Letztes Update: 26. April 2024

When you think of private banking, you probably first think of very wealthy clients, high fees and withdrawn advisors. Alpian – Switzerland’s first digital private bank– proves that there is another way. Find out everything about my Alpian experience, interest rates and fees as well as Alpian asset management in this report and receive a starting credit of CHF 100 with the Alpian code.

Alpian Bank

Alpian was founded in 2019 by REYL Intesa Sanpaolo. REYL is a Geneva-based financial services company offering financial advisory and investment services to private and institutional clients. In October 2022, Alpian was launched as Switzerland’s first FINMA-licensed digital private bank. The Alpian app combines everyday banking services with private banking. For example, customers can consult a wealth advisor based in Switzerland via an in-app video call. Alpian is a purely mobile bank, a web app is not available. As with every Swiss bank, account balances in Swiss francs up to CHF 100,000 at Alpian are protected by the Swiss deposit protection scheme. In November 2023, Alpian launched a banking product specifically for young adults between the ages of 18 and 25 – Alpian PULSE.

Alpian account opening

Opening an Alpian account takes about eight minutes. You can find the necessary app in the App Store or on Google Play. After downloading, you must accept the terms of use, enter your cell phone number and confirm that you are liable for tax in Switzerland. After entering the confirmation code that you receive by SMS, you can create a passcode and choose whether you want to activate biometric authentication. Next, enter your personal details, such as your professional status, the name of your employer and your contact details. Google data is used for the address, which makes filling out the form particularly fast.

You can use either your identity card or passport to verify your identity. You must be resident in Switzerland to open an account. You take a photo of your ID and then a selfie. Alpian uses technology from the British company Onfido for identification. Finally, you must make an initial deposit from a bank account in your name to your new Alpian account.

Alpian account

With Alpian you don’t just get one account; no, you automatically get four accounts in the currencies CHF, EUR, GBP and USD. And all with just one IBAN.

A cash withdrawal in Swiss francs costs CHF 2 in Switzerland. If you withdraw EUR, USD or GBP in Switzerland, you pay EUR/USD/GBP 5. Withdrawals abroad cost 2.5% of the transaction amount.

Payments can be made either by entering the IBAN and the recipient’s details or by simply scanning the QR-bill.

eBill is not available at Alpian.

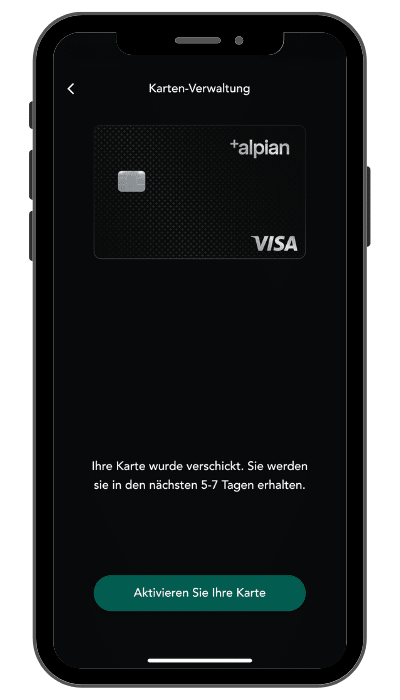

Alpian debit card

You will receive a high-quality metal VISA debit card in elegant black and a virtual VISA debit card free of charge for payments in stationary retail outlets.

In the Alpian app, you can block the card, order a new card, change limits and view card details.

Alpian Apple Pay and Alpian TWINT

Conveniently, you can add your Alpian debit card to Apple Pay directly in the Alpian app. This means you no longer need to take your physical debit card with you when paying at a retailer.

If you want to pay with TWINT, you will have to use the TWINT prepaid app, as Alpian does not yet have its own TWINT app.

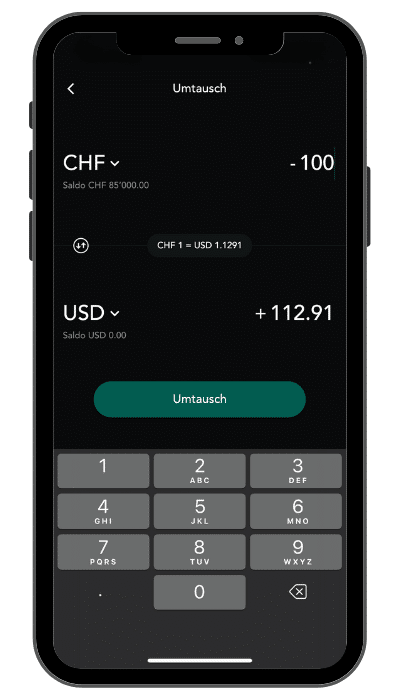

Alpian currencies and international payments

Alpian has set itself the task of offering Swiss and expats more transparent and fairer exchange rates. Alpian also offers attractive rates for the most common currency pairs compared to Wise and Revolut. You can find details in Alpian’s exchange rate comparison.

The exchange rate premium at Alpian is only 0.20% of the transaction volume. If you exchange currencies at the weekend (from Friday 9 p.m. to Monday 8 a.m.), the exchange rate premium is still a favorable 0.50%.

As already mentioned, four currency accounts in CHF, EUR, GBP and USD with a single IBAN are integrated in your Alpian account. So if you receive USD, for example, they will automatically go into your USD account and you can spend them as USD without incurring any fees, because incoming and outgoing payments in these four currencies are free of charge, provided they are made within the respective currency zone. Alpian offers particularly favorable rates for the other 19 currencies.

Alpian interest

In addition to the attractive metal VISA debit card, the interest rates are another highlight of Alpian. At 1.25% for amounts over CHF 100,000, Alpian is one of the Swiss banks with the highest interest rates.

| Amount | Interest |

|---|---|

| CHF 0 – 100’000 | 1% |

| CHF 100’001 – 1’000’000 | 1.25% |

| > CHF 1’000’001 | personalized interest rates |

Alpian credits the interest monthly, unlike most other banks where the interest is only credited to your account at the end of the year. This way you benefit even faster from compound interest. Also attractive: there is no waiting period for payouts. Alpian also does not have a withdrawal limit.

Alpian fees

You pay CHF 0 for the first 6 months. You then switch to the quarterly account fee, which is broken down as follows:

| Total assets | quarterly fee |

|---|---|

| CHF 0 – 10’000 | CHF 45 |

| CHF 10’001 – 50’000 | CHF 22.50 |

| more than 50’000 | CHF 0 |

The total assets are made up of the balance of the account and the market value of the investment portfolio.

All other fees can be found clearly and transparently in a PDF on the Alpian website.

If you are between 18 and 25 years old, you pay no fees for 24 months with Alpian PULSE and then a flat rate of CHF 5 per month.

Alpian Investing

When it comes to investing, Alpian offers two options: The discretionary mandate “Managed by Alpian” or the advisory mandate “Guided by Alpian”. With both options, you can track the performance of your investments transparently in the Alpian app. You can reach the Alpian advisory team via video or chat directly in the Alpian app.

Managed by Alpian

Here you leave the management of your assets to an expert. First you define the investment strategy together with an expert based on your investor profile and then the Alpian investment team takes over the active management of your portfolio. ETFs and investment funds are mainly used for implementation. The minimum investment is CHF 30,000 and the annual costs are 0.75%. In addition, there are product fees, taxes and foreign currency costs (0.20% per foreign currency transaction).

Guided by Alpian

If you want to manage your assets yourself and get advice from experts, “Guided by Alpian” is the right place for you. You can put together your portfolio from a pre-selected range of ETFs. The minimum investment is CHF 10,000 and the advisory fee is 0.75%. This fee includes the costs of managing the portfolio, such as custody account fees, transaction costs, etc. In addition, there are product fees, taxes and the foreign currency fee (0.20% per foreign currency transaction).

Alpian reference code – Alpian starting credit

Enter the Alpian reference code PC97YD when opening an account and you will receive CHF 100 as a starting credit. The bonus will be credited to your Alpian account within 45 days.

Conclusion Alpian interest and fees

For total assets of over CHF 50,000, Alpian is an interesting alternative to other banks or robo-advisors. This is because the quarterly fees are waived from this amount and the interest rates are generally attractive.

In addition to a multi-currency account with a free metal VISA debit card, Alpian offers the most advantageous exchange rates for popular currency pairs throughout Switzerland.

With Alpian Investing, you can put together a portfolio of pre-selected ETFs or have your money managed by experts. The minimum investment amounts start at CHF 10,000 or CHF 30,000 and the management fees are also competitive.

Try Alpian now and benefit from 6 months free account management.

FAQ Alpian Bank

No (not yet), but you can use the TWINT prepaid app.

The custodian bank is the US brokerage firm Interactive Brokers.

No, Alpian has no withdrawal limits or notice periods.

No, account closures at Alpian are free of charge.

Transparency and disclaimer

This article was written in collaboration with Alpian and reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.