Letztes Update: 3. November 2023

After just over six months of investing with digital wealth manager Selma, it’s time for a review. And for a look ahead to 2021, as Selma Finance fees drop for investors with larger accounts. More on this below.

Real Money Depot: Experience with Selma

At the beginning of June 2020, I opened a real money deposit account with the robo-advisor Selma. After paying in the minimum investment of CHF 2,000, I transferred another CHF 1,000 as a one-time payment three and a half months later, and since then I’ve been transferring CHF 50 a month. So even with little money, you can run a savings plan with Selma.

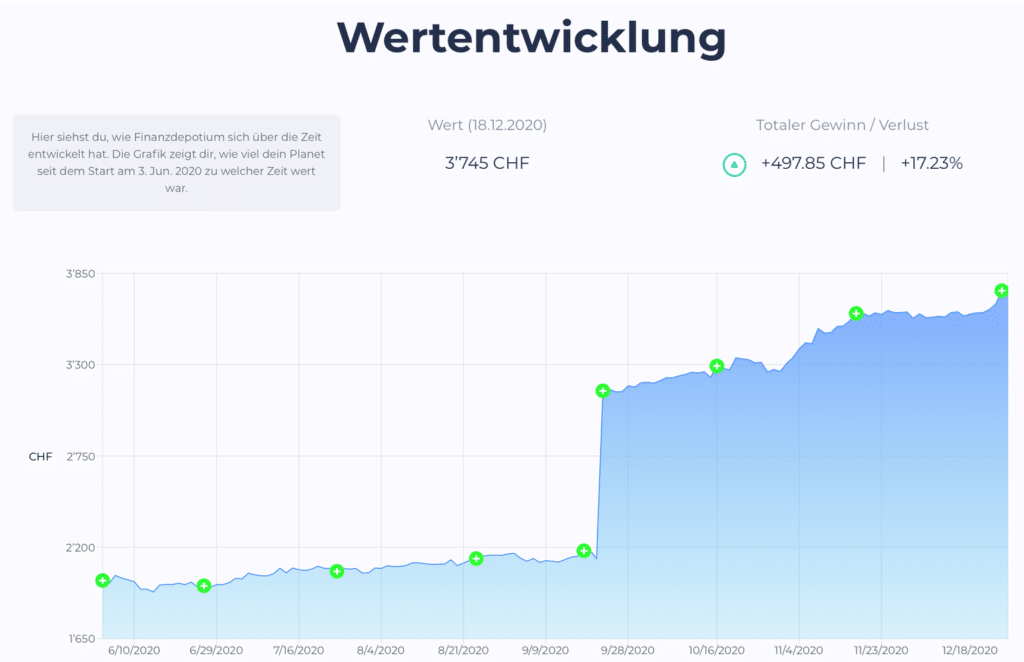

And this is how the increase in value of the portfolio looks:

The big jump, of course, comes from the one-time payment. It should also be noted that the graph does not start from zero. Nevertheless, the portfolio shows a time-weighted return of +17.23% since inception, which corresponds to a gain of CHF 497.85 in Swiss Franc terms (as of December 19, 2020).

Selma “Savings Plan

Selma invests my money in sustainable ETFs every time I make a deposit. For simplicity’s sake, I set up a standing order with neon for this. Included in my portfolio are ETFs on America, Europe, Switzerland, emerging markets, corporate bonds, gold and silver. By the way, emerging markets performed best with +26.23%, while gold was the worst performer with -6.01%.

Even with just over CHF 3,000, I am invested in several hundred companies worldwide. And the digital asset manager also takes care of the diversification across different currencies and sectors for me.

Of course, Selma also offers “normal”, i.e. non-sustainable, ETFs. With one click you can choose your desired strategy.

I am still convinced of Selma after six months. Do you want to invest easily, without much effort and inexpensively, then be sure to take a closer look at Selma!

Selma Finance News

It was announced this week that media company TX Group has joined Selma Finance as lead investor in a Series A funding round. The TX Group was previously called Tamedia AG. You should be familiar with their print media “20 Minuten” or “Tagesanzeiger”. Among other things, Selma aims to become “the leading digital financial advisor in Switzerland” through its collaboration with TX Group.

Sparrow Ventures, a growth capital investor of the Migros Group, is also taking a new stake in Selma. This is Sparrow Ventures’ first investment in a fintech. Further, in February 2021, it was announced that Migros Bank is partnering with Selma to jointly develop innovative digital wealth management services and distribution channels.

So let’s be curious about what the next few years will bring. With my real money deposit, I, and you if you follow my blog, are up close and personal.

By the way, around 4,000 (as of February 2021) customers now have a securities account with the fintech Selma.

Selma Finance Fees

Selma has screwed with the fee structure. Thus, the Selma Finance fee decreases from the beginning of 2021, the more you have deposited with Selma. It will look like this:

| Wert aller Vermögenswerte | Selma Gebühr pro Jahr |

| < 50'000 | 0.68% |

| 50'000 - 150'000 | 0.55% |

| 150'000 - 500'000 | 0.47% |

| > 500'000 | 0.42% |

The great thing about this is that not only your assets in the investment account count, but also your funds in pillar 3a. This way you will reach the first threshold at CHF 50,000 much faster. Other providers either do not offer pillar 3a at all or do not count the two accounts together.

If the value of your assets falls below the threshold due to negative performance, the sum of deposits minus the sum of withdrawals will be used for calculation instead. Thus, a negative performance does not have a negative impact on fees. As an example: Current value of all assets: CHF 49’500. Actually, the Selma fee of 0.68% would apply. However, you have deposited a total of CHF 60,000 and withdrawn CHF 5,000 once (so your deposit is currently 10% in loss). Selma calculates in this example the fee based on the CHF 60’000 – CHF 5’000 = 55’000, which is to your advantage, because you still only pay the lower Selma fee of 0.55%.

Stamp duty

Another change concerns stamp duty: until now, Selma refunded stamp duty, so it was included in Selma Finance fees. This will no longer be the case as of January 2021.

Per purchase and sale 0.075% (ETF domiciled in Switzerland) to 0.15% (ETF domiciled abroad) tax is now due. Here you will find more information on how this will affect your portfolio when making new deposits or adjustments to investments.

Selma was the only supplier besides Inyova that refunded stamp duty, to my knowledge. Meanwhile, even Inyova does not refund the stamp tax. All others have always charged stamp taxes to customers. Of course, these taxes also apply if you buy ETFs and shares yourself, for example at Swissquote. With index funds it’s a little different, you can find more details in this blog post.

By the way, the minimum investment remains at a low CHF 2,000.

Advertising

Open your custody account or your pillar 3a with the digital investment assistant Selma via this link* or the code finanzdepot and receive a starting bonus of CHF 34

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.