Letztes Update: 25. January 2024

Although you can now get pretty far with Neo Bank debit cards and use them almost anywhere, in some situations a “real” credit card is an advantage. This post is about my experience with cashback cards* and you’ll learn everything you need to know about Swisscard’s free cashback credit card Switzerland, including the pros and cons.

How I found the Cashback Cards

After buying my Apple Watch, I really wanted to pay with it, but hardly any Swiss credit cards could be deposited with Apple Pay at the time. So I tried the German Boon card at that time. But I could never really get used to prepaid cards and since the Wirecard bankruptcy Boon is history anyway.

Then in 2018, I applied for the black Cashback World Mastercard, which to my knowledge was the first Swiss free credit card that you could deposit with Apple Pay. The fee for foreign currency or foreign transactions was 1.5% at that time, which was still somewhat acceptable. On top of that, there was a cashback of 0.25% or a cashback of 0.5% for one year.

Before that, I was on a credit card with a rewards program. However, I have rarely felt a deep desire for a steak cutlery set, blood pressure monitor, window vacuum or shower gel set. I’d much rather have a cashback that is added to my credit card bill once a year.

But back to the black Cashback World Mastercard. This could be managed in the cardservice online portal and in the Swisscard app. However, both were quite junky. It took several years before payments were displayed in real time in the Swisscard app. As of mid-2019, you could no longer apply for a black Cashback World Mastercard. It was replaced by the Cashback Cards, which finally brings us to the topic.

Cashback Cards – the Swiss free credit cards

The Cashback Cards always come as a duo, and the annual fee for both is CHF 0. Either choose an American Express with a World Mastercard or an American Express with a Visa. This is also necessary, because the American Express is not accepted everywhere.

The editor

The cashback Cards are issued by Swisscard AECS GmbH. Swisscard is owned by Credit Suisse and American Express.

The cashback

If you pay with your World Mastercard or Visa, you will get 0.2% cashback. With the American Express you even get 1% cashback. If you consistently do your weekly grocery shopping with it, it adds up quite a bit. On the Cashback Cards website you will find a cashback calculator*, which you can use to easily get an overview.

In the first three months after card issuance, the cashback with American Express is even 5%. Whereby this bonus cashback is capped at CHF 100.

The accumulated cashback is credited to your card account once a year. Somewhat unpleasant: If you cancel the card during the current year, you are not entitled to the accumulated cashback.

Mobile Payment

The following mobile payment wallets are supported:

- American Express: Apple Pay and Samsung Pay

- World Mastercard: Apple Pay, Samsung Pay, Swatch Pay and Google Pay

- Visa: Apple Pay, Samsung Pay and Google Pay

I physically carry the World Mastercard with me most of the time in case contactless payments don’t work, and I have the American Express on file with Apple Pay. Most of the time, I pay with the Apple Watch.

Insurances

Other credit cards have a wide variety of insurance policies integrated. With Cashback Cards, you only get merchandise return insurance. But I’m not a fan of all the credit card insurance anyway. In case of need, I have one hundred percent forgotten that insurance would actually be included with my credit card.

The Swisscard app

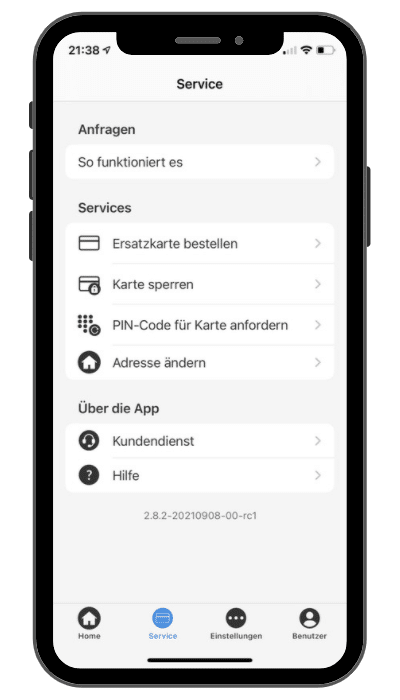

As mentioned, there was also a desktop login. However, this was abolished and now there is only the Swisscard app for iOS and Android. This gave a brief outcry, but I’m quite happy with the app actually. Anyway, I’ve never had any problems and the ratings in the App Store and on Google Play with 4.2 each aren’t bad either. For the credit card bills, I signed up with eBill, so they come directly into my eBanking.

In the app, payments are now displayed in real time and you can enable push notifications. So you are informed about every payment. If a payment seems unfamiliar, you have the option of temporarily blocking the card or reporting it as lost or stolen directly in the app.

You can also get an overview of the payments made, the current balance and the invoices.

If you wish, you can set up a notification when a certain amount is exceeded. This will also help you keep track of your expenses.

The 3-D Secure service is integrated directly into the Swisscard app. With it, you can conveniently check and approve payments online.

In the Swisscard app, you can now display card details and your PIN code. So you don’t always need the physical card when shopping online. You can easily copy and paste the details into the payment screen.

Cashback Cards: The cheapest credit cards in Switzerland

In June 2021, the online comparison service moneyland.ch compared the costs of different credit cards, with the cashback credit card Amex coming out on top in each of the user profiles frequent user, occasional user and shopper.

Compared to the most expensive credit cards, an occasional user can save several hundred francs per year with the Cashback Cards. You can find the complete article directly at moneyland.ch.

The advantages of Cashback Cards

- No annual fee

- Is a real credit card (not a debit card, not a prepaid credit card)

- Cashback of 1% (American Express) or 0.2% (Mastercard, Visa)

- Mobile payment (Apple Pay, Samsung Pay, Swatch Pay, and Google Pay; varies by card).

- Swisscard app for self-management

The disadvantages of the Cashback Cards

- The fee for foreign currency or foreign transactions is 2.5%. Read this article to find out which providers are more suitable for payments in foreign currencies.

- Cash withdrawals are charged at 3.75% (min. CHF 5).

- The annual interest rate is 11.95%. So be aware that credit card has the word credit in it. Accordingly, you should always keep an eye on your expenses.

- The fee for the telephone service is CHF 1.90 per call. However, card blocking and complaints about the monthly statement are excluded from this.

How is the cashback financed?

If you pay with your credit card, the merchant must pay a merchant commission. This is usually a certain percentage of the transaction amount and is made up of the interchange fee and the merchant support fee. With the Cashback Cards you get a part of this merchant commission refunded. Classic credit cards without a cashback feature also incur this merchant commission, you just don’t benefit from it.

In an upcoming post, we’ll take a closer look at how a card payment actually works and what fees are involved for merchants.

FAQ

There is no annual fee. On the contrary, you get the cashback credited to your credit card bill once a year.

The fee for foreign currency or foreign transactions is 2.5%.

Cash withdrawals are charged at 3.75% (min. CHF 5).

With Mastercard/Visa 0.2%

With the American Express 1%

The American Express cannot be used everywhere. That’s why, in addition to American Express, you can always choose between a Mastercard and a Visa.

Transparency and disclaimer

I was not paid by anyone for this blog post, it reflects my subjective opinion.

If you open accounts or business relationships, order products or services through my links and codes, I may receive a commission for doing so. However, you will not suffer any disadvantages such as higher prices or the like. The terms and conditions of the respective providers apply. Affiliate links are marked with a *.

Investments are associated with risks which, in the worst case, can lead to the loss of the capital invested.

All publications, i.e. reports, presentations, notices as well as contributions to blogs on this website (“Publications”) are for information purposes only and do not constitute a trading recommendation with regard to the purchase or sale of securities. The publications merely reflect my opinion. Despite careful research, I do not guarantee the accuracy, completeness and timeliness of the information contained in the publications.