Letztes Update: 28. September 2023

We have already opened the securities account, transferred Swiss francs and exchanged them into euros – as you can read here – and now it’s time to set up the savings plan as Swiss at Smartbroker.

The fund to be saved

I have chosen “The Digital Leader Fund” (DLF). Yes, an actively managed fund. You’ll find out why in a moment, but first a little info about the fund.

The fund is divided into three sections:

- Digital Transformation Leaders (Straumann, BBVA…)

- Digital Business Leaders (Facebook, The Trade Desk…)

- Digital enablers (Nutanix, HubSpot…)

I originally wanted to save for a Nasdaq-100 ETF, but with the dominance of Apple (13.52%), Microsoft (10.98%), Amazon (10.94) and the rest of the tech giants, I was a little uncomfortable. These stocks are already very well represented in my America ETF. The ten largest positions already account for 55.84% in the Nasdaq-100 ETF.

That’s why I was looking around for a tech alternative and came across DLF. The team around DLF presents itself with a blog, is on the road with its own Wikifolio on Wikifolio and has recently appeared more and more frequently on Instagram, YouTube and in podcasts.

The largest position in DLF is Facebook and amounts to 5.54%. The second position is much more unknown with Pure Storage (4.30%). So smaller companies tend to be overweighted here. Walmart then appears in third place (3.83%), which should come as something of a surprise, as the first thing that would come to my mind would not be a retail group as a pioneer in digitization. However, the ten largest positions still account for a respectable 41.23%.

The ongoing charges are 1.66% and a performance fee (performance-related remuneration) is payable. So not quite cheap compared to a Nasdaq ETF with a TER of 0.30%.

As always, this is not an investment recommendation, I simply needed a fund that I could save in order to test Smartbroker extensively. And of course I do that with my own money.

Savings plan setup

To create a savings plan, select “Investment” and then “Create savings plan”. You search for your desired ETF or fund, define the monthly rate (minimum 25 euros), as well as the interval and the execution day. You can also specify a start and end date.

Settlement is done either through your Smartbroker settlement account or via LSV through another bank’s account. Whether this also works with a Swiss account, I do not know. But you should be careful with the lousy exchange rates of the Swiss banks.

For me, however, the setup only worked on the laptop. I could not select the dropdown list with either the smartphone or the tablet.

Once everything is done, you will be taken to an overview where the savings plans that have been set up are listed. This is not readable on the smartphone. The responsive display makes a real mess. One really wonders why they Smartbroker teamed up with a backward French big bank. Once again, this has nothing to do with smart.

Experience with Smartbroker

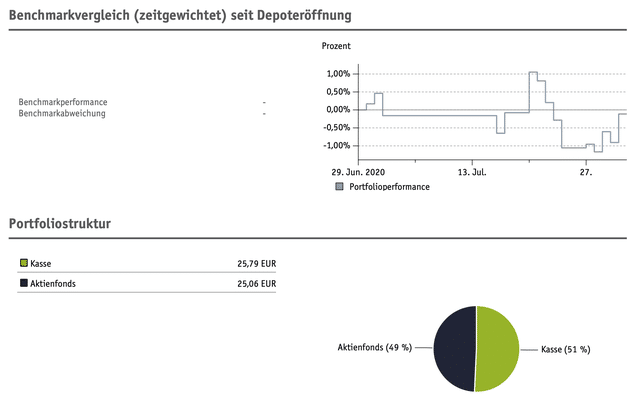

At the end of the month there is a personal wealth report. On this multi-page PDF you will find an asset overview, a portfolio overview and a transaction overview.

The design is debatable, but if you go to Smartbroker, that’s not the main argument anyway. Anyway, the list is quite extensive and you get a good overview of the past month. The data is also processed graphically, as you can see below.

In terms of transparency, the fee schedule should also be highlighted. At first glance, you can see which fee has been incurred and in what amount.

If the whole thing doesn’t interest you, then you don’t need to read this. You will not receive it as an e-mail, but you will find it in your mail manager. As already mentioned, a cumbersome login with TAN request is necessary to retrieve the data.

Speaking of TANs: Recently, the DAB SecurePlus app has had to be downloaded. This scans the QR code displayed when logging in. An eight-digit code is generated on it, which you have to type in at the input mask. The design… well, you know… At least the setup worked flawlessly and reasonably fast for me.

Unfortunately, I still can’t report anything about the support, because they still haven’t contacted me after one and a half months. An absolute no-go. At the beginning there was an automatic mail that there may be delays due to high email volume, but waiting over one and a half months for the simplest questions, that’s way too long! Even after six months, not a single e-mail was answered. Smartbroker really has a problem with customer service.

Conclusion

As you can probably guess from the basic tone of my article, I’m not really excited about Smartbroker. The opening process is extremely cumbersome, the design is stale, and the handling is anything but smart. And then there’s the downside with the currency: the exchange of Swiss francs into euros incurs additional fees.

But in Germany seems to pull cheap and cumbersome anyway. Smartbroker announced on August 13 that they have recently started servicing assets of over one billion. This is remarkable, after all, the broker has only been in existence for eight months.

Unfortunately, there is still no viable ETF savings plan for Swiss investors. So what are the alternatives? Either you take everything into your own hands, create a manual savings plan with a custody account at a Swiss broker like Swissquote and buy your ETF yourself on a monthly, quarterly or semi-annual basis. Or you can opt for a robo-advisor like Selma, which takes everything off your plate for a fixed fee and creates a globally diversified portfolio for you.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.