Letztes Update: 11. April 2025

As the first digital Swiss asset manager, Descartes integrates the cryptocurrency Bitcoin into strategic asset allocation. In addition to the ‘Passive’ and ‘Minimum Risk’ investment models, you now have the option to choose the ‘Minimum Risk BTC‘ model. This combines a risk-based investment strategy with Bitcoin. Here you can learn about the benefits of even a small Bitcoin addition.

Inhaltsverzeichnis

- Bitcoin as Part of Digital Asset Management

- Why Bitcoin? Descartes’ Strategic Approach

- How Descartes Integrates Bitcoin into Asset Allocation

- Opportunities of Bitcoin Addition in the Minimum Risk Portfolio

- Bitcoin in the Portfolio: Who Benefits from Integration?

- Conclusion: Minimum Risk BTC from Descartes

Bitcoin as Part of Digital Asset Management

Until now, a few digital Swiss asset managers only offered the possibility to hold Bitcoin in self-assembled portfolios. But Descartes goes a step further and integrates Bitcoin directly into the strategic asset allocation. I believe that clients of asset managers should trust their standard strategies, and if they don’t, they should look for another asset manager. After all, this is their craft, and one should judge an asset manager not only by costs but also by performance and portfolio composition. And if you really want to put something together yourself, you’re probably better off with a broker.

Why Bitcoin? Descartes’ Strategic Approach

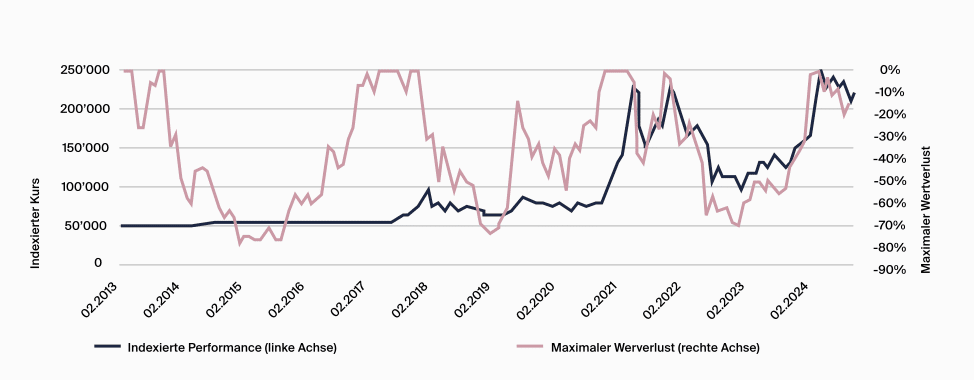

Comparing Bitcoin’s performance with other major asset classes over the past eleven years, Bitcoin was the best-performing asset class in eight years – in the remaining three years, Bitcoin was the worst-performing asset class. It’s becoming increasingly difficult to completely ignore Bitcoin. Measured by market capitalization, Bitcoin is by far the largest and most well-known cryptocurrency. It also has the longest data series, which makes a comprehensive analysis for a well-founded investment strategy possible in the first place.

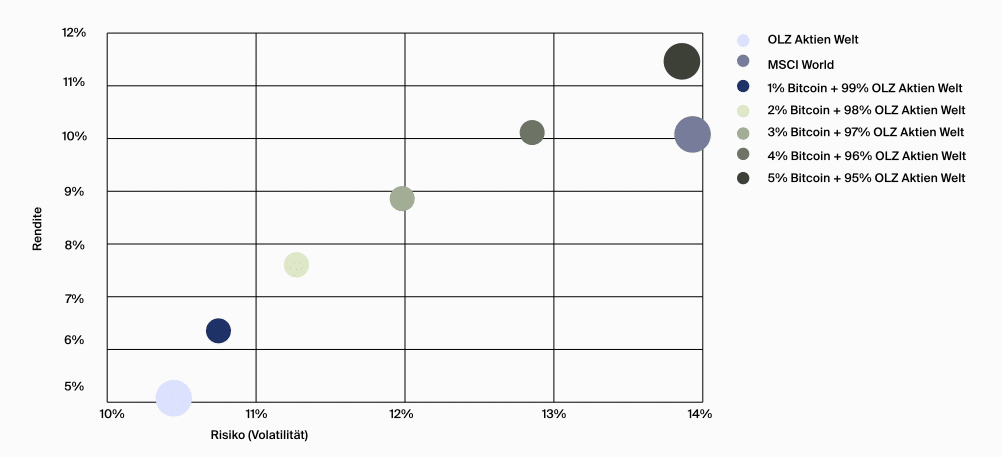

Descartes has conducted simulations that impressively show that adding Bitcoin to the Minimum Risk strategy significantly improves the risk-return profile. The average return increases by 318%, while volatility only slightly increases. The Sharpe ratio, which evaluates risk in relation to return, improves significantly as a result. Higher returns with moderate additional risk – exactly what many investors are looking for.

How Descartes Integrates Bitcoin into Asset Allocation

Descartes’ Minimum Risk Strategy

Let’s first look at what the Minimum Risk strategy is. For this strategy, Descartes uses funds from the Bern-based asset manager OLZ. OLZ specializes in risk-based and scientifically founded investment solutions. Compared to index solutions, where companies are usually weighted by their size, OLZ’s investment concept creates much better diversified portfolios. This leads to lower value fluctuations and smaller losses in negative market phases. In times of increased price fluctuations, the Minimum Risk strategy offers the greatest added value. This was also evident in the first months of 2025, when portfolios with a strong focus on the US and technology stocks had to accept losses – while OLZ funds largely remained unaffected.

The risk-optimized equity strategy from OLZ thus allows for optimal use of the freed-up risk budget. Descartes uses this leeway for targeted Bitcoin inclusion. At the highest equity quota of 95%, the Bitcoin Core ETP from 21Shares is added at 5%. As the equity quota decreases, so does the Bitcoin share; at 20% equities, it’s only 1% Bitcoin.

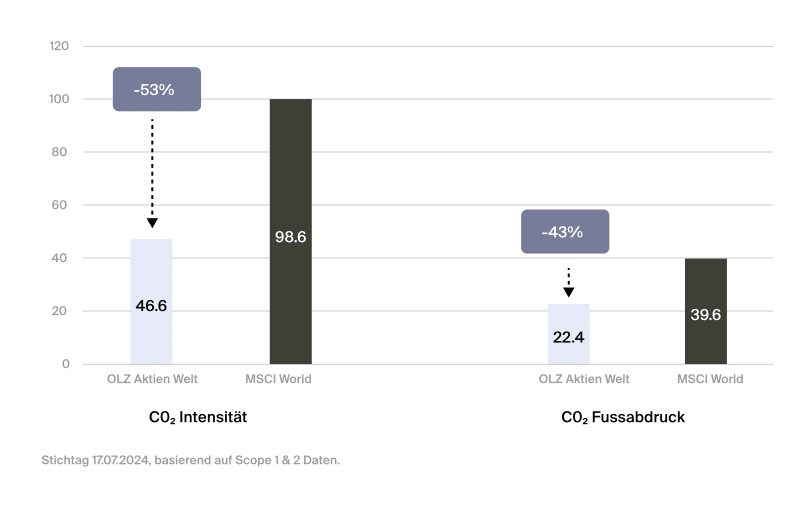

Sustainability and Bitcoin

In addition to the ESG score, OLZ also incorporates CO2 emissions into the investment process, resulting in significantly lower CO2 intensity and a reduced carbon footprint compared to the index. The addition of Bitcoin to the Minimum Risk strategy – which is only done to a small percentage – has no significant impact on the environmental balance. This is also because part of Bitcoin mining is already powered by renewable energies, and the industry is increasingly moving in a more sustainable direction. Moreover, more traditional alternatives like gold are not unproblematic in terms of CO2 emissions and human rights violations.

Descartes Invest, Pillar 3a and Vested Benefits

The addition of Bitcoins with Descartes is only possible in combination with the Minimum Risk strategy, not with the Index strategy. And only in free assets. Within the framework of Pillar 3a and vested benefits, a Bitcoin ETP currently cannot be added with most foundations. As soon as a Bitcoin ETF is approved in Switzerland, Descartes will also offer Bitcoin in occupational pension schemes.

Opportunities of Bitcoin Addition in the Minimum Risk Portfolio

By integrating Bitcoin, the portfolio is not only diversified, but the risk-adjusted return is also improved. Bitcoin is increasingly viewed as ‘digital gold’ and thus offers a hedge against inflation, which can be particularly advantageous in economically uncertain times.

Another advantage is that Bitcoin and traditional financial markets often have only a low correlation, which means that adding Bitcoin makes the portfolio more resilient to market fluctuations. The long-term appreciation potential of Bitcoin could also lead to higher returns, especially in a time of increasing institutional acceptance and growing regulatory clarity.

ETP vs. ETF: What You Should Know About Bitcoin Integration

While no Bitcoin ETF has been approved in Europe yet and a US ETF could have tax disadvantages, the 21Shares Bitcoin Core ETP (Exchange Traded Product) offers a cost-effective and secure way to integrate Bitcoin. The ETP is 100% backed by Bitcoin and is held by an institutional custodian in cold storage.

Unlike an ETF (Exchange Traded Fund), which is considered a special fund, an ETP is a secured debt obligation backed by the underlying assets. However, it does not offer insolvency protection like an ETF, which is why the issuer of the ETP – in this case 21Shares – is of particular importance. 21Shares launched the world’s first physically backed crypto ETP in 2018 and is now the world’s largest issuer of crypto Exchange-Traded Products.

Bitcoin in the Portfolio: Who Benefits from Integration?

For those who don’t want to deal with custody, security, the risk of losing private keys, setting up external wallets, determining tax values, and other challenges, the one-stop shop solution from Descartes offers a simple and uncomplicated option. You can invest in the ‘Minimum Risk BTC’ model with a starting amount of only CHF 10. The all-in fees range between 0.88% and 1%, and a tax statement is, of course, included.

Conclusion: Minimum Risk BTC from Descartes

Bitcoin complements Descartes’ Minimum Risk portfolio – for more diversification and optimized returns with controlled risk. With the ‘Minimum Risk BTC’ model, Descartes enables investors to benefit from a Bitcoin addition without having to deal with the challenges of Bitcoin custody and security. With a minimal entry amount and transparent fees, the solution is accessible to everyone.

Transparency and disclaimer

This article was written in collaboration with Descartes and reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.