Letztes Update: 25. January 2024

Before we get to the impact investing provider Inyova and my Inyova 2024 experience, I would first like to show you what sustainable investment opportunities are available and shed some light on the ESG and SRI jargon. This is admittedly a bit dry, you can of course scroll down directly to Inyova if that interests you more.

ESG and SRI in ETFs and funds

As written in the post about Selma, you can select there whether you want to invest sustainably or not. If you select the option, as I did, Selma will buy sustainable ETFs for you. You can also buy these quite usually through your broker and hold them in your securities account. Major banks have also recently converted their pillar 3a products to sustainable. But what ‘s in it? How do stocks get into an index? Or rather, how do stocks get out of the index?

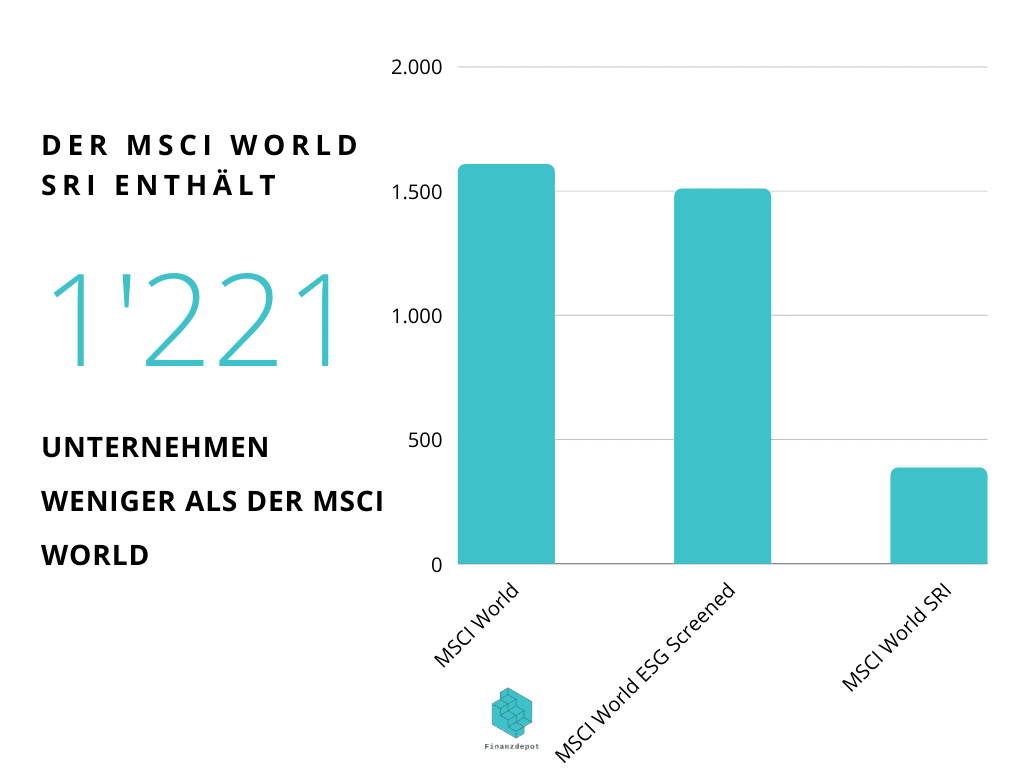

Let’s look at this using the well-known “MSCI World” index. A total of 1,607 shares are listed there.

MSCI World ESG Screened

For the “MSCI World ESG Screened” (Environment, Social, Governance) Index, companies that are associated with controversial, civil and nuclear weapons and tobacco, that generate revenue from thermal coal and oil sands extraction, and that do not comply with the principles of the United Nations Global Compact are excluded. A total of 98 companies are thus eliminated, leaving 1,509 companies in the index. Weighting is still based on market capitalization.

MSCI World SRI

Let’s go one step further with the “MSCI World SRI” Index (Socially Responsible Investing). By the way, Selma uses ETFs on SRI indices in their sustainable strategy.

First, companies that operate in controversial business areas and have a negative impact on society and the environment are excluded. These include: Alcohol, tobacco, gambling, nuclear energy, military weapons, civilian weapons, genetically modified organisms, and adult entertainment.

A best-in-class filter is applied to the remaining companies: This means that only companies with the best sustainability rating per sector remain in the index. The MSCI ESG rating is based on 38 criteria relating to the environment, society and corporate governance. Whereby 4-7 ESG risks are defined for each sector. The MSCI ESG rating scale goes from AAA to CCC, and only companies with a minimum score of BBB are included.

Finally, a controversy score is applied. This verifies compliance with international standards and principles (e.g.: UN Global Compact, ILO standards). The rating scale ranges from 0 to 10. To be included in the index, there must be a rating of 4 or higher.

Here, only 386 companies remain. The remaining shares continue to be weighted according to market capitalization. And the largest company, Microsoft, now has a weight of over 13%. Many ETF providers therefore apply a slightly modified index, the “MSCI World SRI 5% Issuer Capped Index”. In it, the weight of a single company is limited to 5%.

Conclusions

Thanks to the best-in-class principle, the index also includes energy companies such as Norway’s Neste Oil. This is a petroleum company, but it also produces a synthetic biofuel. Within energy companies, it therefore has a higher ESG score than Shell or BP, for example.

As you can see, it’s not all that simple and we’ve only looked at MSCI’s method here. Depending on the index provider, the methods differ – once Nestlé is included, once not, once Apple is in, once not. After all, ETFs have the advantage that you can see the composition very transparently. Go to a provider’s site, download the Excel, and you’re ready to go through all the stocks.

Many actively managed funds, on the other hand, only publish their investments every six months, so you never know exactly where your money is actually invested. Here you have no choice but to trust the management of the fund.

Individual shares

Another way to invest sustainably is to target sustainable companies that match your morals, read their annual report, and then decide to invest. It’s very time-consuming, and before investing, it wouldn’t be a bad idea to not only look at the sustainability issues, but also take a look at the financials. And once you have finally found a suitable company, you should not invest all your money in this one stock, but you should pay attention to a certain diversification, i.e. consider different countries, currency areas, industries.

And this is where the startup Inyova finally comes into play.

Yova went live in 2017 and has digitized the investment methods of private banks to create a sustainable, universally accessible investment solution. In 2021 they changed the name to Inyova. Inyova stands for Invest in Your Values. With Inyova, small amounts of moneycan be invested in a diversified and risk-optimizedmanner. In the meantime, around 200 new customers are added each month.

Inyova is only your asset manager, your shares are held in custody at Saxo Bank Switzerland. When you open an account with Saxo Bank, you will automatically receive a unique IBAN. Incidentally, Saxo Bank is regulated by the Swiss Financial Market Supervisory Authority FINMA.

The Inyova team now includes 23 employees, and as you can see above, the team is quite young and diverse.

Thus, the number of female customers is also higher in percentage terms than with other financial providers. Inyova is strongly committed to women’s financial empowerment and consistently hosts events on this and other topics such as “Starting Investing Without Being a Financial Expert?” and “Investing Basics.”

Impact

Not just ESG, but Impact. Inyova has adopted the definition of the GIIN (Global Impact Investing Network), the global pioneer in impact investing, and understands that: “Impact investing is investing with the goal of achieving a positive, as well as measurable, social and environmental impact in addition to a financial return.”

With Inyova, similar to individual stocks, you can determine which companies you want to invest in and which ones you clearly want to exclude. But Inyova, in addition to pre-selecting companies, also takes care of risk optimization, ensures optimal diversification and makes sure that your portfolio is composed in a way that generates market returns. It goes without saying that this costs something.

Fees

Up to CHF 50,000 you pay an all-inclusive fee of 1.2%. Above that, 0.8% is due and if you have invested more than 150,000, you only pay 0.6%.

In addition, there are no product fees because you are not investing in a financial product like an ETF, but owning the shares directly. And except for the currency exchange fee (0.4%), everything is included, even the stamp duty and the tax statement.

On average, an Inyova portfolio consists of 30 to 40 stocks. Imagine if you had to pick each one out individually and especially buy each one separately. At Swissquote this would cost (let’s calculate with an average of 12 francs per transaction) 360 to 480 francs and then there are custody fees, stamp duty is not included and a tax directory is also missing. With an investment amount of CHF 2,000, 1/4 would already have gone to fees. And Swissquote is still one of the low-cost providers in Switzerland.

Topics and account opening

And how does that work? It’s simple: You first choose your impact topics.

First, you choose the handprint, which is what a company produces or supplies. The following twelve areas can be selected:

- Renewable energy

- Energy saving technology

- Traffic of the future

- Circular economy

- Sustainable forest use

- Clean water

- Vegetable food

- Better education

- Healthcare

- Social justice

- Digital champions

- Swiss champions

After that, you choose the footprint, which is how a company does business. The choices are:

- CO2 footprint

- Human Rights

- Gender Equality

- Fair wages

And finally, you can choose exclusion criteria. These are similar to the ETF exclusion criteria I touched on earlier with ESG ETFs:

- No fossil fuels

- No nuclear energy

- No pesticides

- No weapons

- No meat

- No animal testing

- No alcohol

- No tobacco

Furthermore, you determine the investment amount. The great thing about Inyova is that you can join from as little as CHF 2,000. You can also specify whether you want to set up a monthly savings plan. This one doesn’t commit you to anything, you can just sit it out and pick it up again later.

Risk profile

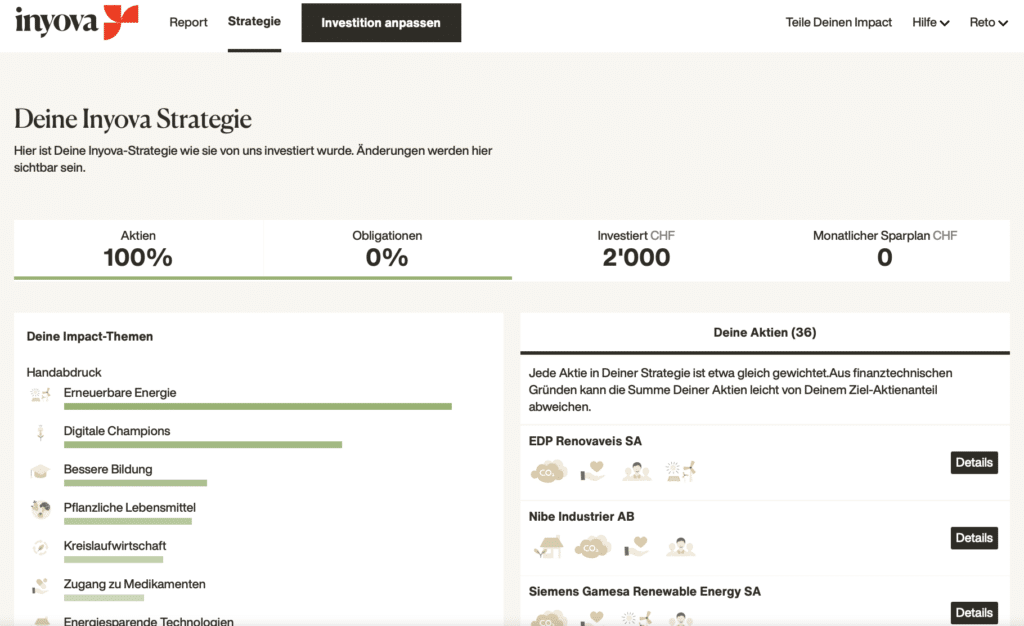

Now your risk profile is created. Based on questions, Inyova puts you into a category, but you can easily override it with a slider. This is especially about how long you want to invest the money and how high the Inyova share is in your total assets. This is then used to determine the ratio of shares to bonds. I have opted for the “very dynamic” risk profile, i.e. I do not use bond ETFs.

As a bond component, Inyova uses a Green Bond ETF for profiles with a lower risk profile. This contains a mix of green corporate and government bonds.

By the way, you can make strategy adjustments at Inyova once a year. Then you can modify your risk profile or the values and impact topics.

Strategy

The Inyova engine spits out a strategy and you get a list of companies – 32 for me. A short description is displayed for each company. So you can go through each one, and if a company doesn’t suit you, you can easily exclude it. In total, Inyova has around 400 companies in its investment universe. You can also add companies to your wish list. The Inyova team then checks whether the company meets their criteria and, if so, includes it in their cosmos. In general, when dealing with Inyova, I had the feeling that the team is very interested in contact and exchange with customers.

By handpicking and dealing with the companies and their products, the attachment is certainly greater than if you have a relatively anonymous ETF with 386 companies.

What happens so quickly on your side, of course, needs expertise in the background. On the one hand in the evaluation of companies according to sustainability criteria, on the other hand in financial theory. This is how your portfolio is put together according to modern portfolio theory. If you want to know more, you should read the whitepaper from Inyova.

General environmental, social and governance ratings are obtained by Inyova from Asset4, the other analyses are performed internally.

I deselected from the Inyova proposal some companies of which I already own individual shares and then had a new strategy created for me.

Account opening

To open the account, a short video chat is now required for identification. Inyova has created a video for this, so you can see in advance how something like this works. If that makes you uncomfortable, you can also attend an Inyova Open Night and have your identity verified in person.

After completing the verification process, which only took one day for me, although Saxo Bank was said to be experiencing delays at the moment, you will receive your personal IBAN number. On it you transfer your initial deposit, in my case CHF 2’000.

By the way, you can also invest money with Inyova for your godchild, grandchild or your own children – of course, also as a savings plan with regular or irregular deposits. Once you have opened your own account, this is a requirement, you can create a Kids account. For this, you create a new strategy. The securities are held as a sub-account in your Saxo bank account. When the person receiving the gift has turned 18, the securities can simply be transferred to them.

Real money account

As I not only want to introduce Inyova, but also follow it in the longer term because I think it is an exciting product, I have opened an account with Inyova with my own money. So you can, as already with Selma, quite transparently follow how my portfolio develops and what innovations there are.

And you can benefit from it too: Use this link* and enter the code FINANZDEPOT when opening an account. This means you pay no fees for the first 12 months.

Speaking of news, here’s what’s planned for the future at Inyova:

- Vote online at general meetings on important decisions of your companies

- Inyova Climate Focus Portfolio

You can find the roadmap here.

I was a little surprised that you can only see your overall performance. I therefore asked customer service what the weighting of the individual companies was and whether it was possible to view the performance of the individual shares. The answer came within half a day and was competent and friendly. The companies are roughly equally weighted, i.e. each is represented with about 3%. Only the overall performance is deliberately shown, as the Inyova strategy is designed for good long-term performance of the entire portfolio. I can understand this argument, but I find it a bit strange: when selecting companies, I can deselect each one and there is in-depth information about them, but then I don’t see how they perform on the stock market. The whole bond falls by the wayside.

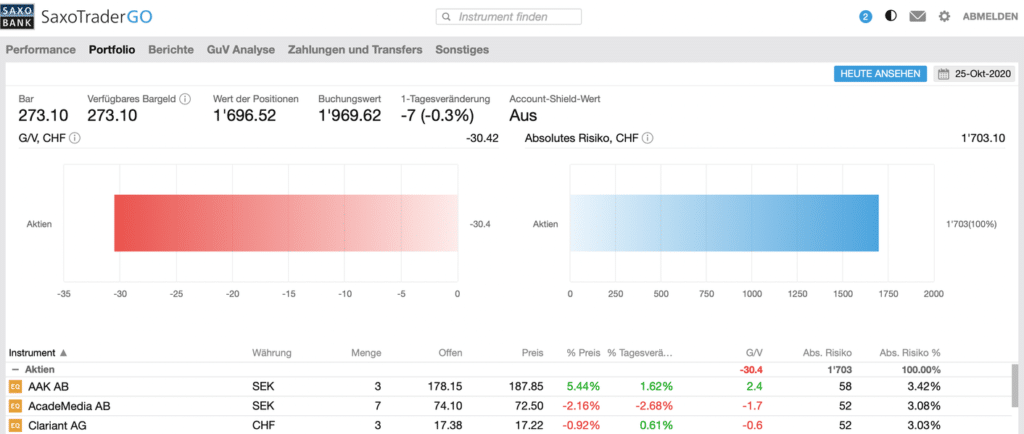

Monitoring access

At my request, I was then given monitoring access to my Saxo account, and there all shares can be tracked individually. The presentation is then no longer quite as hip as that of Inyova. It certainly doesn’t make sense for you to sit in front of it for hours and watch it move. The good thing is that you can’t intervene and trade wildly, the login is only for monitoring, you can’t place buy and sell orders. But on a quarterly basis, I am interested to see how, for example, solar stocks have done compared to stability stocks.

App

The app, which has only recently become available, is kept simple and clear.

You see there the performance, the gross (that is, before fees and reimbursements) and net income, as well as the gross income of the market as a comparison and the impact. For example, this year my company shares saved 213 kg of CO2 and produced 1,844 kWh of clean electricity.

News about the companies can also be found. For example, we can read that Sunrun is acquiring Vivint Solar. The articles are written in an understandable way and put the events in order.

In addition, you will find under “Report” the development of the individual shares in the last 30 days. If you click on the respective stock, you will get a short overview. In addition to the geographical affiliation, you can find out in which industry the company operates and which services or products it offers.

Conclusion Inyova experience 2024

If you don’t want to leave your money lying around on the savings account – because there it is also used by the bank for investments and you can’t influence at all, for which ones – but want to invest in companies, which correspond to your ethical and moral ideas, then Inyova is a super product. I am not aware of anything comparable in the German-speaking world. The fees are a bit higher than with a robo-advisor with ETFs, but in return the investment strategy is also tailored to you, except for the individual companies.

Are you interested in the topic? Then I recommend you the VZ study: an investigation of sustainable equity ETF. You can order the free study with detailed presentation of the different sustainable MSCI indices directly from VZ.

Advertising

Open your Inyova account here* with the code FINANZDEPOT and you will pay no fees for the first 12 months with the impact investing provider Inyova.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.