Letztes Update: 28. September 2023

VZ VermögensZentrum recently started offering individual shares as a supplement to pillar 3a. Instead of an SMI index fund or ETF, the 20 shares are held directly in the custody account. Other providers are waiting in the wings with similar plans. So reason enough to ask the pioneer about the advantages and the motives.

Interview with Manuel Rütsche, Head Asset Management and Member of the Executive Board VZ Group

VZ is the first provider to offer individual shares in the third pillar. In your opinion, what are the advantages of individual shares over funds in pillar 3a?

If I may briefly elaborate: In 2009, we launched our online platform VZ Finanzportal and in this context also our pillar 3a. At that time, pension fund customers could only invest in strategy funds at banks. With our offering, we created a better solution for the benefit of our customers, which was significantly more cost-effective, transparent and flexible compared to strategy funds. For example, for the first time it was possible to invest directly in ETFs and index funds. And thanks to our online platform, customers were already able to take out and manage their pillar 3a online themselves. As we later realized, we also launched the first robo-advisor in Switzerland with it.

Today, to the detriment of pension recipients in Switzerland, it must unfortunately be said that not much has really changed in the last 10 years. Banks still basically sell the same strategy funds to their customers. At least there are a few new players on the market that also want to provide better alternatives.

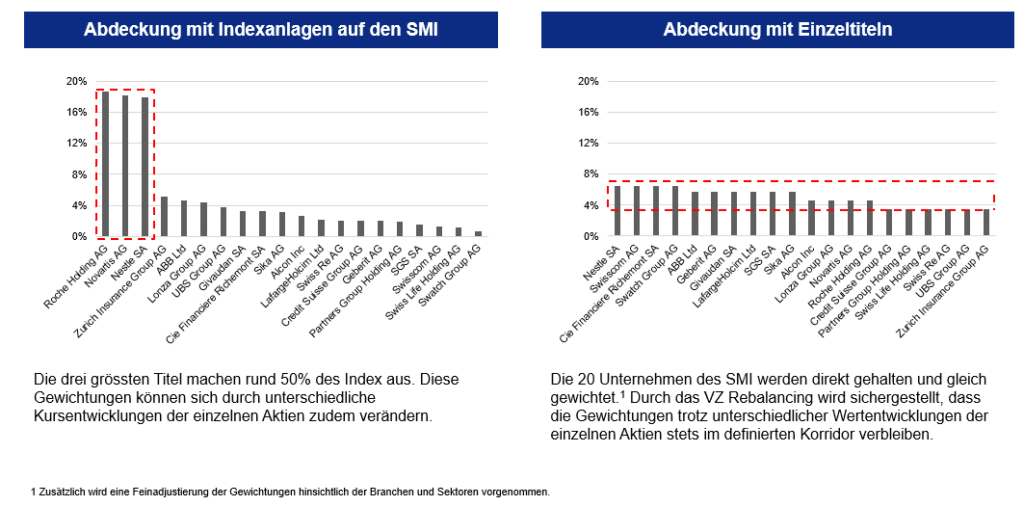

In this respect, the VZ solution is still considered very innovative and cost-effective today. This is also confirmed by the unabated strong customer growth in our pillar 3a. Nevertheless, we have been looking for ways to make our offering even more attractive to certain customer groups. With the option of investing directly in individual securities (equities), we are once again creating a unique investment solution in Switzerland. It also allows us to further increase transparency for our customers and further reduce fees. And through the more or less equally weighted direct investment in the 20 stocks from the Swiss Market Index (SMI), diversification can be increased over and above this, in contrast to an ETF or index fund.

What fees does the VZ charge for this?

For 10 years now, our customers have been benefiting from a favorable all-in fee of 0.68%. This fee covers all charges of the VZ, so for example also the transaction costs. In addition to online access to the VZ financial portal, the customer also receives a personal advisor with comprehensive financial expertise – and not just on investment topics. Product costs for the portion invested in index funds or ETFs are added to the all-in fee. These are in the range of 0.11%.

In addition, there may be extraneous fees, such as federal stamp duties, which may apply to the purchase and sale, depending.

When does the rebalancing of the 20 shares to the original weighting take place?

This depends, on the one hand, on the timing of the deposits and, on the other hand, on the stock market development. For example, some customers transfer CHF 500 each month as part of a savings plan. Then the rebalancing is performed monthly each time after the deposit. Other customers pay the possible total amount once a year. Here, rebalancing also takes place at the time of deposit. In addition, further rebalancings may occur depending on stock market developments. There is no fixed point in time for this – the customer portfolios are reviewed on an ongoing basis and, if they are too far away from the defined target proportions, they are reduced to these.

What happens when new companies join the SMI? When will these conversions be made?

If there is an adjustment in the index, that change is implemented in the portfolios within a few days, forecast-free.

Can other indices or themes be mapped with individual shares at VZ in the future?

Yes, we are already in the process of designing further focus topics. However, I do not want to reveal more about this at the current stage.

Is there a minimum investment amount?

The minimum investment amount is CHF 500. We work with fractions, i.e. fractions of shares, for individual shares so that we can also implement small amounts. This is shown to the customer on the securities account statement to up to four decimal places.

At what frequency and from what amount are deposits invested?

In the meantime, we invest on a weekly basis. We have implemented this due to customer requests. Before that, we invested monthly.

So every week it is checked if there is more than CHF 500 in the account from deposits or distributions or dividends and if so, it is reinvested.

Can the shares simply be transferred to the normal securities account after retirement?

Yes, this can be done without any problems. Only the fractions cannot be transferred. For example, if you hold 305.78 shares of a company at retirement, then the 305 shares can be transferred while the 0.78 shares are sold and transferred as liquidity.

Closing words

Index funds and ETFs were mentioned several times in the interview. You can find a post about the differences and similarities here.

I am curious to see what other focus topics VZ will offer in the future and what the competition’s offerings will look like.

By the way, Selma, which uses the solution of VermögensZentrum for pillar 3a, does not currently offer the addition of individual shares.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.