Letztes Update: 31. July 2024

Life courses are rarely linear these days – mine is one big patchwork quilt – and suddenly, after a life event, you’re faced with the question of what to do with your saved pension fund money. This article deals with how such vested benefits are created and how they can best be parked or invested. Finally, I share my experience with Descartes Vested Benefits – the digital pension provider with whom I have a vested benefits and a pillar 3a custody account – and show you the differences to other providers.

What are vested benefits?

First of all, the absolute basics: If you are affiliated with a pension fund through your employer, the employer pays the so-called BVG contributions. The BVG entry threshold, from which employees are subject to mandatory occupational pension insurance, is CHF 22,050 in 2024. The employer pays part of the contributions, the other part is deducted from your salary. Together with the interest charged annually, this builds up your retirement assets. And this money is yours. If you change employer, your BVG retirement assets will also be transferred from the pension fund of your old employer to the pension fund of your new employer.

Now, however, you may be laid off and not be able to find a new job immediately afterwards. Or you go on a longer trip, dedicate yourself full-time to the offspring or start your own business. For all of these events, you must also leave the employer’s pension fund when you leave the employer. Your pension assets now become vested benefits and you can choose to which vested benefits institution they should be transferred.

Incidentally, if you don’t tell the old pension fund where to transfer the money, it will park it in a vested benefits account at the Stiftung Auffangeinrichtung BVG after two years at the latest.

What to do with vested benefits?

For vested benefits, the word “park” has become accepted. Well, depending on the parking space, there is a parking meter, the car rusts away and loses value. That would be the account solution. Some banks have now introduced a monthly account maintenance fee for vested accounts and offer only measly interest rates.

| Bank | Interest rate | Account maintenance fee |

| Migros Bank | 0.60% | |

| PostFinance | 0.40% | CHF 9 per quarter |

| Raiffeisen | 0.70% | |

| UBS | 0.40% | CHF 3 per month |

| ZKB | 0.40% |

I prefer the word “invest”, which brings us to a vested benefits deposit. As with pillar 3a, you can invest your vested benefits profitably in securities. In the long term, you have a higher chance of a return than with the account solution.

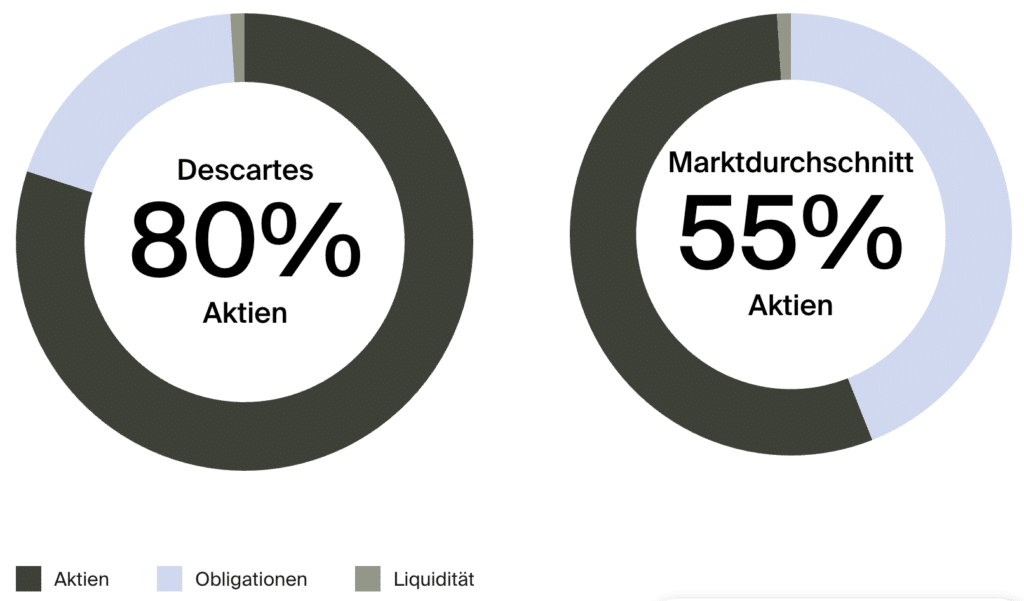

Now it depends a bit on how long your investment horizon is. If you’re only going on a world trip for five months, the account solution is probably still the right choice because of the fluctuations in the stock market. If you plan to take a break of three to five years, you could look at a securities solution with a similar equity component as the pension funds. By the way, on average, the share of equities in pension funds is about 33%. And if your investment horizon is longer, then you could choose the highest equity allocation, depending on your risk appetite.

Please note: As soon as you have a new employer and are affiliated to a pension fund through them, you must transfer your vested benefits to the new pension fund in accordance with the law.

To minimize the cluster risk of only one provider, it is possible to split vested benefits. You can therefore instruct your previous pension plan to transfer your vested benefits to a maximum of two vested benefit institutions. However, subsequent splitting is not possible.

Choosing two independent providers is highly recommended. Not only do you minimize cluster risk, but you can run two different strategies and save on taxes when you draw.

Descartes

Now we finally come to the provider Descartes. You already know this from the pillar 3a comparison.

Descartes launched its digital offering for free assets in 2016, making professional asset management accessible to private investors. The minimum investment in the owner-managed start-up was reduced to CHF 10 in 2024. The following two investment solutions are available for free assets under Descartes Invest:

- Passive

- Minimum risk

Descartes has also been offering digital investment solutions for tied pension provision since 2019.

In the meantime, Descartes has been able to gain various cooperation partners who use Descartes’ digital solutions in both open and tied pension provision. For example, Glarner Regionalbank offers its customers Descartes’ pension solutions. Or the finance app Yuh relies on Descartes as a Finma-approved platform orchestrator for its pillar 3a pension product.

Descartes is a Swiss provider that is completely independent of banks and products. The foundation and the custodian bank are also independent.

Descartes Freedom of movement Investment models

Two investment models are available:

- Passive: Sustainable index funds

- Minimum risk: clever risk minimization (ESG) and massive CO2 reduction

In addition, you can choose between four risk categories, which differ in terms of the equity component:

- Low (20%)

- Moderate (40%)

- Medium (60%)

- High (80%)

Below the respective risk level, you can see transparently on the website how your portfolio is structured, which countries are represented and in what percentages.

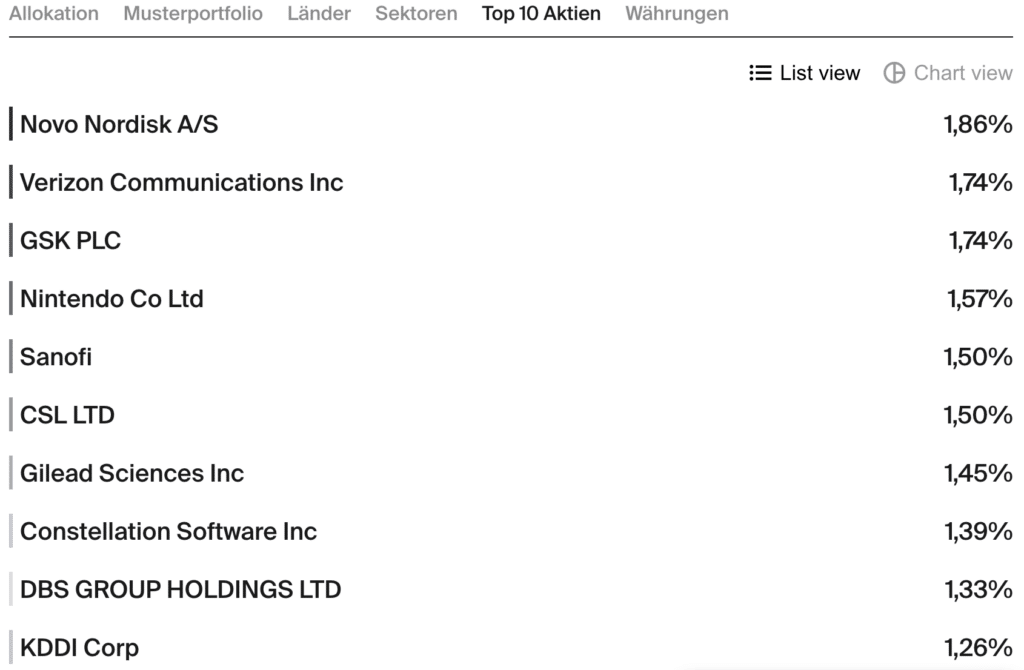

And this is where the first difference to other providers becomes apparent: The “Minimum Risk” investment model differs greatly from indexed strategies. On June 19, 2024, for example, the USA is represented in the “High” risk category with only 15%, while Switzerland is represented with 20%. Other providers weight Switzerland at over 70%, for example. Thus, individual shares are sometimes represented with more than 7% – for example Nestlé. Not so with “Minimum Risk” Descartes. The largest share accounts for just 1.86%. At the moment this is Novo Nordisk.

Minimum risk

The “Passive” investment model, which uses Swisscanto’s index funds, is widely known, while “Minimum Risk” is less well known and therefore deserves a more in-depth look. Descartes uses OLZ funds for this purpose. OLZ is a Bern-based asset manager in the field of sustainable and risk-based portfolio optimization and one of the largest Swiss asset managers. OLZ compiles the portfolios according to the concept of “minimum variance”, also known as “minimum volatility”.

Explained very briefly: Shares are known to fluctuate. This is called volatility and this deviation from the mean can be measured. The aim of a minimum variance portfolio is now to select those shares that reduce the volatility of the overall portfolio and thus the overall risk of the portfolio.

This means that the OLZ funds fall less sharply in a crash and rise less sharply in a stock market boom. You can therefore hold a higher proportion of equities for the same risk.

In summary, it can be said that Descartes takes a more active approach to the “Minimum Risk” model than its competitors, which has a positive effect on diversification. Pension funds also invest actively in Swiss equities in particular, because the three largest companies would otherwise take up a very large share of the portfolio.

You don’t have vested funds to invest? Descartes also offers the same investment strategies for pillar 3a and free assets. There, with the strategy “Very high” even 100% shares are possible.

Descartes sustainability

Descartes invests exclusively ESG-compliant in all strategies and was thus the pioneer among the young digital providers. Companies that violate fundamental sustainability criteria are screened out. Thus, companies that operate mainly in the following areas are excluded:

- Nuclear and controversial weapons

- Civilian firearms

- Steam coal

- Oil sand

At the beginning of 2022, Descartes adapted the “Minimum Risk” investment model and focused even more consistently on sustainability. Companies with lower CO2 emissions are now weighted more heavily than companies that have a greater impact on the climate. As a result, the CO2footprint of the new investment strategy is at least 30 percent lower than that of the market index. And China was completely excluded.

But it is not only at the portfolio level that Descartes focuses on sustainability. For example, Descartes’ software was developed in Switzerland and hosting is also done in Switzerland by a Swiss company. A look at the photos of the board of directors also reveals that it is diverse and does not consist of older, white-haired men. Further exciting projects in the area of sustainability are being planned.

Descartes Freedom of movement Registration and advice

With the Descartes pension calculator you can calculate your future retirement capital yourself using the two investment models and the four different equity ratios.

If you decide to open a custody account with Descartes, you first enter your personal details and after answering four questions, an investment profile tailored to your needs will be proposed to you. If you agree, you can simply sign the advance care directive digitally. After five minutes, everything is done.

However, if you are unsure which investment strategy is the most suitable for you and would like to have the splitting explained to you again, or if you have any other questions, you can contact the Descartes team for online advice. You can reach it by email and phone or you can book a no-obligation pension consultation on the website.

On the Descartes website you will also find an informative blog and a comprehensive glossary.

Descartes freedom of movement All-in fees

The total annual fees for vested benefits are between 0.65% and 0.77%, depending on the investment model and equity allocation. The fees are deducted on a quarterly basis.

Due to the more active approach of the “Minimum Risk” investment model, Descartes’ fees are slightly higher than those of the other digital providers. If, on the other hand, they are compared with the banks, they are still around 50% lower.

Descartes does not charge any additional costs for opening an account or balancing. In addition, the funds are bought for you in Swiss francs. Foreign currency fees are therefore also not incurred. You can find a blog post on yield-diminishing foreign currency fees here. When you buy funds from some dinosaurs, you’re charged what’s called an issuance commission, and when you redeem, you’re charged a redemption commission. This can amount to as much as 5%. Descartes can do without at all. You can find more details about Descartes’ fees here.

Descartes customer portal

Based on my personal Descartes vested benefits custody account, let’s take a final look at the customer portal. Access is provided as a web app. A smartphone app is not available. As long as a website is responsive, I don’t think it needs an app – especially for long-term investing. What do I want to check my assets every day if I’m not going to access them for thirty years anyway?

To log in to your Descartes vested benefits account, enter your user name and password and you will then receive a code by SMS.

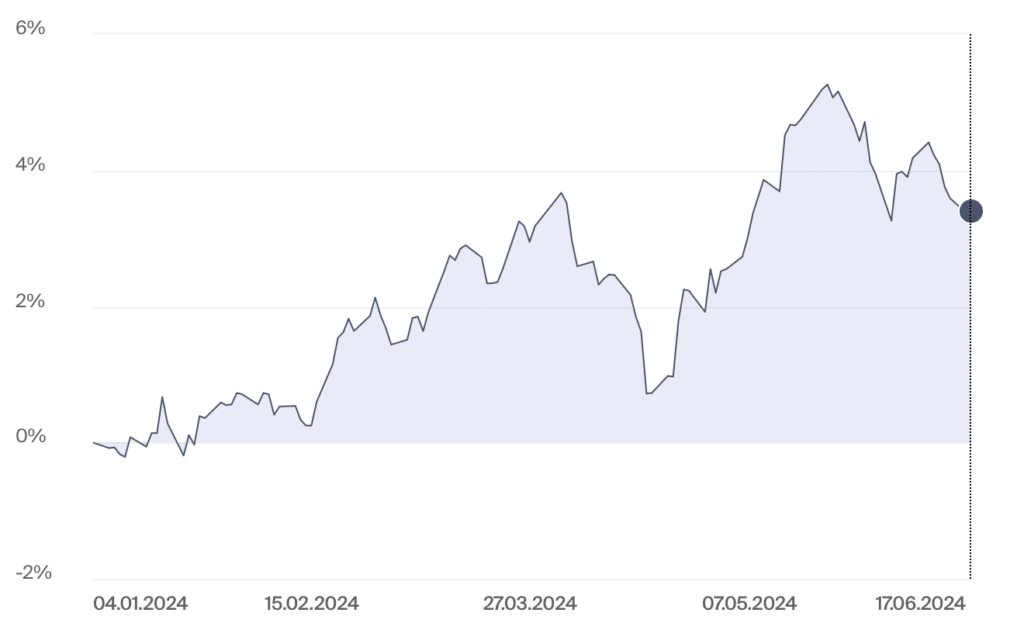

The interface is very tidy and clear. On the left you can see the total assets and the total performance. On the right, you can display either your pillar 3a custody account, your vested benefits custody account or your custody account for unrestricted pension provision. If you click on a portfolio, you will find a chart that shows you the money-weighted return. You can find a blog post explaining the different types of returns here.

Under “Asset structure” you can see which fund has performed how. If you would like more information on the funds, click on the name of the fund and a PDF of the factsheet will open.

You can find all contracts and regulations under “Documents”. The bank documents are also stored there. This way you can always track which funds were bought or sold and see transparently how many fees were deducted.

FAQ Descartes freedom of movement

The all-in fees for Descartes Free Movement are between 0.65% and 0.77%

No, you can only transfer 2nd pillar funds that are already tied up to a vested benefits account or custody account.

Yes, you can. However, only during the first twelve months after confirmation of self-employment by the AHV compensation fund.

Other reasons for a withdrawal are:

– Reaching AHV retirement age (possible 5 years earlier)

– Promotion of home ownership

– Purchase into the pension fund

– Leaving Switzerland (restrictions on emigration to EU/EFTA countries)

– Disability or death

Yes, it is possible. However, there are costs associated with certain providers. So it is best to inform yourself before the transfer.

No, there are no property, income or withholding taxes. The vested benefits assets are not taxed at a reduced rate until they are withdrawn (lump-sum benefit tax).

Transparency and disclaimer

This article was created in collaboration with and with the support of Descartes. The content reflects my own opinion. You can find out more about transparency and paid contributions here.

If you open accounts or business relationships or order products or services through my links and codes, I may receive a commission. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with an *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices and blog posts on this website (“Publications”) are for information purposes only and do not constitute a recommendation to buy or sell securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.