Letztes Update: 12. December 2023

CapTrader is a German online broker with favorable conditions for worldwide trading. As a so-called reseller (Introducing Broker), CapTrader uses the trading platform and securities management of Interactive Brokers. As a result, it offers direct access to more than 1.2 million securities across 135 exchanges in 33 countries with 23 currencies. It has been possible to trade online via CapTrader since 2011.

Interactive Brokers

Interactive Brokers was founded in America in 1978. The broker manages 981,000 customer accounts and processes more than one million securities transactions daily. It has received several awards for its trading platform and service.

Securities accounts at Interactive Brokers are protected by the U.S. Securities Investor Protection Corporation (SIPC) up to a maximum coverage amount of USD 500,000. Cash is hedged up to USD 250,000.

Customer accounts of European Union residents were previously held in the United Kingdom. Due to the Brexit, client accounts – including those of CapTrader – will be transferred to either Ireland, Luxembourg or Hungary. The compensation claims will then amount to only EUR 20,000 due to EU laws. Swiss customers are not affected by this, according to a statement from CapTrader’s press office on January 4, 2021. Your accounts will continue to be held in the UK (with IBUK). New accounts of Swiss nationals will also continue to be opened with IBUK. In this respect, nothing changes regarding compensation claims. Here you can find more information about deposit protection at CapTrader.

The Swiss deposit insurance, as it is applied for example by the Swiss bank Swissquote, does not apply here. And you should be aware that a legal dispute with a foreign broker could possibly become complicated and costly.

Account opening

When you open an account, CapTrader will ask you whether you want a margin or cash account. The difference is simplified: with the margin account you can trade on credit. Your securities account with your securities and cash holdings serves as collateral.

This is not possible with the cash account. For example, if you have transferred CHF 1,000, then you can only buy shares and ETFs up to CHF 1,000. For long-term investors, a cash account is fully sufficient. By the way, if necessary, you can easily make a switch yourself via the account management.

I would select Swiss francs as the account currency. You can still keep any other currency in your multi-currency account, but the statements and overviews will be in your home currency. However, a change is also still possible here at a later date.

The completely paperless opening is quite cumbersome, and quite a few forms have to be digitally signed and questionnaires filled out. The terminology is not always easy to understand for beginners. However, CapTrader offers a telephone customer support with callback service.

To complete the account opening process, you must upload proof of identity and proof of address.

After a few days and after successful verification your account will be activated.

If you want to try out CapTrader without your own money first and familiarize yourself with the trading environment, you can open a risk-free demo account free of charge.

Initial deposit and transfers

In order to trade after opening an account, you must first transfer your minimum or initial deposit. This amounts to EUR 2,000. USD 2,000 or the equivalent in Swiss francs. The money must come from an account that is in your name.

In general, transfers to CapTrader are a bit cumbersome, as you do not receive your own IBAN. Therefore, you need to create a deposit notification in the account management. You fill in the requested details of the sending bank, enter the currency as well as the amount you want to transfer, and then you get all the relevant information to enter in the e-banking of your sending bank. They vary depending on the currency. In your bank’s e-banking you must also always specify a reason for payment (U account number – first and last name). You will need to follow these steps for each individual transfer. However, there is also the option to set up a standing order template.

The money is then usually available for trading at CapTrader within a few hours after the transfer from your Swiss bank account. Note that depending on the currency, account and transfer type, your funds may be blocked with a trading and/or withdrawal block. This will be shown to you when you create the deposit note. The closures usually last three days.

Account management and trading environment

Account management is very extensive and you can set a lot yourself. For example, you can release your shares for lending and receive half of the interest income. These vary depending on the share. The whole thing is called the Stock Yield Optimization Program and is subject to certain conditions.

The WebTrader for trading in the Internet browser and the Trader Workstation for trading on the desktop seem cluttered and are designed more for professional traders. For beginners, the client portal or the mobile app is suitable. If you set up adjacent columns in the app, you will also always have an overview of all the important key figures of your securities. Here, too, the setting options are almost endless.

When you buy a stock, you have to select a stock exchange. The designations or letters are often not self-explanatory. Here you can find out which abbreviation belongs to which exchange, including the corresponding opening hours. For the Swiss stock exchange SIX Swiss Exchange, for example, the abbreviation is EBS.

By the way, market data subscriptions are not necessary for long-term oriented investors, even if you are always told that you are trading “blind”.

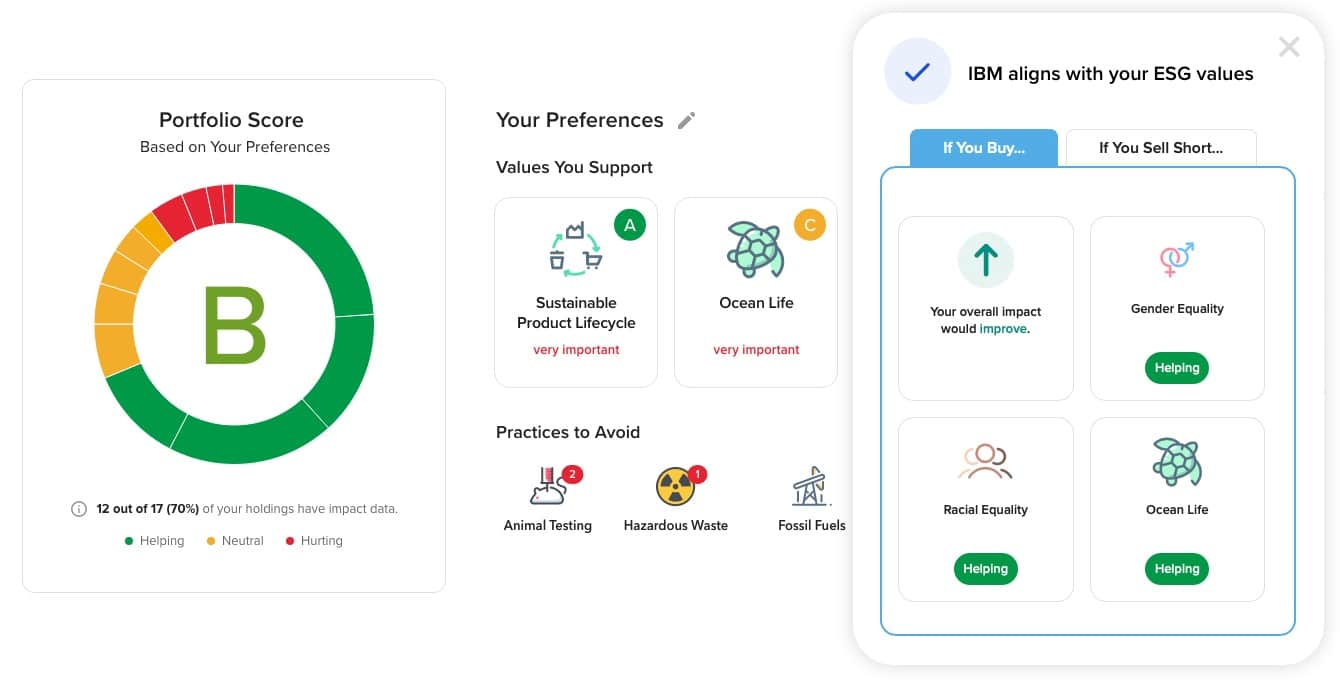

What’s great is the Impact Dashboard introduced in the fall of 2020. You define which values such as “clean water” or “transparency” are particularly important to you. What practices like “animal testing” or “nuclear energy” you oppose. And then, for each stock for which ESG data is available, you will see whether it matches your values or not, and which of your values it violates. The total score of your portfolio is also determined. You can find more information here.

CapTrader offers a variety of webinars, videos and a good German-speaking customer support. Many German YouTubers and podcasters use CapTrader or Interactive Brokers, so you can find an answer to almost any question on the internet.

Want to try CapTrader? Then benefit today from the attractive conditions and the huge selection of securities Open an account.

Comparison

| CapTrader | Swissquote | |

| Mindesteinlage | EUR 2'000 | keine |

| Depotgebühr | keine | 0.1% pro Jahr (mind. CHF 60, max. CHF 200) |

| Inaktivitätsgebühr | wenn Depotwert Ende Monat unter USD 1'000 ist und kein Trade durchgeführt wurde, wird in diesem Monat USD 1 verrechnet | keine |

| Negativ Zinsen auf Barvermögen in CHF | 1% ab 50'000 | 0.75% ab 500'000 |

| Sparpläne | keine | keine |

| Eigene IBAN | nein | ja |

| Aufsicht | BaFin (Deutschland) | FINMA (Schweiz) |

| Schweizer Einlagensicherung | nein | ja |

| Eintragung Schweizer Aktienregister | nicht möglich | ja (gratis) |

| Kauf Schweizer ETF an der SIX für CHF 1'000 | CHF 15 | CHF 9* |

| Kauf Schweizer Aktie an SIX für CHF 1'000 | CHF 15 | CHF 20* |

| Kauf amerikanische Aktie an Nasdaq für USD 1'000 | USD 2 | USD 25* |

| Kauf deutsche Aktie an XETRA für EUR 1’000 | EUR 4 | EUR 25* |

| Währungswechsel (Aufschlag zum Interbankenkurs) | 0.003% (min. CHF 3.75) | 0.95% |

| Online Überweisung ausgehend | Eine pro Monat gratis, danach EUR 2 (SEPA) bez. EUR 8 (Banküberweisung) pro Überweisung | CHF 2 |

| Kontoeröffnung | ■■■□□□ | ■■■■■□ |

| Web-Handelsplattform | ■■■■□□ | ■■■■■□ |

| App | ■■■■□□ | ■■■□□□ |

| Support | ■■■■■□ | ■■■■■□ |

* plus real-time data surcharge, stamp duty and possibly exchange fee

** plus stock exchange fee, any third-party charges and external fees

As CapTrader is not a Swiss broker, it does not have to pay Swiss stamp duty.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.