Letztes Update: 11. October 2024

This step-by-step guide will show you how easy it is to buy an ETF from Saxo Bank Switzerland. I show the purchase of an ETF via SaxoTraderGO in the internet browser. Buying via the SaxoTraderGO mobile app is of course also possible and does not differ significantly from buying via the browser. At the end of this tutorial you will be able to buy an ETF yourself from the cheapest Swiss broker Saxo.

With the Saxo Bank ETF savings plan AutoInvest, you can now invest in ETFs every month free of charge. There are more than 100 ETFs to choose from.

Open a Saxo Bank Switzerland account

The prerequisite for buying an ETF is, of course, an account with Saxo Bank. In my case, opening an account went smoothly and my experience with Saxo Bank Switzerland has been consistently positive.

I was able to conveniently sign the contract electronically using the IDnow video ID app. After opening the account, it took one working day before the account was available for deposits. It is important that the transfer to activate your account is made from a bank account in your name.

If you do not yet have an account with Saxo Bank, click on “Open now” and you will receive CHF 200 trading fees as a gift.

Are you still looking for the best Swiss online broker for you? Then read the comparison Swissquote vs Saxo: Find the best Swiss online broker.

Saxo Bank Switzerland ETF Buying Guide and Tutorial

You do not need to download a separate program to access SaxoTraderGO. Access is via the Saxo website by clicking on “Login” in the top right-hand corner. After entering your user ID and password, SaxoTraderGO will be fully available to you.

Mobile apps are available from the Apple App Store and Google Play. Search for “SaxoTraderGO” in the respective app store.

SaxoTraderGO is free of charge in both the desktop and mobile versions. Advanced trading functions can be found on the SaxoTraderPRO trading platform, which is also free and can be downloaded as software for Windows and Mac.

The even simpler SaxoInvestor trading platform has been available since September 2024. This is particularly suitable for long-term investors.

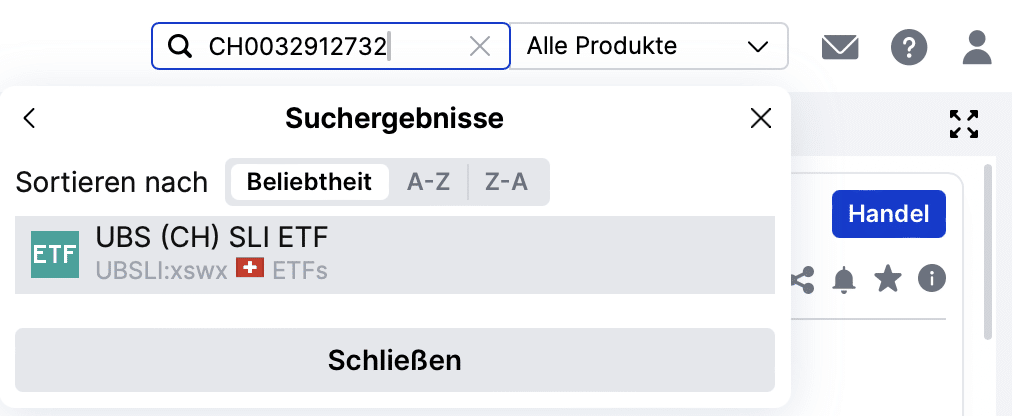

Search ETF guide Saxo Bank Switzerland

In the search field at the top right labeled “Search field by instrument” you can search for the desired ETF. To find the ETF you are looking for, enter the ISIN or the ticker symbol. In our example, we use the UBS ETF (CH) on the Swiss Leader Index (SLI) with ISIN CH0032912732. As always, this is not an invitation or recommendation to buy or sell this ETF, but only an example.

If the ETF looks like the picture below, you can click on it. The green box shows you that it is an ETF. If it is a different instrument, a different color and text will be displayed.

The ETF is now displayed in the product overview below the search field. In the overview you will see a chart and can call up details such as the running costs of the ETF. Sometimes the German translation is a little confusing, e.g. under “Typ” it says “verteilen”. This probably means that the ETF is distributing, i.e. the dividends end up in your settlement account. Here you will also find the current basic information sheets in various languages.

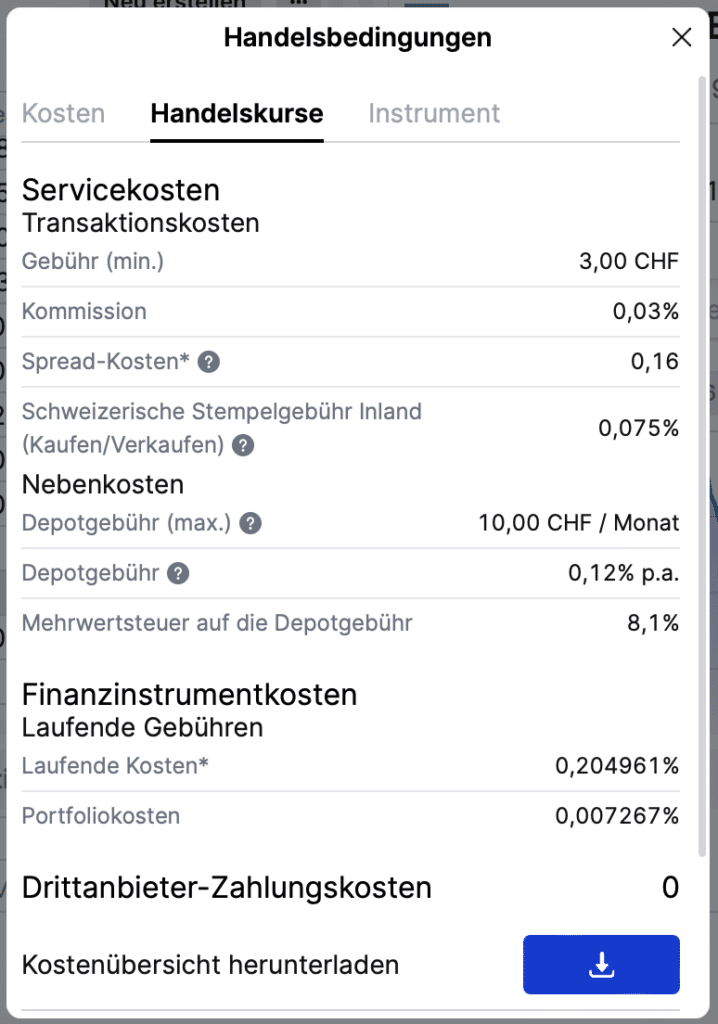

If you click on the small i symbol in the product overview, the trading conditions will be displayed. You can view the transaction costs transparently in the window that opens. To the left of it, you have the option of adding the instrument to one of your watch lists by clicking on the star.

SaxoTraderGO – Exchange selection

If an ETF is available on several stock exchanges, such as the Invesco FTSE All-World UCITS ETF Acc with ISIN IE000716YHJ7, this is indicated by a number and a downward-pointing arrow. If you click on it, the drop-down menu opens and you can select the desired stock exchange. The small country flags are helpful in providing a quick overview.

If you are sure that you have selected the right ETF in the product overview, you can click on the blue “Trade” button.

How to buy ETF Saxo Bank Switzerland

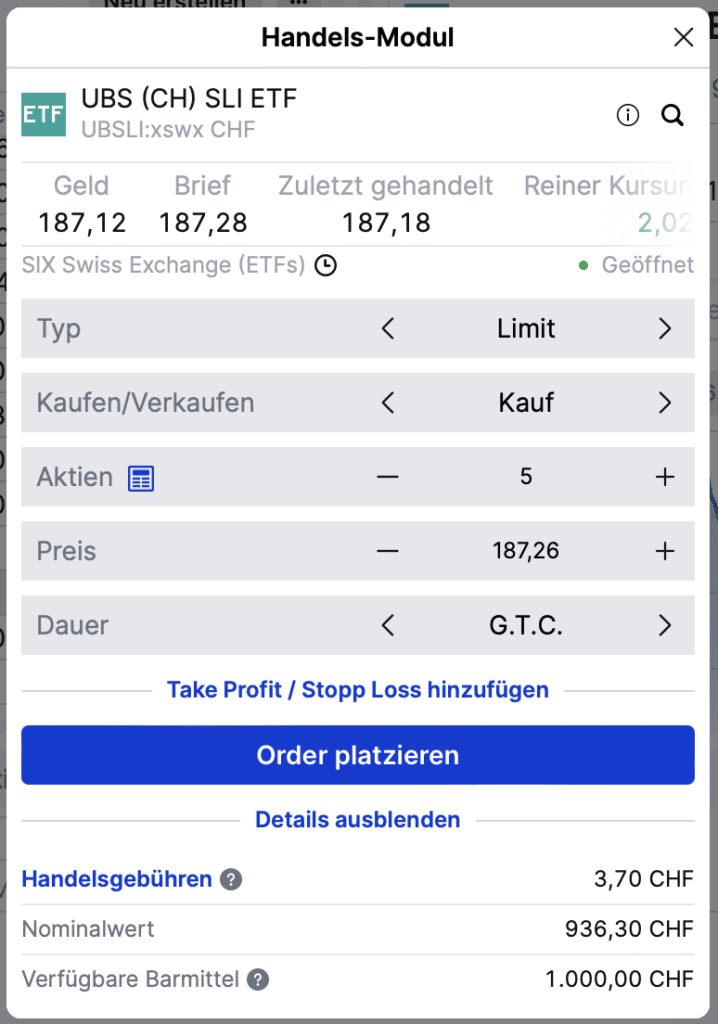

The trading module will now open:

You can choose whether you want to place a market or limit order (there are also other order types, but we won’t go into them here) and whether you want to buy or sell. If you select “Sell”, the “Place order” bar will turn red to avoid confusion.

You can enter the number of shares below. If you are not yet familiar with these, Saxo will provide you with a practical calculator. Enter the amount you want to invest and it will calculate the number of shares. When you click on “Apply”, the number is transferred to the trading module. With a limit order, you also enter the limit and finally you can select how long the order should be active. G.T.C. (good-till-cancelled) means that the order remains active until it has been executed or until you delete it.

The nice thing is that you can already see how high the fees will be. If you click on the blue text “Trading fees”, you can see in detail how the fees are made up. If you buy a share or ETF in a foreign currency, the current exchange rate is also displayed transparently. Incidentally, Saxo charges a low 0.25% fee for currency conversion. Other providers can take a leaf out of our book.

Next, a window will open with a summary of your order. After you have checked them again, you can send them by clicking on “Confirm”.

SaxoTraderGO: List of positions and portfolio

Once the purchase has been completed, the ETF appears in the “List of positions”. If you want to view or change the open orders, simply switch from “Positions” to “Orders”.

If the list of items shows you too little or too much information, you can click on the three dots on the right and select “Manage columns”. Now you can decide for yourself what should be displayed.

If you click on “Portfolio” in the top center, you will be taken to the account overview. Here you can clearly see the current account value and the available cash. Under “Performance” you will see a chart with your account value and another chart with the percentage performance.

Under “Transactions” you can see all purchases, sales and cash transfers made. If you click on “More”, you will see details of the trade and can export a PDF.

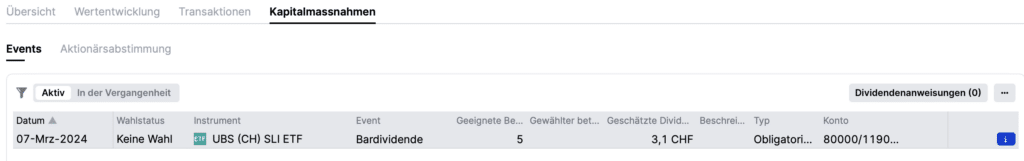

In the “Capital measure” section, you can see the estimated future dividends and the dividends actually received. For our sample ETF, for example, it looks like this:

Conclusion Buy Saxo Bank ETF

With SaxoTraderGO you can buy ETFs from the Swiss online broker Saxo easily and cheaply in your browser or via the mobile app. The trading platform is intuitive to use and you can see transparently what each order will cost you. Positions that have already been purchased are clearly listed under “Portfolio” so that you can track their performance at any time .

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.