Letztes Update: 29. October 2024

Anyone looking into savings plans keeps coming across German neo-brokers such as Trade Republic, Scalable Capital, Smartbroker or the free US broker Robinhood.

Interview with Andreas Friedrich, Press Officer of Trade Republic Bank GmbH

With Germany’s first mobile and commission-free broker, you have persuaded many customers to switch or to invest at all. How many customers have you been able to attract since the May 2019 launch?

We are happy about every new customer and especially about the fact that about half of our customers have bought their first share ever through us. This shows that many people for whom securities trading was previously too complicated or too expensive are now finding their way to the capital market thanks to our offering. Less than a year after the market launch, we have already welcomed over 150,000 customers to the Trade Republic.

After the announcement that you are planning to enter the Austrian market, many people here are asking when it will be Switzerland’s turn. Are there any plans to do so at Trade Republic?

There are no concrete plans yet for a launch in Switzerland in the near future.

What innovations/developments are in the pipeline after the big financing round?

We want to continue to grow as a company, and in addition to expanding into new countries, our focus is primarily on new products with which we want to make our app even more attractive for our customers, especially in the area of savings.

Smartbroker becomes SMARTBROKER+ and moves from DAB BNP Paribas to Baader Bank. Customers from Switzerland cannot migrate. You will have to stay with Smartbroker (the broker without +), where a new pricing model will apply from January 1, 2024. For USD and CHF orders, 15 euros will then be due. The conditions are then no longer attractive. Therefore, I have already cancelled my account with Smartbroker.

Most providers do not allow Swiss nationals to open accounts, so opening an account with Trade Republic is not possible. Not so with Smartbroker: Swiss citizens are also welcome here. Find out how the low-cost broker with the interesting savings plan offers performs here.

Smartbroker

In December 2019, wallstreet:online announced that, under the name Smartbroker, it would offer customers the opportunity to trade securities on all major stock exchanges at discount conditions. The Smartbroker Group also includes the portals wallstreet-online.de, boersenNews.de, FinanzNachrichten.de and ARIVA.de. This makes it the market leader in the area of financial information.

DAB BNP Paribas acts as the custodian bank. Direkt Anlage- und Vermögensverwaltungs-GmbH was founded in 1994 as the first German discount broker and started business operations as Direkt Anlage Bank GmbH (DAB) in the same year. The major French bank BNP Paribas took over DAB Bank in 2015. Deposits are protected by statutory deposit insurance up to EUR 100,000 per customer.

Smartbroker presents itself as follows: “With over 20 years of experience, we have developed a broker that is tailored to the needs of investors. The time is ripe for uncomplicated trading.” Such promises invite you to test and that’s what I did for you, of course.

Costs

This is where things start to get interesting. Because the broker offers free fund savings plans. There are therefore no savings plan costs and no issue surcharges. Unimaginable for us Swiss. An execution is already possible from EUR 25. The interval can be selected as monthly, bi-monthly, quarterly or half-yearly.

Around 600 ETFs are also eligible for savings plans. One execution costs only 0.20% (minimum EUR 0.80). 279 ETFs are even completely free of charge during the promotion period. Here, too, the intervals as above are possible and an execution from EUR 25.

ETC and share savings plans are also possible. You can find more information on this and the funds and ETFs eligible for savings plans here.

By the way, trading Swiss securities on the Swiss stock exchange is not worthwhile. The fees are quite high there at Smartbroker. You pay a basic commission of EUR 9.00 per order and in addition a trading center fee of 0.05%. at least CHF 20.00.

Swissquote is cheaper.

The custody fee is somewhat special. For Swiss francs, this amounts to 0.75% p.a. starting from a cash ratio of 15% in relation to the portfolio balance. The calculation of this negative interest is based on the respective average of the balances in the quarter. The custody fee is waived for the first three months from opening. EUR and USD accounts are excluded. However, hoarding a lot of cash in accounts at Smartbroker doesn’t make sense anyway. Either invest it directly or still keep it in your savings or payroll account.

Unfortunately, there is not yet an app. However, you can also access and use the full range of functions via your browser on your smartphone.

Opening

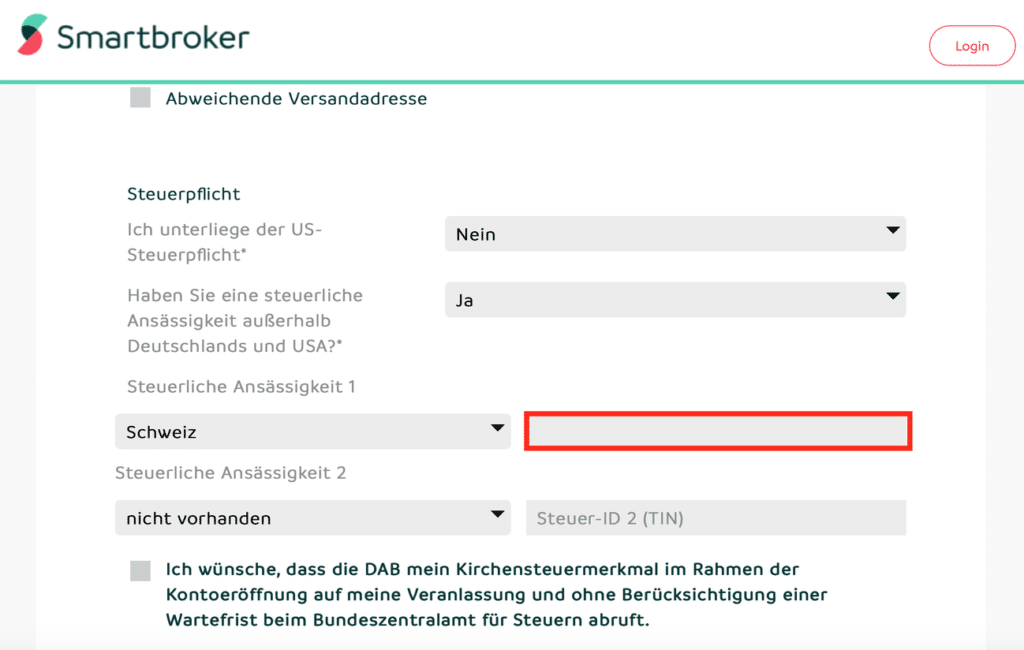

First of all: The opening is extremely unsmart! The first steps work digitally. As everywhere, you enter your personal data as well as information about your professional activity. During the opening process you will often be asked for the Tax ID 1 (TIN). In Switzerland, this corresponds to the AHV number. You also indicate your experience with financial instruments.

You can also choose whether you want to open one or more foreign currency accounts at the same time. I recommend you to open at least a CHF account, for transfers from Switzerland certainly a good idea and free of charge anyway.

So far so good. But as a Swiss, you also have to fill out a FATCA self-disclosure. This is a PDF form that you can fill out on your computer. Then it is printed, signed, scanned and sent by mail. In addition, an official certificate of registration is required. In Zurich, the confirmation of residence is called “Wohnsitzbestätigung” and costs CHF 20.00. at least you can request them digitally from the city. However, it is delivered in analog form, so scan it again and send it by e-mail.

Finally, you have to identify yourself using the PostIdent procedure. An app is downloaded for this purpose. You enter certain data again and finally an agent guides you through the next steps via video telephony. Photos will be taken of your identity card and of you. Once the identification is completed, the documents are forwarded to the custodian bank DAB BNP Paribas.

And then it’s a matter of waiting. Waiting for ulkige letters from the custodian bank DAB BNP Paribas. After a week, a letter arrived with the access number for online access. A few days later, a letter arrived confirming the opening of the deposit account. Enclosed with this letter was a CD-Rom with the “Basic Information on Securities and Other Investments”. If you do not have the possibility to retrieve the contents of the CD-Rom, please contact your financial advisor (in this case Smartbroker) to get the information in written form. A CD-Rom by mail – I felt like I was in a museum.

So there is still some room for improvement in the onboarding process. Dear Smartbroker and dear DAB BNP Paribas please urgently look at Swiss Fintechs like Viac, Selma Finance or neon – thank you.

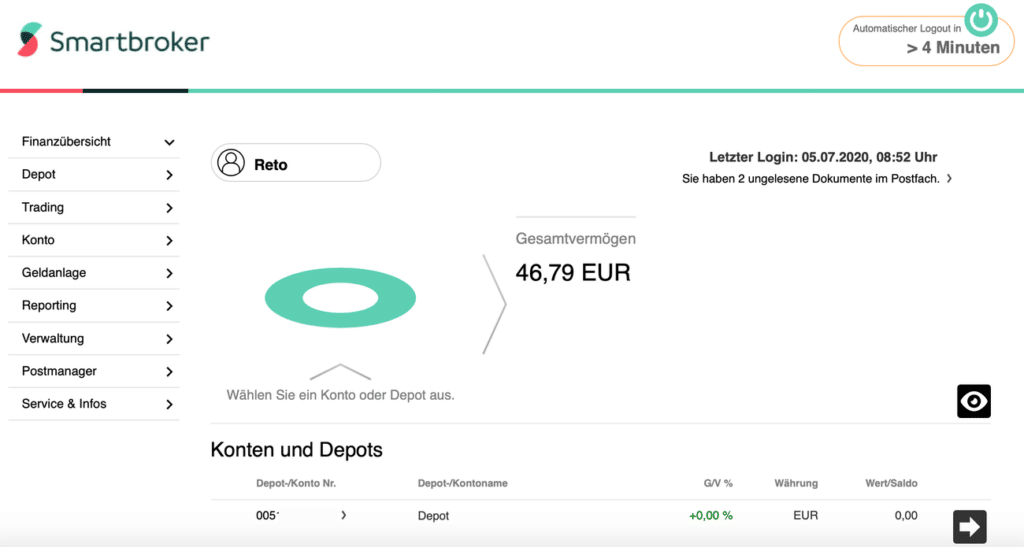

Log in

Even the first login seems to be from the stone age of the internet. On the letter from DAB BNP Paribas there is an identifier, a SuperPIN and a telephone PIN. So you log in and then have to change the identifier. Finally, the mobile TAN must be activated, whereby one must enter the SuperPIN. So here, too, there is an urgent need for simplification!

Once you have finally managed to log in, you are confronted with a rather ugly user interface. Unfortunately, nothing smart can be seen here either. A gray wasteland of type with disastrous formatting. And even to view documents in the mail manager, you have to log in via mobile TAN.

Bank transfer and currency exchange

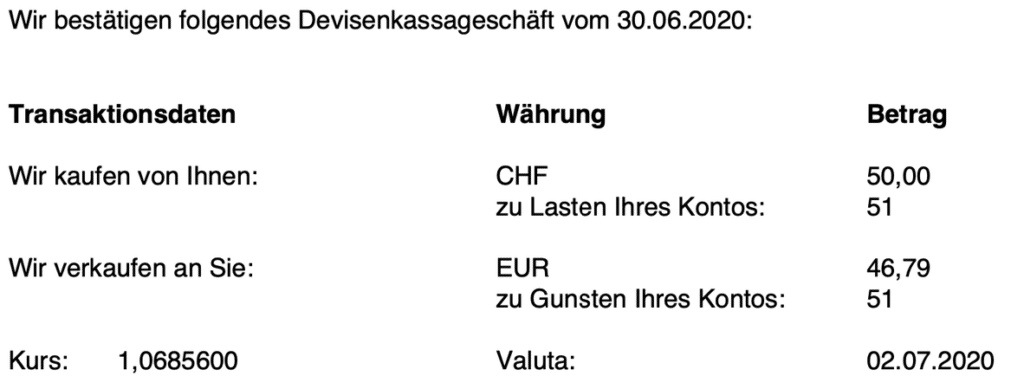

I indicated at the time of opening that I would also like to have a USD and a CHF account. Unfortunately, I could not transfer Swiss Francs from my Zak account nor from my neon account to this account. As soon as I entered a German IBAN, it automatically set the currency to Euro for me. However, with Revolut I finally managed to transfer Swiss Francs to my Swiss Franc account at Smartbroker. I transferred CHF 50.00 and the entire amount arrived in Smartbroker’s account.

The currency exchange is quite simple. Under “Account”, “Foreign exchange transaction” you can initiate a conversion. For the exchange of Swiss francs into euros, an exchange rate surcharge or discount of 0.2% is charged. In the case of other currency savings, the exchange rate premiums are bez. -discounts were higher in some cases. This just about keeps it within reason and is cheaper than if I had used Wise, formerly TransferWise, to do a conversion and transfer. For larger amounts, Wise, formerly TransferWise, may be less expensive.

Customer service

Customer service is extremely slow. I will soon be waiting over a month for several e-mail inquiries. So I can’t judge how customer service is doing yet – so far, not a single response has reached me. Just a standard reply that my request will be processed “as soon as possible”.

Even after six months, I still have not received a response. And more recent inquiries also came to nothing.

Conclusion

The opening process is extremely old-fashioned and cumbersome. Except when you want to hold a CD-ROM in your hand again, it’s hardly worth the effort 😉. Besides, Smartbroker is really cost-effective only in the Euro currency. So you always have to do a manual currency transaction from Swiss Francs to Euros.

Are you looking for a more modern foreign broker where you can also buy ETFs and shares on the SIX in CHF at a reasonable price? Then take a look at DEGIRO*.

If you want to be more convenient and prefer Swiss providers, you should look at robo-advisors like Selma or True Wealth.

Attractive at Smartbroker are of course the free fund savings plans without issue surcharge. You can find out which active fund I chose and how to set up a savings plan with Smartbroker here.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.