Letztes Update: 14. June 2024

This summer it was announced that there will soon be a new digital bank in Switzerland. According to the media release at the time, ” [FlowBank das] is reinventing online retail experiences.”

Since the end of November you can open an account at FlowBank. Reason enough to take a closer look at the offer and test it.

You can find the update to this article here.

On June 13, 2024, the Swiss Financial Market Supervisory Authority FINMA opened bankruptcy proceedings against FlowBank SA. Bankruptcy serves to protect depositors. According to the current calculations, the privileged deposits can be repaid in full from the bank’s existing funds. In addition, according to FINMA, clients’ securities accounts will be segregated and refunded.

If you are looking for an alternative to FlowBank, you will find it in the comparison Swissquote vs Saxo: Find the best Swiss online broker.

FlowBank

The digital bank is headquartered in Geneva. It was founded by Charles-Henri Sabet. The latter founded Synthesis Bank – a pioneer in Swiss online banking – back in 1999. Synthesis Bank was later merged with Saxo Bank. You have already encountered Saxo Bank in the posts about Selma and Inyova.

In the summer of 2020, FlowBank SA received a banking license from the Swiss Financial Market Supervisory Authority (FINMA). It is a member of esisuisse, the deposit guarantee association for Swiss banks. So it then becomes, “Your assets in a Swiss vault.”

Fees

The bank advertises “transparent” and “competitive” prices. Let’s take a closer look at this promise below. Since the end of 2021, there have been two pricing models: Classic and Premium. From “Fonds initial minimum de 100 000 CHF” (the bad translations are unfortunately still everywhere) the premium prices apply. We limit ourselves here to the Classic prices. The prices differ mainly in the percentage commissions (e.g. share on Nasdaq: Classic 0.15%, Premium 0.10%), the minimum commission is the same for both pricing models.

Custody fees

The custody fees amount to 0.1% per annum plus VAT, or a minimum of CHF 40 per year plus VAT. The upper limit is CHF 200 plus VAT per year. This makes it one of the most favorable on the Swiss market. There is no minimum investment, and there are no fees if you don’t trade. However, CHF 15 will be due upon account closure.

Commissions

If you buy shares or ETFs on the SIX Swiss Exchange, no commission is currently charged. Yes, that’s right, in the summer of 2022 FlowBank introduced free trading on SIX and BX Swiss. Only the federal stamp tax is still levied. There are also no additional exchange fees. In the initial phase, trades are free of charge on both SIX and the much smaller BX Swiss exchange. FlowBank has not yet communicated when this initial phase will end. After that, only the purchase of Swiss shares on the BX Swiss will be free of charge.

Foreign currencies incur a commission of 0.5%, which is also quite attractive.

Entry in Swiss share register

FlowBank offers registration in the Swiss share register free of charge. Contact customer service for registration. You will receive a document from them, which you can sign and return to FlowBank.

Comparison

Let’s now compare FlowBank with the well-known and established online bank Swissquote:

| FlowBank | Swissquote | |

| Depotgebühr pro Jahr | 0.1%, min. 40 CHF, max. CHF 200 (+ MwSt) | 0.1%, min. CHF 60, max. CHF 200 (+ MwSt) |

| Wechselgebühr Hauptwährungen | 0.5% | 0.95% (bis CHF 50'000) |

| Titelauslieferung (elektronischer Transfer) pro Position | CHF 45 | CHF 50 |

| Kauf Aktien an der SIX im Wert von CHF 1'000 | CHF 0 + Eidg. Stempelsteuer | CHF 20 + CHF 0.85, Kosten für Echtzeitinformationen + Börsengebühr + Eidg. Stempelsteuer |

| Kauf Aktien an der SIX im Wert von CHF 10'000 | CHF 0 + Eidg. Stempelsteuer | CHF 30 + CHF 0.85, Kosten für Echtzeitinformationen + Börsengebühr + Eidg. Stempelsteuer |

| Kauf ETF an der SIX im Wert von CHF 1'000 | CHF 0 + Eidg. Stempelsteuer | CHF 9 + CHF 0.85, Kosten für Echtzeitinformationen + Börsengebühr + Eidg. Stempelsteuer |

| Kauf ETF an der SIX im Wert von CHF 10'000 | CHF 0 + Eidg. Stempelsteuer | CHF 9 + CHF 0.85, Kosten für Echtzeitinformationen + Börsengebühr + Eidg. Stempelsteuer |

| Kauf Aktien an der NASDAQ im Wert von USD 1'000 | USD 6.50 | USD 25 + CHF 0.85 (Kosten für Echtzeitinformationen) + Eidg. Stempelsteuer |

| Kauf Aktien an der NASDAQ im Wert von USD 10'000 | USD 15 + Eidg. Stempelsteuer | USD 30 + CHF 0.85 (Kosten für Echtzeitinformationen) + Eidg. Stempelsteuer |

| Kauf Kryptowährung | nur indirekt (ETFs, ETPs, ETNs, Tracker Zertifikate...) | 1% (CHF 5-10'000) |

| Überweisung eingehend | kostenlos | kostenlos |

| Online Überweisung ausgehend CHF | kostenlos | CHF 2 |

| Anzahl handelbare Wertpapiere | eingeschränkt | sehr umfangreich |

| Eintragung Schweizer Aktienregister | kostenlos | kostenlos |

Please always check the providers’ websites for the current fees.

Trading place FlowBank Pro

App

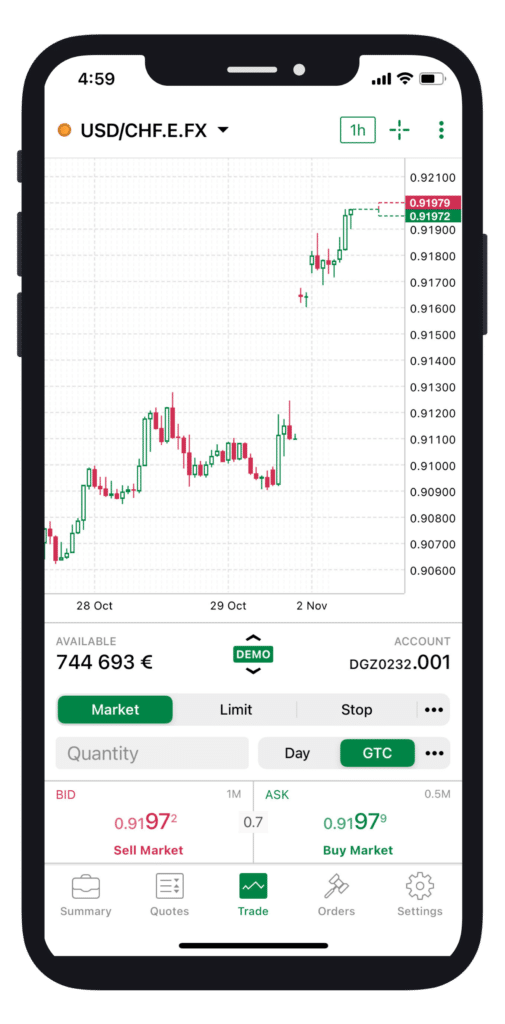

If you also want to try out the app, you can open a demo account: Simply download the app, enter your email address, set a password, and you’re ready to go. With a fictitious EUR 100,000, you can then try out the app extensively.

FlowBank describes its trading venue as an “intuitive, innovative and cost-effective platform.” But if you are brand new and have never bought a stock or ETF before, there are still a lot of incomprehensible terms like “GTC” or “IOC”, and they are not explained further in the app.

By the way, GTC stands for Good-til-Canceled and means that your order is valid until revoked. While Day means that your order will be deleted at the end of the day if no purchase was made. This is the order option you will use most often. IOC stands for Immediate or Cancel, you can safely ignore this option as a private investor with a long investment horizon.

Bid and Ask – i.e. the bid and ask prices(see article on buying an ETF) – are displayed so small in a limit order that I almost need a magnifying glass for them.

The operation has nothing in common with the playfulness of German online brokers with their sleek and tidy apps. Anyway, it took me a while to find my way around the FlowBank Pro interface – intuitive is different. The new Flow Bank app is much cleaner than the FlowBank Pro app. You can find details here.

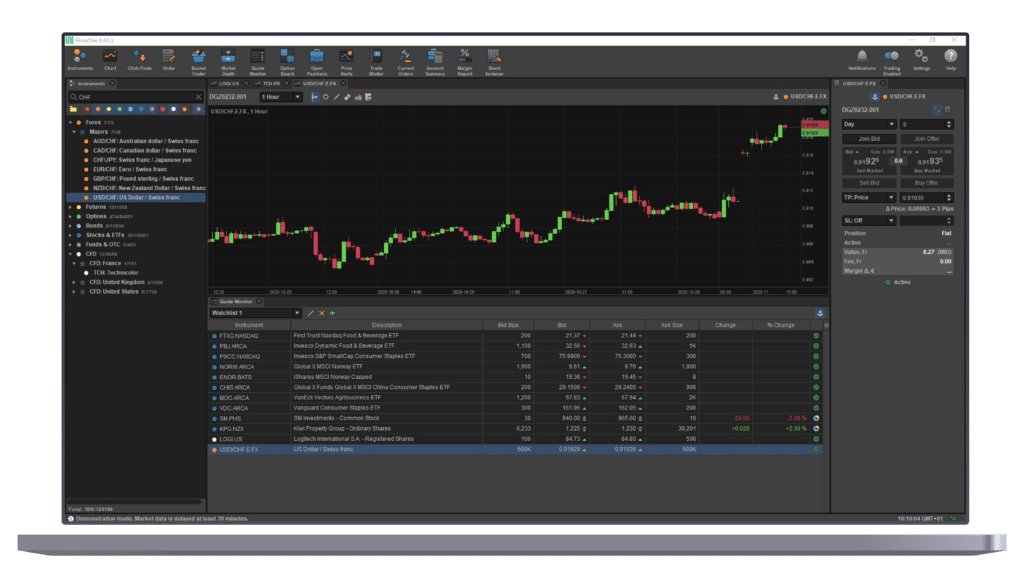

Desktop

The web trading platform is unfortunately even more confusing and geared more towards the experienced frequent trader than the sporadic long-term investor.

A lot of weight, both in the app and web trading platform, is given to graphical charts. In the app they are so small that most of the time they are unusable, besides that they are rather uninteresting with my long-term investment style. However, the fact that the purchase price is shown in the charts is a good solution. With other brokers, the general chart is simply displayed and you don’t see where you entered.

Trade products and translation

And there are quite few securities available. For example, when FlowBank launched, I searched for the popular Vanguard FTSE All-World UCITS ETF with the symbol VWRL on the Swiss Exchange in Swiss francs, but only found it on the London Stock Exchange. However, new ETFs and stocks will be added on an ongoing basis. For example, the VWRL is now also available. And if you are missing a security, you can write to the customer service, they will check your request and unlock the missing security if necessary.

Unfortunately, the German translation is often lacking on the trading floor. So after changing an order it says: “After filling your position will increase from 0 to 5 ZURN.SIX” – aha or rather hä.

Outlook

In the future, there will be a FlowCard, a bank card in several currencies. A branch office in Zurich as well as the step abroad are planned.

Conclusion

The low custody fees and the partially competitive and transparent trading fees are certainly interesting. The promise of an intuitive trading platform that reinvents the trading experience has unfortunately not yet been delivered. But the bank is still young, so let’s give it time to find its feet.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.