfer or pay in at least CHF 1,000 within the first 12 months.

FAQ finpension

finpension invests weekly on the second bank working day.

Your Pillar 3a funds are invested in securities and are only held in trust by finpension; they do not appear on finpension’s balance sheet. In case of finpension’s bankruptcy, your securities form a separate asset and can be transferred to another provider. Cash balances are protected by deposit insurance up to CHF 100,000.

Yes, there is a finpension referral code. Enter the code FIDE83 directly on the last page of the registration process or within 24 hours afterwards in the app under referral program, and you will receive a fee credit of CHF 25.

Advertising

Enter the code FIDE83 directly in your profile during registration or 24 hours later at the latest and you will receive a fee credit of CHF 25.

Condition: You transfer or deposit at least CHF 1’000 within the first 12 months

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.