Letztes Update: 28. September 2023

Instead of an account, I got all my prejudices about big banks confirmed.

Act 1 – The online onboarding

Here comes an email with the following content: “You have the opportunity to download the CSX app now, before the official market launch on October 26, 2020, and become one of the first CSX customers. The account will be active immediately after your successful registration and you can “go banking” right away.”

Great, download app and open account, nothing easier than that. As written, this process happens as in a chat. Until the complete question of the fictitious CS lady appears, it takes too long for me and the questions are not really easy to understand. Here, CS has not yet loosened its tie.

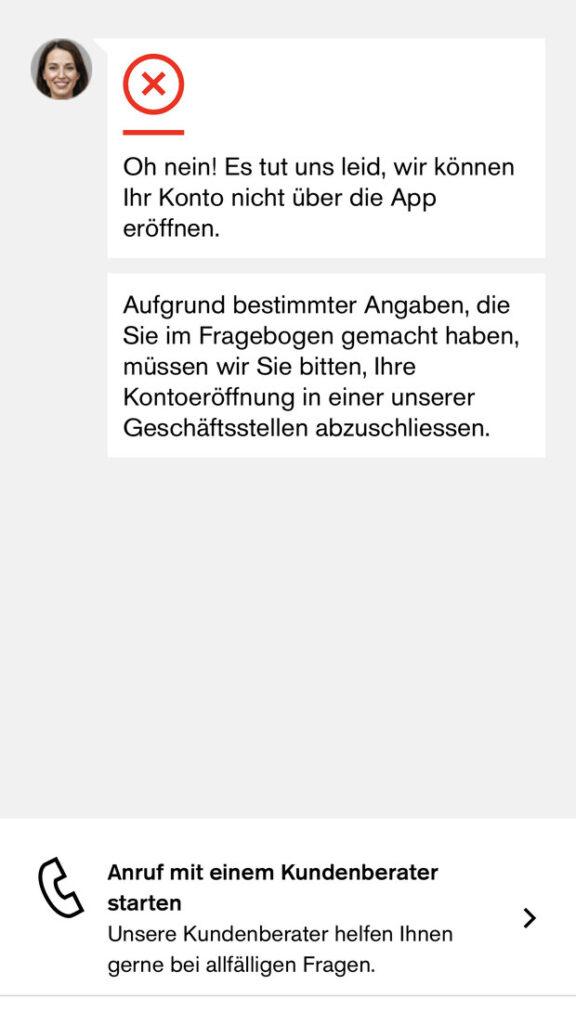

Nevertheless, I successfully made it to the video identification. The next hurdle is the scan of the identity card. The Swisscom employee obviously sees a different camera section than I do. With a bit of fiddling, however, the ID is then sufficiently close and all details are visible. And already my smartphone says: “Your new account is being prepared…”, yay, not bad at all and reasonably fast. But then here’s what happens:

Now I know where the X in CSX comes from.

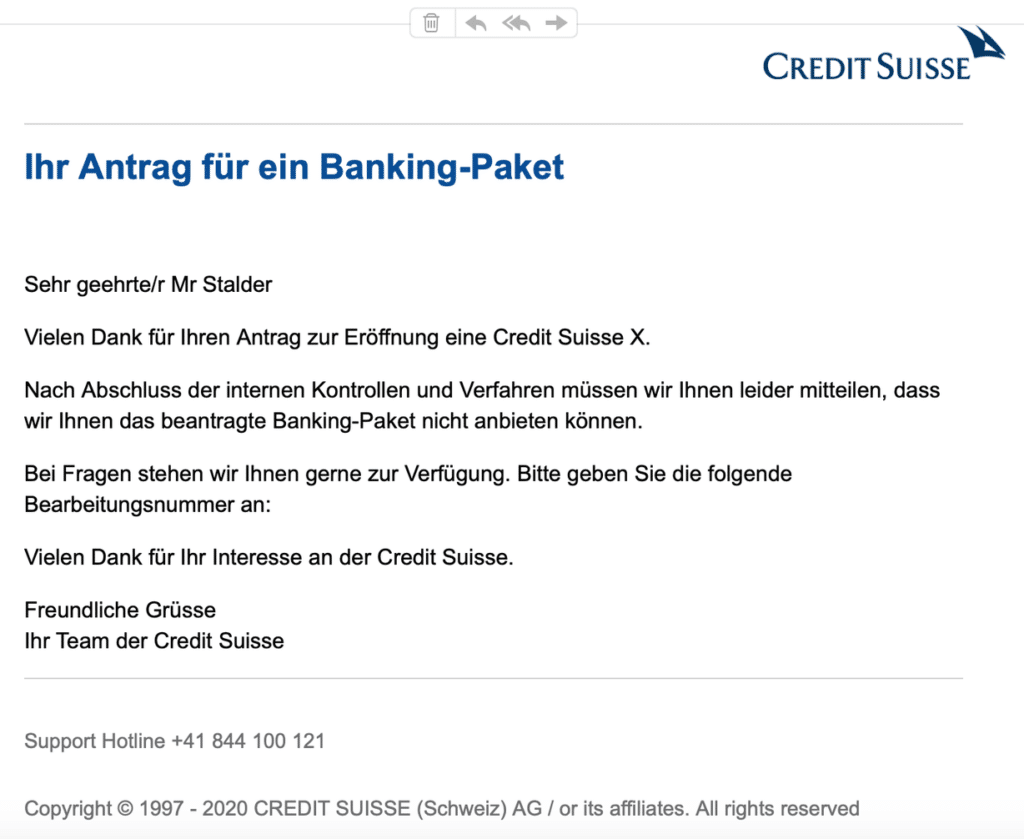

Furthermore, an e-mail comes with the following content:

It’s also nice how Credit Suisse emphasizes its internationality and addresses me as “Dear Mr. Stalder. She didn’t know my gender when she said “dear”, but she knew it when she said “Mr”? Anyway, these are small things, I just want an account.

So, as suggested in the app, I contact the support hotline.

Act 2 – First phone call

The gentleman is very friendly, asks whether I have relations with the USA or am taxed in another country besides Switzerland, all of which I can deny. Luckily, I had taken some screenshots, so I was able to go through the steps of the opening process with him.

He finds it amazing that the identification could still be done and then suspects that something may have gone wrong with the identification.

By the way, deleting the app would not do any good; when reinstalling it, the opening process would continue at the same point. I really should report to a branch after all. He also finds me the nearest one and its opening hours.

I am on the phone for a total of 21 minutes.

My questions were not answered, but that’s why Credit Suisse has real people in the branch. So let’s go there.

Act 3 – First Branch

I join the queue in front of the two counters right after lunch. When it was my turn to explain my problem, the employee said that unfortunately she couldn ‘t open any more accounts this afternoon because all the staff were busy. They told me to come back in the next few days or go to another branch. She would see in the system that employees in a nearby branch still had capacity. She did not reach the colleagues by phone, but I should go there.

Unfortunately, the employee on the first phone call was probably unable to see in his system that they do not open accounts in the first branch this afternoon. Well, not far away there is the other branch. So let’s go there.

Act 4 – Second Branch

Here I am served immediately. Again, I describe my problem. However, CSX is a purely digital product, so he can’t do anything in the branch. He has this confirmed by a colleague.

I persist, the app would send me here and so would the gentleman on the phone. Maybe there is a check running in the background, I should just wait a few days. I remain persistent, the mail says that the internal controls have been carried out. He types and reads on his laptop, asks whether I have relations with the USA or am taxed in another country besides Switzerland, which I again deny. Furthermore, he thinks I should try deleting the app. Aha, the one on the phone told me it wouldn’t do any good, I’d try anyway. Of course without success, the red X appears again.

But he really couldn’t do anything here, it was a 100% digital product, I had to contact the hotline again, they could look at my problem in more depth. He hands me a small card and marks the correct phone number.

First conclusion: Real people are of no use at all if they are not trained accordingly.

Act 5 – Second phone call

So on the following weekday, I call the number marked, describe my problem, am connected again, describe my problem again. First tip: “Have you already deleted and reinstalled the app once?” Yeah, that didn’t do anything. Whether I have relations with the USA or am taxed in another country besides Switzerland, all of which I can answer in the negative. Maybe I would just have to wait, the team sometimes had to do internal checks. Again, I refer to the e-mail, the control had apparently already been carried out. She discusses this with someone, I get to hear music in the meantime. She couldn’t see what went wrong with the process, I guess I would have to go to a branch. I note that I would find it strange that no one has yet taken an interest in the processing number from the email. She then says that she could try it once. I give her the fifteen-digit number of the mail and get music again. She gets back in touch and asks me for the number again. I give her the fifteen-digit number one more time and listen to music again. Finally, she gets back in touch. It was probably an IT problem, she had now opened an IT ticket and when the problem was solved, I would get a message or someone would contact me by phone.

I am on the phone for a total of 37 minutes.

Act 6 – CS recall

A day later, someone answers and tells me that I do indeed need to go to the branch. The employees in the branches had misinformed me, in certain situations a visit was effectively necessary. His team now wants to monitor the further process more closely and inform the relevant branch in advance. So I get to specify the day and the office I will visit. What had not worked at the opening, they could not tell me again.

Act 7 – Second visit to the first store or the manual onboarding.

Two days later, I visit the branch and this time I am lucky – account openings are carried out. I describe my problem again and the first thing they ask me is whether I have relations with the USA or am taxed in another country besides Switzerland, all of which I can deny.

Unfortunately, she did not see what had caused the failure. If I have time, they can do the opening right now at the branch, which I of course gratefully accept. So you retire to a separate little room and the whole opening process starts all over again: name, address, employer, whether I have ties to the US or am taxed in another country besides Switzerland, which again I can deny.

The system is incredibly slow and user-unfriendly. After each click, the poor employee has to wait until the cog has turned out. If she enters the answers in the wrong order, previous answers will be deleted again. I ask incredulously if it always took this long. She says people have gotten used to it, sometimes the wait is up to three minutes. After all, I have to sign quite a few documents digitally on the iPad.

The user ID, password, and SecureSign graphic would then be mailed to me.

And I get a paper card with the IBAN on it. How hard, I feel reminded of my childhood, where there was a wheel of sausage every time in the butcher’s shop Bergmann.

Act 8 – The paper documents come

One week after the first account opening attempt, four! Letters:

- User ID and password for online and mobile banking access

- SecureSign graphic for setting up SecureSign

- Registration code for setting up the debit mastercard for online shopping

- PIN for the Debit Mastercard

By 100% digital and “without paperwork” I mean something different – in any case, I haven’t received that much paper in a long time.

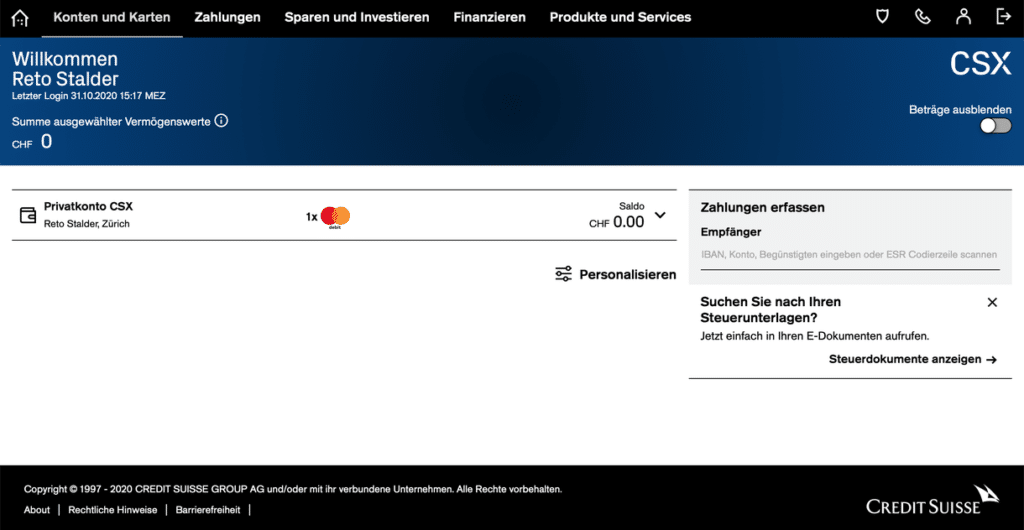

Act 9 – I am in

Yay, I can finally get rid of banks.

And what’s also possible thanks to SecureSign: I can access my bank account from my desktop. This is not possible with the neo-banks I know. Some of my acquaintances only found an app for banking suspicious. Here they get both. Let’s see if that can persuade them to switch.

And the CSX financial plan looks pretty good at first glance. This as a small final applause.

Act 10 – The card and a mail arrive

Finally, the debit Mastercard also arrives by mail. Using the letter with the registration code, I can set it up for online shopping – all quite cumbersome.

Ah, and a mail comes that I have not completed my recently started online account opening process.

The only thing that comes to mind is “The left hand does not know what the right hand is doing”.

And the moral of the story

Of course, the product has just been launched and the processes are not yet in place. But other products I use were also very new and some of them did not work. The crucial thing is how employees deal with it, what resources are made available to employees to find solutions, how they identify with the company, or what kind of culture is practiced in a company, and at Credit Suisse I see dark blue to black in this regard.

My conclusion: I feel quite comfortable and in good hands with “hobby banks“, their commitment and customer orientation.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.