Letztes Update: 28. September 2023

Some of you may wonder what possessed me to introduce a strategy fund. Or how much I get paid for it. I can reassure you, I’m fine and I don’t get a centime for presenting the fund. Find out why the Swiss investment fund is an interesting alternative to robo-advisors, asset management mandates or a self-assembled portfolio in this article. The presentation of the Partisan Strategy Fund is not an invitation to buy or sell the fund.

The Partisan Strategy Fund

Since its launch in 2013, the Partisan Strategy Fund has been managed by Felix Enderle as Asset Manager and Product Head. Prior to that, Felix Enderle was, among other things, head of fund management within the asset management division of UBS AG. He is supported by portfolio manager Christian Hörnlein and Prof. Dr. René Capitelli acts as external advisor. The fund is managed by PMG Investment Solutions AG, a bank-independent Swiss fund management and asset management boutique. The owner-managed company manages CHF 3.7 billion in client assets.

The website says about the Partisan Strategy Fund:

The Partisan defends your assets against attacks from all sides: Negative interest rates, price losses, the threat of inflation, costs and taxes.

True diversification, low costs and tax efficiency are its effective tools.

https://www.partisan.swiss/

The investment objective is explained in somewhat more detail in the prospectus with integrated fund contract:

The investment objective of the PARTISAN Strategy Fund (CHF) is mainly to protect investors from large real asset losses under as many scenarios as possible by means of a broad diversification in different asset classes, countries, regions and sectors and to preserve the real purchasing power of the capital after inflation in the long term. This includes achieving appropriate nominal returns. Extraordinary developments such as high inflation, distortions on the currency markets or the insolvency of major countries are also taken into account as scenarios. Using concepts of diversification, portfolio optimization and scenario analyses, the investment strategy aims to achieve an appropriate return in a normal market environment and to avoid large asset losses under extraordinary scenarios.

| ISIN | CH0215106581 |

| Valor | 21’510’658 |

| Flat administrative fee | flat rate 0.5% |

| Total Expense Ratio (TER) | 0.62% (31.12.2022) |

| Output Commission | none |

| Redemption Commission | max. 0.25% in favor of the fund |

| Performance fee | none |

| Appropriation of profits | distributing |

The Partisan Management Team has invested a total of approximately CHF 4 million in the Partisan Strategy Fund. So it’s not just investors like you and me who are affected by any losses, but also the portfolio managers responsible. This is called “skin in the game.”

Before we take a closer look at the Partisan Strategy Fund, let’s take a step back:

What is a strategy fund?

A strategy fund invests in more than one type of security. While an equity fund contains equities, a strategy fund can contain bonds, real estate, commodities, etc. in addition to equities. This is why we also speak of mixed funds.

Classically, you go to your house bank, get advice and get a strategy fund to take home. The TER is around 1.1%, but can also be as high as 2%, and an issue surcharge of up to 5% is often payable on purchase.

In most cases, banks offer strategy funds with different risk profiles, which differ in the equity quota.

| German designation | English designation | approximate percentage of shares |

|---|---|---|

| Fixed-interest | Fixed Income | 0% |

| Income | Income or Yield | 25% |

| Balanced | Balanced | 50% |

| Growth | Growth | 75% |

| Shares | Equity | 100% |

Somewhat maliciously, strategy funds could also be described as standardized asset management for mass business. True to the motto: one of the strategy funds fits every customer.

In most cases, the quotas of individual types of securities are not fixed, ranges are set. In the Partisan Strategy Fund, for example, the target range for equities is between 35% and 55%.

What is the difference between an ETF and a fund?

ETFs are exchange-traded funds that bundle a variety of securities such as stocks and bonds. Just like shares, an ETF can be bought and sold during stock exchange opening hours. So you can buy an ETF and sell it ten minutes later, but that doesn’t make much sense.

A traditional fund, on the other hand, is generally not traded on the stock exchange and can therefore only be purchased directly from the fund company once a day (or less frequently) at the net asset value (NAV). In simple terms, NAV is the value of all assets less liabilities. After the close of trading, all values are added together. For example, if there are 1,000 Nestlé shares in a fund and a Nestlé share is quoted at CHF 116 at the close of the market, the Nestlé share in the fund is worth CHF 116,000. This is what is done with each asset, and at the end this large number is divided by the fund shares issued. This is how you get the NAV of a share.

To buy both an ETF and a fund, you need a broker, and most of the time the buying process works pretty similarly. You enter the number of shares, check the fees and click “buy”. Both securities are booked in your securities account after the purchase, with a fund this usually takes a little longer. The fees are very different depending on the broker, more about that later.

Asset allocation Partisan Strategy Fund

Let’s take a closer look at the breakdown of security types, also known as asset allocation:

The great thing about the Partisan Strategy Fund is that you can view the current portfolio in detail on a monthly basis on the website. Most active funds only disclose their portfolio on a semi-annual basis, and most of the time you have to wade through the mile-long semi-annual report to do so.

The Swiss share is represented by approximately 30 shares. No share accounts for more than 2% of total assets. Large cluster risks, such as those contained in the SMI, are thus deliberately avoided. The focus is on shares of companies with a high equity ratio and one or more significant shareholders who are strongly and personally affected by a poor business performance.

The international equity portion is covered by futures, ETFs and index funds. These indirect investment vehicles have the advantage that the shares are held in tax-efficient structures. Withholding taxes can thus be reclaimed more easily and cost-effectively or are not incurred in the first place. On the other hand, the costs incurred within the funds are disadvantageous. These are payable in addition to the Partisan Strategy Fund’s flat management fee of 0.5%. However, the TER of 0.62% includes these costs.

If we look only at the share of equities, the regional distribution is as follows:

Compared to the MSCI ACWI Index, in which the USA has a share of over 60%, the Partisan Strategy Fund is thus significantly less invested in the American market.

Bonds

The Partisan Strategy Fund deliberately does not invest in high yield bonds, i.e. bonds issued by companies with low credit ratings. While high yield bonds offer a higher coupon, they are more volatile and have historically suffered greater price losses in stock market crashes than investment grade bonds.

In addition, inflation-indexed bonds (also called inflation-linked bonds or TIPS) are used. These are government bonds whose interest and principal repayments are linked to inflation.

Precious metals and real estate

Precious metals can help stabilize a portfolio because they generally have a lower correlation to other asset classes. Specifically, the Partisan Strategy Fund contains the precious metals gold, silver and platinum.

Real estate shares are added for additional diversification. These can provide inflation protection in some circumstances. The Partisan Strategy Fund invests in real estate equities and real estate investment trusts (REITs) from various countries.

What are insurance-based bonds?

The German term admittedly sounds a bit unwieldy. The more common term is insurance-linked bonds. Specifically, the Partisan Strategy Fund uses so-called cat bond funds. These are catastrophe bonds (CATs), where repayment of principal is contingent on whether or not a specified loss event occurs. These include events such as hurricanes and earthquakes, as well as other natural catastrophe and mortality risks. Insurance risks are securitized in CAT bonds as fixed-income securities. Or, to put it more simply, investors take on the role of a reinsurer to a certain extent. One advantage of CAT bonds is their historically low correlation to traditional financial markets.

On the website of the Partisan Strategy Fund there are documents with reflections and explanations of the investment strategy and one can sign up for the monthly newsletter, which informs about the development of the fund and new blog entries.

Best Funds Switzerland

At the very bottom of the Partisan Strategy Fund homepage, you will find a PDF with the competitor comparison, which is updated monthly. Fintechs can take a leaf out of their book here. They often use the word transparency, but when it comes to performance comparisons, they keep a surprisingly low profile.

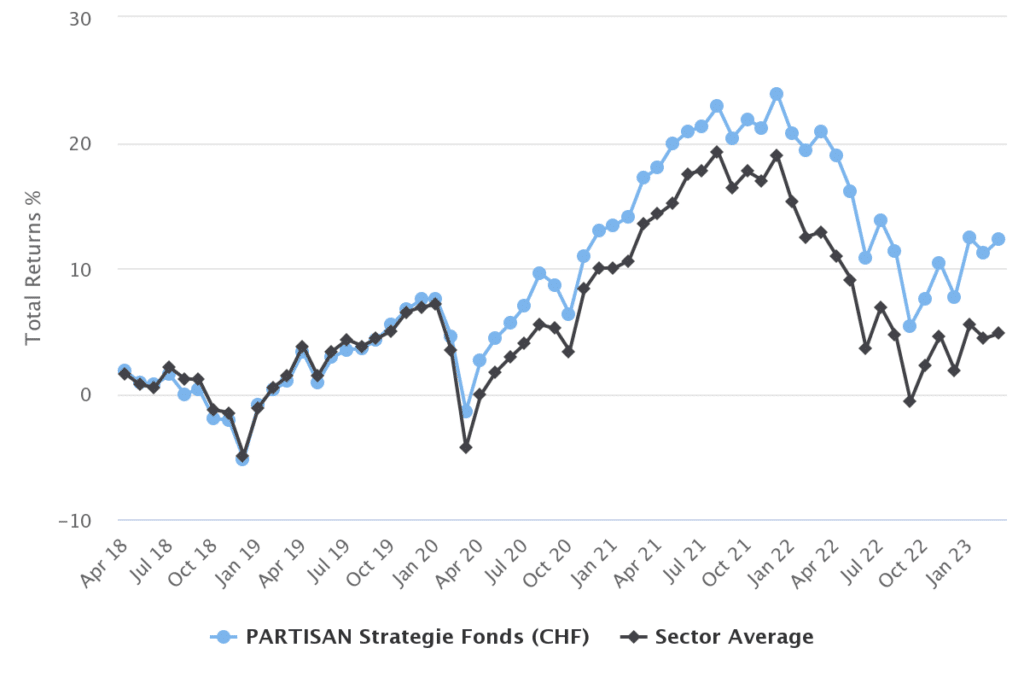

The competitor comparison lists more than 30 similar strategy funds with an equity share of about 40% to 55%. The Partisan Strategy Fund is at the top of the chart as well as in the table below, with various key figures.

| since inception (31.12.2013) | 5 years | 3 years | this year | Corona- Drawdown (Feb. 19-March 23, 20) | Volatility (3 years) | |

|---|---|---|---|---|---|---|

| Partisan Strategy Fund | 32% | 11% | 10% | 4.6% | -15.8% | 8.6% |

| Average comparative fund | 16% | 2% | 5% | 3.4% | -18.4% | 9.4% |

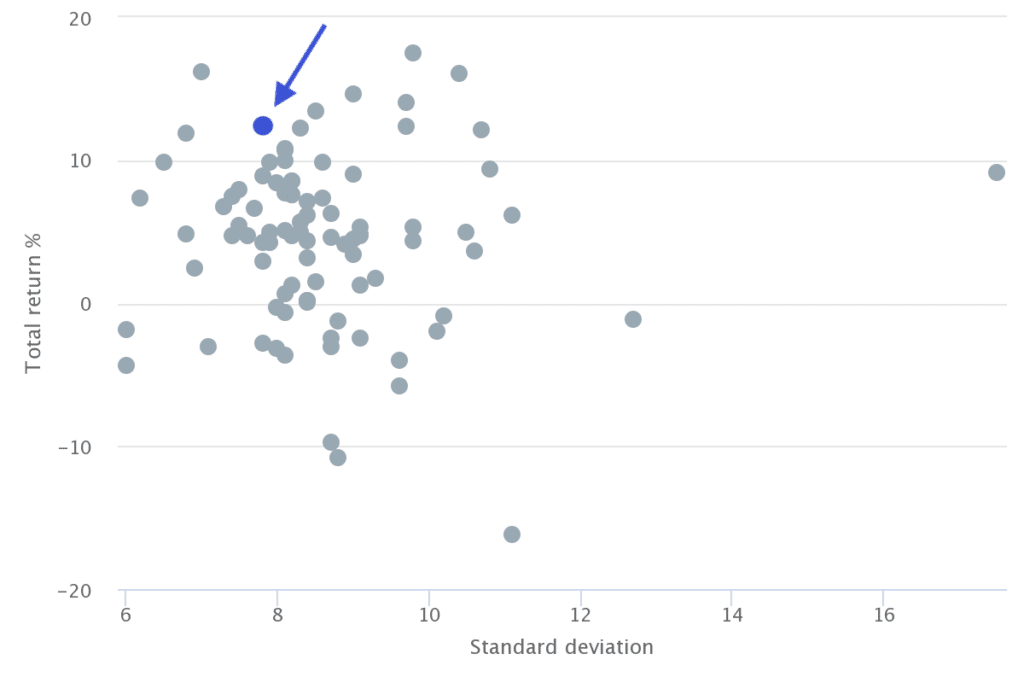

The Partisan Strategy Fund also ranks high on Citywire, a financial publishing and information group that specializes in tracking the performance of fund managers:

This applies to all three categories, i.e. total return over the last five years, standard deviation (volatility) and maximum loss.

The Partisan strategy fund also performs very well in the Morningstar star rating. It achieves a total of five out of five stars and is thus above average.

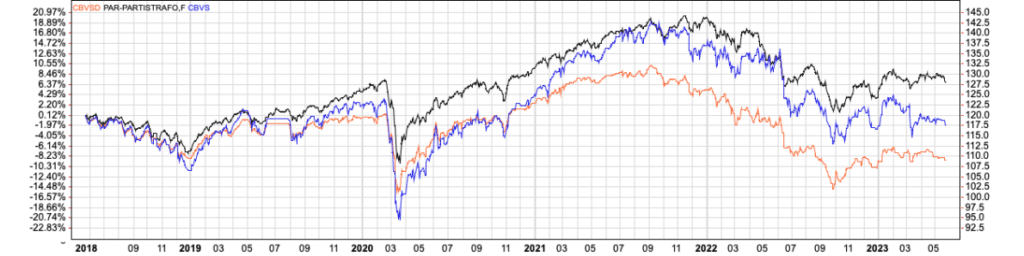

Multi-asset ETFs vs. partisan strategy funds

In comparison with two multi-asset ETFs, the Partisan strategy fund also performs well. Multi-asset ETFs also contain various asset classes.

- Lyxor Portfolio Strategy Defensive (DE000ETF7029, TER 0.40%, CBVSD)

- 50% Bonds and money market instruments

- 40% Shares

- 10% Gold

- Lyxor Portfolio Strategy (DE000ETF7011, TER 0.45%, CBVS)

- 60% Shares

- 30% Bonds

- 10% raw materials

The exact composition of the multi-asset ETFs can be found on the Amundi ETF website.

Where to buy the best Swiss fund?

As mentioned above, you need a broker and a securities account to buy funds. The cost of purchase varies greatly depending on the provider. At FlowBank for example, the fee is 0.15%, but at least CHF 8. At Swissquote the purchase costs 0.5%, but at least CHF 50. Swiss funds are usually not available in trading apps and with foreign brokers.

With low-cost online brokers, custody fees of around 0.1% to 0.2% can be expected. It’s best to check with your broker to see if the fund is available and what it costs to buy it.

A savings plan is certainly not very attractive with these price structures, but one-time larger purchases can be handled inexpensively with the right broker.

Robo-advisor vs. mutual fund

The flat fee of a robo-advisor is about 0.6%, plus product costs of about 0.2%. It does not usually include currency exchange fees, stamp taxes, spreads and transaction costs within the products. On the other hand, there are no additional fees for buying and selling. This brings us to at least 0.8%.

The TER of the Partisan Strategy Fund is 0.62% plus approximately 0.10% custody fees, i.e. 0.72%. In addition, there are the transaction costs within the fund and the fees for the purchase. And here again it depends on how expensive your broker is, how often you trade and how high the respective trading volume is. Stamp duty is not payable on Swiss funds (all transactions within the strategy fund are also exempt from stamp duty).

These are all very rough assumptions. I just want to show that a strategy fund can be quite competitive, even if they are always dismissed among financial bloggers as insanely expensive. As is so often the case when it comes to finances, it all comes down to your personal financial situation.

Advantages Partisan Strategy Fund

- Transparent: The entire portfolio is available on the website on a monthly basis.

- Comparable: Unlike the strategy of most robo-advisors, the Partisan Strategy Fund compares very well with other funds on fund platforms.

- Cost-effective: Comparable funds are about twice as expensive and asset management mandates cost up to three times as much.

- Simple: with just one product you invest in several types of securities.

- Long track record: past performance is no indicator of future performance, but a lot has happened in the markets over the past decade.

- Boring: What sounds negative is an advantage! Find an exciting hobby and let your money work for you in peace.

- Tax favorable: Compared to asset management mandates and robo-advisors, a Swiss fund is tax favorable for the private investor in Switzerland with regard to income, value added and stamp taxes.

Disadvantages Partisan Strategy Fund

- Fixed equity allocation: Younger investors who have a long investment horizon may be able to take on more risk. This can be avoided with an additional equity ETF or index fund. Conversely, a higher cash ratio can be held or invested in medium-term notes, bond ETFs or funds.

- Purchase costs: Less suitable for manual savings plans, or strongly dependent on the broker.

Conclusion best Swiss investment fund

The Partisan Strategy Fund is an interesting option for investors who do not primarily focus on asset growth but also on asset preservation. The low-cost Swiss fund is a transparent and broadly diversified investment fund and also performs very well in a comparison of its competitors. The portfolio is reviewed once a quarter and no short-term, tactical reallocations are made. In this way, transaction costs can also be kept low.

By the way: If you want to record the fund in Portfolio Performance, you will find it there under the symbol 0P0000ZFOU.SW.

Four questions for the partisan fund management

What about the fund’s portfolio turnover rate (measure of asset turnover)? Is there a lot of rebalancing or is it more buy and hold?

The turnover rate is very low in the Partisan. We deliberately focus on the long-term investment strategy. Experience has shown that stock prices, interest rates or exchange rates can hardly be forecast profitably in the short term. As a rule, we only sell investments when this is indicated by risk considerations. We dispose of shares in exceptional cases if we have doubts about the quality and long-term orientation of the company’s management.

Why are futures and options partially used in the equity section? What are the advantages of this?

Futures, if backed by cash, are directly comparable to buying an ETF. We use them because they are significantly less expensive than ETFs for large volumes. In addition, they offer certain advantages from a tax perspective. We use options to hedge parts of the equity portfolio against sharp setbacks on the stock markets, such as during the Covid crisis. The options act like an insurance policy: If everything goes well, you pay a small premium. If the shares lose a lot of their value, part of the losses are insured.

What does the daily routine of a fund manager look like?

We spend a large part of our time tracking and assessing economic and political developments and risks. This includes reading relevant professional publications and newspapers, discussions with colleagues, but also the study of history. Knowledge of past developments facilitates the assessment of future risks. In addition, there is the daily business, the investment of new customer funds, the detailed analysis of financial instruments with regard to their risks, costs and tax effects and, of course, the conversation with customers.

What is the difference between the Partisan and the Avadis Growth investment strategy (60% equities, 40% bonds)?

The main difference between these two products stems from differences in asset allocation. The equity quota of the Avadis Strategy Growth is slightly higher. Further, the addition of Emerging Markets Debt, Corporate Bonds, Emerging Markets Equities and Small Caps Equities historically results in a slightly higher risk profile compared to Partisan, which has slightly lower volatility and lower asset correlation over time with Precious Metals, Insurance-Based Bonds, Inflation Protected Bonds and Real Estate.

The 5-year performance comparison supports this assumption. We have had a good environment for higher risk investments over the last 5 years. In terms of 5 year performance, the Avadis strategy beats the Partisan by 2.39% (14.39% vs 12%). In a difficult market environment (performance 2022), the partisan beats the Avadis strategy

3.82% (-16.9% vs -13.08%).

The costs of the two strategies are comparable and may be described as investor friendly.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.