Letztes Update: 28. September 2023

Most do not pay their 3a contribution until the end of the year. This also made little sense when there was still significant interest. This is because it was not possible to benefit from the higher interest rate for the entire year.

In addition, many simply pay into a pillar 3a account. Yet equities in pillar 3a would be very worthwhile, especially for younger people.

Retirement provision

Pillar 3a is also called tied pension provision. Why bound? Because the money can be drawn only after retirement. Together with the AHV and 2nd pillar, it is possible – depending on the amount saved – to maintain approximately the same standard of living in retirement as before retirement.

You can also save taxes with pillar 3a. You can calculate your personal annual tax savings here.

There are legally limited purchase possibilities. Under certain conditions, however, the saved capital can also be withdrawn before retirement. This includes, for example, buying a home, financing self-employment or if you emigrate.

Securities solution instead of account solution

It makes sense to consider a securities solution, especially for younger people who do not want to (or cannot) access the capital they have saved for more than ten years and therefore have a long investment horizon. The stock market is not a one-way street to the top, but studies show that any entry point always results in a profit after about ten to 15 years.

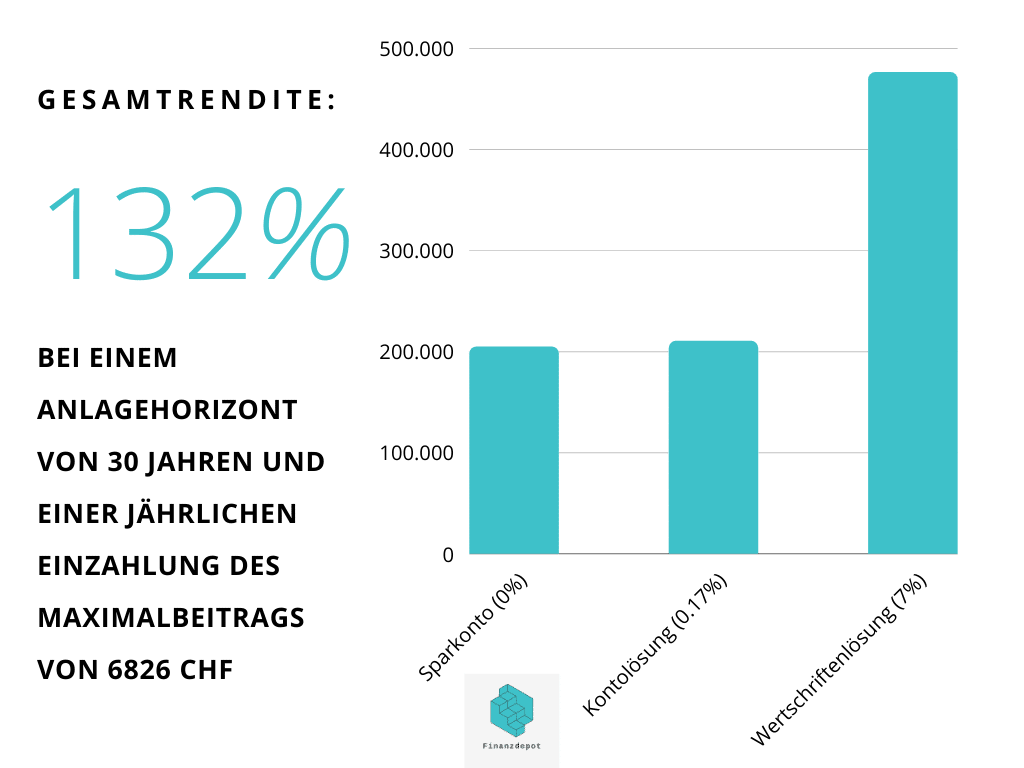

Securities are all the more attractive in the current low interest rate environment. The market average interest rate for account solutions is currently 0.170%. A globally diversified portfolio generated an annual return of about 7 percent in recent years. By the way, you can also have the saved capital transferred from one provider to another with higher interest rates. However, depending on the provider, costs are incurred for this. So you should check with your provider before transferring.

However, if you already know that you want to buy a house or a condominium or start your own business in five to ten years, then the securities solution with a high equity component is not for you.

The provider VIAC

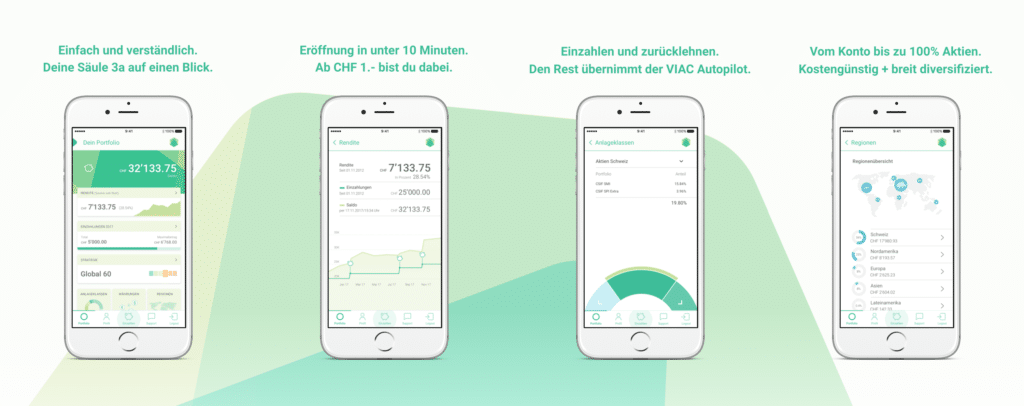

The pioneer on the Swiss market was VIAC. In 2018, he came up with a digital and low-cost product. Especially with a long investment horizon, you can save several thousand francs over the entire investment period with low costs!

Those who have no experience with shares or funds (ETFs) can test their risk tolerance with the “KontoPlus Global” strategy, which has an equity component of only 5%. The remaining 95% is subject to an interest rate of 0.10%, which is quite competitive compared to other providers. Best of all, no management fee is charged on either the equities or the fixed-income portion of the assets.

At launch, the “Global 100” strategy was unrivaled in terms of price and the proportion of equities was comparatively high. This is because a full 97% of the 3a assets are invested in a globally diversified equity portfolio. The total costs amount to a low 0.51% and include all costs for custody, administration, transactions and for the products contained therein. You can follow the fluctuations of this strategy below on the last picture. VIAC produces a semi-annual portfolio report where you can transparently track all transactions and gains/losses.

Sustainable strategies and Swiss-focused strategies are also available. If you have a little more experience, you can also put together your own strategy and add gold or bonds, for example. A change of strategy is possible on a monthly basis and is included in the total cost. VIAC automatically checks the weighting of the asset classes and only allows percentages that are BVG-compliant.

To minimize the risk, it is worth making the deposit monthly by standing order. The financial industry speaks of the Cost Averaging Effect. With a regular deposit, sometimes you buy shares at high prices and sometimes at low prices. The rule-based transfer also prevents the company from lapsing into actionism, which is detrimental to returns.

By the way, the still young FinTech VIAC cooperates with WIR Bank . This is a financially sound, cooperatively organized and purely Swiss bank. You can manage your account via app or, more recently, desktop.

You can find a comparison of seven providers here.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.