Letztes Update: 20. December 2024

What many have wished for and what was demanded with the so-called Ettlin motion, submitted in 2019, is now becoming possible: Catch-up payments into Pillar 3a. Until now, it was only possible to pay in the annual maximum amount of Pillar 3a and deduct it from income. If nothing or only a partial amount was paid in one year, the resulting gap could not be compensated in subsequent years. From 2025, this will change: Subsequent payments to close such gaps will be allowed for the first time. However, there are some conditions to consider, which we will examine more closely in this article.

Inhaltsverzeichnis

- What does “Pillar 3a catch-up payment” mean?

- What should I consider when making catch-up payments into Pillar 3a?

- How does catch-up payment into Pillar 3a work in practice?

- What remains of the Ettlin motion?

- Tips for optimally using retroactive payments into Pillar 3a

- Conclusion: Is it worth making retroactive payments into Pillar 3a?

What does “Pillar 3a catch-up payment” mean?

The “Ordinance on Tax Deductibility for Contributions to Recognized Forms of Provision (BVV 3)” is being adjusted. Since the law itself is not being amended, but only the ordinance, parliamentary approval is not required for the change.

A new Art. 7a is being introduced. It now refers to purchases, as we know from pension funds. Purchases are possible in the following cases:

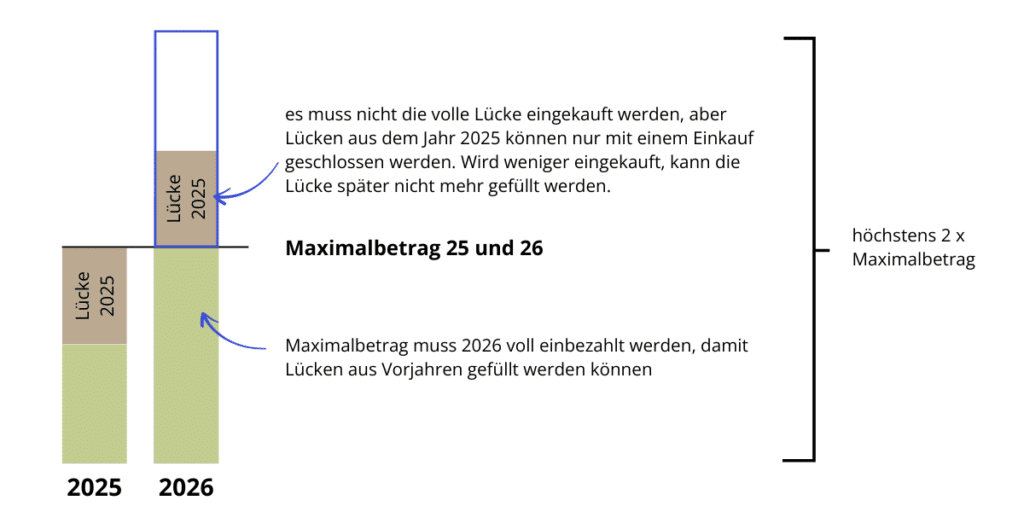

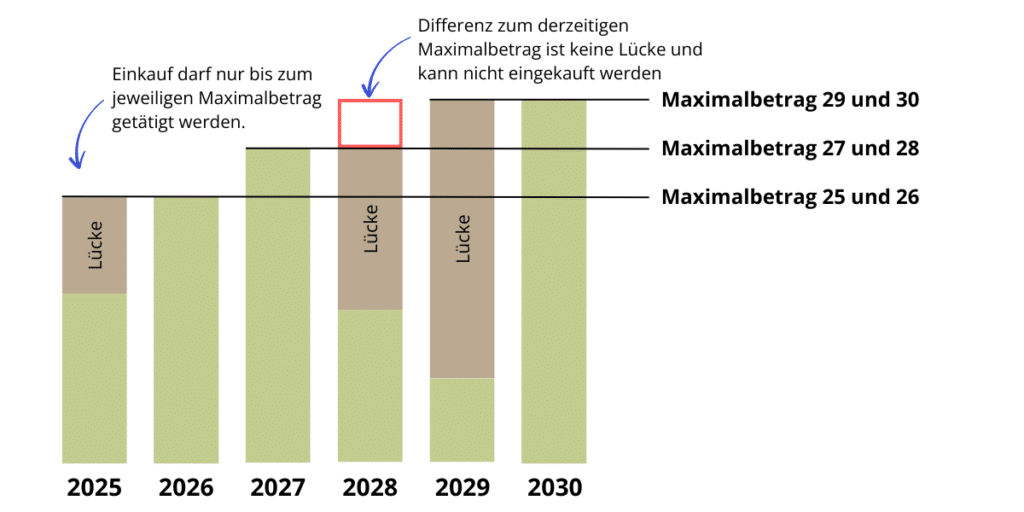

- In the year of purchase, the respective maximum amount must be fully paid in. If you want to close the gap for the year 2025, you must first pay in the maximum amount for 2026 in the year 2026 and only then can you fill the gap from 2025.

- There are gaps from the previous ten years because less than the maximum allowable contributions were paid in.

- In the years with gaps, AHV-liable income was earned.

What should I consider when making catch-up payments into Pillar 3a?

To close a gap, only a single purchase is allowed. Here’s an example: In 2025, people with a pension fund can pay a maximum of CHF 7,258 into Pillar 3a. But you only paid in CHF 2,000. A gap of CHF 5,258 arises. You can now close this gap – or part of it – with a purchase. If you only purchase CHF 3,000, for example, there’s still a gap of CHF 2,258. You can’t fill this anymore, as only one purchase is allowed. So it’s best to wait until you can fill the entire gap – in our example with CHF 5,258. You have ten years in total to do this.

After receiving a retirement benefit, no more purchases are possible. This also applies to accounts that have not yet been withdrawn.

The amount to be purchased may at most equal the respective maximum amount. Assuming that the maximum amount for Pillar 3a in 2026 is CHF 7,258, you must first pay in the respective maximum amount, i.e., CHF 7,258, and additionally you may purchase a maximum of CHF 7,258. Together, this results in a maximum of CHF 14,516 that you can deduct from your income in this year under Pillar 3a. This also applies to self-employed individuals; they too may only make catch-up payments up to the “small” maximum amount.

How does catch-up payment into Pillar 3a work in practice?

The procedure is regulated in the new Art. 7b. Those who want to close gaps must apply for the purchase in writing to the tied pension provision institution. It must be confirmed that:

- you have paid in the maximum amount in the year of purchase.

- you earned AHV-liable income in the years for which the contribution gap is to be closed.

- you have not yet closed the gap.

- you have not yet received any retirement benefits.

Note that there is a transitional provision and you can only close gaps that have arisen from 2025 onwards. So in 2026, you can close the gap that arose in 2025 for the first time. If you did not pay in the maximum amount in 2024 or in previous years, you cannot fill these gaps even with the new regulations.

What remains of the Ettlin motion?

Originally, the Ettlin motion proposed that individuals without AHV-liable income could also retroactively fill gaps. Here is the exact wording of the motion:

To reach people with gaps in employment (e.g., due to maternity), the purchase options should be defined so that amounts can also be paid retroactively for periods when the pension recipient had no AHV income. In the year of purchase, the usual annual contributions should be able to be made tax-effectively in addition.

However, this idea was discarded during implementation. A prerequisite for retroactive payment is that AHV-liable income was earned in the year of the gap. The Federal Council wrote in its statement: “Furthermore, it would contradict the basic concept of Pillar 3a as occupational insurance if purchases were allowed for contribution periods in which insured persons had no AHV-liable income. The Federal Council and Parliament have already repeatedly examined and rejected an opening of Pillar 3a for non-employed persons”

The Federal Council then requested the rejection of the motion. It wrote: “The introduction of retroactive purchase options in tied self-provision would […] unilaterally privilege persons with higher incomes, but would not contribute to any improvement in pension provision for the vast majority of the working population. Moreover, the proposed measure would result in an unforeseeable reduction in tax revenues.” Nevertheless, the National Council and the Council of States accepted the motion.

According to rough estimates, annual direct federal tax revenue losses of 100 to 150 million francs can be expected. For income taxes of cantons and municipalities, revenue losses between 200 and 450 million francs per year are anticipated.

Tips for optimally using retroactive payments into Pillar 3a

Interesting, for example, for people who have major property maintenance in one year and therefore already pay little tax. They can skip the payment into Pillar 3a for one year and benefit from the double deduction in the following year.

For people who already know today that they will earn significantly more next year, it can be advantageous not to pay anything into Pillar 3a in the current year and to pay the maximum amount twice in the following year. This way, the progression can be broken. Those who have will be helped.

Conclusion: Is it worth making retroactive payments into Pillar 3a?

If the Swiss pension system were completely digital, one could easily imagine retroactive payments into Pillar 3a. I log into the pension portal, see that I haven’t exhausted the potential in one year. The first pillar is also displayed there, so the system knows whether I had AHV-liable income and shares this information with the pension foundation, which sends me a bill, and the purchase is documented in the pension portal. Well, unfortunately, this is all future music, and so the retroactive payment of Pillar 3a becomes a bureaucratic monster – for those making retroactive payments, pension providers, and tax authorities.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.