Letztes Update: 28. September 2023

ETFs are on everyone’s lips. When it comes to low-cost investment products, sooner or later ETFs fall. Index funds are often completely forgotten in the process. However, these already existed before ETFs. This article is about the differences and similarities.

In the second part of the post, I’ll show you how to find an index fund and how to buy it from Swissquote.

Index funds

In the 1970s, the first index fund was launched in the USA. What does an index fund do? It stubbornly holds the shares that an index issuer specifies. The best-known index in Switzerland is the SMI. If the SMI index contains 18% Roche, the SMI index fund must also hold 18% Roche. So there are no ingenious fund managers at work trying to pick out the best stocks, but rather an index is followed quite simply and transparently. This is also called passive investing. Because the effort is less than if someone has to actively evaluate and select stocks, index funds are usually very cost-efficient. They have a low TER (total expense ratio). Compared to actively managed funds, they are only about half as expensive or even cheaper.

ETF

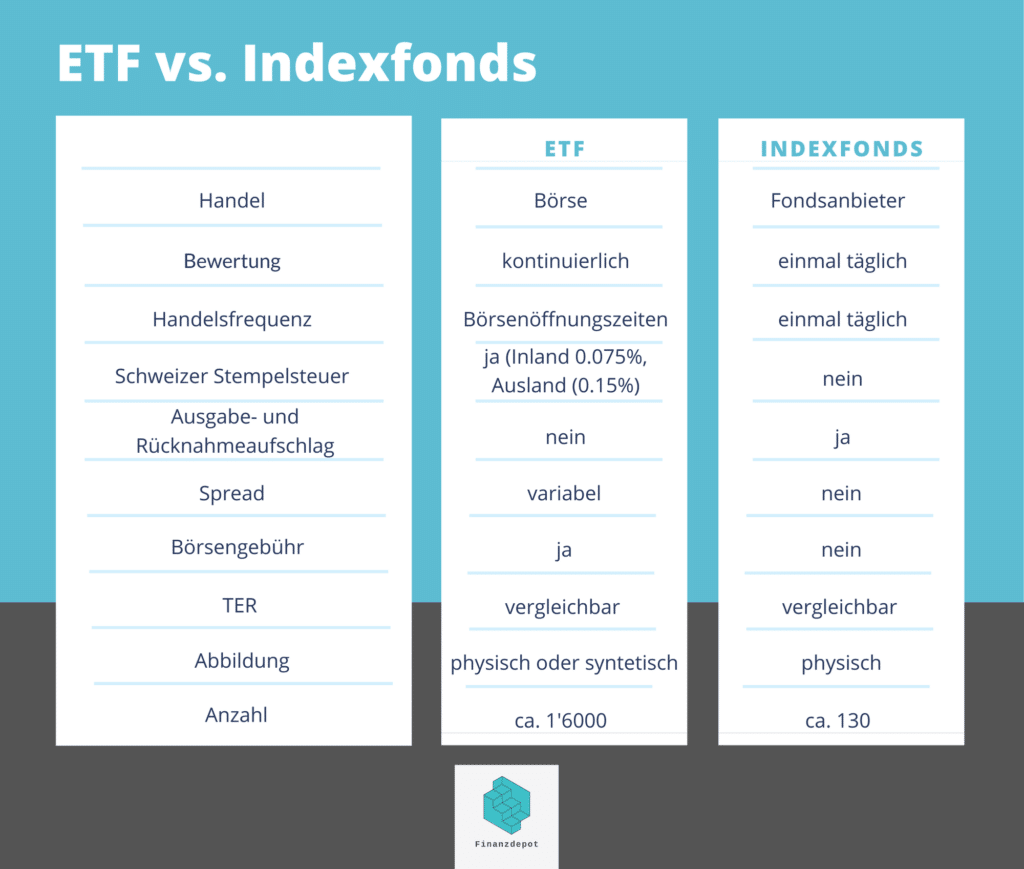

A little more than ten years later, an ETF-like product was launched – again in the USA. Basically, an ETF does exactly the same thing as an index fund, it follows an index. However, you can buy and sell an ETF just like a stock during stock exchange opening hours. After all, the name implies this. The three letters are the abbreviation for Exchange Traded Fund. This brings us to the biggest difference – tradability.

Differences

An index fund, on the other hand, is issued directly by the fund company only once a day and is not traded on an exchange. This has the advantage that there are no exchange fees and no spread. On the stock exchange, there is always a buying and a selling price for a share. The more frequently a share or an ETF is traded, i.e. the more liquid it is, the closer these prices are to each other. For investors with a long investment horizon this does not play such a big role, but for short-term traders it does.

In contrast, an index fund has an issue premium and a redemption premium. When you buy an index fund, this front-end load is deducted. In this way, investors who are already invested in the fund are not disadvantaged. This is because your purchase means that the fund manager now has to buy additional shares, which results in transaction costs. Of course, this happens only once, at the time of purchase. The redemption premium is then deducted upon sale.

In terms of running costs, the two products are similar. The TER is therefore similarly low. However, the competition among ETFs is greater, so the costs are even lower.

And another thing they have in common: both are legally considered special assets. If a provider goes bankrupt, the securities do not end up in the bankruptcy estate.

Because an ETF can be traded during the entire trading period, its price naturally fluctuates. With the index fund, there is a single price per day. It is traded, mostly in the afternoon, at NAV. How is the net asset value (NAV) of an equity fund calculated? You add up the value of all the stocks in the fund and subtract liabilities like the total expense ratio (TER). Then divide this value by the number of units issued by the provider to obtain the net asset value.

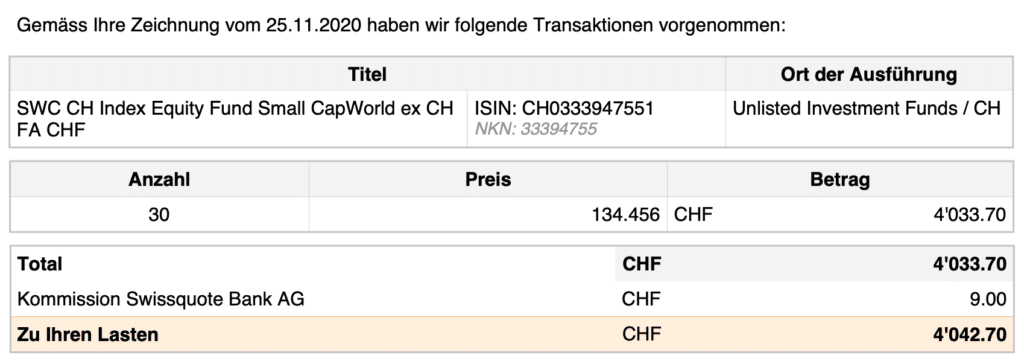

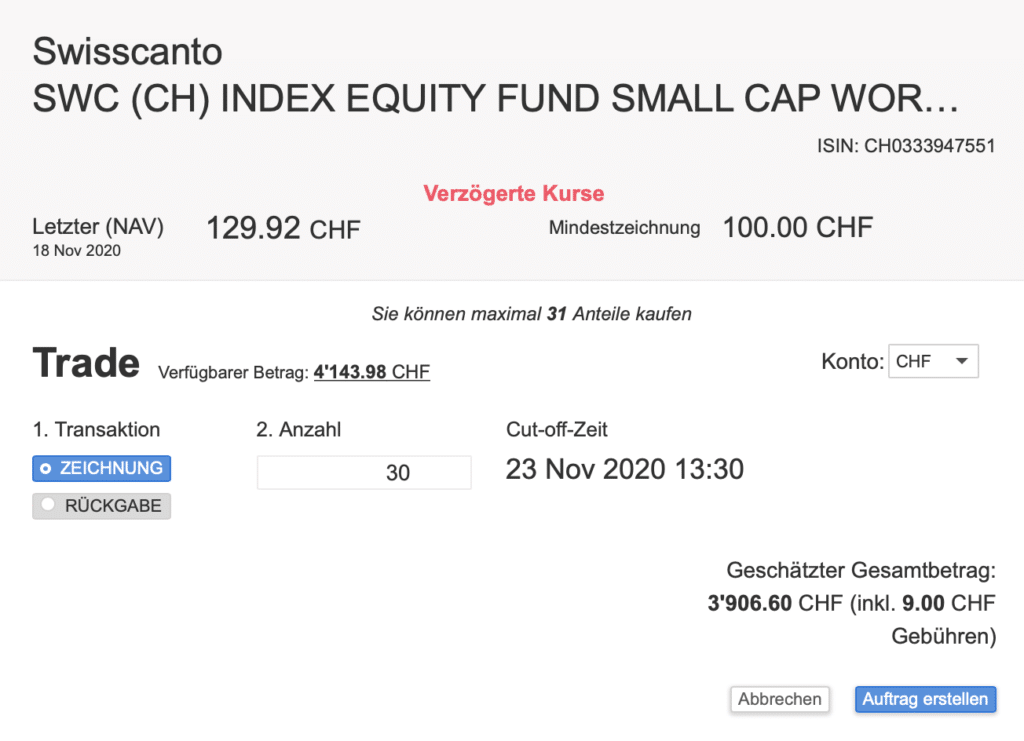

A simplified example: A fund consists only of Roche and Novartis shares. A Roche share has a value of CHF 300, a Novartis share of CHF 80. The fund contains 10 Roche shares and 40 Novartis shares, giving 300 x 10 + 80 x 40 = 6,200. Now the TER would be deducted, calculated down to one day, but we leave that out for the sake of simplicity. A total of 1,000 shares were issued. So the NAV is 6’200 : 1’000 = 6.20. The index fund I bought had a NAV of CHF 129.92 on the day I placed the order. You can see this on the print screen of Swissquote below.

Another difference: Index funds are always physically represented in Switzerland. What does that mean? The fund actually purchases the securities contained therein. Synthetic replication uses swaps and does not require the shares of the index to be held. This barter transaction with a bank gives rise to a so-called counterparty risk. These are all rather complicated constructs and, at first glance, not very transparent for the private investor. Many then also do not feel comfortable with it and therefore opt for the physical image. The advantages of synthetic replication are: The ETF usually follows the index somewhat more closely and is often somewhat cheaper, since not all shares have to be purchased. A synthetic ETF can also make sense from a tax perspective.

ETFs can track the index both physically and synthetically. Most ETF comparison tools allow you to filter by replication method to find the right ETF for you.

In addition, the range of ETFs is much larger. Around 1,600 ETFs are now tradable on SIX. While there are only about 130 index funds to choose from.

The following table shows you the differences at a glance.

But now let’s get to the practical. How do you find an index fund, and how do you buy one?

Search of an index fund

Let’s start with the more difficult part. While you can search and compare ETFs on various portals, there is no such tool for index funds in Switzerland. If you know of one, be sure to post it below in the comments.

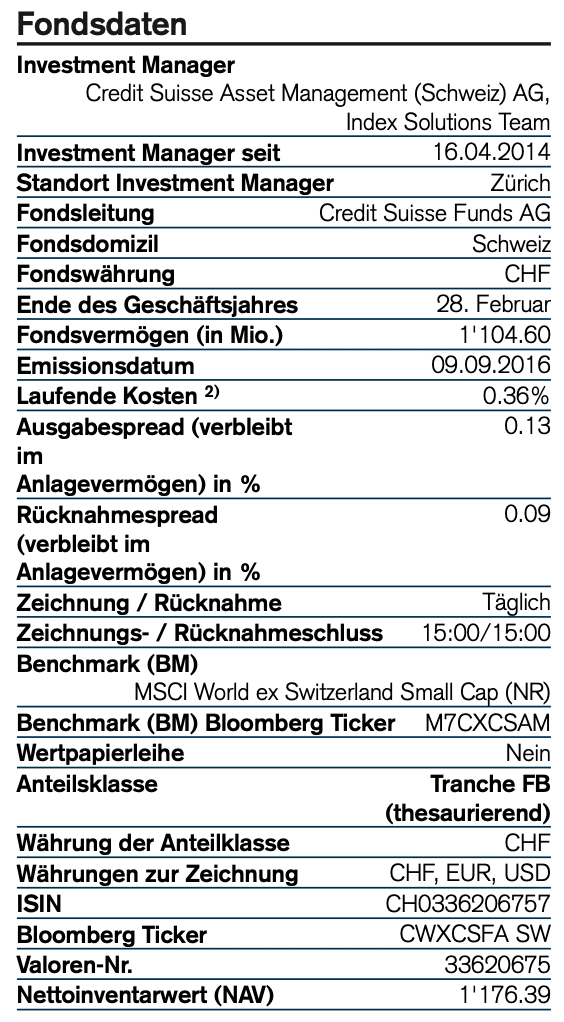

So you have to go to each individual provider’s website and search for the fund. In addition to UBS and Raiffeisen, which both have a very limited selection, Credit Suisse and Swisscanto offer the most products. BlackRock, Vanguard or Pictet also offer index funds in Switzerland. However, their NAV is usually very high, so that they are only suitable for private investors to a limited extent.

If you know which strategy you want to follow, that is, which index you want to follow, you can go searching on their websites. Now you have to collect all the data for your comparison yourself. With two providers, however, the effort is still limited.

I was looking for a global small cap fund. This is also available as an ETF, but there is only one ETF listed on the SIX with a TER of 0.45%. There is no exact equivalent as an index fund, as Switzerland is always excluded from the index funds offered. The index is then also called “MSCI World ex Switzerland Small Cap Index”. But I don’t mind, Switzerland only accounts for a little more than 2% anyway, and I have an ETF on Swiss small caps. So they are already overweighted anyway.

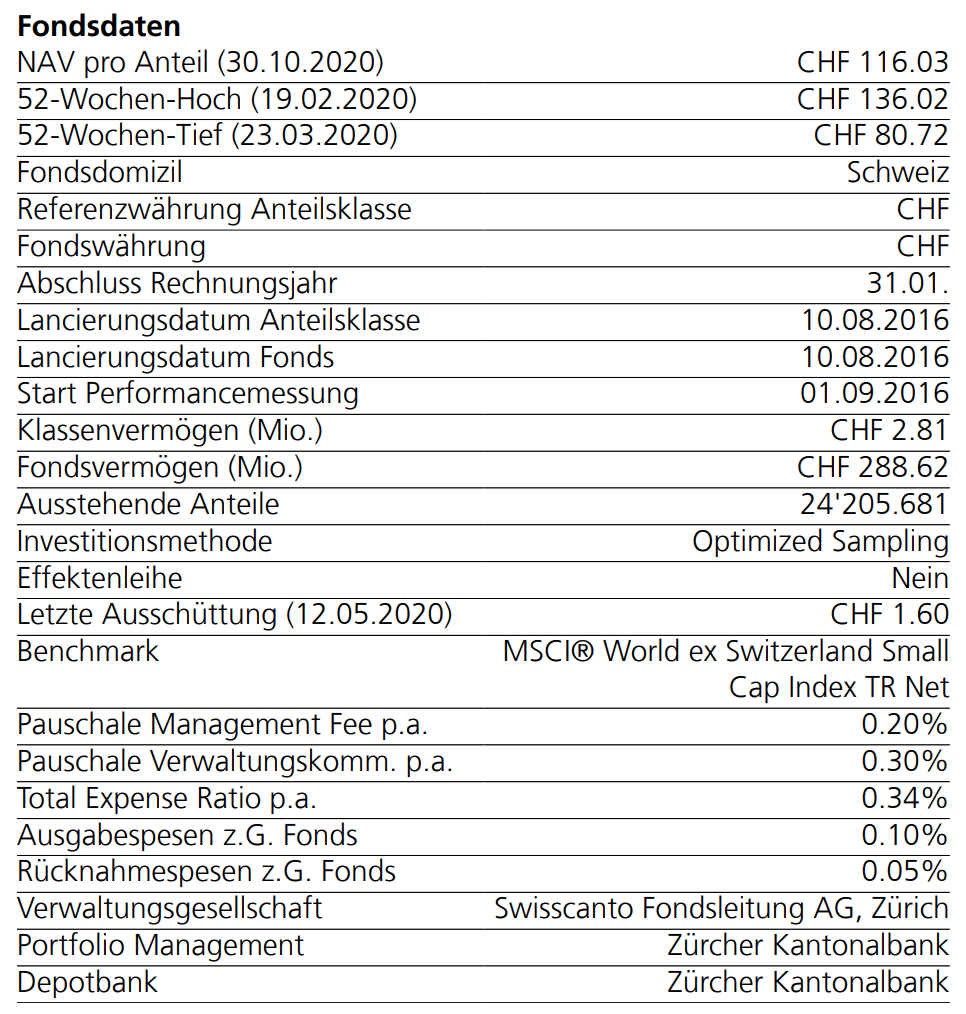

I have chosen the index fund “Swisscanto (CH) Index Equity Fund Small Cap World ex CH FA CHF” with ISIN CH0333947551. Although the website looks very old-fashioned and the graying and almost transparent, trying to smile friendly gentleman, where you have to constantly accept the terms of use, rather deterrent.

This index fund has a TER of 0.34% and issue fees of 0.10%. The redemption fee is 0.05%, but I am not interested in it at the moment. What is special about Swisscanto’s index funds is that a so-called “crossing” is made. For example, if 70 shares are bought and 50 are sold by different players on the same day, then no issue and redemption fees are charged on the intersection, in our example on 50 shares, in favor of the fund.

Purchase of an index fund

This time I decided to buy through Swissquote’s browser interface, so you can also see right away how it looks and works. How the app looks like and how you can buy a share there, I have shown you here.

First, search for the index fund, the easiest way is to use the ISIN, select “TRADE”, then a window will pop up. Next, select “DRAW” for the purchase and enter the desired number. Conveniently, Swissquote also shows you the maximum number you can buy with your existing cash balance.

Above you can also see the cut-off time, this is the acceptance deadline. Comparable to the emptying time of a mailbox. The order must be placed by this time, otherwise it will be executed on the following day. As you can read above, index funds are traded only once a day.

On the bottom right you will see the estimated total amount, with the fees displayed transparently.

If you click on “Place order”, you will see a summary again. If everything meets your expectations, click on “Place order” again.

For an ETF or stock purchase, you would still enter a limit, that is, up to what price you are willing to buy the security. This is not possible with an index fund, as there is only one price per day. Since you have to enter your order the day before, you never know exactly what the NAV will be when you actually buy an index fund.

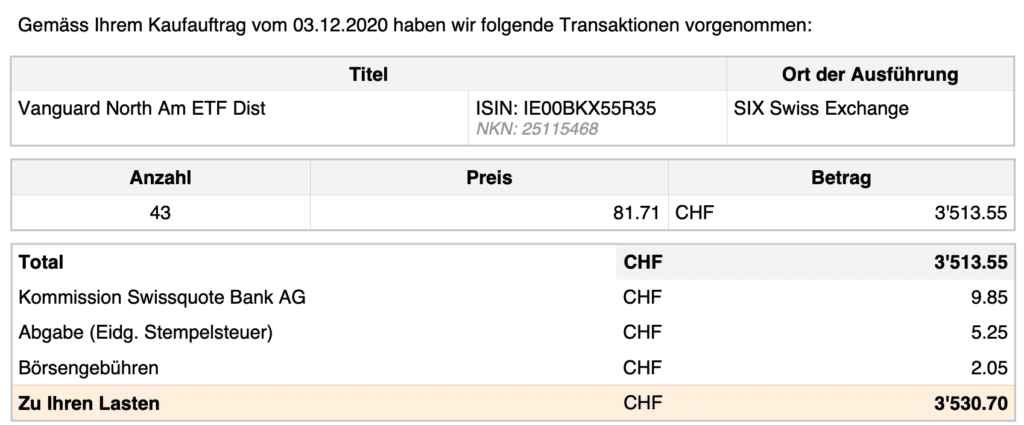

Below you will find an excerpt of a stock market statement for the purchase of an index fund from me. And next to it, the stock market settlement for a purchase of an ETF of approximately the same amount. This way, you can compare which fees and taxes apply to the respective security or not. By the way, I do not have any special conditions for buying securities at Swissquote. In your case, the billing would look exactly the same.

If you have found another index fund, make sure that it is marked as “Prime Partners” at Swissquote, because then you only pay CHF 9 for the purchase.

Another tip for those who track their performance with Portfolio Performance: You won’t find any index funds there. But you can still enter them. Simply create a new security and then import the historical data as CSV. My source for this is www.swissfunddata.ch. However, rounded values without decimal places are used, but this is sufficient for me. Do you know of another source with historical sources, post it in the comments.

At Swiss Fund Data you can click on “Chart” and then at the very bottom on “Download historical values” and you will have the CSV file you need to import. However, Portfolio Performance does not update the rates automatically. You have to generate and read the CSV file again and again if necessary.

In the case of Credit Suisse index funds, you can have the prices retrieved automatically in Portfolio Performance. Simply select “VIAC/CS Fonds” as the quote provider and insert “https://amfunds.credit-suisse.com/ch/de/institutional/fund/history/{ISIN}?currency={CURRENCY}” as the URL. The URL for the CS Small Cap World Index Fund will look like this: https://amfunds.credit-suisse.com/ch/de/institutional/fund/history/CH0336206757?currency=CHF. If you enter this link in a web browser, you must select “Qualified Investor” otherwise it will not work. In Portfolio Performance you don’t have to do anything else.

Incidentally, this also works with the funds that VIAC uses in its Pillar 3a, which are also from Credit Suisse.

To conclude and to deepen your understanding, you will now find an interview with Swisscanto’s index team.

Interview with Swisscanto

What advantages do index funds have over ETFs for private investors?

Index funds have various advantages over ETF. In particular, the exemption from Swiss stamp duty is a weighty advantage that directly reduces trading costs. In addition, there are also no costs for the market maker, as the index funds are traded in the primary market. This is then also another advantage for the investor: He has maximum transparency, as he can enter and exit at NAV in each case. In addition, all Swisscanto index funds are only physically replicated, i.e. what is written on the product is actually in it. It is also important to remember that index funds can be bought nominally, i.e. they can be settled in fractions.

The funds are all domiciled in Switzerland. What are the implications for withholding tax? For example, a fund in Ireland can reclaim a portion of U.S. withholding taxes.

The Swisscanto index funds are all funds under Swiss law and can benefit according to the double taxation agreements between Switzerland and the respective investment countries (such as various European countries). Currently, Swiss funds for private investors cannot reclaim U.S. withholding taxes. There are ways to optimize this: In the Swiss fund Swisscanto (CH) Index Equity Fund World ex CH, for example, we improve the return through the targeted use of Irish ETFs. Thus, an investor can benefit from the advantages of Swiss index funds (stamp duty exemption, NAV valuation, etc.) and at the same time from a partial exemption from US withholding tax.

You write about “Crossing” in your brochure and on your website. As a private investor, how can I understand how much the issuing commission actually amounted to?

The so-called crossing option within the Swisscanto index funds is unique on the market and brings only advantages for the investor. Thus, the issue or return commissions are calculated only on the intersection of the traded daily volume. The customer can easily understand this by comparing the NAV of the fund with the settled price. The difference corresponds to the effectively invoiced subscription or Redemption Spread. Since our index funds are traded daily and there are many subscriptions and redemptions in each case, there is a good chance that private investors in particular can enter or exit at a lower price. In the worst case, the customer pays the publicly disclosed spread, which is based on the effective costs incurred in the fund and regularly reviewed.

Advertising

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.