Letztes Update: 1. May 2024

Hardly anyone has talked about medium-term notes in recent years. Interest rates have been so low that many savers have either left their money sitting around in the flexible pay account or have sought alternatives with higher returns. As a result, some banks no longer offered medium-term notes at all, or they disclosed interest rates only upon request. In this post, we’ll take a look at what cash bonds are in the first place, and we’ll do a cash bond interest rate comparison.

If you are interested in bonds in general, you can find more information in the article Investing in bonds in Switzerland: what you need to know

Medium-term notes simply explained

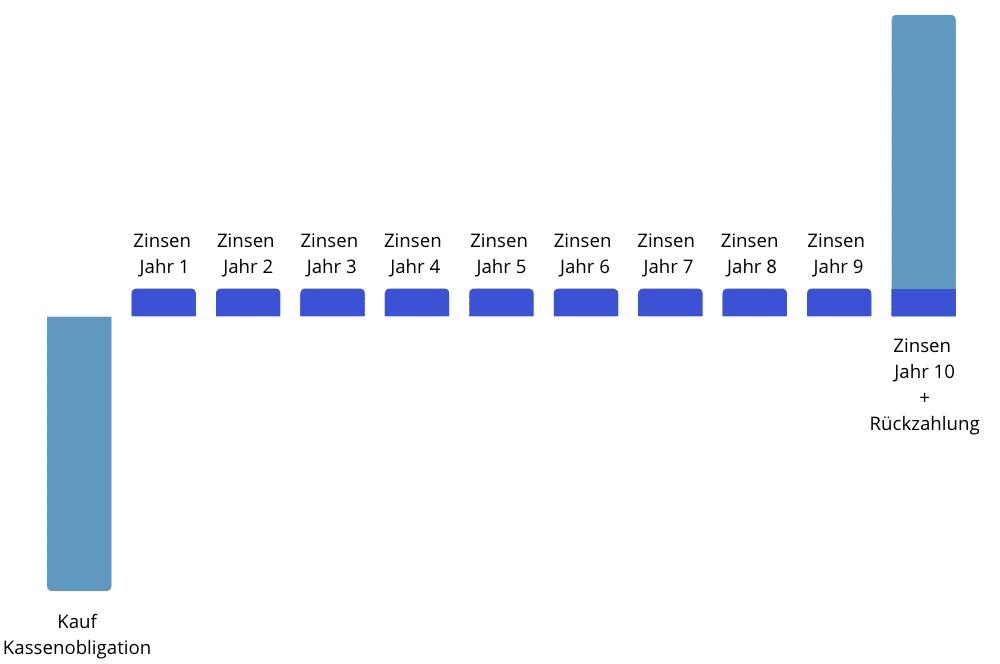

A medium-term note is a fixed-interest bond issued by a bank. At the beginning you choose the amount, mostly denominations in CHF 1’000 steps are possible, and a term. The interest rate you then receive annually is higher the longer you choose the investment period.

Unlike bonds, medium-term notes cannot be traded on the stock exchange. So, at the beginning you need to think about how long you can do without your invested money. Some banks offer the possibility of returning medium-term notes or selling them to internal buyers, but the conditions are usually rather poor. Other banks offer collateralization of medium-term notes.

Because the interest rate is fixed, you should think carefully about whether you really want to invest your money at this interest rate for longer terms. Because if interest rates continue to rise, you can’t just switch to a cash bond with higher interest rates.

With some banks, you need an account to be able to subscribe to medium-term notes. Often a free savings account is sufficient for this purpose. Find out more on the banks’ websites or from your customer advisor.

At the end of the term, the invested amount (nominal value) is paid out to you.

Features of medium-term notes Switzerland

- Fixed amount (usually from CHF 1,000 or CHF 5,000)

- Fixed term (mostly from 2 to 10 years)

- Fixed interest income

- not tradable (with exceptions)

Medium-term notes vs. bonds

Since medium-term notes are not traded on the stock exchange, their value does not fluctuate. This is in contrast to bonds, where the bond price fluctuates in a similar way to shares. Medium-term notes are therefore also suitable for investors with a low risk tolerance and as a risk-free component of your portfolio. However, you should not invest the liquidity reserve in medium-term notes, as you want to be able to draw on it immediately in emergencies.

If you buy bonds through your broker, transaction fees will apply. The subscription of medium-term notes, on the other hand, is usually free of charge. A securities account is also required for holding medium-term notes. Often this is carried out by banks free of charge. By the way, in the cash bond interest rate comparison I have only listed banks that do not charge any fees for subscription.

Medium-term notes vs. savings account

Savings accounts usually offer a slightly lower interest rate, but you can withdraw your money more quickly. Here, too, the conditions vary greatly from bank to bank.

Some banks are currently enticing customers with particularly high interest rates, but these are only valid for one year. Or the high interest rates are only available up to a maximum amount such as CHF 25,000. So you should always read the terms and conditions carefully before choosing a savings account.

Medium-term notes comparison current interest rates

In the cash bond interest rate comparison, I have only listed providers that do not charge fees for underwriting cash bonds.

| Bank | Rating S&P | Minimum amount | 2 years | 5 years | 10 years |

|---|---|---|---|---|---|

| Alternative Bank Switzerland | CHF 1’000 | 0.80% | 0.85% | 1.10% | |

| Baloise | A+ | CHF 1’000 | 1.25% | 1.30% | 1.45% |

| Cembra Money Bank | A- | CHF 20’000 | 1.60% | 1.60% | 2.00% |

| PostFinance | AA | CHF 5’000 | 0.80% | 0.75% | 0.80% |

| WIR Bank (fixed deposit account) | CHF 5’000 | 1.10% | 1.15% | 1.25% | |

| ZKB | AAA | CHF 5’000 | 0.90% | 0.95% | 1.05% |

Source: Provider websites

Date of the last update: 01.05.2024

S&P rating codes

| AAA | Highest credit rating / low risk |

| AA+, AA, AA- | Very high creditworthiness / high probability of meeting obligations |

| AA-, AA, AA- | Very high creditworthiness / high probability of meeting obligations |

| A+, A, A- | Good to satisfactory credit rating / Slightly dependent on economic situation |

| BBB+, BBB, BBB- | Satisfactory credit rating / currently stable situation, but not fully secured |

FAQ cash bonds interest rate comparison

This depends on the current interest rate level and the term. Usually, the interest rates are higher the longer the term is chosen. You can find the cash bond interest rate comparison with the current interest rates above.

Similar to bonds, the amount of interest depends on the creditworthiness of the issuer of the medium-term notes. Usually, the better the credit rating of the issuer, the lower the interest rate.

Yes, medium-term notes in Swiss francs deposited in the name of the depositor with the issuing bank also count as deposits and are protected up to CHF 100,000. Multiple accounts at the same bank are added together.

With some banks, you need an account to be able to subscribe to medium-term notes. Often, a free savings account is all you need. Find out more on the banks’ websites or from your customer advisor. Medium-term notes are held in your bank’s custody account after subscription.

Yes, medium-term notes are subject to the 35% withholding tax. Withholding tax is paid from the first franc of interest. The bank will provide you with a recovery voucher at the end of the year.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.