Letztes Update: 28. September 2023

This article is to be seen as a follow-up to“THE COLUMN 3A COMPARISON – FIND THE SUITABLE PROVIDER“. It can be called a neerdy variant of it. So before you read this post, I recommend you read the previous one, and you don’t have to understand every last detail of what is talked about here to open an account with one of the providers – as already written, I can recommend all four. But don’t worry, it won’t be that dry now, I tried to include some graphics as well.

One rainy Sunday afternoon, I was interested to see how the asset allocation of providers differed. So I wanted to know how each provider allocates to different regions and what other asset classes, such as gold or real estate, they weight and how heavily.

For this purpose, I looked for the strategies with an 80% share of stocks at the individual providers and found the weighting on their factsheets.

All figures in the table below have a certain inaccuracy factor. So not all datasheets and factsheets are from the exact same date and frankly there is only one strategy with 75% or 95% stocks, so some inaccuracy here as well. Of course, I chose the 75% strategy for the comparison because it is closest to the 80% of the other providers. But even with this inaccuracy, interesting differences show up, as you’ll see in a moment.

By the way, Selma’s strategy with 80% shares no longer exists.

Country and regional breakdown

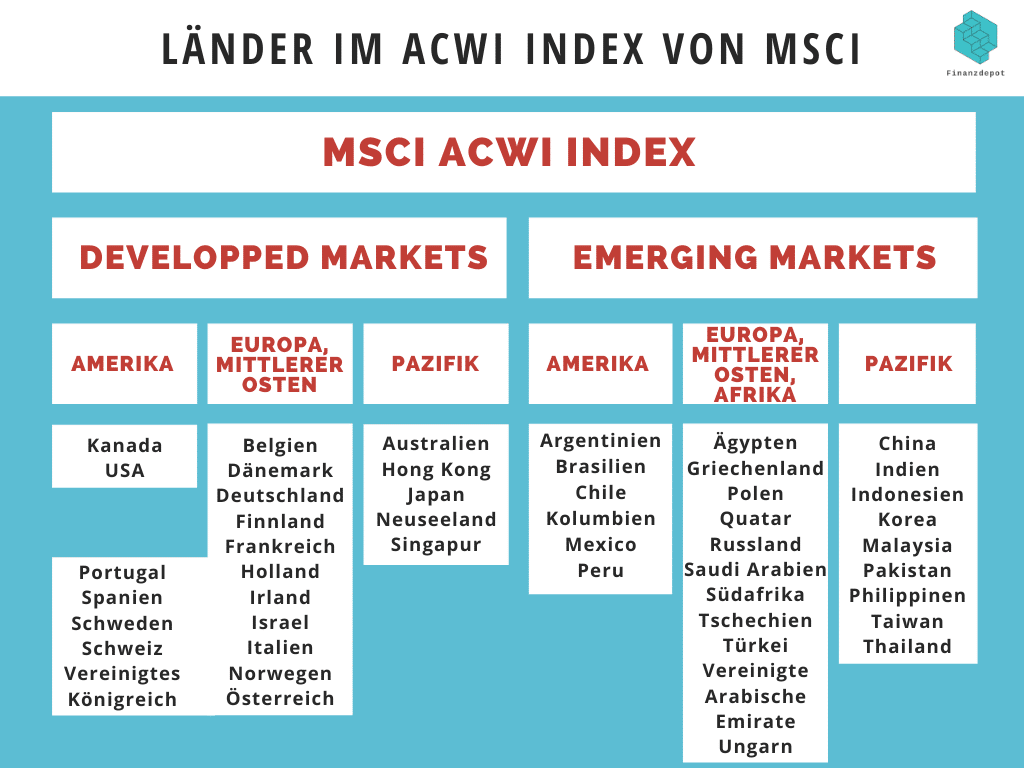

In order to compare regions, we must first define which countries belong to which region. I have relied on the classification of the major index provider MSCI, as many funds have MSCI’s indices as benchmarks (measures of comparison).

And that looks then so also – as promised as a picture:

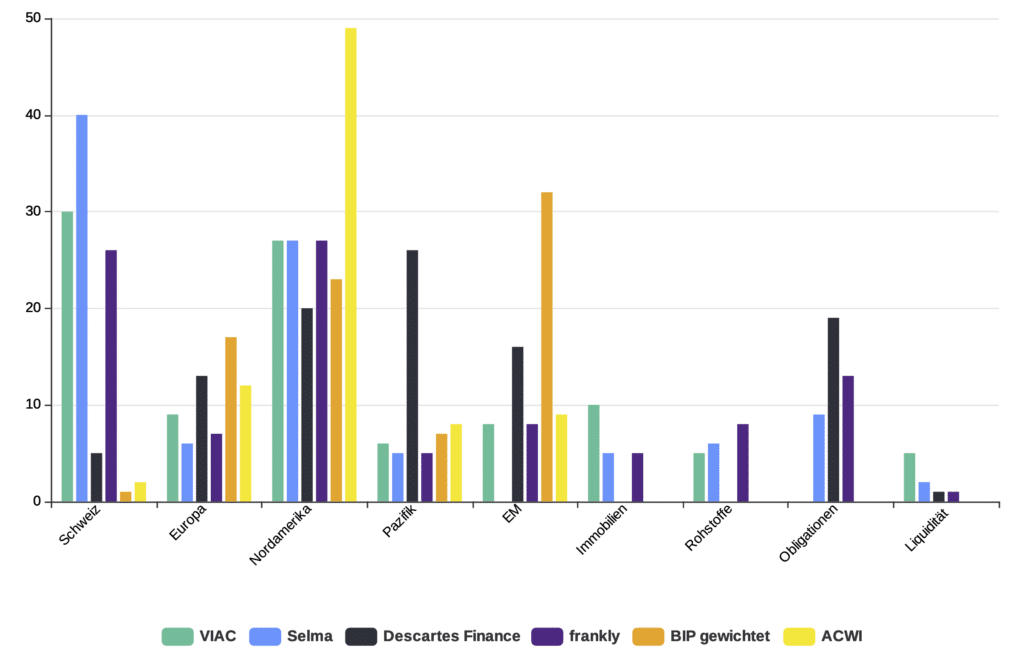

In order to compare the strategies of the Pillar 3a providers with the ACWI allocation, I have excluded the 20% portion that is not invested in equities.

Most and largest ETFs you can buy are market weighted, like the ACWI. To calculate market capitalization, the market value, i.e. the share price traded on the stock exchange, is multiplied by the number of shares of the company in circulation. For example, Apple’s market capitalization is CHF 1,849.77 billion, while Nestlé’s market capitalization is CHF 306.07 billion. Accordingly, Apple is weighted six times higher in the index than Nestlé.

In addition, I have included the weighting by gross domestic product GDP in the comparison and removed the 20% share as well.

What exactly does GDP measure? In extremely simplified terms, GDP measures the economic performance (value of all goods and services) of a country. This can be used to compare countries and regions or to calculate economic growth. The weighting is therefore based on the economic performance of the countries or regions.

Comparing the two weightings, it is noticeable that in the weighting by market capitalization, North America is represented twice as strongly, while the emerging markets have a much lower weighting.

It will look like this:

The strategy comparison

| VIAC | Selma | Descartes Vorsorge | frankly | BIP | ACWI | |

| Strategie | Global 80 | AP 7 | 80% | Strong 75 Index | Bruttoinlands- produkt | MSCI All Countries World Index |

| Schweiz | 30% | 40% | 5% | 26% | 1% | 2% |

| Europa | 9% | 6% | 13% | 7% | 17% | 12% |

| Nordamerika | 27% | 27% | 20% | 27% | 23% | 49% |

| Pazifik | 6% | 5% | 26% | 5% | 7% | 8% |

| Emerging Markets | 8% | - | 16% | 8% | 32% | 9% |

| Immobilien | 10% | 5% | - | 5% | - (20%) | - (20%) |

| Rohstoffe | 5% | 6% | - | 8% | ||

| Obligationen | - | 9% | 19% | 13% | ||

| Liquidität | 5% | 2% | 1% | 1% |

Or more colorful and graphic:

In general, it is noticeable that Switzerland was weighted relatively high compared to the ACWI or GDP weighting for all providers.

In addition, the U.S. is underweighted in all providers compared to the ACWI weighting. In the ACWI, the U.S. also has a very strong position, whether this makes sense is another question.

And if we compare the strategies of the pillar 3a providers with each other, the following stands out:

- Selma bez. the VermögensZentrum is invested with 0% in emerging markets (emerging economies)

- Descartes Vorsorge has a comparatively small Swiss position, but is relatively heavily invested in emerging markets and the Pacific region.

- Descartes pension plan is not invested in commodities or real estate funds at all

To better understand the background that led to these weightings, I checked with VermögensZentrum and Descartes Vorsorge and asked them the following questions.

Telephone interview with Andreas Akermann, Head of Private Clients VZ VermögensZentrum

How does the comparatively high percentage figure for Swiss equities come about?

The high weighting of the home market makes sense because, historically, the Swiss stock market has tended to be defensive and because the dividend yield of Swiss companies is higher than in international comparison.

Another argument is the high sustainability rating of the SPI. Compared to other countries, Swiss companies would perform better.

Finally, there would be no foreign currency transactions for Swiss equities. Due to the international nature of many Swiss companies, Swiss equities are already invested in many regions of the world.

The emerging markets asset class is completely missing. What are the considerations behind this exclusion?

Exposures to emerging markets are often associated with higher costs, he said. In addition, the sustainability rating of emerging market funds is lower and the shares are more susceptible to fluctuations.

What is the portfolio structuring based on? Is this regularly reviewed and adjusted or is it static?

As a pioneer in the use of ETFs in the third pillar, VermögensZemtrum VZ has a lot of experience in putting together portfolios. These are reviewed regularly and reacted to market conditions. The products used would also be reviewed regularly, and if they were cheaper or more suitable, they would consider replacing them. In addition, the expansion of the product range can be expected in the future.

Written interview with Dr. Adriano B. Lucatelli, Co-Founder and Managing Director Descartes Vorsorge

How does the comparatively low percentage figure for Swiss equities come about?

Our goal is to maintain an optimally diversified portfolio worldwide. We therefore deliberately avoid a so-called “home bias” – i.e. a strong overweighting of the Swiss equity market. Even the 5% Swiss equities in our portfolio already correspond to a small overweight compared to the share of market capitalization of Swiss companies in the global equity market. Moreover, this does not lead to more foreign currency risks in the portfolio for the following reasons:

- Despite being listed in CHF, Swiss equities have major foreign currency risks, as almost all large Swiss companies generate most of their sales abroad. This was demonstrated to investors once again when the CHF/EUR minimum exchange rate was lifted on January 15, 2015, during the sharp drop in the price of Swiss equities.

- In the case of the World Equities (ex Switzerland) fund we use, the foreign currency risks are hedged against the CHF hedged.

In contrast, a relatively large amount is invested in emerging markets and the Pacific region. What are the considerations behind this?

Emerging markets equities account for 20% of the total equity allocation, which has proven to be suitable in terms of optimal portfolio diversification. This figure is slightly higher than the share of the market capitalization of emerging market equities in relation to the overall equity market.

The strong weighting in the Pacific region is the result of risk-based portfolio optimization and is partly due to the significant underweight in US equities.

It is also noticeable that investments are made neither in commodities such as gold nor in real estate funds. Why are these asset classes excluded?

We attach great importance to the separation of risk factors, which is why we invest exclusively in first-class bonds (interest rate risks) and equities (equity risks). Only investments are held where the risks incurred are compensated in the form of an additional return (risk premium), which is why commodities are deliberately avoided. In addition, our investments have a high level of liquidity, which can be traded daily without any problems even in periods of stress. This excludes investments in real estate funds. Some real estate exposure is also included in our portfolios within the equity portion, via the listed real estate companies.

What is the portfolio structuring based on? Is this regularly reviewed and adjusted or is it static?

The equity funds are implemented according to OLZ’s minimum risk investment concept. Intelligent and risk-based selection and weighting of stocks can reduce the risk by around 20%-30% compared to conventional investment solutions. Our equity funds also benefit from the excess return of low volatility equities. The result is an additional return in the long term with lower risk at the same time. In addition, all funds used take sustainability criteria (ESG) into account in the investment process (e.g. by excluding companies with an insufficient sustainability rating; above-average sustainability rating at portfolio level).

Within the funds, portfolio weights are “rebalanced” quarterly based on the new portfolio optimization. The stock selection/weightings thus change in each case due to changes in the market environment, which naturally also leads to changes in the sector weightings or country weightings.

As you can see, the products of the providers and the concepts behind them differ quite significantly from each other. And I don’t want to pit the individual providers against each other here or comment further. Ultimately, you need to be comfortable with your provider and the strategy you use. Hopefully, this blog post can help you make your decision or reinforce the decision you’ve already made.

As written in the previous post, it also doesn’t hurt to have more than one Pillar 3a and more than one provider. You can also start with small amounts monthly and once you feel comfortable with one provider, you can transfer the funds to that one or consider only that one for further deposits. And I repeat myself again: starting is the biggest hurdle, so better today than tomorrow. Since you can open a Pillar 3a online with all providers, you can also start in the evening or on the weekend – so go ahead.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.