Letztes Update: 7. February 2025

Interest rates on savings accounts are falling again across the board. The comparison service moneyland.ch has determined that adults now receive an average of only 0.35% interest on savings accounts in Swiss francs. At the end of 2024, it was still 0.5%, and at the end of 2023, even 0.8%. But what alternatives are there when interest rates are falling to still invest your money profitably? In this post about declining interest rates and alternatives, you’ll learn how to achieve attractive returns even in low-interest phases with the right investment opportunities.

Inhaltsverzeichnis

- Why are interest rates falling in 2025?

- The effects of falling interest rates on your assets

- Inflation and interest rates: How they are connected and what it means for you

- Safety-oriented alternatives: What savings accounts, cash bonds, and co. offer

- Stocks and ETFs: Attractive not only when interest rates are low

- Robo-advisors and digital asset management: An easy entry into investing

- Conclusion: How to find the right strategy despite falling interest rates

Why are interest rates falling in 2025?

In December 2024, the Swiss National Bank lowered the key interest rate not just by 0.25%, but by 0.5% to 0.5%. The aim of this relatively large interest rate step is to weaken the franc and stimulate the economy. Zero and negative interest rates are thus once again becoming a possibility.

The effects of falling interest rates on your assets

Interest rate cuts allow banks to offer cheaper loans and can help stimulate the economy and increase demand for goods and services. This has a positive effect on assets such as real estate, the book value of bonds, and generally also on stocks. The resulting higher demand is intended to increase inflationary pressure and reduce unemployment.

The interest rate decisions of the Swiss National Bank have a direct impact on the refinancing costs of banks and thus indirectly on the interest rates that banks offer their customers. An interest rate cut usually leads to banks also lowering their savings interest rates. Interest rate cuts are usually implemented immediately. Most banks are somewhat slower with interest rate increases.

Mortgages tend to become cheaper with falling interest rates. Thus, the reference interest rate relevant for rent levels is highly likely to fall in March 2025, so that tenants can again demand rent reductions. On the other hand, the interest rate cut is likely to drive real estate prices further up.

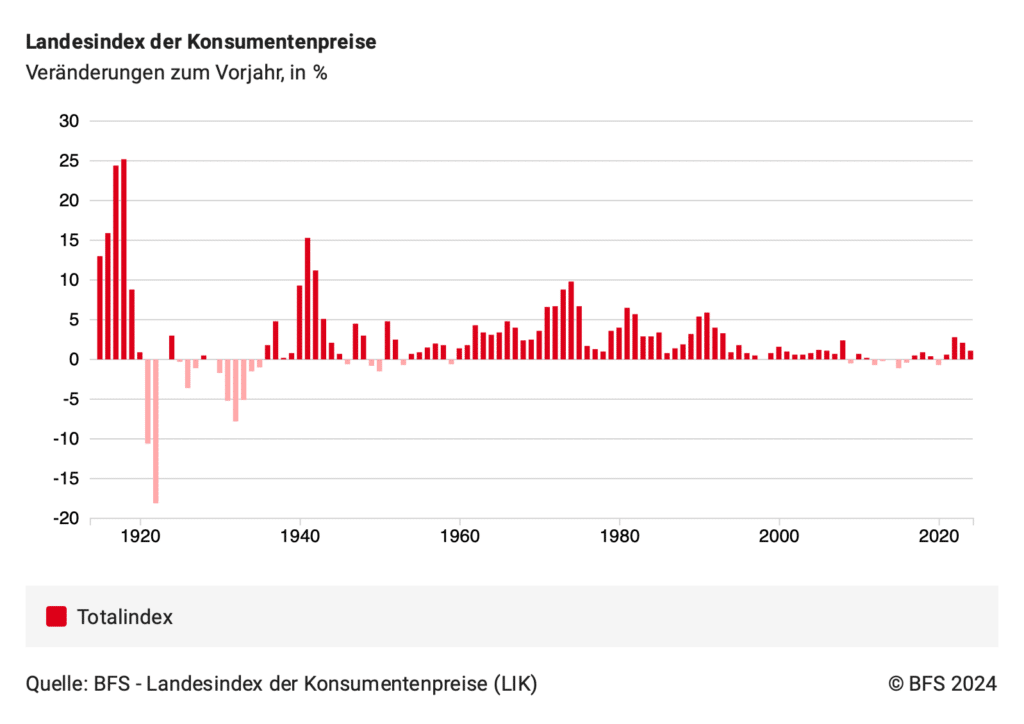

Inflation and interest rates: How they are connected and what it means for you

Inflation and interest rates are closely linked, as interest rates are a central instrument used by central banks to control inflation. When interest rates fall, loans become cheaper, which increases demand for goods and services and can fuel inflation. When the interest rate rises, saving becomes more attractive. Consumption and investments decline, which dampens inflation.

It would therefore be misleading to look only at the interest rate on the savings account. Much more important is a real consideration. Here’s an example:

| Savings Account Interest Rate | Inflation Rate | Real Return |

|---|---|---|

| 3% | 3.5% | -0.48% |

| 0.5% | 1% | -0.50% |

The 3% interest on the savings account in the first example sounds good, but in real terms, i.e., adjusted for inflation, the return is even negative. So you’re losing money if you just leave it in the savings account.

If we now consider taxes as well, the first example with 3% interest becomes even less attractive, because you pay income tax on the interest received. Let’s assume a marginal tax rate of 25%. This means that out of every franc you earn additionally in interest, 25 cents must be paid as taxes.

| Savings Account Interest Rate | Inflation Rate | Real Return | Tax-Adjusted Return |

|---|---|---|---|

| 3% | 3.5% | -0.48% | -1.23% |

| 0.5% | 1% | -0.50% | -0.63% |

The tax-adjusted real return is thus -1.23% – a loss-making business. And the interest rate of 0.5% at low inflation is suddenly more attractive than the 3% at higher inflation.

moneyland.ch has also examined the historical real interest rates: Between 1933 and 2019, there were positive real interest rates for savers in 51 years and negative ones in 36 years. On average over the entire period of 87 years, the real interest rate was just 0.07% per year.

Should I invest my money in a foreign currency with higher interest rates?

The short answer is no. Firstly, exchange fees are incurred for conversion and reconversion, and you bring a currency risk into the relatively safe form of investment that is cash.

Often, not only are interest rates higher abroad, but so is inflation, and now you know that interest rates and inflation are interconnected. This is reflected in a weaker currency. The Swiss Franc has been a stable currency in the past, and there’s little to suggest that this will change in the future. Most other currencies have always lost value against the Swiss Franc (in the long term). For example, since the end of May 2024, the Euro has depreciated by about 4.5% against the Swiss Franc. Adjusted for currency, real and after taxes, you would have lost quite a lot of money in a safe asset class like cash.

And if you hold funds as cash at a foreign bank, you should always inform yourself about the local deposit insurance.

Safety-oriented alternatives: What savings accounts, cash bonds, and co. offer

Here you can find a monthly updated interest rate comparison. For savings accounts, always pay attention to the withdrawal conditions and that banks can adjust interest rates at any time.

If you can do without your money for a bit longer, cash bonds might be interesting for you. Cash bonds are fixed-income securities issued by banks that offer investors a secure, medium-term investment opportunity with a fixed term and guaranteed interest. Here you can find a cash bond interest rate comparison.

Cash bonds in national currency, which are deposited in the name of the holder at the issuing bank, are subject to the Swiss deposit insurance of CHF 100,000, just like savings accounts with Swiss banks. If you have multiple accounts at the same bank, the balances are added together and a maximum of CHF 100,000 is insured in total. Here you can find details on Swiss deposit insurance.

Stocks and ETFs: Attractive not only when interest rates are low

Money that you don’t need in the next 15 years can be invested more profitably in the stock market. The prerequisite is that you have both a sufficiently long investment horizon and the necessary risk tolerance. Investing in stocks and ETFs always involves fluctuations. The higher the proportion of stocks in a portfolio, the greater the fluctuations.

For example, if you want to buy a property in 5 years, the stock market is not the right place to invest the equity capital you’ll need then. The investment horizon is too short and the risk is too high that the stock market might be in a bear market and you’d have to realize the book losses.

Meanwhile, there are also affordable offers from brokers in Switzerland, where you can relatively easily put together your own portfolio with ETFs. Currently, Saxo and Swissquote are among the most attractive providers in the Swiss market. You can learn more about these two Swiss brokers in the article Swissquote vs. Saxo: Find the best Swiss online broker.

Robo-advisors and digital asset management: An easy entry into investing

If you don’t want to take care of selecting ETFs yourself, digital asset managers, so-called robo-advisors, are the right choice for you. After determining your risk profile, these determine the appropriate stock quota and manage your portfolio at attractive conditions. Often, the minimum investment is only a few Swiss francs. With many robo-advisors, a Swiss eTax statement is included in the annual fee, making filling out your tax return a breeze. If you’re looking for a Swiss robo-advisor, you’ll find it in the Robo-Advisor Comparison Switzerland 2025.

Conclusion: How to find the right strategy despite falling interest rates

Despite falling interest rates in 2025, there are still many ways to invest your assets sensibly and profitably. The key is to choose the right investment strategy that matches your investment horizon and your risk profile.

For short-term goals, you should opt for safe alternatives like savings accounts or cash bonds. These offer lower returns but high security and a more stable source of income than the volatile stock market.

For long-term goals, where you’re also willing to take on higher risk, stocks and ETFs are suitable. Here you can benefit from higher returns, provided you have a sufficiently long investment horizon and can withstand market fluctuations.

Additionally, digital asset managers like robo-advisors offer an easy way to passively manage your portfolio and benefit from professional strategies.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.