Letztes Update: 28. September 2023

In addition to countless best-ofs and rankings, everyone is also interested in the return on their own portfolio at the end of the year. Often you will see a red or a green number in your depot. What the colors mean should be clear, but how is this number made up? If you dig a little deeper into your provider’s FAQs, it usually states that the return is calculated as a “time-weighted return”. Timely… what? That’s what this post about yield types is all about with simple examples.

Because only when you know how the return of your investments was calculated, you can compare it with the return of others. In addition to the time-weighted return, there is also the money-weighted return and the simple return.

If you do not make any deposits or withdrawals during the period under consideration, then all three returns will be exactly the same during this period. But let’s take a closer look with three examples.

For the nerds among you, the calculations are listed in each case. However, you by no means need to be able to do the math yourself or keep track of it in order to invest money. But when comparing, it’s interesting to know what yield you’re talking about.

Simple return

Let’s start simple. To calculate the simple return, you divide the profit by the investment amount, i.e. the amount you originally paid in.

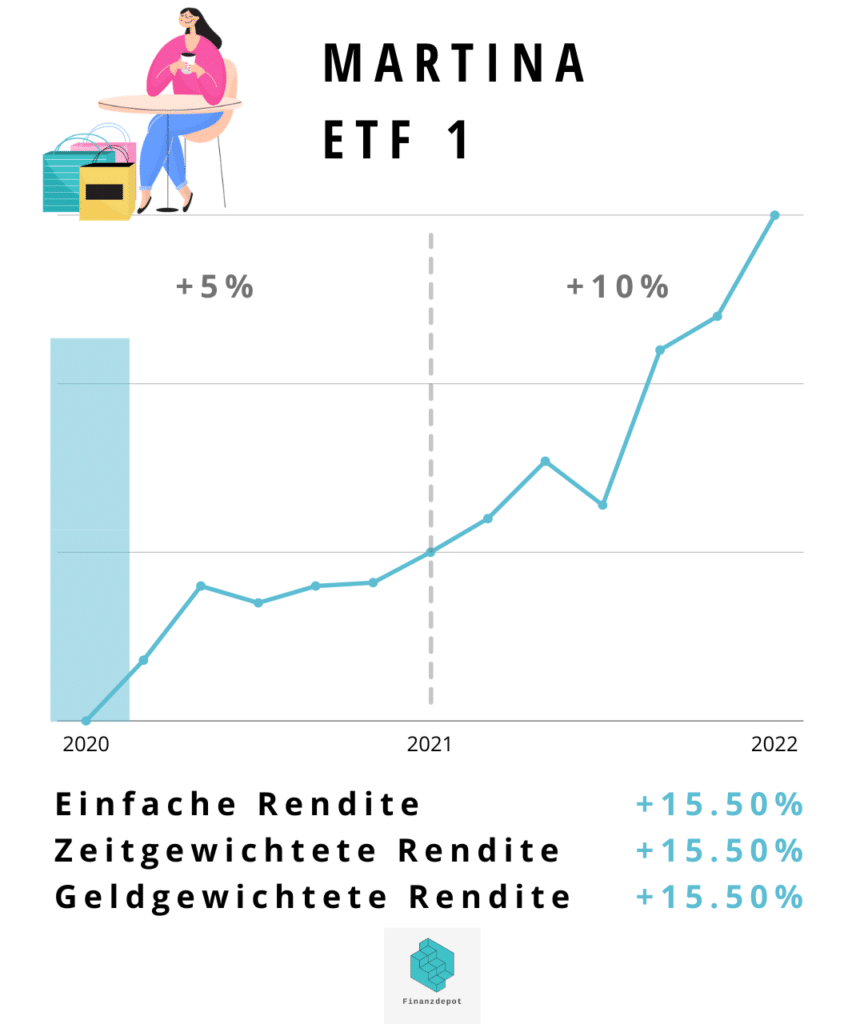

Let’s take Martina as an example: She pays in CHF 2,000 at the beginning of the year, recognizable by the bar on the far left of the picture. In the first year, their ETF increases by 5%. At the end of the first year, she has CHF 2,100 in her deposit. In the second year, it does not trade, consequently does not deposit or withdraw money. Your ETF, and therefore your portfolio, increases by 10% in the second year. So after two years she has CHF 2,310 in her deposit. Your profit is CHF 310. The simple return calculated with this is: 310 : 2’000 = 15.5%.

By the way, their time-weighted and their money-weighted returns are also 15.5%. However, the situation is somewhat different if you make deposits or withdrawals during the period. This is because the simple rate of return ignores the impact that deposits and withdrawals have.

Time-weighted return

The time-weighted return is called time-weighted-return and is abbreviated as TWR. Here, the performance is divided into partial periods. With each deposit or withdrawal, a new period begins, for each of which a percentage return is calculated individually. The returns of the individual phases are multiplied together to give the return for the entire investment period.

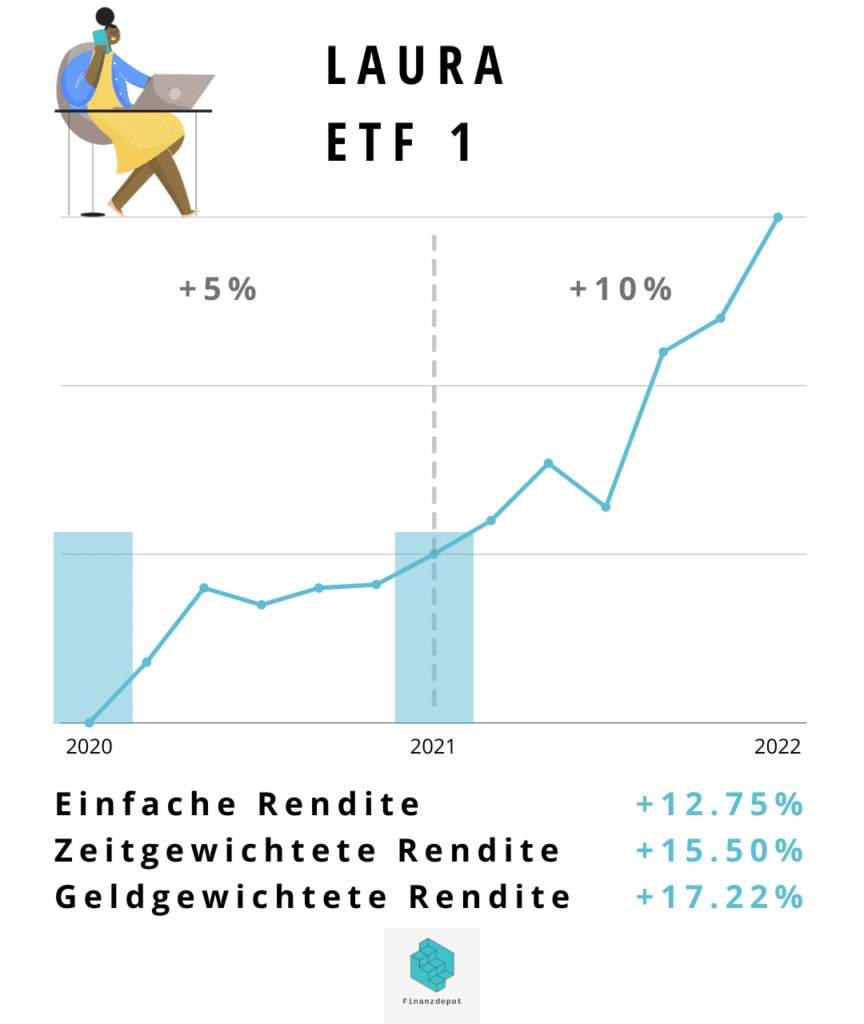

Let’s take an example again: Laura invests in the same ETF. However, it invests only CHF 1,000 at the beginning of the first year. This is the first subperiod. Since she invests in the same ETF as Martina, her investments also increase by 5%. At the beginning of the second year, she invests another CHF 1,000, shown with the bar in 2021. This is now, of course, the second subperiod. In the second year, the ETF increases by 10%. After two years Laura has CHF 2’255 in the deposit and thus a profit of CHF 255. Its simple yield is 12.75%. This is lower than Martina’s, since only CHF 1,000 was invested in the first year.

The time-weighted return on the other hand is now: (1 + 0.05) – (1 + 0.1) – 1 = 15.5%.

The number should look familiar, it is the same as Martina’s time-weighted return. This also makes sense: Martina and Laura had invested in the same strategy and the same ETF, respectively. Thus, their time-weighted returns are also the same. Both times it is 15.5%.

In the case of time-weighted returns, payments are neutralized. It is suitable for comparing different investment strategies with each other or with a benchmark.

Money-weighted return

The money-weighted or capital-weighted return is called money-weighted-return in English and is abbreviated MWR. It now explicitly takes into account how much money was invested at which rate of return at a given point in time. The calculation is then also a bit more complicated, and if more than two time periods are considered, then you need a calculator or spreadsheet program to solve the equation.

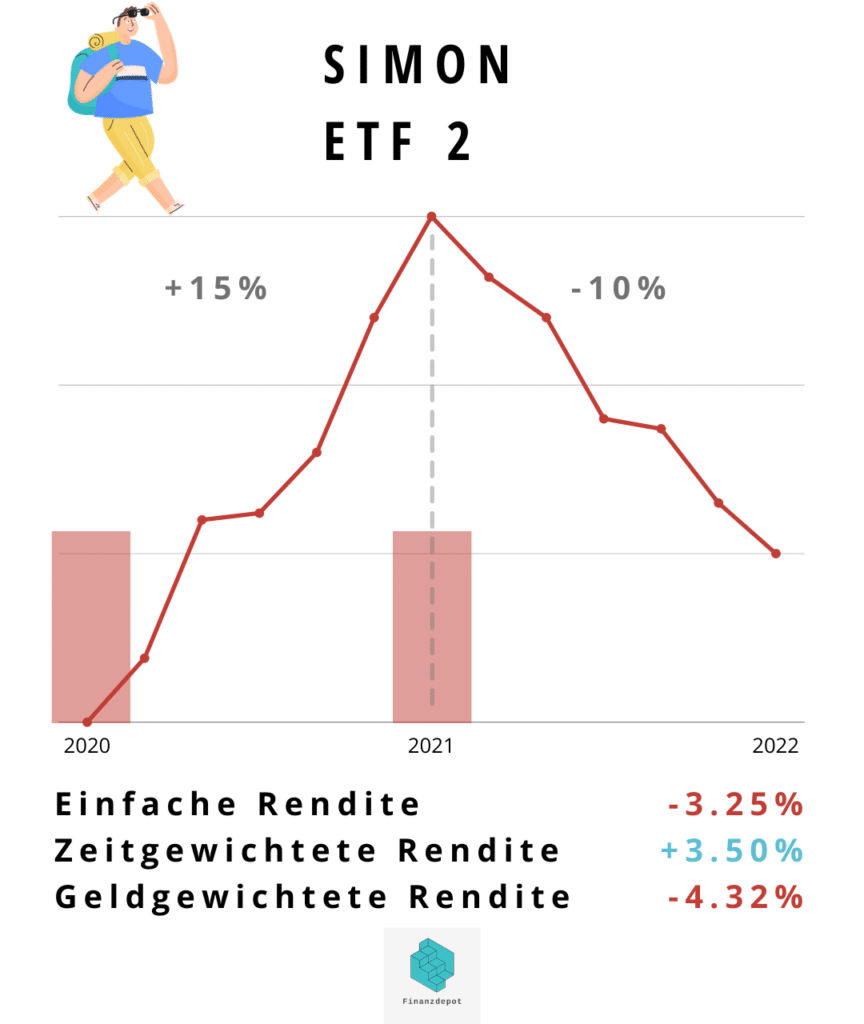

But let’s come back to a simple example. Simon has followed a different strategy over the two years and invested in a different ETF. At the beginning of the first year he invests CHF 1’000. His investments gain 15% in the first year. In the second year, he invests another CHF 1,000. However, the ETF drops 10% this time. The final value is CHF 1,935, the loss is CHF 65. The simple return is therefore -3.25%.

The time-weighted return is: 3.5%

And the value-weighted return is: 1’000 – (1 + IRR)² + 1’000 – (1 + IRR)¹ – 1’935 = 0; resolved to: IRR = -4.32%

Here we can now see well that the time-weighted return is quite uninteresting for Simon. It shows him that his ETF has not performed that badly over two years. The ETF is still five percentage points ahead of where it was at the beginning of 2020, but Simon was unlucky with his timing, so his portfolio still took a loss.

With the money-weighted return you can therefore see whether you had good timing, i.e. deposited at the right time. It takes into account both the timing and the amount of cash flows. It shows most honestly what return on capital has been achieved, taking into account all inflows and outflows.

If your money-weighted return is higher than your time-weighted return, then your market timing has improved your return.

If your money-weighted return is lower than your time-weighted return, then your market timing has worsened your return.

As a regular reader of my blog, you may know that I don’t think much of markettiming. However, the differences in your two returns do not necessarily come from attempted market timing, but simply from your regular and always equal deposits of your savings plan.

Conclusion types of yield examples

For your personal portfolio, the money-weighted return is the most meaningful. However, if you want to compare your strategy with others or with an index, then the time-weighted return is suitable for this purpose.

As you saw in the example with Simon, one return may be negative and the other positive, and yet both are correct. Because now you know: they measure two different types of returns.

VIAC and Inyova for example, only show time-weighted returns. True Wealth and Selma show both returns, although the two returns are found in different places in Selma. Descartes Pension shows only the money-weighted return.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.