Letztes Update: 5. May 2024

I opened my very first securities account with the Dutch broker DEGIRO*. The broker with competitive fees is especially suitable for beginners. The great thing about DEGIRO is that you can manage your securities account in Swiss francs and the conditions – especially for American shares – are very attractive. However, you should be aware that DEGIRO is not a Swiss broker and is therefore not regulated in Switzerland. Nevertheless, it is often mentioned as an alternative to Swissquote. You can read everything else worth knowing in the following article about my DEGIRO experience in Switzerland.

DEGIRO Switzerland

In 2013, DEGIRO started as a broker in the Netherlands. In 2020, DEGIRO merged with the German flatex AG and flatexDEGIRO thus became one of the largest brokers in Europe. By the way, flatexDEGIRO’s shares are listed in the SDAX – the German small caps index. DEGIRO has won over 90 international awards and over 2.5 million investors from 16 countries entrust DEGIRO with their money. Through DEGIRO you can trade on more than 50 exchanges from 30 countries.

flatexDEGIRO Bank AG is primarily supervised by the German Federal Financial Supervisory Authority (BaFin).

If you activate your DEGIRO investment account before June 1, 2024*, DEGIRO will reimburse you the transaction fees up to CHF 110.

*Conditions apply.

DEGIRO Switzerland – Account opening

To open a free account with DEGIRO, you need the DEGIRO app. When you register, you scan your ID card with your phone camera and take a selfie. In addition, you provide information about yourself such as age, profession, etc.

DEGIRO Switzerland – Deposit

When you open a securities account, you specify a reference account. The initial transfer confirming your identity must also come from this account. The minimum amount of the initial transfer is CHF 0.01. DEGIRO doesn’t offer a demo account, but since the initial transfer is so low, you can easily open an account and have a look around the DEGIRO interface. With SEPA transfers, there are no fees for either deposits or withdrawals.

Transfers to DEGIRO are only possible from this reference account and are usually booked within one day. Sometimes, however, it can take two to three working days. DEGIRO does not accept all other payments, including those from third-party providers such as Wise and Revolut or payments in foreign currencies. However, it is possible to set up multiple reference accounts. This way you can make deposits from other accounts, as long as they are in your name. For your security, withdrawals from DEGIRO are only possible to your reference account.

I can’t say anything about opening an account with DEGIRO because it was several years ago. If you’ve recently opened a deposit account with DEGIRO, share your experiences below in the comments.

DEGIRO Switzerland – Money Market Funds and Money Accounts

DEGIRO was not a bank before the merger into flatexDEGIRO was an investment company, and in the Netherlands investment companies are not allowed to hold money from customers. Therefore, your money, which was not invested in your account at DEGIRO, was automatically invested in money market funds.

By merging with flatex, which is a German based and regulated bank, DEGIRO has started to liquidate money market funds and your money will be newly held in cash accounts. The German deposit guarantee now applies to these accounts up to EUR 100,000.

The personal bank details incl. IBAN for deposits at DEGIRO can be found most easily in the top left corner of the DEGIRO app under “Deposits/Withdrawals”.

DEGIRO Switzerland – Fees and Profiles

DEGIRO advertises that it offers “incredibly low fees”. For example, trading shares on the Swiss Stock Exchange SIX costs only CHF 5.00 plus a handling fee of CHF 1.00. And this is even independent of the volume. So it doesn’t matter if you trade shares worth CHF 200 or CHF 20,000.

ETFs are even cheaper, namely EUR 2.00 plus a handling fee of CHF 1.00. This makes DEGIRO the most favorable broker for Swiss ETFs on the Swiss stock exchange.

The highlight comes at the end: On all major US and Canadian stock exchanges, such as the New York Stock Exchange, NASDAQ and Toronto Stock Exchange, DEGIRO charges only a fee of EUR 1.00. In addition, external processing fees of EUR 1.00 per transaction will be charged. Incidentally, American ETFs cannot be purchased, as DEGIRO applies European regulation to Swiss clients as well.

Transfers of securities to another broker are relatively expensive. External costs are added to the EUR 20 for DEGIRO per outgoing position. For example, the total fee per outgoing position for the Swiss stock exchange SIX is EUR 88.00. Other exchanges are usually cheaper. The securities account transfer to DEGIRO is now free of charge (previously EUR 10 per position was due).

DEGIRO offers a total of three different types of securities accounts. The “Basic” securities account profile is suitable for private investors with a long investment horizon. This means that securities loans are not available, trading in options and futures is not possible, and securities cannot be sold short.

Later changes from the Basic profile to a more complex profile are possible. However, you will then have to take aptitude tests, where your knowledge and experience will be tested.

Basic

DEGIRO can lend your securities with this type of custody account. The borrower deposits a security deposit with DEGIRO in the amount of at least 104% of the value of the borrowed securities. Cash amounts, liens on cash amounts or other securities can be deposited as collateral.

The lender – in this case DEGIRO – receives a fee for the securities lending. This fee is fully due to DEGIRO and enables the favorable fees.

Custody (no longer available)

With the custody profile, your securities are not lent out. Therefore, a different price list applies. So here the dividend processing costs EUR 1.00 plus 3% of the dividend (maximum 10%). If you choose accumulating ETFs instead of distributing ETFs, the reinvestment of the dividend takes place in the ETF itself and therefore you can avoid this fee.

Unfortunately, new customers can no longer open a custody profile. However, existing customers can continue to use their custody profile.

The fees for trading securities are the same for both profiles. You can find all details about the fees in the PDF price lists on the DEGIRO website. For existing custody customers: Make sure that there are two different ones: A “Custody Price List” and a “Price List” that applies to the remaining four profiles.

Currency exchange

By default, AutoFX Trader is enabled. This means that foreign currencies are automatically converted to CHF and you hold only CHF on your cash account. For example, if you receive dividends in USD, they will be automatically converted to CHF. This exchange costs a favorable 0.25%. If you don’t want to do this, for example because you trade mainly American stocks, you can switch to manual currency exchange and keep a cash position in USD. An exchange then costs EUR 10 plus 0.25%.

The fees are always calculated in the home currency. So you should always keep a certain CHF balance. As already written, deposits and withdrawals are only possible in the home currency.

By the way, the settlements to the foreign currency are shown transparently in the transaction confirmation emails. There you can see exactly in absolute francs how much you paid for the exchange.

There is a fee per exchange to set up trading modalities. This somewhat absurd fee is made up as follows: For the home exchange – for us Swiss the SIX – the fee does not apply. However, as soon as you trade on another exchange or even hold a position on another exchange, you will be charged a fee of EUR 2.50 per exchange and calendar year.

As DEGIRO is not a Swiss broker, no stamp taxes have to be paid.

Registration in the Swiss share register is not possible at DEGIRO. This means that dividends in kind cannot be drawn and participation in general meetings is more costly. For EUR 5 you can get a UBO certificate from DEGIRO. This identifies you as the Ultimate Beneficial Owner and allows you to self-register for the Annual General Meeting. However, check with the investor relations department of the company in question beforehand to see if they will accept such a certificate at all.

DEGIRO Switzerland – Savings Plans

Unfortunately, savings plans cannot be set up at DEGIRO. However, DEGIRO offers a core ETF selection. These are ETFs that you can trade once a month without commission. You only pay a handling fee of EUR 1.00.

For example, the Vanguard FTSE All-World UCITS ETF in the accumulating variant (IE00BK5BQT80) is offered as a core selection ETF on the XETRA and Tradegate exchanges.

Unfortunately, not a single core selection ETF is traded on the SIX or in CHF. So, there is always a currency transaction and the fee to set up trading modalities is due. You can find the list of ETFs at DEGIRO under Prices/ETF Core Selection.

DEGIRO Switzerland – Orders

Orders on some exchanges are not forwarded directly to the exchange in question, but are passed on to a third-party provider. Currently, DEGIRO uses Morgan Stanley as a third-party broker. For example, orders on the Swiss stock exchange SIX are processed via Morgan Stanley and not directly via DEGIRO.

As a securities trading firm, DEGIRO and the third party brokers are required by law to ensure that orders are executed on a best execution basis. DEGIRO regularly monitors Morgan Stanley’s execution quality and makes the information from this review available on the website.

It is important to note that DEGIRO does not receive any third party payments in any form from the third party brokers used.

Further details can be found in the document “Information on Securities Services, Orders and Order Execution Policies” directly on DEGIRO’s website.

DEGIRO Tax return Switzerland

DEGIRO does not offer a Swiss tax statement. However, you will automatically receive a PDF called “Annual Summary” from DEGIRO for the past year, listing all positions and dividend receipts. This allows you to manually transfer all items to the Swiss tax return and send the PDF as a receipt for the tax office. This has always worked well for me and there have been no inquiries from the tax offices in Bern and Zurich. So if you only have a small trading volume, it is quite feasible to complete the Swiss tax return with DEGIRO.

In order for DEGIRO to apply the reduced withholding tax rate on U.S. income, you must complete the online form “W8-BEN/W8-BENE”. However, DEGIRO only applies reduced tax rates to selected US shares. The list of approximately 2,000 U.S. stocks to whose dividend distributions the reduced rate of 15% is applied can be found on DEGIRO’s website.

DEGIRO Switzerland Experience and Conclusion

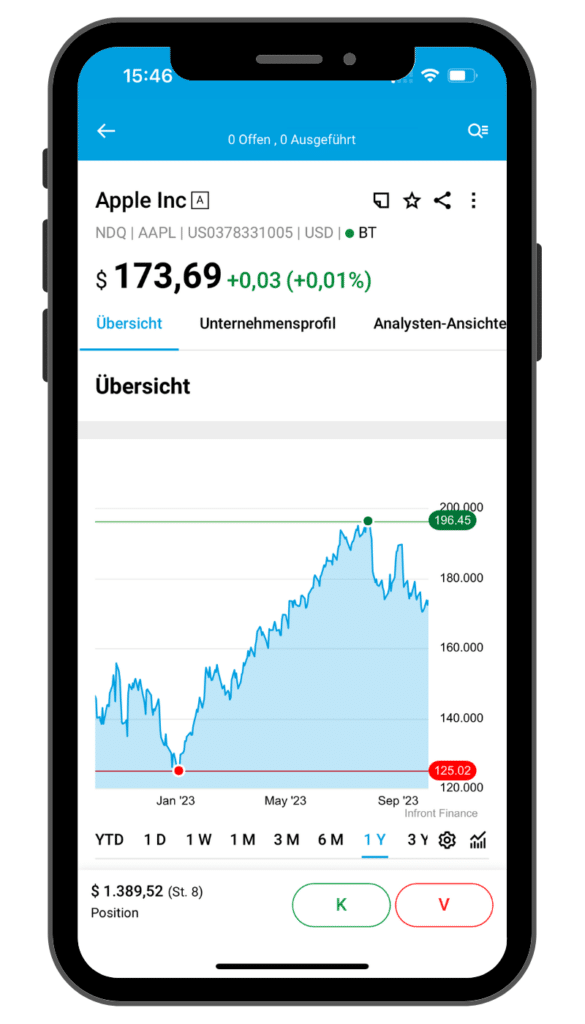

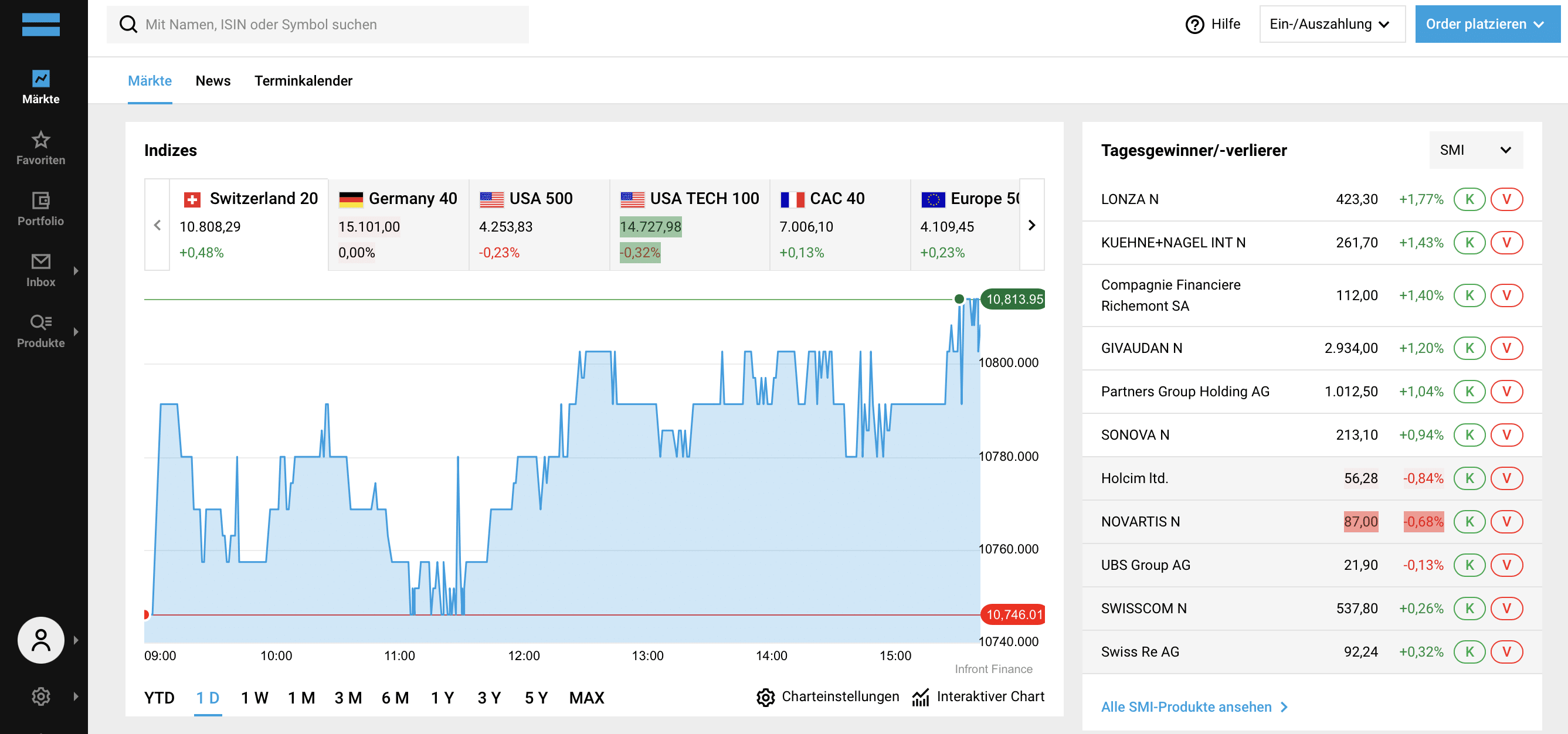

So far I have not had any bad experiences with DEGIRO. Deposits and withdrawals always arrived on time and the trading platform works reliably. The full-fledged app is constantly being expanded, but is still easy to use. And the desktop version is also suitable for beginners.

Find out how you can easily buy an ETF at DEGIRO here.

If you are not concerned that your securities are not held through a Swiss broker and you can do without the registration in the share register, DEGIRO offers a very attractive price-performance ratio.

Investing involves risk of loss.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.